G7 Central Banks Confront US Chaos: ECB to Cut Rates, Canada Watches Inflation

G7 central banks are, at the time of writing, responding in different ways to the US economic chaos that has followed President Trump’s recent trade war. Right now, the ECB is planning to cut rates while the Bank of Canada continues to focus on inflation amid the ongoing trade tensions with the US. These different approaches actually showcase how G7 central banks are trying to navigate the complex global financial impact created by the current US economic instability.

Also Read: If You Invested $1,000 in Shiba Inu at Its All-Time Low, Here’s Your Returns

How G7 Central Banks Are Responding to US Economic Instability and Inflation Concerns

ECB Set for Rate Cut

G7 central banks on the European side are currently preparing to ease monetary policy. The ECB rate cut of a quarter point is widely expected this Thursday as European policymakers are working on their first response to the market turmoil triggered by US chaos.

ECB president Christine Lagarde stated:

“Price stability and financial stability go hand-in-hand.”

This marks the second time in just over two years that ECB officials have had to face crucial decisions amid financial turbulence originating from the United States. Unlike after the Silicon Valley Bank collapse when they decided to deliver a planned half-point hike, the current conditions seem to be pointing toward monetary easing as Trump’s tariffs continue to threaten the European economy.

Canada’s Inflation Balancing Act

G7 central banks across the Atlantic are also facing challenges, though of a different nature. The Bank of Canada will most likely keep rates unchanged on Wednesday due to Canada’s inflation concerns during the ongoing US tariff disputes.

Canadian officials must try to balance competing factors – US tariffs are already hurting business investment and consumer spending while inflation expectations remain stubbornly high. The consumer price data coming out on Tuesday will be extremely crucial for their final decision.

Also Read: De-Dollarization: China Dumps $23 Billion Worth of US Dollars

The situation faced by the Bank of Canada demonstrates how G7 central banks must adapt their policies to external pressures coming from US economic instability while also trying to protect their domestic economies.

Federal Reserve’s Response

While European and Canadian G7 central banks are acting first, the US Federal Reserve won’t actually make its next policy decision until May 7. However, various Fed officials will be offering their economic assessments throughout the week.

Fed Chair Jerome Powell will speak on Wednesday at the Economic Club of Chicago, with regional Fed presidents also discussing economic conditions. Investors will carefully scrutinize these statements for any clues about potential rate adjustments amid rising Treasury yields, a weakening dollar, and the ongoing stock market volatility tied to US trade policy.

Global Central Bank Decisions

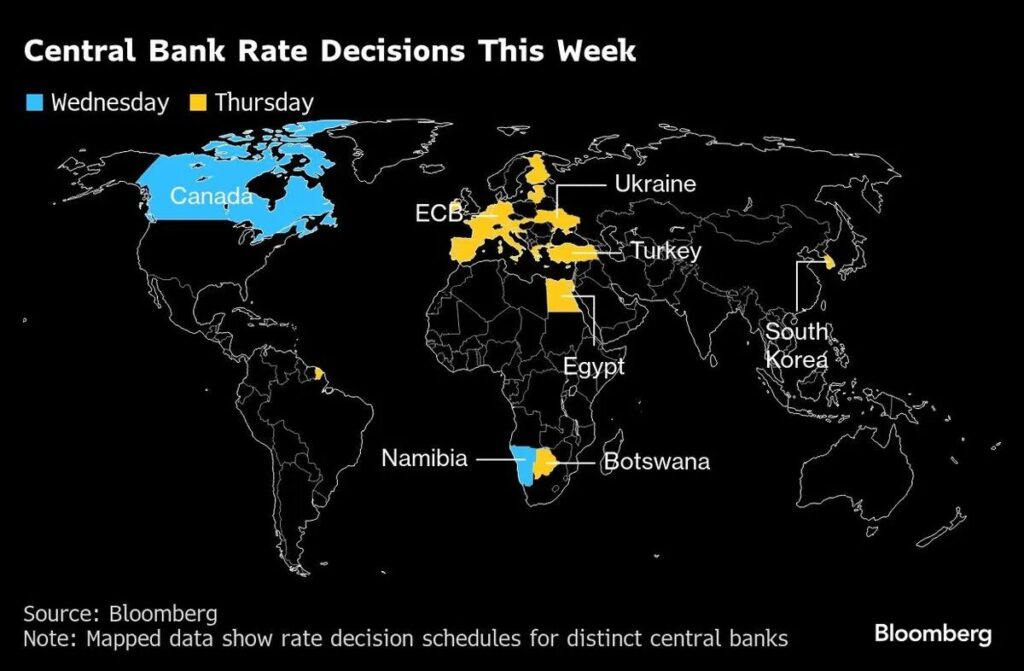

The impact of US economic chaos extends well beyond just the G7 central banks. Several other central banks are also making important policy decisions this week, including South Korea, Turkey, Egypt, Namibia, and Botswana.

Also Read: Mantra Token’s 90% Drop: Reckless Liquidations or Insider Trading?

Turkey faces a particularly difficult decision amid the recent market turmoil, while Egypt might begin easing despite potential complications from US tariff-related money outflows. These diverse responses highlight how US economic instability creates ripple effects that require customized policy approaches worldwide.

As G7 central banks continue to navigate these challenges, their decisions will significantly influence how global markets weather this uncertain period. The divergent responses reflect the complex reality that different economies are affected by US chaos in different ways, which necessarily requires tailored monetary policy strategies.

Senate Targets Crypto Market Bill by August as Trade Policy Adds Volatility

US economic policy is entering a new phase as lawmakers push forward with comprehensive digital asset legislation while the administration redefines its trade strategy through targeted sector tariffs.

Senator Tim Scott, chair of the Senate Banking Committee, has confirmed that a crypto market structure bill could be signed into law by August 2025, a timeline echoed by both industry leaders and fellow lawmakers.

Meanwhile, Commerce Secretary Howard Lutnick’s clarification that recent tariff exemptions on electronics are only temporary further signals a broader government focus on national security and domestic industry protection.

Lutnick Clarifies Trump Tariff Strategy as Volatility Grips Global Markets

The United States’ approach to global trade policy remains in flux as Commerce Secretary Howard Lutnick walked back the recently announced reciprocal tariff exemptions on key electronics, signaling a more permanent, sector-focused strategy in the Trump administration’s ongoing trade war.

The exemptions, announced in an April 12 bulletin from US Customs and Border Protection, were initially seen as a potential olive branch to ease tensions and bring stability to volatile global markets.

However, during an April 13 appearance on ABC News, Lutnick clarified that the exemptions were only temporary and would remain in place for “a month or two” until the administration finalized a broader “sector tariff regime” targeting semiconductors, phones, graphics processors, and other critical computing components.

“President Trump has called out pharmaceuticals, semiconductors, and autos,” Lutnick said. “He called them sector tariffs, and those are not available for negotiation. They are just going to be part of making sure we ensure core national security items are made in this country.”

Lutnick further emphasized the administration’s national security priorities, underscoring the importance of domestic manufacturing for essential items such as medicine and microchips. “We can't be relying on China for fundamental things we need. Our medicines and our semiconductors need to be built in America,” he stated.

Strategic Shift or Negotiation Tactic?

Lutnick’s comments have fueled speculation that the Trump administration’s tariff agenda is less a temporary tactic to influence trade talks and more a long-term strategy to realign the US industrial base. Analysts suggest this signals a geoeconomic pivot from free-market globalization to targeted onshoring of supply chains deemed essential to national security.

While Lutnick did express optimism about reaching a trade agreement with China, the tone of his remarks suggested that any deal would not touch core sectors designated as off-limits by the Trump administration.

The sectors in question—pharmaceuticals, semiconductors, and automobiles—are not only vital to the US economy but also strategic arenas in the ongoing technological competition with China.

This evolving trade stance is expected to have a profound impact on multinational corporations, supply chain logistics, and inflationary pressures. It also sets the stage for potential retaliatory measures by China and other US trading partners.

The announcement and subsequent walk-back of tariff policy have contributed to growing unease in financial markets. The Volatility S&P Index (VIX), a widely tracked measure of expected stock market turbulence, remains elevated as investors brace for more policy whiplash.

The situation escalated earlier this month when President Trump’s tariffs triggered a dramatic sell-off in both equity and crypto markets, erasing approximately $3.5 trillion in market value as investors fled riskier assets.

The S&P 500, a bellwether for global economic sentiment, hit a volatility rating of 74 in April—surpassing even Bitcoin’s, which registered at 71, according to Bloomberg analyst Eric Balchunas.

Markets briefly rallied on rumors of a 90-day reciprocal tariff pause, with stocks surging and roughly $2 trillion in value reentering the system. However, that optimism was quickly squashed when Trump dismissed the rumors, prompting another mass exodus of capital.

When the pause was finally confirmed days later, the market rebounded once more—only to now face renewed doubt following Lutnick’s assertion that the exemptions are merely a temporary measure.

Traders and institutional investors are left grappling with a landscape in which US trade policy can pivot on a dime, making it difficult to assess long-term risk. Some market participants have described this environment as “policy-induced volatility,” a term reminiscent of the 2018 trade war era, which saw similar fluctuations.

Decoupling or Recalibration?

Interestingly, Bitcoin has shown signs of decoupling from traditional risk assets in recent days, with price action becoming slightly more stable even as the S&P 500 lurches in both directions. This phenomenon, while still nascent, has sparked debate about whether digital assets could emerge as alternative safe-havens in the face of political and economic instability.

Still, with macroeconomic pressures mounting—from inflationary shocks to supply chain disruptions—the crypto market remains vulnerable to broader sentiment shifts, especially if US policy becomes increasingly protectionist.

If Lutnick’s statements are any indication, the United States is preparing for a fundamental economic shift—one that puts domestic manufacturing, national security, and technological sovereignty at the center of its trade agenda. Unlike previous trade skirmishes aimed at leveling the playing field, this iteration appears designed to rebuild the field entirely.

Whether this doctrine can coexist with global supply chains and capital flows remains to be seen, but for now, it is clear that the Trump administration is doubling down on an America-first industrial policy—one that is already reshaping global markets.

Senator Tim Scott Says Crypto Market Bill Likely by August as Bipartisan Momentum Builds

US lawmakers are also setting their sights on a pivotal summer for cryptocurrency legislation, with Senator Tim Scott, Chairman of the Senate Committee on Banking, Housing, and Urban Affairs, expressing confidence that a comprehensive crypto market structure bill will be passed into law by August 2025.

Scott's remarks, made in a recent interview with Fox News, mark a significant milestone in the years-long effort to craft a federal regulatory framework for digital assets.

The senator also pointed to the committee’s advancement of the GENIUS Act in March—an ambitious regulatory bill aimed at establishing clear rules for stablecoins—as evidence of a growing focus on responsible innovation in the crypto sector.

“We must innovate before we regulate — allowing innovation in the digital asset space to happen here at home is critical to American economic dominance across the globe,” Scott told Fox News.

Momentum for crypto legislation continues to build on both sides of the aisle. Speaking at the Digital Assets Summit in New York City last month, Representative Ro Khanna (D-CA) echoed Senator Scott’s outlook, stating that both market structure and stablecoin bills are expected to pass in 2025.

Khanna noted that approximately 70 to 80 Democrats in Congress now recognize the importance of establishing digital asset policy that encourages responsible growth, promotes technological innovation, and safeguards the role of the US dollar in a rapidly digitizing global economy.

Among Democrats, support for dollar-backed stablecoins is particularly strong. According to Khanna, many lawmakers believe these digital tokens could play a vital role in boosting global demand for the US dollar by facilitating fast, low-cost, internet-based payments without relying on foreign banks or traditional infrastructure.

Executive Branch Aligns with Legislative Agenda

The legislative momentum is matched by strong signals from the executive branch. Bo Hines, executive director of the President’s Council of Advisers on Digital Assets, stated at the same conference that stablecoin legislation could be signed into law within the next 60 days, further aligning with Senator Scott's August timeline for broader market structure reforms.

The Trump administration has made digital asset regulation a key policy focus, emphasizing its importance for national economic security and technological leadership. President Trump, Treasury Secretary Scott Bessent, and crypto policy lead David Sacks have repeatedly stressed that developing clear and competitive rules for crypto is crucial for attracting capital and innovation to US-based blockchain firms.

The GENIUS Act, which advanced out of committee in March, lays the groundwork for federal oversight of stablecoins, requiring issuers to maintain full reserves, provide regular audits, and register with regulatory bodies. Industry stakeholders have largely welcomed the bill as a step toward mainstream adoption and regulatory clarity.

Kristin Smith, CEO of the Blockchain Association, a leading crypto industry advocacy group, also expressed optimism that both the GENIUS Act and a broader crypto market structure bill will be passed by August. Smith praised the bipartisan approach taken by Congress, noting that it reflects growing recognition of crypto’s role in the US economy.

Toward Regulatory Certainty

As 2025 progresses, lawmakers appear increasingly aligned on the need to move beyond regulatory ambiguity. In past years, the absence of federal rules left US crypto firms navigating a patchwork of state regulations while competing with jurisdictions overseas that offered clearer frameworks.

Now, with bipartisan support, executive alignment, and industry cooperation, there is real hope that the US could soon establish a comprehensive regulatory structure for digital assets—covering both the operation of crypto platforms and the issuance of stablecoins tied to the US dollar.

If successful, this effort could help cement the United States' role as a global hub for crypto innovation while reinforcing the dollar’s dominance in a digitally connected financial world.