The Open Network (TON): On the Path to Uniting Web3 and Consumers

Key Findings

-

TON's strategic advantage. Leveraging Telegram's vast user base, TON stands out as a unique blockchain with the potential to bridge the gap between mainstream users and Web3.

-

User-friendly Onboarding of non-crypto users. Telegram Mini Apps provide an intuitive and seamless entry point for non-crypto users, allowing them to engage with blockchain technology without needing extensive knowledge of crypto.

-

Overreliance on GameFi incentives. TON's recent growth has been driven primarily by tap-to-earn incentives, which may not sustain long-term user engagement. There is a need for more complex and engaging applications to maintain momentum.

- Lack of DeFi ecosystem maturity. While TON's DeFi ecosystem shows promise with over $540 million in TVL, it remains concentrated in a few key protocols and lacks the diversity needed to fully absorb and retain a large influx of new users from mini apps.

TON Blockchain Specifics and Challenges

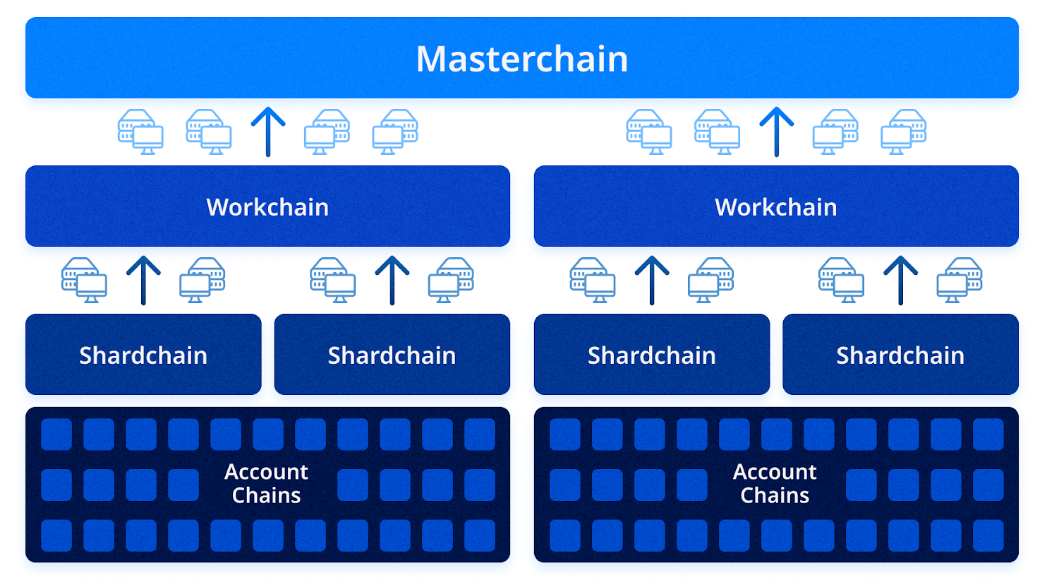

The TON blockchain was designed as a multi-layer, hierarchical system intended to overcome the scalability and efficiency limitations of previous generations of blockchains. Its architecture is composed of three primary layers: the masterchain, workchains, and shardchains.

-

At the top of the hierarchy, the masterchain functions as the backbone of the network, maintaining the global state and ensuring the security and coherence of all other chains within the ecosystem.

-

Below the masterchain, there are workchains—specialized blockchains that manage specific tasks or applications.

-

Each workchain consists of multiple shardchains responsible for processing transactions in parallel and handling the overload.

Shardchains have the ability to split or merge in response to the transaction load, allowing the network to adapt in real-time to fluctuating demand. This dynamic sharding mechanism is the cornerstone of TON's scalability, ensuring the network remains efficient and responsive regardless of usage levels. Unlike blockchains like Ethereum, which can become congested during periods of high demand, dynamic sharding theoretically allows TON to maintain high throughput by distributing the load across multiple, asynchronously operating chains, increasing the network's capacity without compromising security or consistency.

However, despite its theoretically advanced architecture, TON faces significant challenges in practice, including high gas fees and network overloads. The primary issue stems from the fact that only one workchain, the basechain, is currently active. This concentration of activity within a single workchain has led to bottlenecks during periods of intense network usage. For instance, during a performance test in an idealized environment, the TON blockchain achieved an impressive transaction speed of over 104,000 TPS. Yet, a later real-world stress test during TON's inscription craze proved different when transaction processing speed dropped to 1 TPS on some shardchains. The basechain had to split into 11 shardchains, but that wasn’t enough to manage the overload; eventually, it took a few days to overcome the issue.

So, TON's potential for scalability has not yet been fully realized, primarily because additional workchains have not been deployed. While the introduction of more workchains and the actual implementation of sharding could theoretically resolve these issues, only practical demonstration will determine whether these solutions are sufficient.

Toncoin Characteristics and Utility

Toncoin is the native crypto-asset of the TON blockchain. Currently ranked 9th on CryptoRank's capitalization list, Toncoin holds a market capitalization exceeding $16 billion at the time of writing. Out of a total supply of over 5.1 billion tokens, less than half (2.53 billion) are in circulation. In a governance vote held in February 2023, the community decided to freeze approximately 1.08 billion Toncoin (20% of the circulating supply) for four years. The annual inflation rate stands at 0.6%, determined by the payments made by the TON community to validators.

The rapidly growing utility of the TON token is helping to improve the uneven distribution situation. Beyond gas payment and staking uses, Toncoin is actively utilzed in the expanding DeFi ecosystem, including lending, liquidity, and liquid staking protocols. Liquid staking options are presented by platforms like Tonstakers, bemo, and Hipo, offering Liquid Staking Derivative (LSD) tokens—tsTON, stTON, and hTON, respectively.

Toncoin has found a special place within the Telegram ecosystem. $TON can be used to buy Telegram Premium subscriptions, purchase anonymous phone numbers, acquire channel names, and support content creators through donations or subscriptions to private groups and channels. This integration makes Toncoin more practical in the real world, acting as a bridge between crypto and mainstream digital services.

Toncoin Issuance Controversy

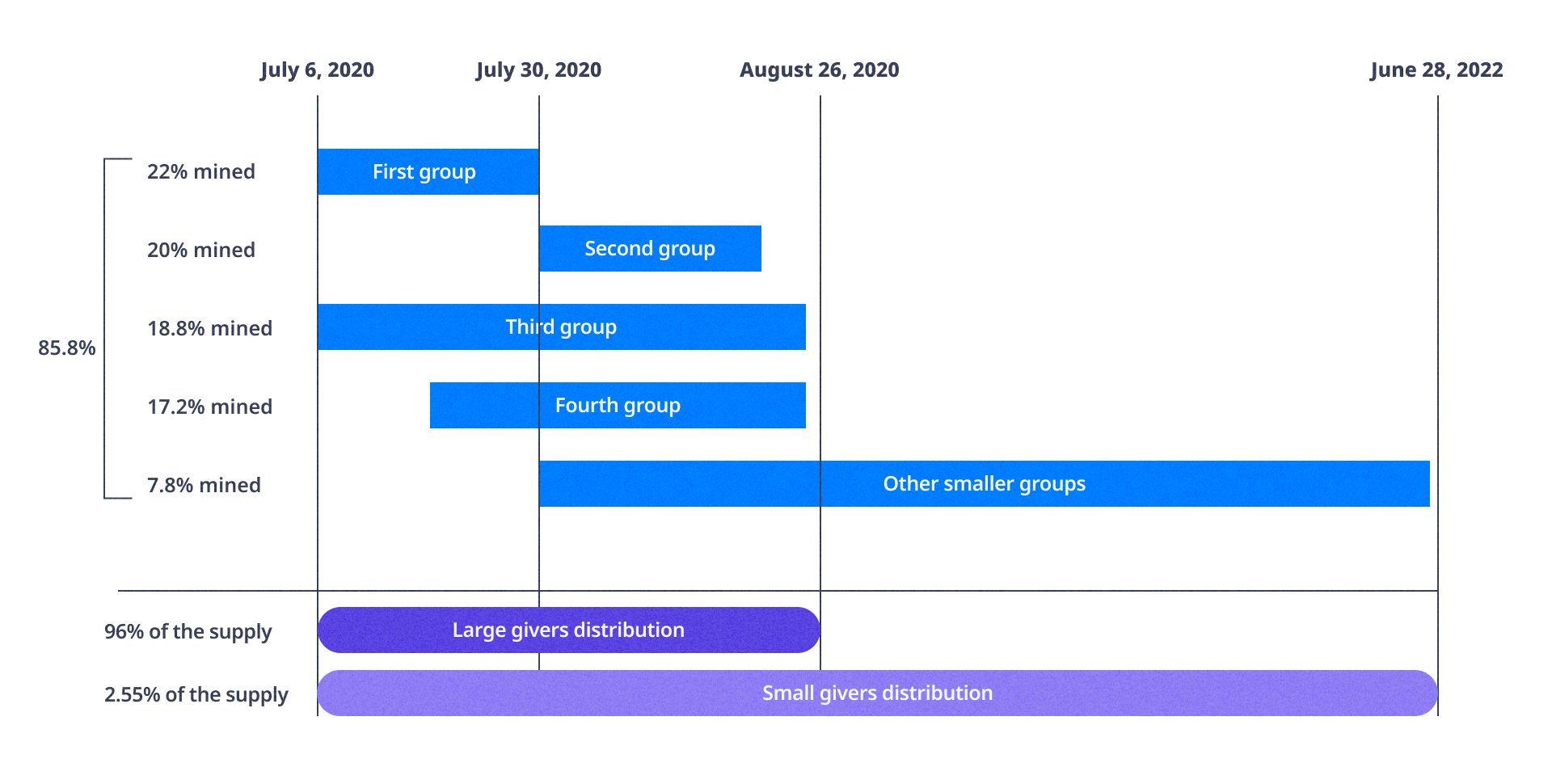

Toncoin emerged from a controversial and opaque token issuance process that still raises concerns about the network's decentralization and governance. Originally designed as a testnet of the Gram blockchain, the TON mainnet inherited the specific token distribution mechanism. All token issuance was locked within special Proof-of-Work (PoW) Giver smart contracts that required users to engage in activities, referred to as "mining," to obtain Toncoin. Although the mining process was officially open to everyone from June 2020 to June 2022, the reality was far from egalitarian. By the time the broader public became aware of the opportunity, the lion's share of tokens had already been captured by a few groups of wallets with presumably insider knowledge.

A significant portion (96%) of the Toncoin supply was mined between July and August 2020 by 248 addresses. These early miners, who control the majority of the network’s tokens, currently dominate the validator set, raising concerns about decentralization and governance. On the other hand, such control over the network enables the team to make necessary decisions at a speed unavailable with decentralization, as well as fund critical endeavors. In an attempt to address these issues, TON validators voted in 2023 to freeze inactive addresses for four years, thus targeting approximately 20% of the total supply.

One of the main problems with the TON is that there is a significant concentration of whales holding the token. According to IntoTheBlock, 14 whales are controlling (>1% of supply) slightly over 66% of supply. Meanwhile, retail (<0.1% of supply) controls only 8.7%. The positive factor is that the retail share is growing, potentially benefiting from the TON listing on the major exchanges including Binance and high-profile airdrops in Q2 and Q3 2024.

Source: Whiterabbit on Medium

TON On-Chain Performance

Total Value Locked

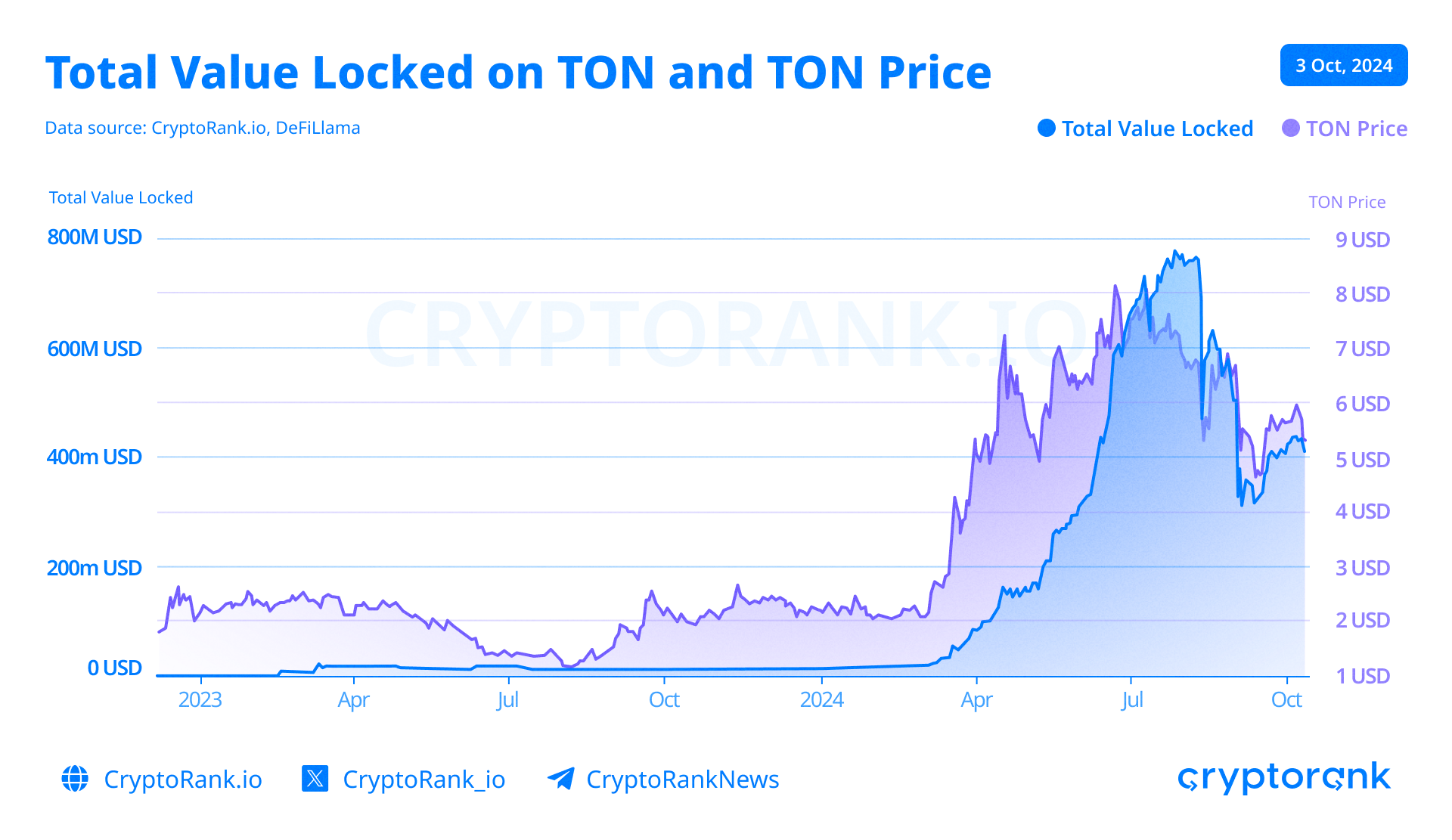

As of October 2024, the Total Value Locked (TVL) on the TON blockchain stands just above $400 million. The TVL peaked at $776 million on July 20, marking an extraordinary surge from the $17 million recorded at the beginning of the year—a growth of over 45 times. This rapid expansion was primarily driven by the tap-to-earn meta, the surge in meme coins, and a USDT pools-focused incentives program spearheaded by the TON Foundation.

Transaction Count and Volume

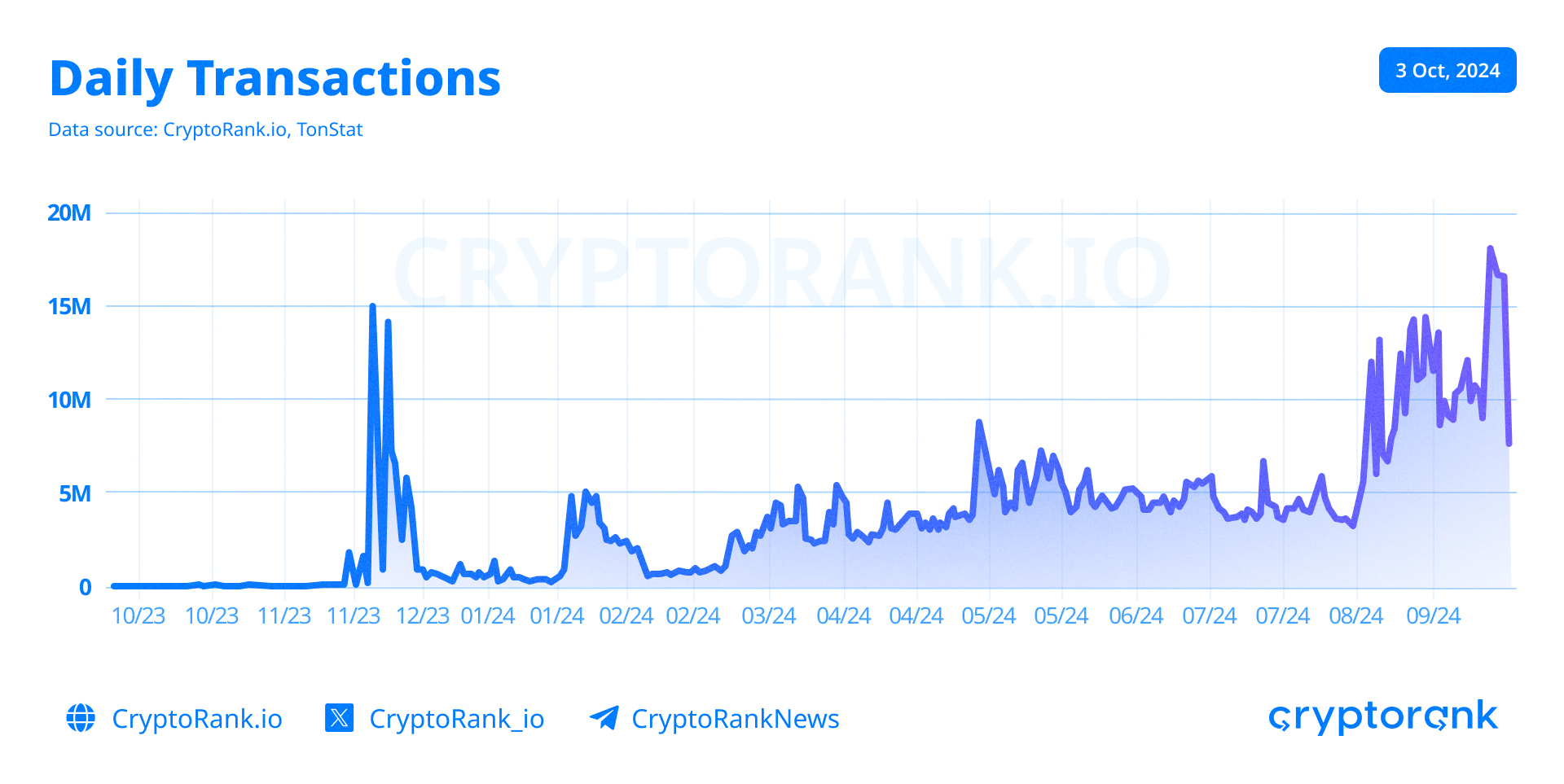

Since late March, the number of daily transactions has consistently remained above 3 million. The highest transaction count in 2024 occurred on September 27, with 18,146,948 transactions, setting a new all-time high. This spike was driven by the Hamster Kombat airdrop.

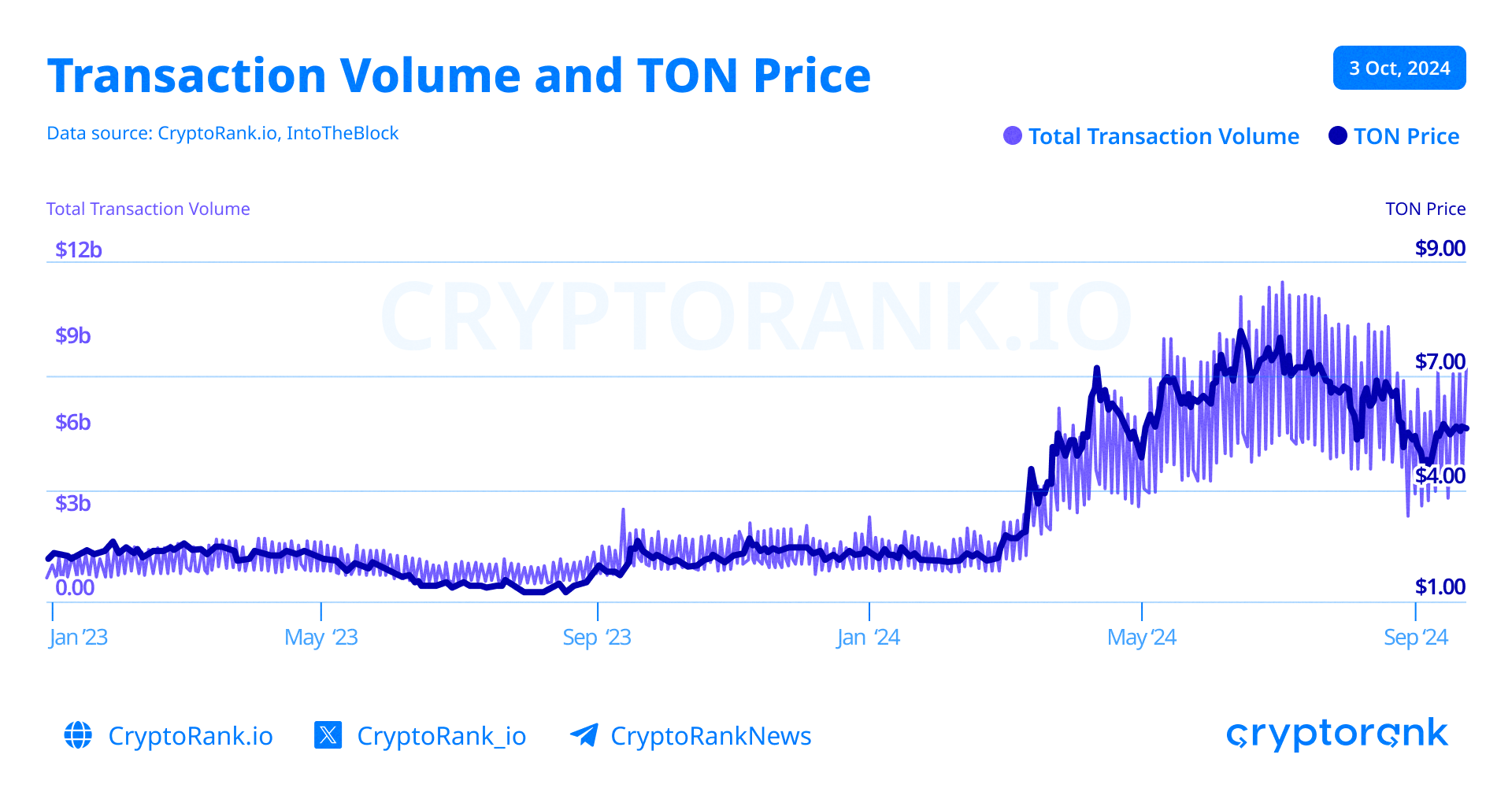

Since early May, the daily transaction volume, representing the daily U.S. dollar turnover, has consistently exceeded $4 billion. This performance shows a clear correlation with the price movements of the TON token.

Active Wallets

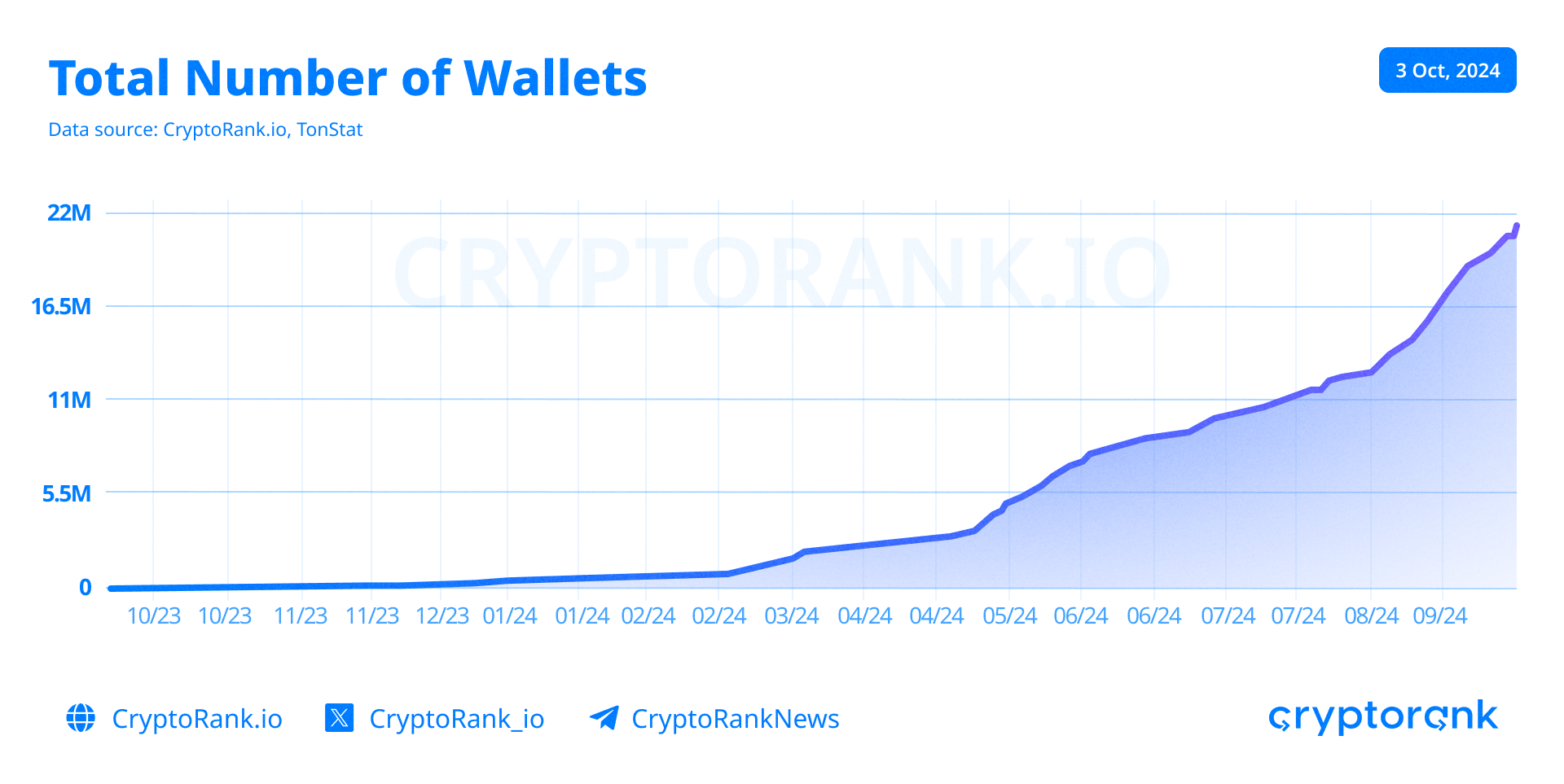

The chart below shows the total number of activated on-chain wallets. A wallet is marked as "activated" once it has sent at least one outgoing transaction. By the beginning of October, the number of activated wallets has surpassed 21 million, representing an almost 20x increase since the start of the year.

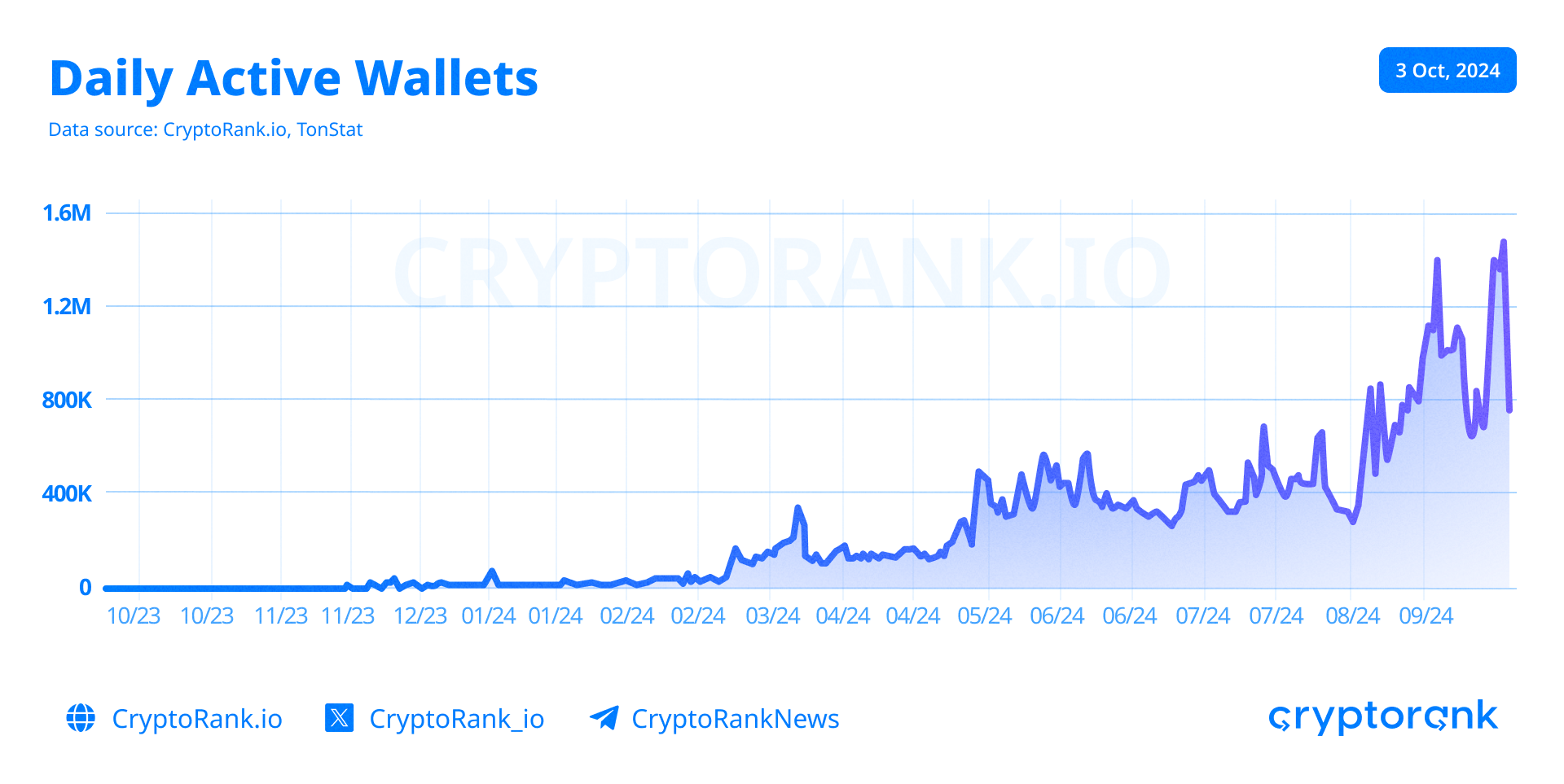

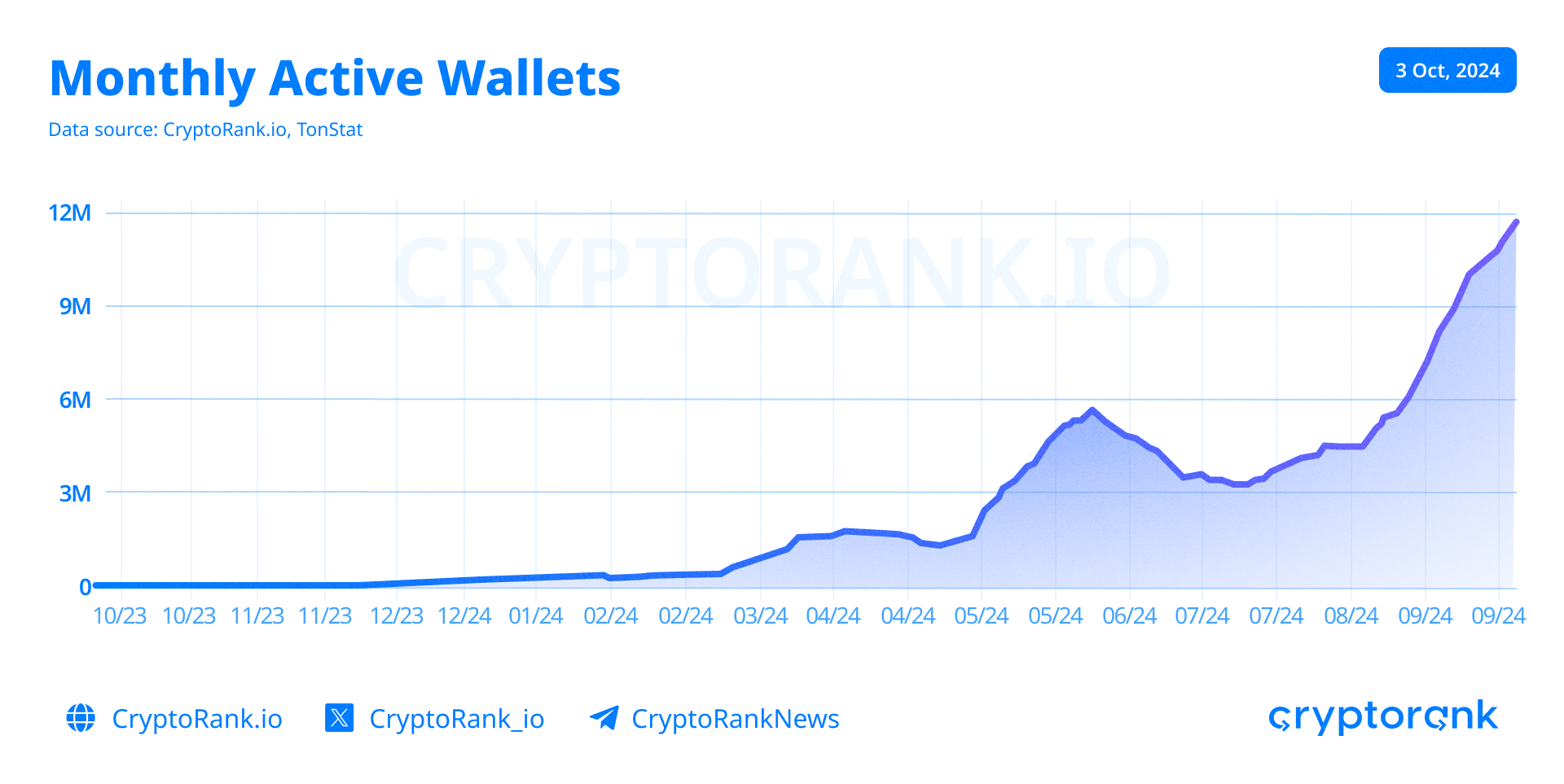

The number of Daily Active Wallets (DAW) reached a new ATH of 1.4M, reflecting a more than 53x increase since the beginning of the year. Notably, in Q3 2024, TON outpaced Ethereum in DAW on several occasions. Considering that TON's primary objective is to bring non-crypto users into the crypto space, the number of active addresses is arguably the most critical metric.

As of October 3, the number of Monthly Active Wallets (MAW) crosses 11.7 million, marking an impressive 53x increase since the beginning of the year.

TON Ecosystem Performance

It’s nearly impossible to find an article about TON that doesn't revolve around the central idea that Telegram is the network's ace in the hole. The prevailing belief is that Telegram's vast user base will become the catalyst for mass adoption, potentially drawing in the next 100 million—or even billion, depending on how optimistic you are—crypto users.

We can't ignore this argument either. However, we'll strive to avoid redundancy and resist indulging in copium—a term often used online to describe a psychological defense mechanism where one distorts reality to fit their desires. Instead, let's focus on the tangible prospects of leveraging Telegram's user base for broader adoption.

Discover more TON ecosystem projects on CryptoRank: https://cryptorank.io/ecosystems/ton-ecosystem

Telegram Mini Apps as the Game Changer

Telegram’s integration with the TON blockchain indeed provides a unique opportunity to solve one of the most significant barriers in the crypto space, user onboarding. Traditional crypto platforms typically struggle with onboarding new users due to complex processes and unfamiliar interfaces. Telegram, with its established user base and familiarity, offers a seamless entry point for users who might otherwise be hesitant to engage with blockchain technology. The key entry point is Telegram Mini Apps, which have evolved from Telegram bots.

These apps open directly within Telegram, offering a smooth and familiar interface for users to explore decentralized applications (dApps) and services without even knowing about the crypto infrastructure behind them. As more protocols build out Mini App functionality, the combination of TON and Telegram could set a new standard for mobile UI/UX in the crypto world. Given the scarcity of crypto mobile apps that offer such a seamless experience, Telegram Mini Apps stand out as a potential game changer in the industry.

Telegram's closest analogs in mini app functionality are Facebook and WeChat. Facebook introduced mini-apps in 2007, before mobile gamification took off. Their peak was between 2009 and 2011, but interest has since dwindled, leaving the platform's gamification nearly obsolete today. WeChat launched mini apps in 2017, with in-game transactions reaching $120 billion annually within two years, doubling by 2020.

By 2021, even though the number of mini game developers had soared past 100,000, the growth in monthly active users (MAU) remained stagnant, holding at around 20 million since the feature’s launch in 2017. However, by June 2023, the number of WeChat mini game developers had tripled to over 300,000, and the platform boasted 400 million monthly active gamers, accounting for roughly 31% of WeChat’s 1.3 billion users. Industry insiders estimate that the WeChat mini game market was valued at $6 billion in 2023, with expectations for annual growth between 25% and 30% over the next five years.

Today, WeChat is China's super app, covering everything from socializing to payments and gamification, bolstered by government support that drove out foreign competitors. While Telegram won't have such a monopoly, achieving even 10% of WeChat's success would be a huge win for its mini apps and TON.

GameFi Focus

The GameFi mini apps have become a key driver in attracting users to the network. Notcoin, as the first successful example, allowed users to engage in a straightforward gameplay loop – tapping their screens to level up and earn rewards. This simplicity, combined with the airdrop anticipation, has made the game highly appealing and kickstarted the tap-to-earn meta. Eventually, Notcoin amassed over 40 million users and distributed a generous airdrop to millions of users, making its token, NOT, one of the most widely held tokens on the TON network. As of the time of writing, there are more than 10 million $NOT holders.

Following Notcoin, Hamster Kombat has attracted even more users by adding a hamster-themed twist and more gaming options. The game has reportedly captured 200 million users, according to its official X (ex-Twitter) account. If these figures are true, Hamster Kombat has achieved user acquisition numbers comparable to the top iOS and Android mobile games in 2023. This success shows how TON's GameFi ecosystem can attract a wide audience, as Axie Infinity did back in the day. Despite initial criticism for being too simple, Axie Infinity became widely popular, especially among international users who viewed it as an actual job.

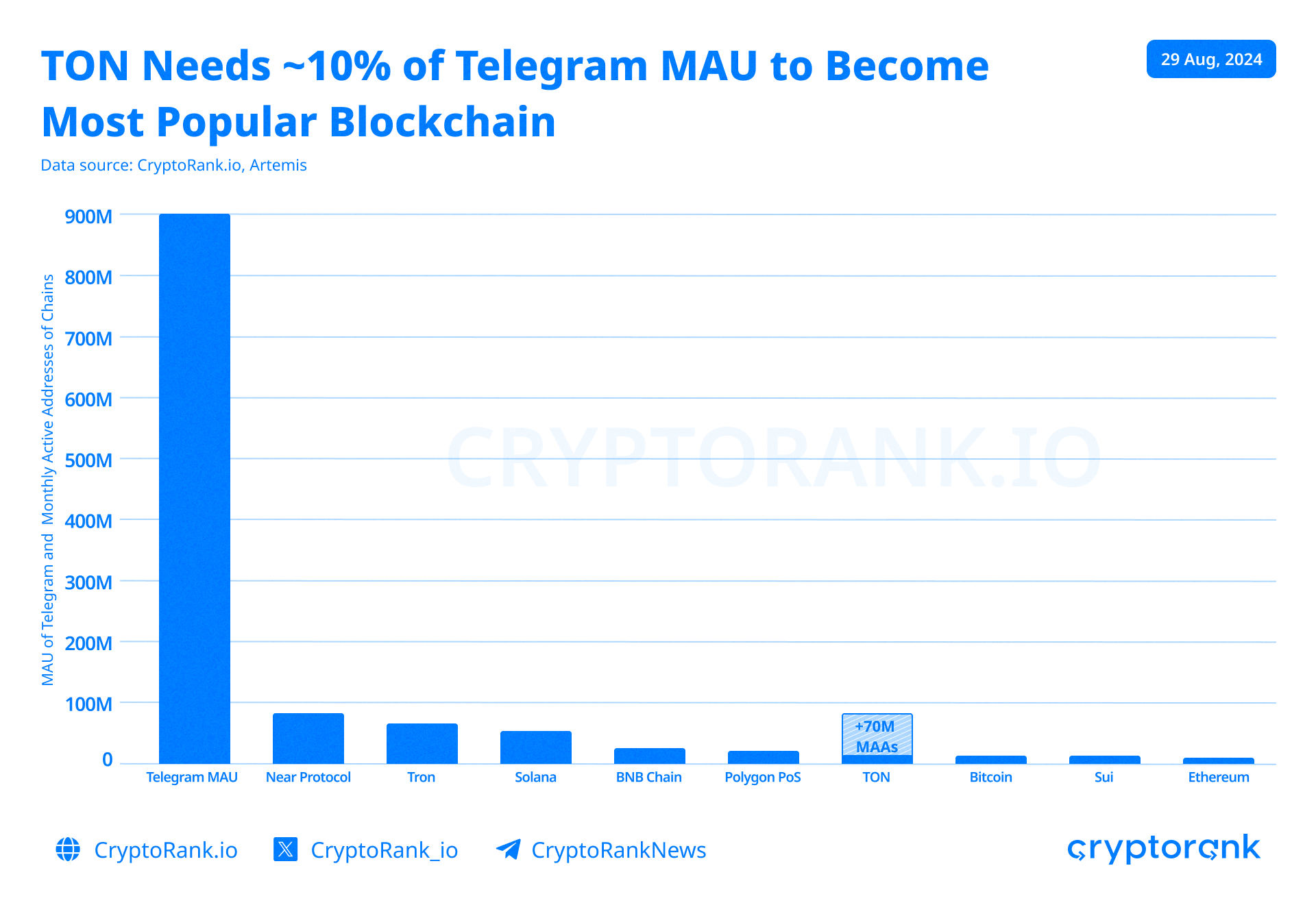

While the impressive numbers touted by Telegram’s tap-to-earn protocols are primarily from Web2-based mini apps without actual on-chain transactions, the scale of user engagement is still notable even by Web2 standards. With each new game, a solid number of new users are being onboarded to crypto through token generation events (TGE). Although the TON Foundation’s goal of converting 500 million Telegram users to TON may seem overly ambitious, converting just 5-10% of the reported 900 million monthly active users (MAU) could make TON the most populated chain by active addresses.

State of DeFi on TON

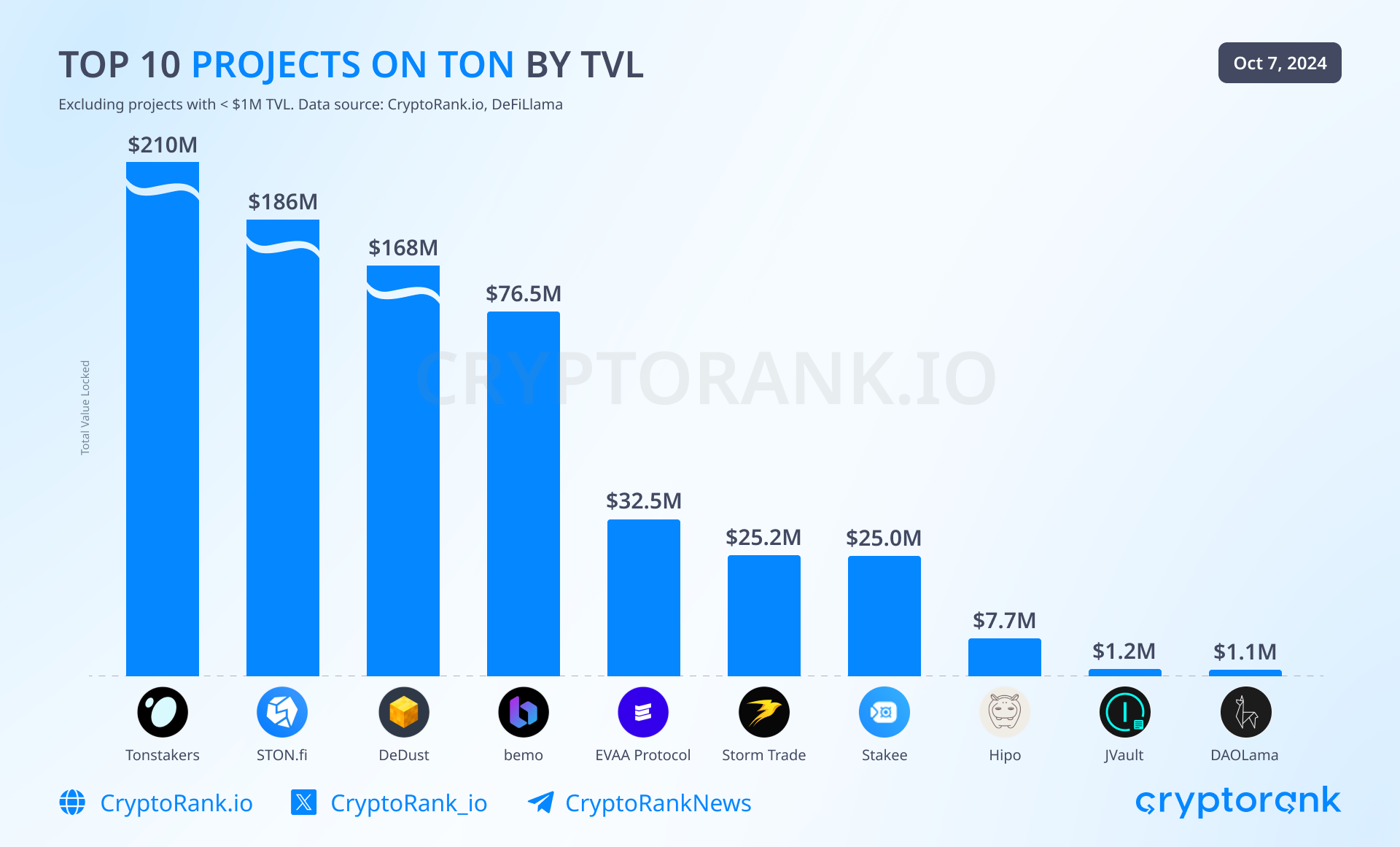

Drawn in by popular GameFi mini apps, new users come to the TON ecosystem. However, the current state of DeFi on TON reveals that the ecosystem is not yet fully prepared to absorb this massive influx of users. With a Total Value Locked (TVL) exceeding $540 million, TON’s DeFi ecosystem shows promise but remains heavily concentrated in a few key protocols. The bulk of TON's TVL comes from its two largest decentralized exchanges, STON.fi and DeDust, which together account for over $450 million. These platforms have seen significant growth, largely driven by the TON Foundation’s incentives for USDT pools, which recently offered attractive APRs of around 75% for TON/USDT pairs.

The top 10 protocols by TVL illustrate where most of the activity is concentrated within TON DeFi.

-

Tonstakers – $210 million. Tonstakers is a liquid staking protocol backed by the TON Foundation.

-

STON.fi – $186 million. STON.fi is the largest decentralized automated market maker (AMM) built on the TON blockchain.

-

DeDust – $168 million. DeDust is a decentralized exchange liquidity pool on TON.

-

bemo – $76 million. bemo is the second liquid staking protocol on TON.

-

EVAA Protocol – $32 million. EVAA is the first decentralized lending protocol on TON.

-

Storm Trade – $25 million. Storm Trade is the first derivatives decentralized exchange on the TON blockchain that allows trading of crypto, stock, forex, and commodities with leverage.

-

Stakee – $25 million. Stakee is a staking service on TON.

-

Hipo – $4 million. Hipo is a decentralized liquid staking protocol on TON.

-

JVault – $1 million. JVault is a customizable staking platform where anyone can create their own staking pool.

-

DAOLama – $1 million. DAOLama is a decentralized P2P-based NFT liquidity protocol for lending and borrowing NFTs.

You may have noticed that GameFi apps are absent from this top 10 list, as TVL (Total Value Locked) plays a minor role in gaming but crucial in DeFi. While the current DeFi offerings are impressive, they are still limited in their capacity to handle a massive influx of new users. For TON to fully leverage the growing interest fueled by its GameFi sector, these tap-to-earn mini apps must evolve into fully integrated mini dApps on the blockchain.

Challenges the TON Blockchain Need to Overcome

As the TON ecosystem continues to grow, several challenges must be addressed to successfully absorb the influx of new users and ensure they remain engaged within the blockchain.

Immature DeFi Ecosystem

The current DeFi landscape on TON, while promising, remains too immature to fully accommodate and retain newcomers. Despite recent TVL growth, the ecosystem lacks diversity and depth, offering limited activities for users beyond basic swapping and staking.

To overcome this, TON must focus on rapidly expanding its DeFi offerings by encouraging the development of more varied and complex financial products, such as advanced derivatives markets, yield farming protocols, and prediction markets.

Overreliance on Tap-to-Earn Incentives

Recent growth in TON’s user base has been largely driven by the anticipation of tap-to-earn airdrops. However, as this initial excitement begins to fade, there are legitimate concerns about sustaining user engagement.

To maintain momentum, gaming mini apps should introduce more complicated game mechanics and offer an actual gaming experience, not just airdrop anticipation. Among these mini games, there needs to be a standout "killer app" that remains relevant and engaging well beyond the airdrop.

Limitations of FunC Programming Language

TON’s native programming language, FunC, poses a challenge for developers due to its relative obscurity and steep learning curve. This has slowed the development and deployment of high-quality decentralized applications (dApps), limiting the ecosystem’s appeal.

To address this issue, the TON Foundation could invest in comprehensive developer education programs and hold more hackathons to make FunC more accessible. Besides, encouraging the development of no-code tools can simplify the use of FunC.

Another solution could be the Tact programming language, a higher-level alternative to FunC. Its primary focus is simplicity and efficiency: with Tact, developers can write smart contracts with almost half the lines of code required. For now, it is an experimental language: it is at a very early stage and it might be too risky to use complicated smart contracts.

Initial Supply Distribution Issues

The initial distribution of Toncoin, where a significant portion of total supply was acquired by a small group of wallets, remains a concern for the ecosystem's long-term health. Although steps have been taken to address this, such as freezing inactive addresses, the problem persists.

To further mitigate these concerns, TON could implement more aggressive token redistribution strategies, such as ongoing community grants and ecosystem development funds. Additionally, promoting transparency around these efforts will build trust within the community and attract new users who are wary of centralized token distributions.

Output

The TON blockchain, with its deep integration into Telegram, holds a unique position in the blockchain ecosystem. Its ability to seamlessly onboard non-crypto users through user-friendly Telegram Mini Apps sets it apart from many other networks, offering a significant advantage in driving mainstream adoption. This strategic edge, combined with its potential to scale and accommodate a large user base, positions TON as a key player in the future of Web3. However, realizing this potential will require overcoming several critical challenges.

To sustain and build upon its current momentum, TON must address its scalability issues by deploying additional workchains and refining its sharding mechanisms. Moreover, the ecosystem needs to diversify beyond basic DeFi protocols and tap-to-earn incentives to create a more mature and engaging environment for users. Addressing the limitations of the unpopular FunC programming language and resolving the concerns surrounding Toncoin’s initial supply distribution are equally important. By tackling these obstacles, TON can solidify its place in the blockchain industry and achieve long-term growth and success.