SEC Sends Letters to Several Crypto Firms Over Involvement With Uniswap Labs: Report

The U.S. Securities and Exchange Commission (SEC) has sent letters to several venture capital (VC) firms over their links to the operator of the Ethereum (ETH)-based decentralized exchange Uniswap, according to a report by online publication Axios.

Citing multiple sources, Axios says that the SEC has sent letters to Andreessen Horowitz, Union Square Ventures and other VC firms over their links to Uniswap Labs.

According to the online publication, VC firms have poured more than $170 million into Uniswap Labs since inception. The crypto-focused subsidiary of Andreessen Horowitz, a16z Crypto, lists Uniswap on its portfolio of investments. Uniswap is also listed as one of Union Square Ventures’ unicorn investments by venture capital data website VC Sheet.

The report about SEC’s correspondence with Uniswap Labs’ backers comes about four months since the US markets regulator sent a Wells Notice to the Ethereum-based decentralized exchange. A Wells Notice is typically issued when the SEC is probing an entity for potential violation of securities laws.

In response to the SEC’s Wells Notice, Uniswap Labs’ chief legal officer Marvin Ammori argued that the markets regulator’s argument that the decentralized exchange violated US securities laws was “weak and wrong.”

“…a token is merely a file format–like a PDF or JPEG. Tokens can represent any value, and overwhelmingly represent commodities (BTC, ETH, stables) & memes & access for useful networks. PDFs are not inherently stock certificates, and tokens are not inherently securities.

Even if securities were involved, the Uniswap protocol (and web app, and wallet) don’t fall under definitions of the ‘securities exchange’ or ‘broker.’

Under law, the Uniswap protocol would have to be specifically designed ‘for’ ‘securities’ – and it is not. It is for general purposes, mainly used for commodities.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post SEC Sends Letters to Several Crypto Firms Over Involvement With Uniswap Labs: Report appeared first on The Daily Hodl.

Read More

Crypto Exchange Gemini Discussing Resolution of $900,000,000 Lawsuit With SEC

$10 Weekly Bitcoin DCA Yields 202% Return, Outshines Traditional Assets Over 5 Years

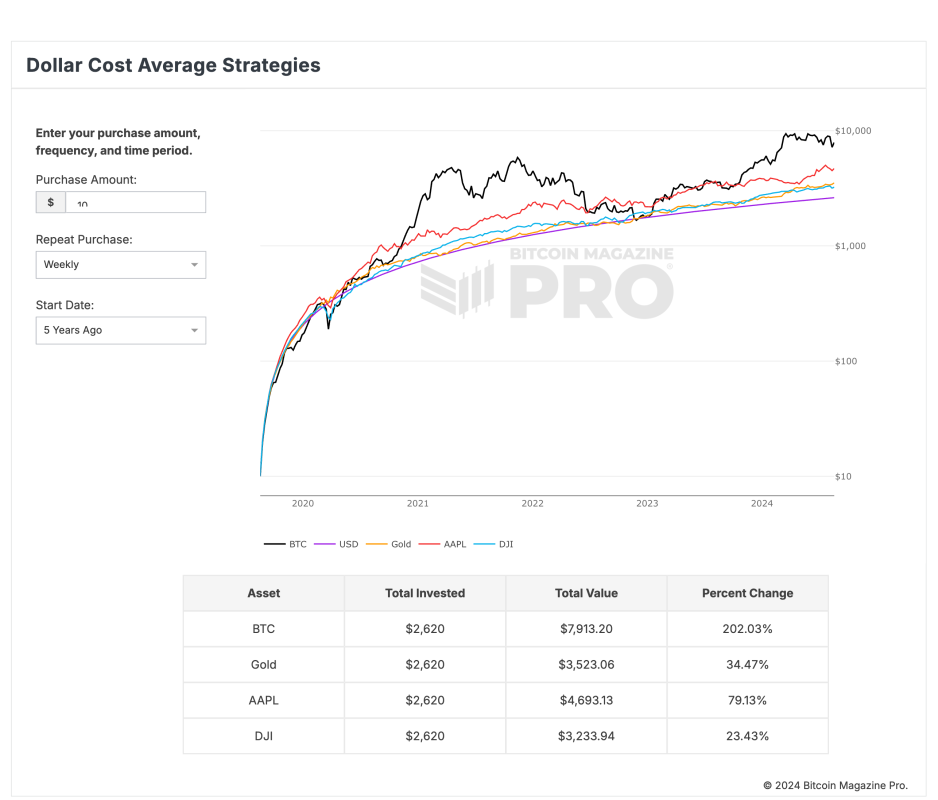

A recent analysis from Bitcoin Magazine Pro showcases the power of dollar-cost averaging (DCA) in Bitcoin compared to traditional assets like gold, Apple stock, and the Dow Jones Industrial Average (DJI). The data reveals that consistently investing $10 weekly into Bitcoin over the last five years would have grown a total investment of $2,620 into $7,913.20, reflecting a remarkable 202.03% return.

In contrast, the same $10 weekly investment in gold yielded a return of 34.47%, growing the initial $2,620 to $3,523.06. Apple stock also performed well, with a 79.13% return, turning the $2,620 investment into $4,693.13. Meanwhile, the Dow Jones provided the least return, with a 23.43% increase, growing the investment to $3,233.94.

This data underscores Bitcoin's potential to be one of the best assets, if not the best asset, for investors to incorporate into their long-term investment strategies. The principle behind dollar-cost averaging—regularly investing a fixed amount of money regardless of price fluctuations—has proven particularly effective with Bitcoin, allowing investors to accumulate wealth over time.

Saving $10 a week into Bitcoin through Dollar Cost Averaging (DCA) offers an affordable and accessible way for newcomers to start investing in Bitcoin. This strategy is especially appealing for those who may be hesitant to invest large sums upfront or are still learning about the volatile nature of the Bitcoin market. By investing a small, fixed amount regularly, individuals can gradually build their Bitcoin holdings, reducing the impact of market fluctuations and making it easier to adopt a long-term investment mindset. This approach allows for consistent growth over time, without the pressure of trying to time the market perfectly.

The Dollar Cost Average Strategies tool from Bitcoin Magazine Pro allows users to explore various investment strategies, optimizing their Bitcoin investments across different time horizons. The tool compares Bitcoin's performance against other assets like the US dollar, gold, Apple stock, and the Dow Jones, illustrating Bitcoin's potential as a superior store of value in a well-rounded investment portfolio.

For more detailed information, insights, and to sign up to access Bitcoin Magazine Pro's data and analytics, visit the official website here.