Table of Contents

- The Power of Hyperliquid: Great Product With Exceptional Execution

- Hyperliquid DEX: How Is It Different From the Rest?

- Market Execution: How to Deliver the Best Airdrop in Crypto History?

- Data-Driven Results of Hyperliquid’ Success

- HYPE Tokenomics

- HYPE Allocation

- HYPE Distribution

- HYPE Utility and Buybacks

- Exploring HyperEVM Ecosystem

- Unit – Gateway for Native BTC and More

- Felix – Native Stables on Hyperliquid

- Hyperbeat – Yield Aggregator

- Drip Trade and Best 5 NFTs to Hold on HyperEVM

- Liquid Staking, Money Markets, Bridges, AMM-Based DEXes and Other Stuff on Hyperliquid

- What to Do on HyperEVM to Maximize Your Airdrop Chances?

- Hyperliquid’s Future

Table of Contents

- The Power of Hyperliquid: Great Product With Exceptional Execution

- Hyperliquid DEX: How Is It Different From the Rest?

- Market Execution: How to Deliver the Best Airdrop in Crypto History?

- Data-Driven Results of Hyperliquid’ Success

- HYPE Tokenomics

- HYPE Allocation

- HYPE Distribution

- HYPE Utility and Buybacks

- Exploring HyperEVM Ecosystem

- Unit – Gateway for Native BTC and More

- Felix – Native Stables on Hyperliquid

- Hyperbeat – Yield Aggregator

- Drip Trade and Best 5 NFTs to Hold on HyperEVM

- Liquid Staking, Money Markets, Bridges, AMM-Based DEXes and Other Stuff on Hyperliquid

- What to Do on HyperEVM to Maximize Your Airdrop Chances?

- Hyperliquid’s Future

The Hyperliquid Thesis 2025: The Only Playbook You Need to Master HyperEVM for Second Airdrop

Key Takeaways:

-

Hyperliquid dominates DeFi perps with above 60% market share and over $170B monthly volume.

-

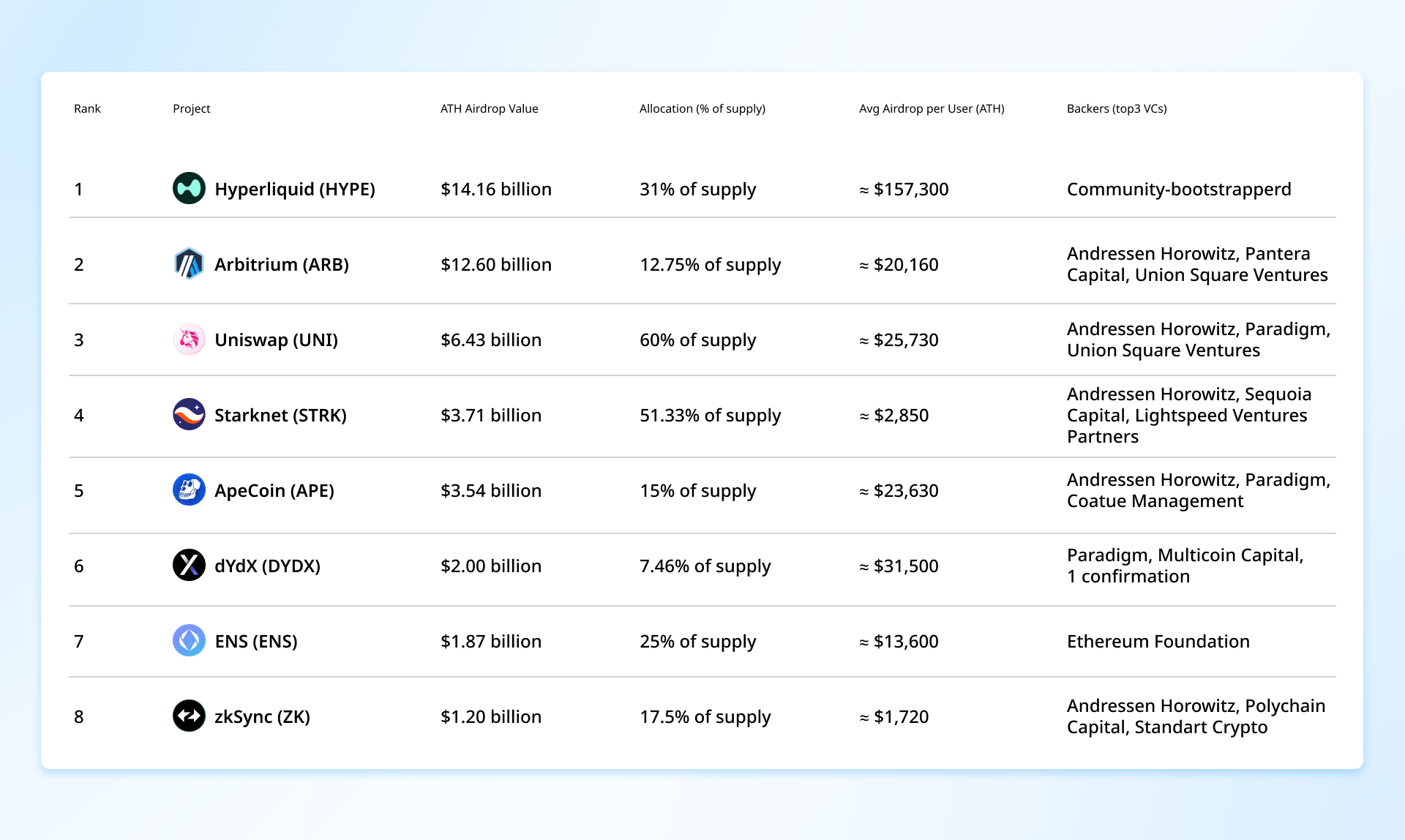

The $HYPE airdrop formula worked: great product + no VC allocations + 31% to community + exclusive exchange listing = wealth effect that kept users in the ecosystem and set the new fair launch meta.

-

390 million tokens or 38.8% of the $HYPE supply remains in the treasury for future incentives. A second airdrop isn't confirmed, but it's the most obvious play to bootstrap liquidity in HyperEVM.

-

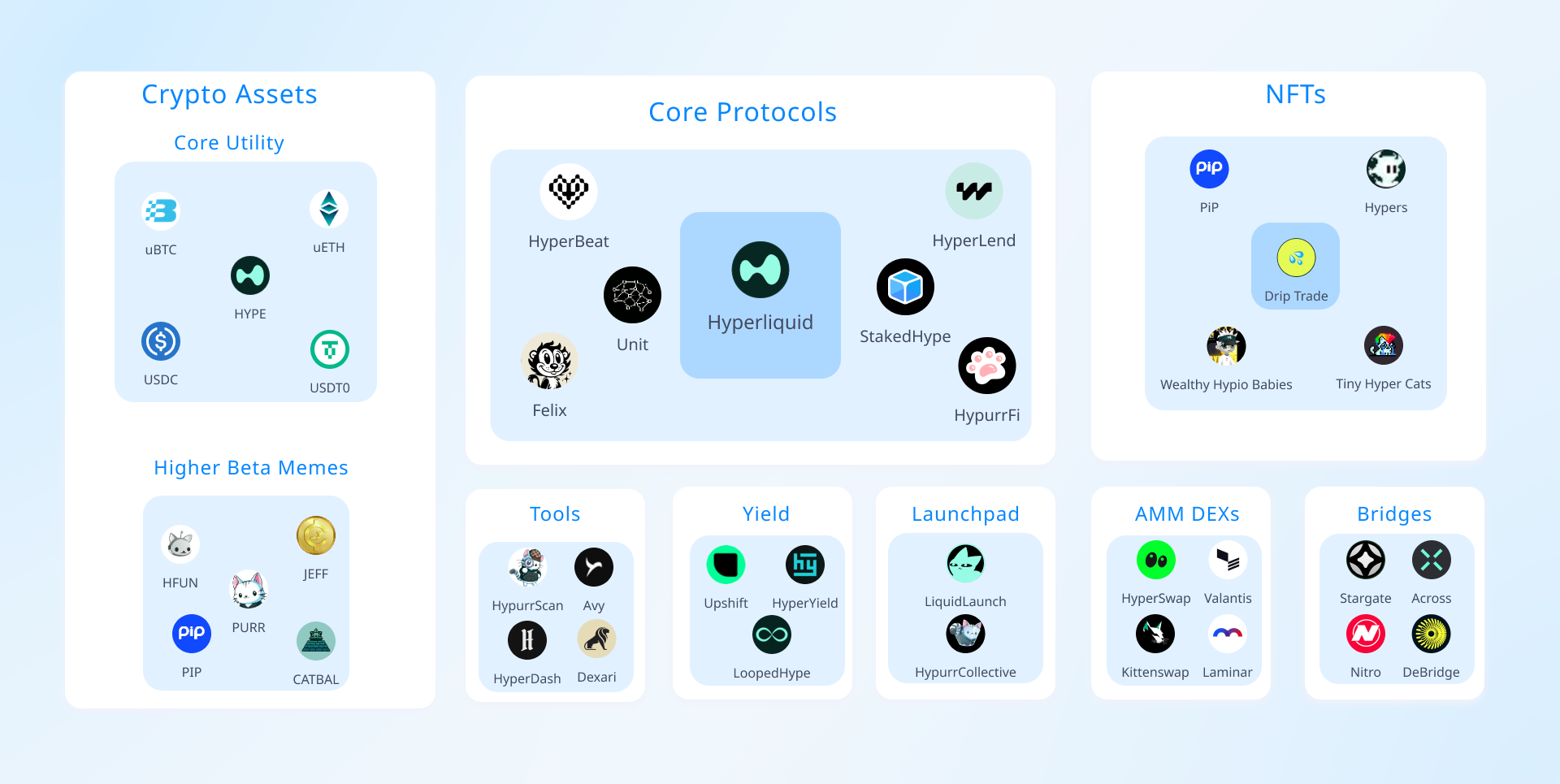

HyperEVM has 170+ launched projects, over 30 are being tracked on DeFiLlama, but there are 5-10 sufficient to cover the entire ecosystem.

First of all, what is HyperEVM? Hyperliquid originally launched as a decentralized order book exchange – one you could trade on after bridging funds from Arbitrum. However, under the hood, it has always been a custom Layer 1 blockchain with its own independent core infrastructure. The chain is split into two main parts: HyperCore, which powers the onchain order books for perps and spot trading, and HyperEVM, a general-purpose EVM-compatible layer. HyperEVM went live on the mainnet in February 2025 and introduced a system of “Builder Codes,” unique identifiers that let dApps “rent” Hyperliquid’s native liquidity in return for fee sharing.

The Power of Hyperliquid: Great Product With Exceptional Execution

Hyperliquid DEX: How Is It Different From the Rest?

Hyperliquid was the first decentralized exchange to achieve a CEX-level trading experience through its architectural design. Operating on a proprietary Layer-1 blockchain with HyperBFT consensus, it processes 200,000 orders per second with 0.2-second latency. All order placement, cancellation, and execution happen on-chain in a single unified ledger, which enables a frictionless trading experience with trades finalizing in under one second. This translates to:

-

Trades execute instantly with a single click and no wallet confirmations required.

-

Built-in account abstraction eliminates gas payments entirely. All costs are covered through trading fees.

-

Even large orders incur less than 0.01% slippage due to the deep liquidity and instantaneous matching.

Let’s compare Hyperliquid’s architecture to some of its competitors. In stark contrast, dYdX v4 relies on a partially off-chain orderbook and matching engine for performance, meaning users never see the live order book on-chain. GMX uses oracles pricing instead of order books that update periodically rather than continuously, causing frustrating delays during rapid market movements.

Beyond that, Hyperliquid delivers institutional-grade features:

-

Advanced Order Execution: Complete suite of professional order types: market, limit, post-only, immediate-or-cancel (IOC), and reduce-only orders.

-

Exceptional Trading Variety: Over 140 perpetual markets and more than 20 spot markets.

-

Flexible Leverage Options: Up to 40× leverage with both cross-margin and isolated-margin modes per position.

-

Ultra-Low Fees: 0.01% maker and 0.035% taker fees. For example, trader with a $1M monthly volume may pay only ~$350 in fees.

Market Execution: How to Deliver the Best Airdrop in Crypto History?

On top of a great product, the team has mastered the airdrop and managed to create the wealth effect within the community. The wealth effect occurs when market participants in an ecosystem experience significant financial gains. As a result, they tend to reinvest capital back into that same ecosystem rather than just cashing out. This creates a positive feedback loop: more capital means more liquidity, more revenue for the protocol, more development funding, and better products, which attract even more users and capital. We saw this with Ethereum's ICO participants funding the early DeFi boom, and now we're watching it happen again.

This is how they managed to execute the best airdrop in crypto history (at least in recent years):

-

Build a Product Users Actually Want: They created something so good that users come and stay organically, not just for points or airdrops. Hyperliquid built a DEX, which is as efficient as CEX: 200K orders per second, one-click execution, 0.01% slippage, over 140 perp markets.

-

Self-Fund to Avoid VC Cabal: According to founder Jeff, the team consciously refused funds to build a truly new financial ecosystem focused on users, without 50% of the network being owned by venture capital. No dumping VCs, no unlocks hanging over everyone's heads, just pure community ownership.

-

Be Genuinely Generous: They distributed 31% of the supply (310M tokens) to users, not the typical 5-15% crumbs. Hyperliquid set a new standard for fair launches, which strengthened trust among existing users and attracted massive market attention.

-

Create Exclusive Access: The team decided to reject the classic scheme where founders pay Binance and other CEXs millions for listings. When you launch your token exclusively on your own exchange, you create a partial supply constraint effect – everyone has to come to you. Of course, for this to work properly, Hyperliquid need the previous three ingredients plus a deep liquidity order book.

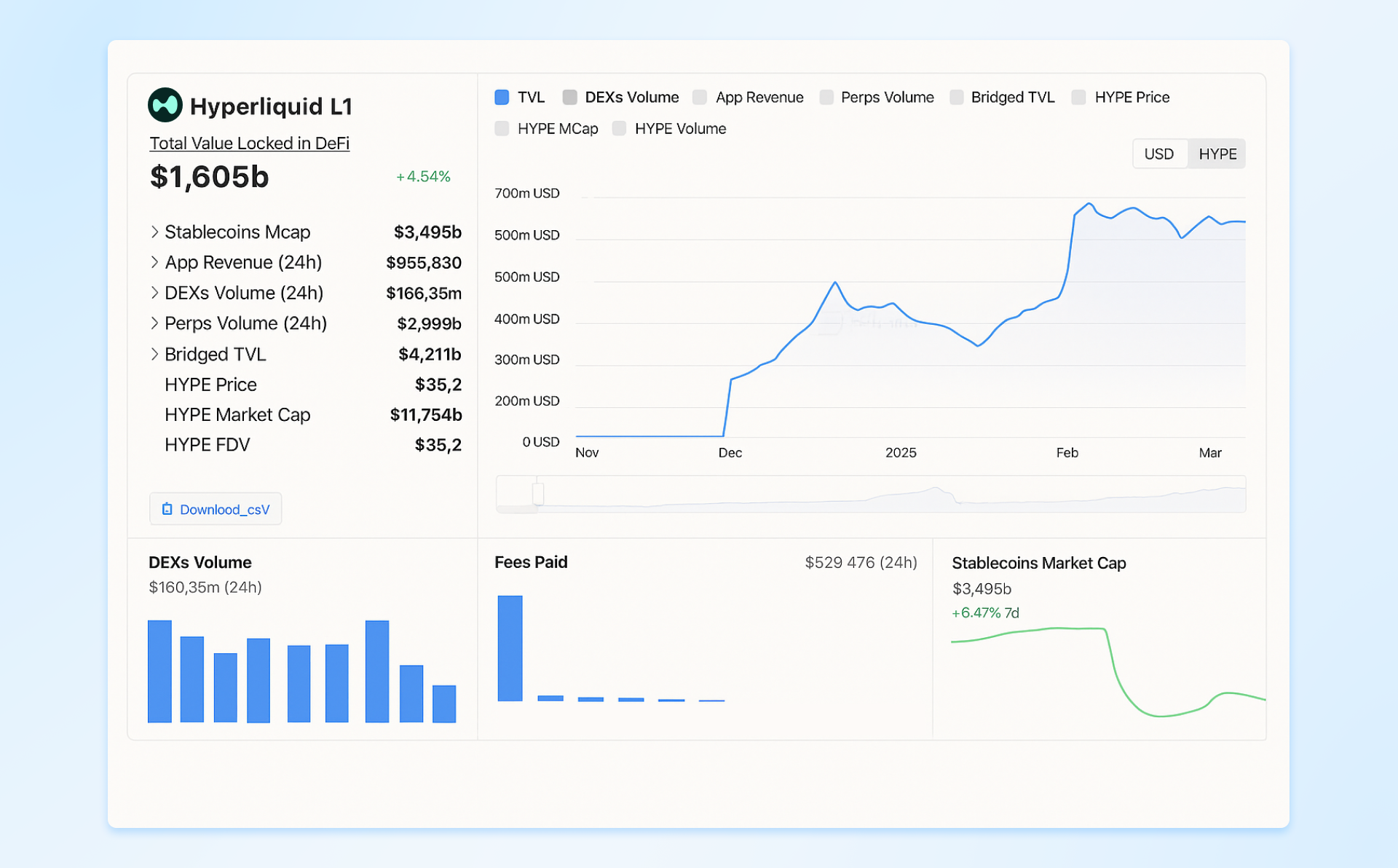

Data-Driven Results of Hyperliquid’ Success

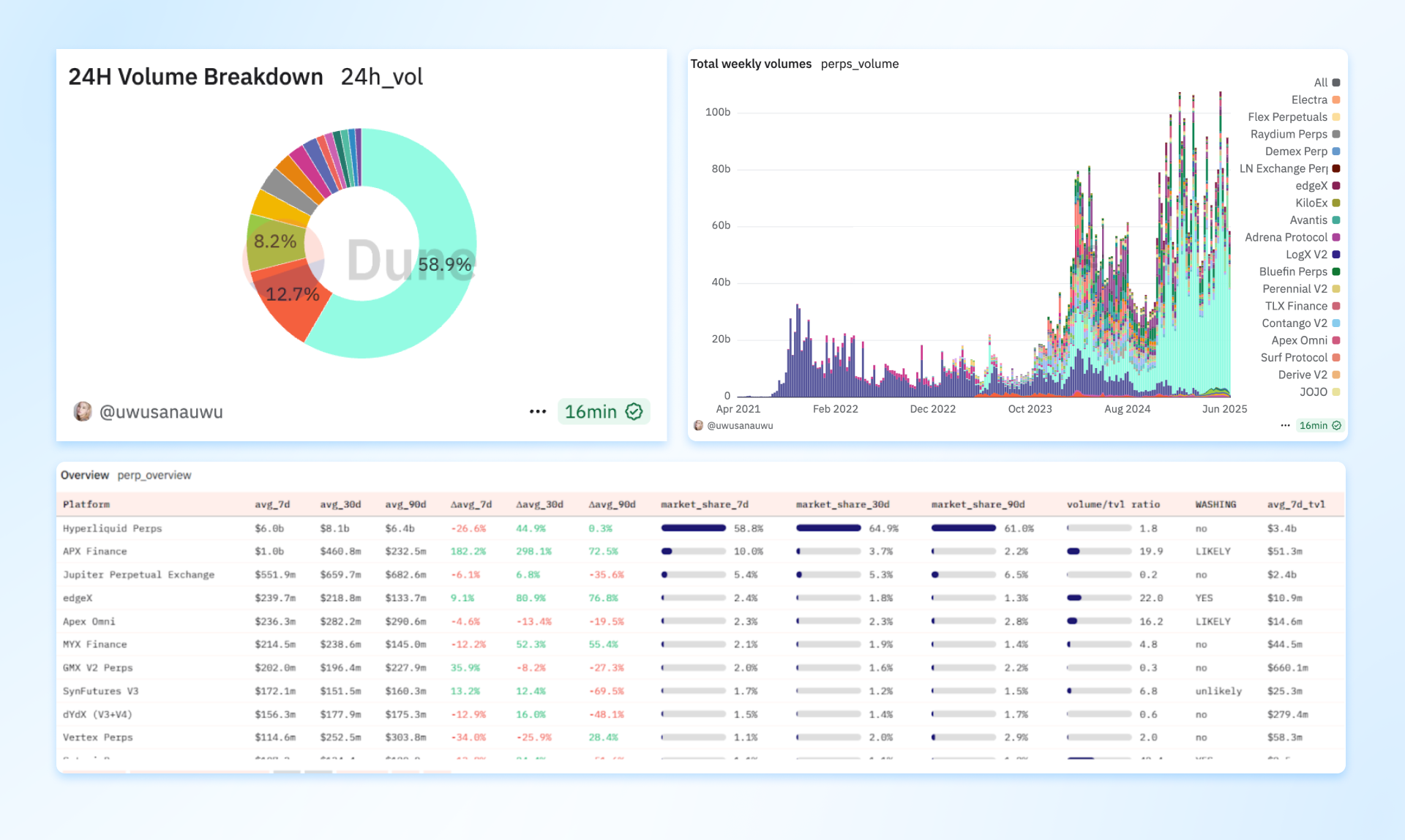

As a result, as of June 2025, Hyperliquid processes over 60% of all perpetual futures volume in DeFi. Most of its competitors are scraping by with 1-5% market share. The only one putting up a fresh fight is APX Finance, which grabbed 10% on a 30-day average basis, but only after it merged with Aster and launched a collaborative incentive program.

Source: https://dune.com/uwusanauwu/perps

The historical competitive performance numbers are even better:

-

Hyperliquid has racked up $1.6T in cumulative volume, hitting a monthly peak of $248B in May 2025.

-

dYdX, the OG of decentralized perps, comes closest with $1.4T cumulative volume, though their monthly ATH was around $107B in October 2021.

-

Jupiter sits at $318B cumulative, with its best month hitting $36B volume in February 2025.

-

GMX has managed $263B all-time, maxing out at $12B monthly volume way back in November 2022.

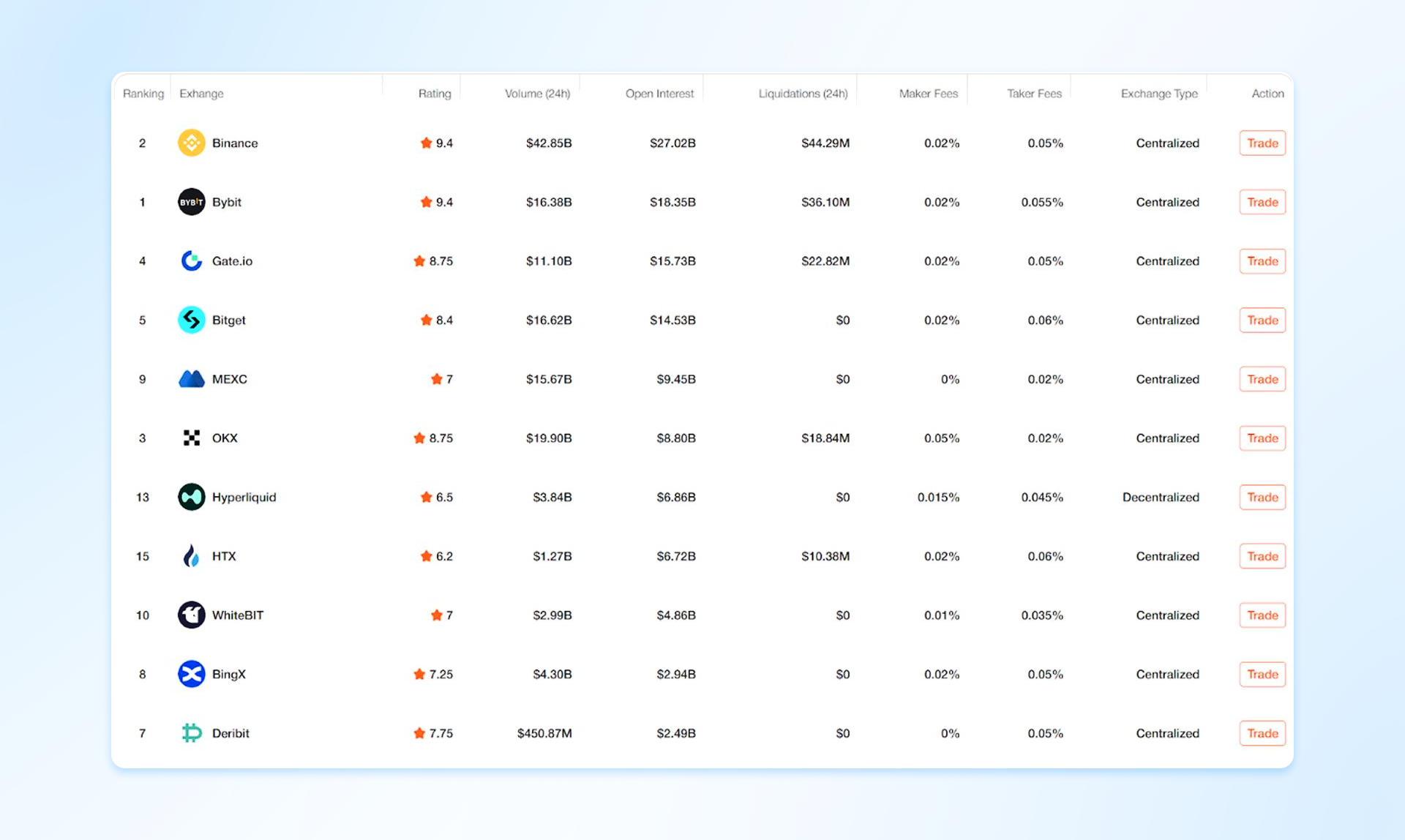

Hyperliquid still isn't touching Binance or Bybit in raw numbers, sitting at 9th place by daily volume and 7th by open interest, according to Coinperps. But give it time – Rome wasn't built in a day.

Source: https://www.coinperps.com/perpetual-exchanges

The Hyperliquid exchange's success has propelled HyperEVM chain to first place in both daily transactions and revenue, leaving competitors behind.

Source: https://app.artemisanalytics.com/home

HYPE Tokenomics

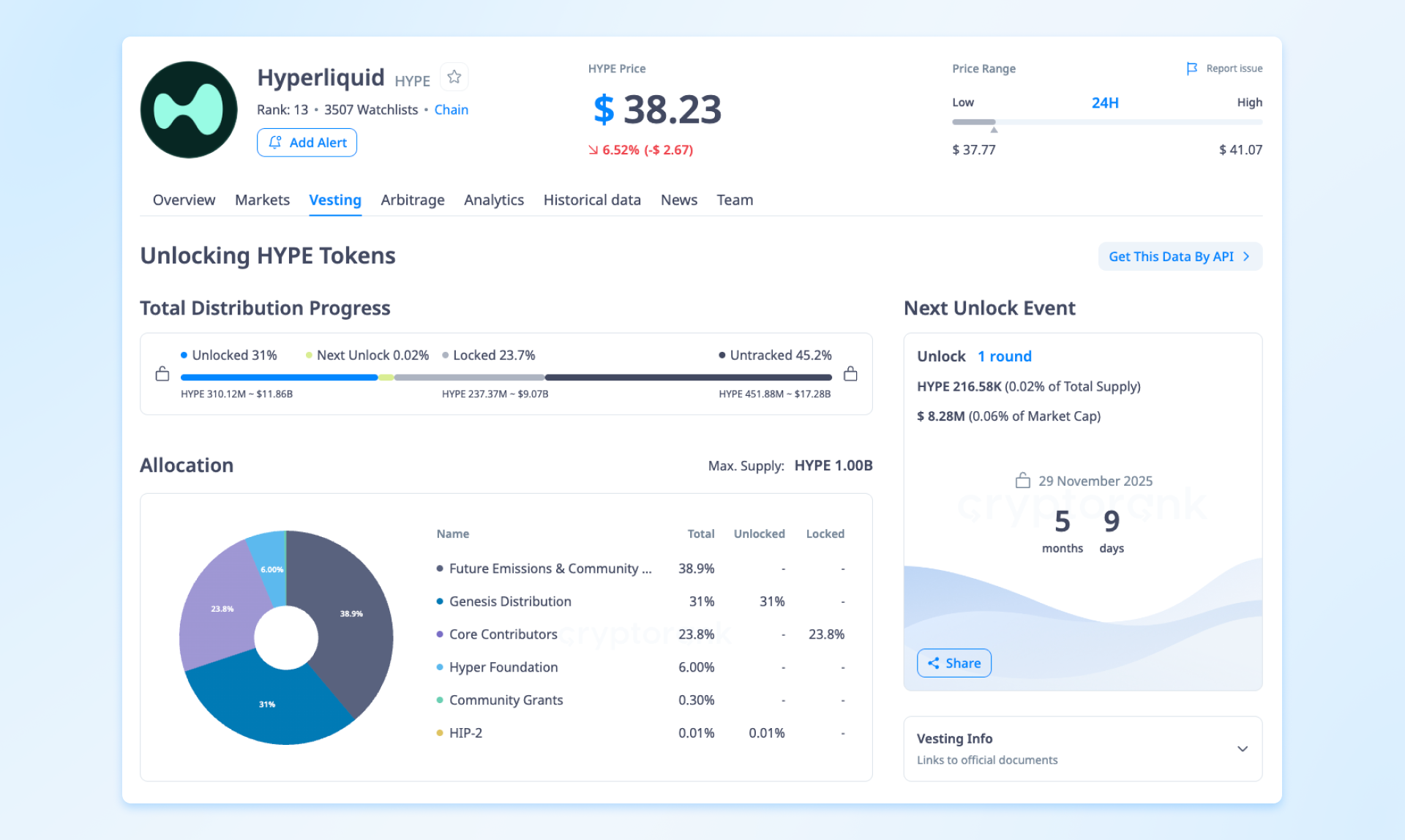

$HYPE is the gas and utility token of the Hyperliquid ecosystem. Maximum supply with a hard cap: 1,000,000,000 $HYPE, with 33.4% currently in circulation (~333.93 million tokens).

HYPE Allocation

-

31.0% – Genesis distribution (airdrop to users)

-

38.8% – Future emissions and community rewards reserve

-

23.8% – Core contributors (founding team and early participants)

-

6.0% – Hyper Foundation budget for ecosystem financing, grants, marketing, and other network development needs

-

0.3% – Community grants and 0.012% – Special allocation per HIP-2 proposal

Team tokens vest linearly over three years with daily unlocks of 216.58K $HYPE (0.02% of total supply), starting December 3, 2025 and ending December 6, 2028. So, no significant market pressure all the way.

HYPE Distribution

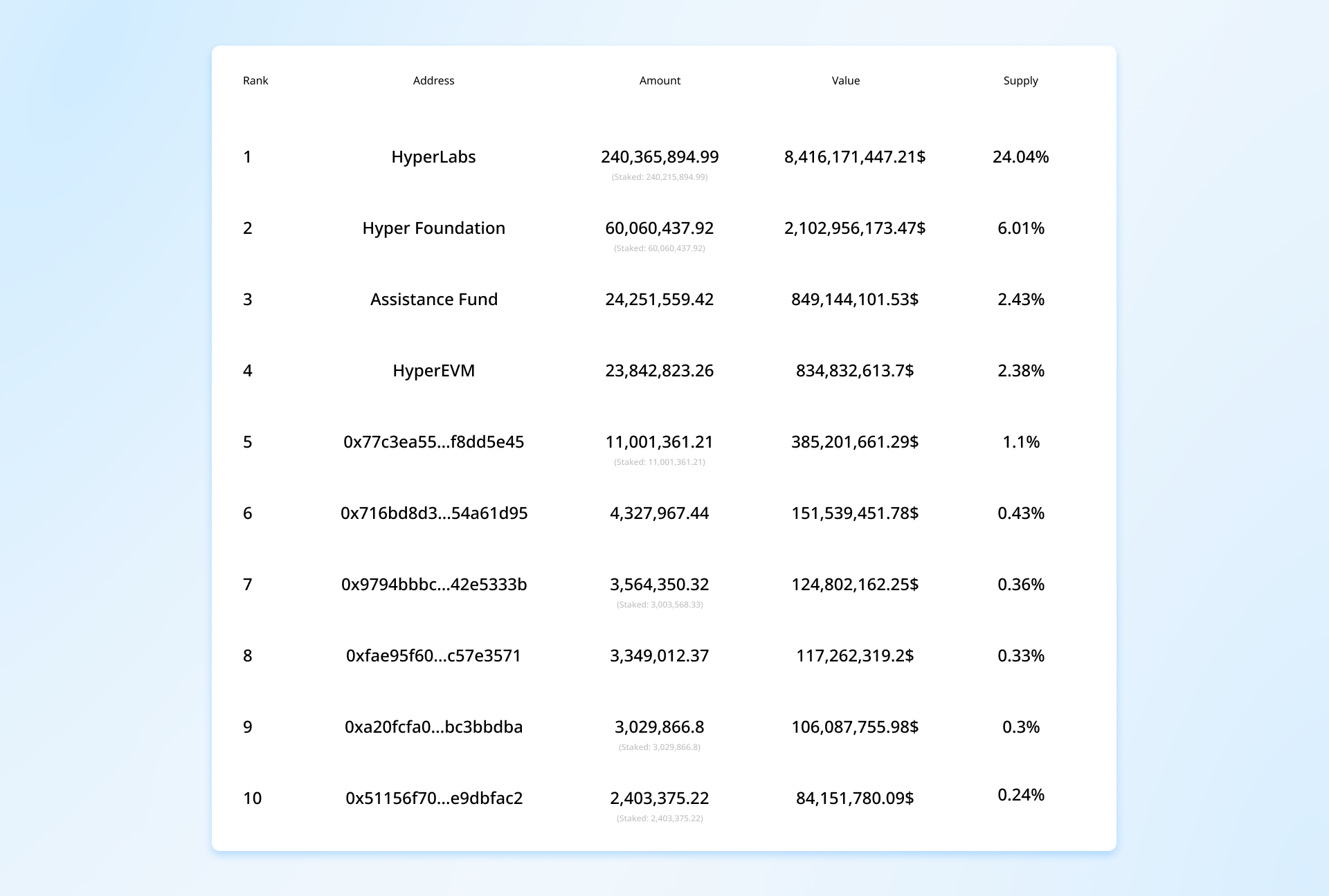

On November 29, the first 310 million $HYPE tokens (31% of the 1 billion supply) were distributed via fair-launch airdrop to over 90,000 early users. If you dig through the current $HYPE token distribution on HypurrScan blockchain explorer, you'll see that the largest individual holder owns just 1.1% of the supply:

-

HyperLabs – 24.04%. These are tokens the team will receive in the future through vesting

-

Hyper Foundation – 6.01%. The Foundation handles funding for new projects, grants, and community growth initiatives

-

Assistance Fund – 2.43%. This is where trading profits from Hyperliquid accumulate (54% of exchange revenue), which then gets used for buybacks

-

HyperEVM system address – 2.38%. That is a special system contract that handles $HYPE transfers between HyperCore and HyperEVM. When you send $HYPE to this address from HyperEVM, it automatically bridges the tokens back to your HyperCore account, emitting a receipt event in the process.

-

Largest individual holder – 1.1%

Source: https://hypurrscan.io/token/0x0d01dc56dcaaca66ad901c959b4011ec

The top 50 holders combined (excluding the first four corporate wallets) own less than 10% of the circulating supply. Most "fair launches" end up with whales accumulating 5-10% each. Here, even the biggest whale sits at 1.1%. This wide distribution explains why $HYPE avoided the typical post-airdrop dump and created genuine community ownership. With over 127,000 current holders, this represents one of the most decentralized token distributions in crypto.

HYPE Utility and Buybacks

$HYPE is the main asset within HyperEVM. Like ETH on Ethereum, $HYPE powers gas fees, governance, staking, and serves as prime DeFi collateral across lending markets and liquid staking protocols. But since Hyperliquid is a DEX, it also offers advanced utility through trading fee reductions. In March 2025, the Hyperliquid Foundation introduced staking tiers that went live May 5, offering discounts from 5% (10 $HYPE staked) up to 40% (500,000 $HYPE staked).

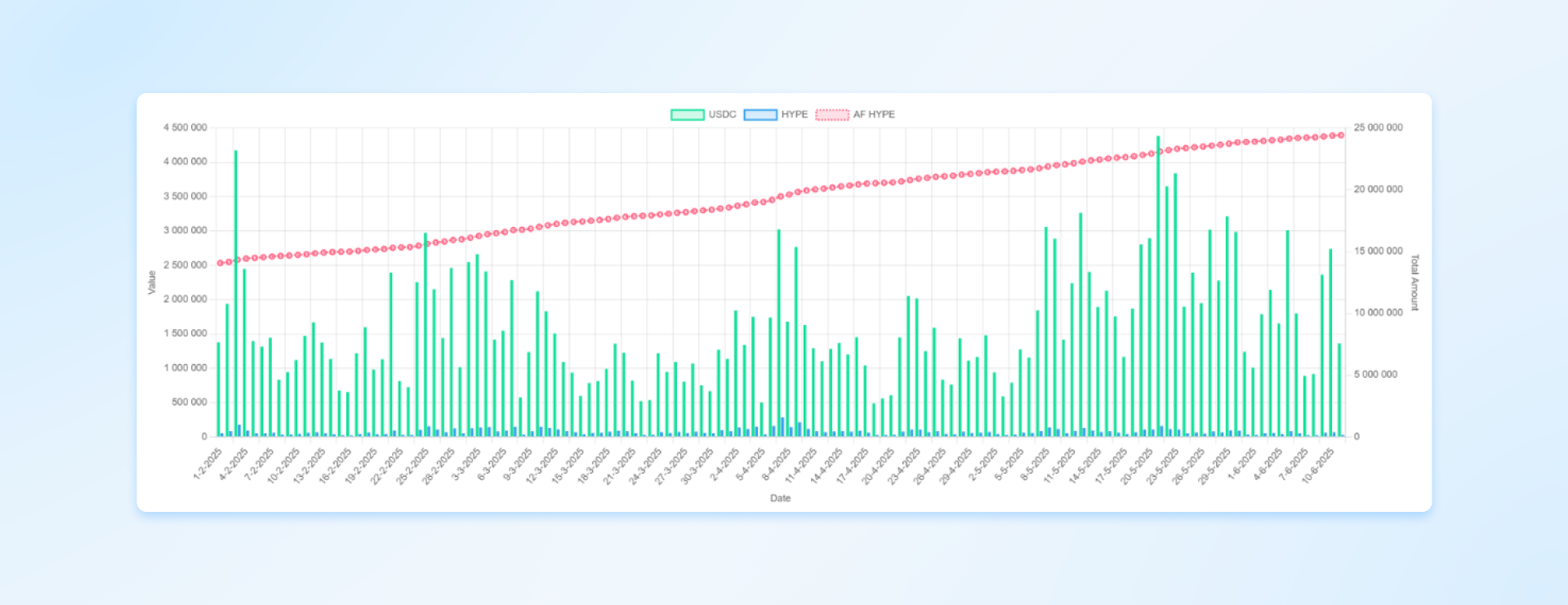

The protocol dedicates ~97% of daily trading revenue to buying back $HYPE tokens from the market, which is roughly $1 million every day. Thanks to the massive volumes and fees on the network, a substantial amount flows into buybacks. As of June 11, 2025, over 24M $HYPE tokens have been bought back, equivalent to over $1B.

Source: https://assistancefund.top/

Exploring HyperEVM Ecosystem

According to the Public Hyperliquid Ecosystem Database by HypurrCollective, over 170 protocols have been launched on HyperEVM. DeFiLlama tracks 31 of these, with a cumulative TVL of $1.6 billion. Currently, just a third of the chain's TVL comes from the Hyperliquid DEX itself.

Unit – Gateway for Native BTC and More

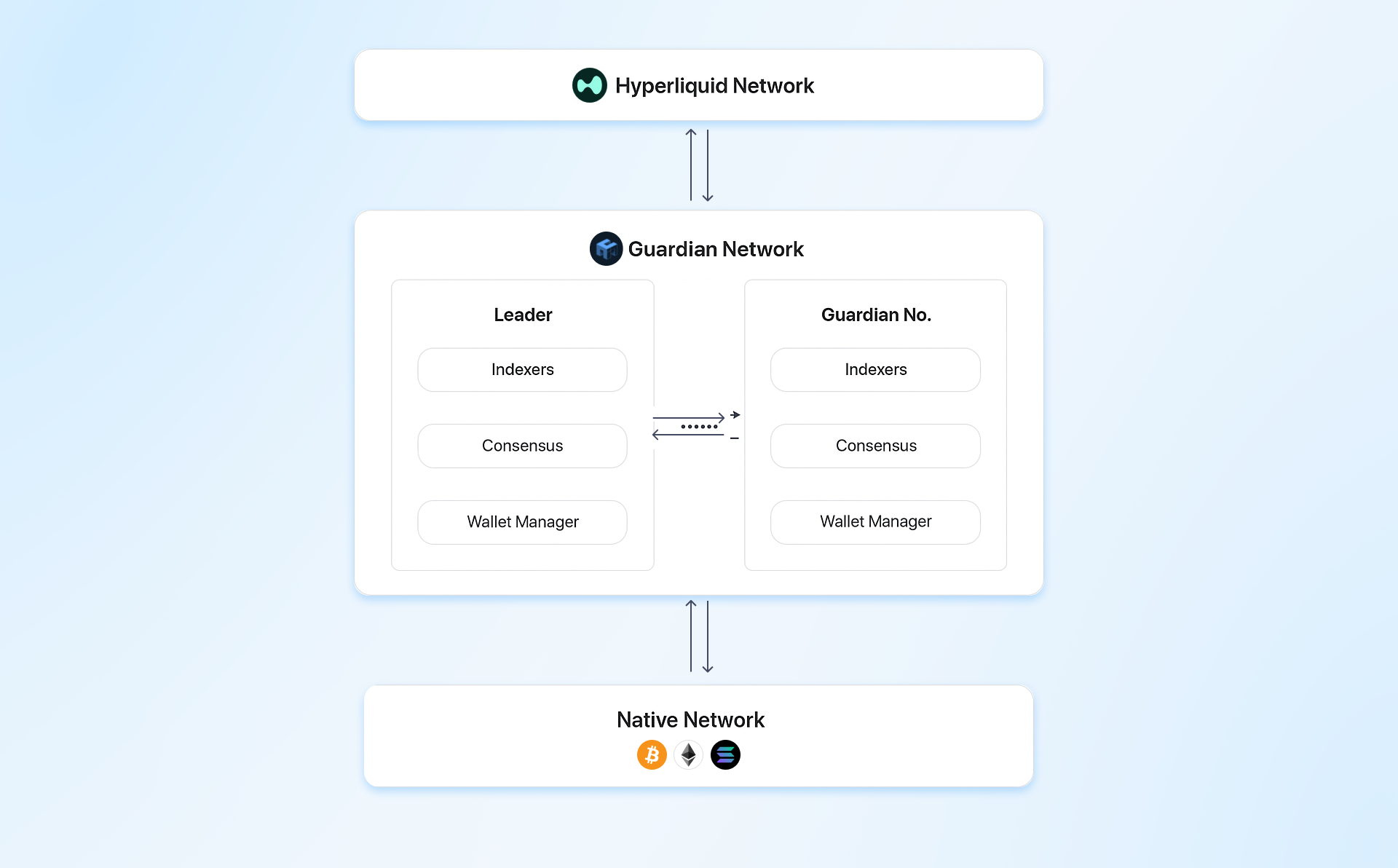

Unit is arguably the most important product in the ecosystem after the exchange itself (though it probably won't have its own token). It's Hyperliquid's native tokenization protocol that enables true self-custodial trading of BTC, ETH, and SOL. Unlike traditional bridges that mint synthetic assets or hold funds in multisigs, Unit uses a 2-of-3 threshold signature scheme where private keys never exist in full, but are split across three independent Guardians (Unit, Hyperliquid, Infinite Field) who must collaborate to mint or withdraw assets. Each Guardian runs local chain indexers to independently verify deposits before jointly signing any action. The output is $uX tokens (like $uBTC, $uETH), the only external assets usable on Hyperliquid L1.

From February 2025 to June 2025, Unit has processed over $6B in spot volume, with BTC alone accounting for over $4B. That makes Hyperliquid one of the largest decentralized exchanges for native BTC trading. According to Jeff, “Unit's launch brings Hyperliquid one step closer to housing all finance. It will be exciting to see Hyperliquid's world class liquidity and UX extend to many more important financial assets.”

Source: https://unit.hyperdash.info/

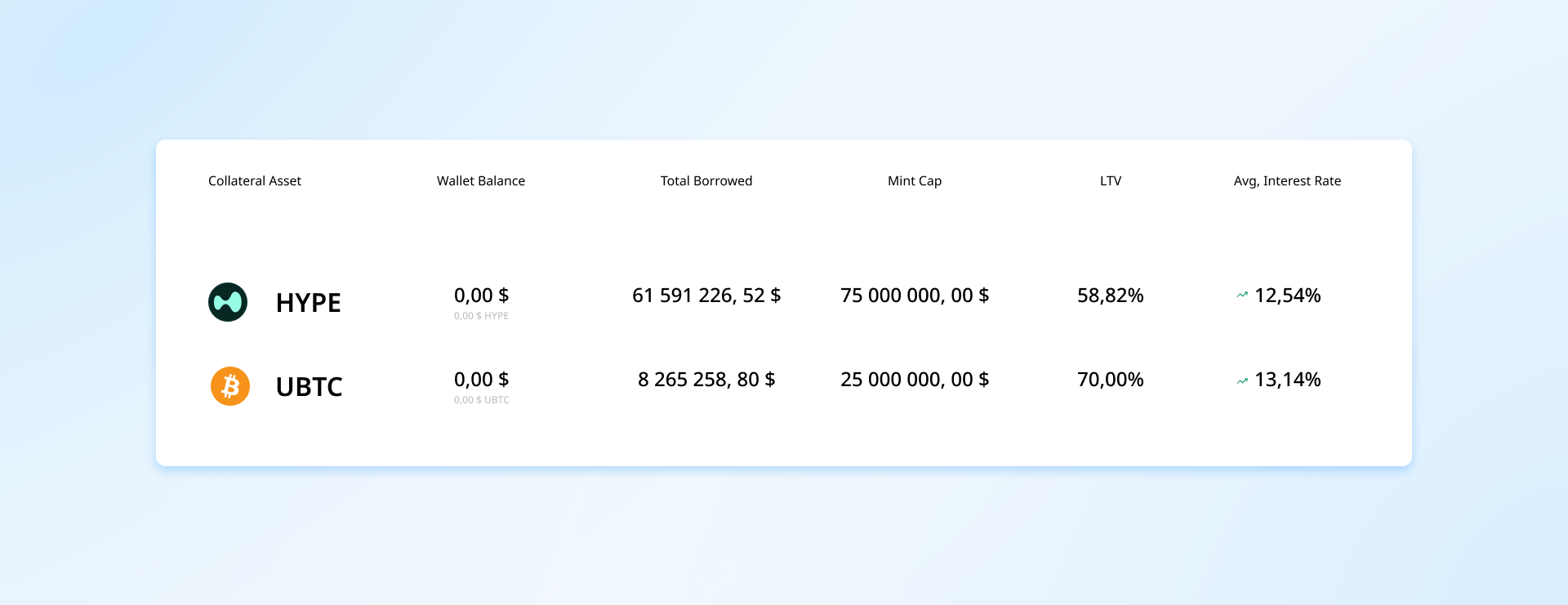

Felix – Native Stables on Hyperliquid

What self-respecting Layer 1 blockchain doesn't have a native stablecoin project? Felix is a CDP protocol that lets you mint $feUSD stablecoin against $HYPE or $uBTC collateral. Felix won't dethrone USDC as the main stablecoin within HyperEVM anytime soon, as the feUSD market cap is over 50 times less than the USDC market cap ($71M against $3.7B); however, it probably remains the #1 decentralized stablecoin. The CDP model works like everywhere else: deposit an asset as collateral and mint $feUSD based on the specified LTV ratio. Interest rates vary by asset. Nothing groundbreaking here – just another overcollateralized stablecoin trying to bootstrap liquidity in a new ecosystem.

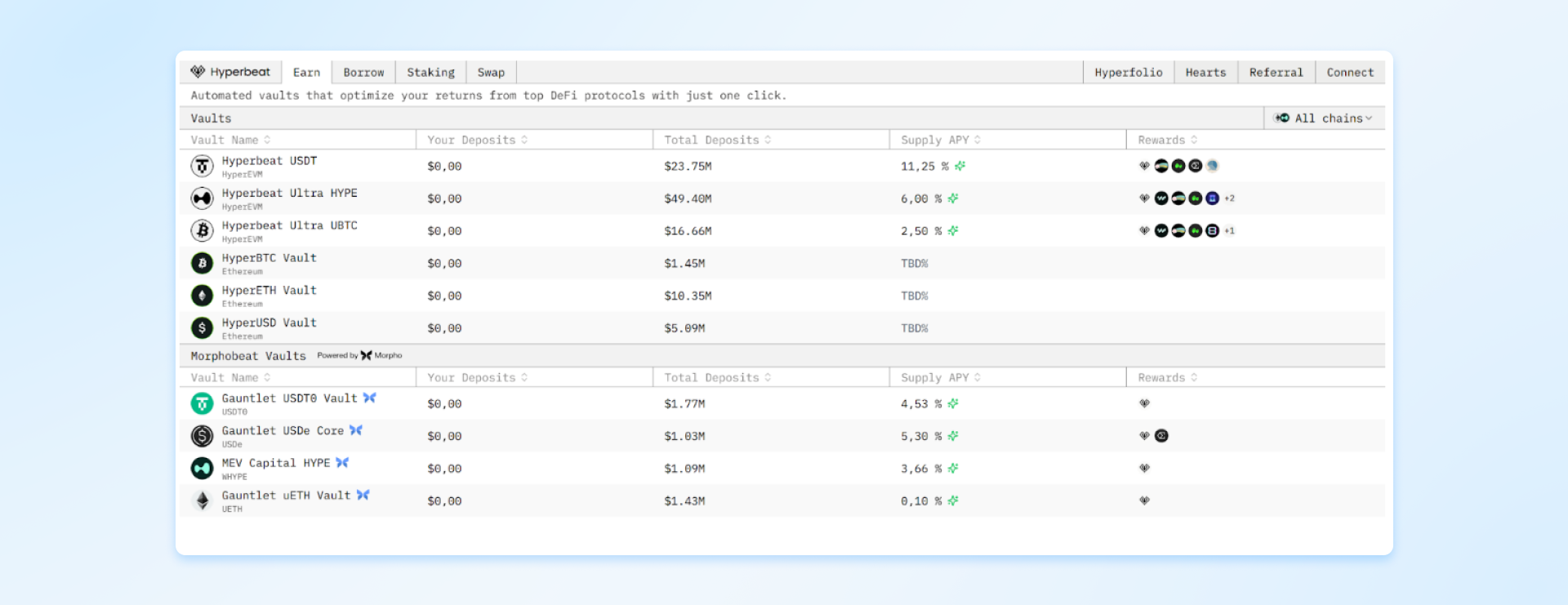

Hyperbeat – Yield Aggregator

Hyperbeat is a yield aggregator that provides various vault strategies, integrated staking, lending, and token swapping. They run the HyperP2PBeatio validator node (launched July 2024 with P2P.org and Hypio NFTs) where you stake $HYPE for network rewards. But the main draw is their vault system: HYPE Vault, uBTC Vault, HyperETH Vault, HyperBTC Vault, and HyperUSD Vault. Each vault deploys your assets across different HyperEVM protocols for lending, liquidity providing, and staking.

Instead of manually depositing into ten different protocols, you can dump assets into one of Hyperbeat’s vaults for autofarming. Some vaults accumulate points from multiple projects (Felix points, HyperLend points, etc.) while Hyperbeat distributes its own Hearts points on top. They also run "Hyperstrategy" treasury operations, where they use a percentage of fees to accumulate $HYPE and fund new ecosystem projects.

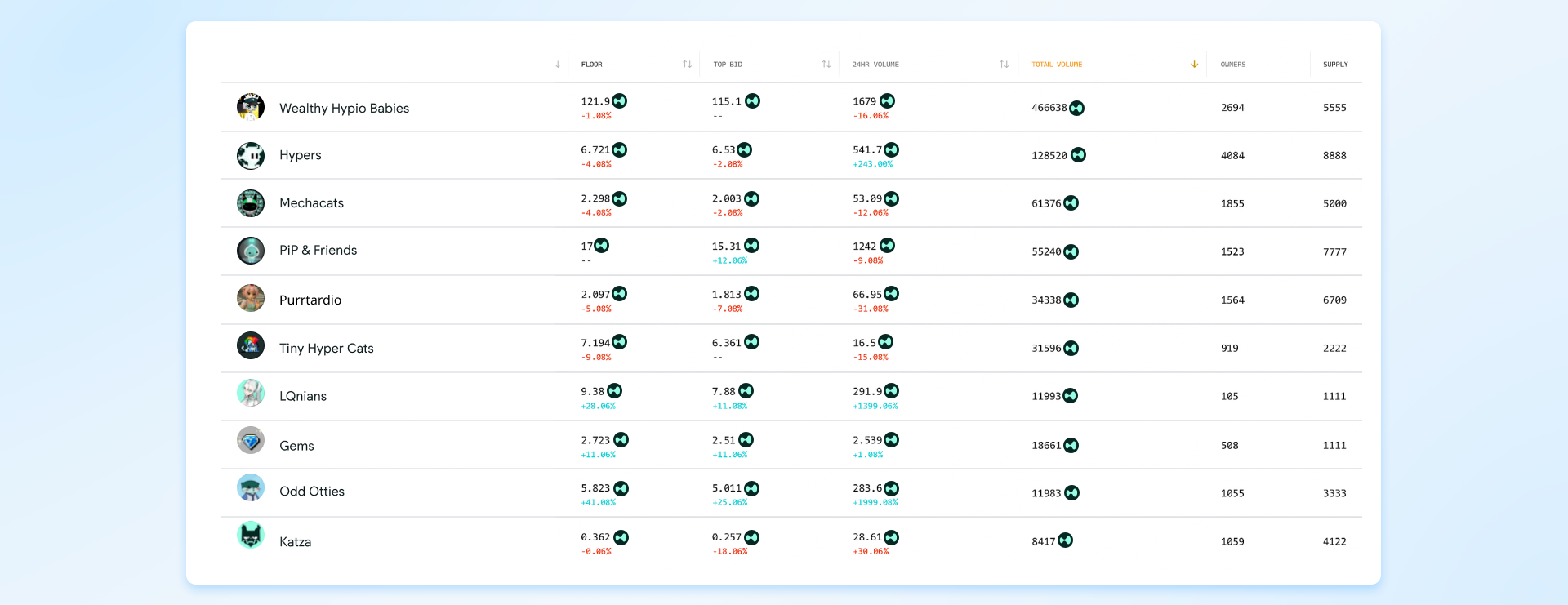

Drip Trade and Best 5 NFTs to Hold on HyperEVM

Drip Trade is the local NFT marketplace, which gives vibes of Solana’s Tensor Trade. There's nothing special about the platform itself, but you need somewhere to buy NFTs – and the NFTs themselves might actually be useful!

-

Wealthy Hypio Babies NFT – 5555 supply. Could be minted for 0.025 $ETH (at that time), now worth ~$6,700. The most viral NFT project and the best to hold, since it actually has utility – lower fees on perps and spot trading on Hyperliquid.

-

Hypers – 8888 supply. The second most popular collection and official collection of Drip.Trade marketplace. Basically the "Tensorians" of Hyperliquid.

-

PiP – 7777 supply. Could be minted with 10 $PiP tokens (~$200), current floor price around ~$600. The entire $PIP token revenue (9% of $PiP supply) was burnt during the NFT generation event.

-

Tiny Hyper Cats – 2222 supply. The mint price was 1 $HYPE (~$20 at that time), and the current floor is at ~$245. This is the first collection originally minted on HyperEVM. Not tied to any protocol or token (yet). Considering the price/supply ratio and OG status, probably the best pick at current prices, if anything.

-

Catbal – the upcoming mint to watch. Catbal is a Hyperliquid local cultural meme (cat + cabal) with its own memecoin. The project's probably connected to some Hyperliquid insiders. NFT mint is coming, but the date is unknown. NFTs will likely be minted with the $CATBAL token.

Liquid Staking, Money Markets, Bridges, AMM-Based DEXes and Other Stuff on Hyperliquid

Let's speedrun through the rest of the ecosystem, because honestly, there's nothing groundbreaking here – just the usual DeFi legos every chain needs to function.

-

Liquid Staking: The main protocol is StakedHype. You stake $HYPE tokens and get liquid $stHYPE in return, which you can then use elsewhere in the ecosystem.

-

Money Markets: HyperLend leads with $290M+ TVL, followed by HypurrFi at $154M+. Both work similarly to Aave and Compound – deposit assets, borrow against them, earn yield on deposits, and pay interest on loans. If you're a regular money market user with substantial capital, here are the two largest lending protocols. If not, don't bother farming.

-

Bridges: You don't actually need other bridges except Unit or the original Arbitrum bridge for depositing stables. Sure, there are Stargate, Symbiosis, etc., deployed so far if you need them once in a blue moon.

-

AMM DEXes: Why the hell do you need swappers when you have the apex onchain order book DEX called Hyperliquid, anon? Alright, you might need to swap once or twice (though you could do it within Hyperbeat). If you must, here are the decent picks: HyperSwap, KittenSwap, and Valantis.

-

Other Stuff: The ecosystem also has its share of AI agent tokens, GameFi pump-and-dumps, and other trendy nonsense that every chain attracts. Plus, there are mobile apps like Avy and others that give you access to the main Hyperliquid interface on your iPhone or Android. You can explore the full list here.

What to Do on HyperEVM to Maximize Your Airdrop Chances?

|

Quick Hyperliquid Do’s and Don'ts |

|

|

What you should definitely do |

Probably useless actions you shouldn't bother doing |

|

Try to love the product and become an organic user. If nothing else, you won't be left behind. |

Don't focus on transaction count. Constant tx abuse proved to be way less effective than just parking your liquidity in some protocol and moving it around from time to time. |

|

Liquidity size and continuity matter the most. TVL is the most important metric for chains, so bring valuable capital. |

Don't buy native domain names. Every time a chain launches, a new native domain copycat arrives. None of them proved worth buying, except the original ENS. |

|

Focus on native-only protocols. Some well-known cross-chain protocols were deployed on HyperEVM, but those aren't worth specific attention. Use them when you actually have to. |

Ignore copycats without any original Features. All those forks of Uniswap and Curve will eventually die after the original protocol deploys or has TGE. Their airdrops tend to be worthless. |

|

Acquire at least one of the mentioned NFTs. That's a highly used way to get an allocation simply because it's a great way to weed out Sybils. |

Avoid protocols that sell whitelist access to token allocations. Those are probably just bad marketing-only products. |

First of all, note that you are the bread and butter of all these crypto protocols, not the other way around. They feed off your fees and liquidity, and token airdrops are a kind of small payback they create from thin air so the little guy has something to live on. More often than not, in today's reality of airdrop farming, you'll lose more (not necessarily money, but also time and nerves) than you'll gain. But there are exceptions – one project in thousands. The one and only "Life Changer" and "Anyone Could" type of protocol to deliver the wealth effect. Hyperliquid happens to be one of this kind, so you might actually stand a chance for a decent slice of the pie.

To get the best resources spent/allocation received ratio, we need to be genuine users who would use the protocol regardless of airdrops. But we can think about an optimal protocol interaction path. Here is what we came up with:

-

Bridge some BTC, ETH or SOL to HyperEVM via Unit, and convert half to $HYPE through the Hyperbeat DEX aggregator or any DEX you like.

-

Get at least one NFT from our list above.

-

Stake 20% of your $HYPE with validators for network security.

-

Convert the rest to $stHYPE via StakedHype.

-

Use $stHYPE as collateral on HypurrFi or HyperLend to borrow more $HYPE. Optionally hedge your $HYPE exposure with a 1x short on the main exchange to stay delta-neutral.

-

Split the rest of the originally bridged funds between $uBTC and $USDC.

-

Deposit half of $uBTC to the Hyperbeat’s ultra uBTC Vault.

-

Borrow some feUSD on Felix with the other half of $uBTC.

-

Use the remaining $USDC for high-conviction trades on Hyperliquid Perps with 3x leverage max, or put it into vaults.

-

Repeat.

Hyperliquid’s Future

The HL team has managed to build the best onchain order book for perpetuals – what's next? The logical progression is enhancing spot trading to match the perps experience. Right now, spot pairs are limited to stables. To truly compete with Binance, they'll need deep liquidity across major pairs like BTC/ETH, BTC/SOL, and others. Once spot trading reaches parity with perps in terms of execution quality and variety, Hyperliquid becomes the first truly complete decentralized trading venue.

The next evolution of HyperEVM should be native collateral integration. Currently, you need to use external money markets for leverage. But imagine depositing BTC directly on Hyperliquid and using it as collateral for trading, with tiered margin requirements based on volatility and liquidity. No more hopping between protocols, no more wrapped assets, just seamless trading with your actual holdings. This would absolutely destroy money market protocols.

The endgame, though, is RWAs – tokenized stocks, bonds, and commodities trading alongside crypto with the same buttery-smooth execution. If they pull this off, Hyperliquid becomes the actual gateway between TradFi and DeFi, where the distinction stops mattering entirely.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

Table of Contents

- The Power of Hyperliquid: Great Product With Exceptional Execution

- Hyperliquid DEX: How Is It Different From the Rest?

- Market Execution: How to Deliver the Best Airdrop in Crypto History?

- Data-Driven Results of Hyperliquid’ Success

- HYPE Tokenomics

- HYPE Allocation

- HYPE Distribution

- HYPE Utility and Buybacks

- Exploring HyperEVM Ecosystem

- Unit – Gateway for Native BTC and More

- Felix – Native Stables on Hyperliquid

- Hyperbeat – Yield Aggregator

- Drip Trade and Best 5 NFTs to Hold on HyperEVM

- Liquid Staking, Money Markets, Bridges, AMM-Based DEXes and Other Stuff on Hyperliquid

- What to Do on HyperEVM to Maximize Your Airdrop Chances?

- Hyperliquid’s Future

Table of Contents

- The Power of Hyperliquid: Great Product With Exceptional Execution

- Hyperliquid DEX: How Is It Different From the Rest?

- Market Execution: How to Deliver the Best Airdrop in Crypto History?

- Data-Driven Results of Hyperliquid’ Success

- HYPE Tokenomics

- HYPE Allocation

- HYPE Distribution

- HYPE Utility and Buybacks

- Exploring HyperEVM Ecosystem

- Unit – Gateway for Native BTC and More

- Felix – Native Stables on Hyperliquid

- Hyperbeat – Yield Aggregator

- Drip Trade and Best 5 NFTs to Hold on HyperEVM

- Liquid Staking, Money Markets, Bridges, AMM-Based DEXes and Other Stuff on Hyperliquid

- What to Do on HyperEVM to Maximize Your Airdrop Chances?

- Hyperliquid’s Future