RWA: Future DeFi Primitive?

Real World Assets (RWA) represent assets that exist in the physical world and can be utilized in the realm of cryptocurrency through the tokenization process. Blockchain technology offers opportunities to bring the value of these assets onto the blockchain, enabling them to be easily traded and converted into liquidity. By combining the real world with Web3, a new foundation for decentralized finance is established, which has the potential to significantly drive the growth of this sector.

Key Takeaways:

-

Real World Assets (RWA) are assets linked to the real world that can be transferred into the blockchain via tokenization process, thus bringing billions of dollars into DeFi and Web3 and creating new investment opportunities.

-

RWA becomes one of the hottest narratives in DeFi with new projects entering this space and adding RWA in their strategies.

-

On-chain private credit opens new opportunities to merge the potential of blockchain technology with traditional financial markets, creating a new DeFi primitive.

- Developing economies lead the adoption of on-chain private credits.

What is RWA in Crypto?

Real World Assets are assets that exist in the real world and can be leveraged as a source of income, for example be sold, traded, or rented. Examples of RWA:

-

Real Estate

-

Stocks and bonds

-

Commodities

-

Art

-

Carbon Credits

Blockchain technology allows such assets to be brought into the crypto industry through the process of tokenization. In general, the tokenization process consists of the following steps:

-

Discussion of the details between issuer, tokenization provider, and investors

-

Agreement about the investment size and tokenization process

-

Minting and distribution of tokens (NFTs) to investors

-

Secondary market operations (if possible)

-

Investors earn yield from their share of tokenized asset

RWA has the potential to boost the development of DeFi with billions of dollars of investments. Additionally, it provides the crypto community with exposure to the real world, effectively merging crypto with our everyday lives.

There are several ways to participate in RWA-based protocols:

- Provide liquidity and lend funds. As a liquidity provider you can lend money directly to the borrowers via credit pools or provide your funds to the protocol for management.

- Trade tokenized assets. You can buy, hold and sell various tokenized RWA - bonds, securities, art, even carbon credits.

- Own a share of Real Estate. Using the tokenization process you can become a part owner of real estate: houses, commercial real estate, even islands and profit from their usage (for example, renting the house).

RWA in DeFi: Current State

The Real World Assets sector shows an impressive growth given the current state of the crypto markets. While total value locked (TVL) in DeFi stagnates in 2023, TVL of the leading RWA projects surged from $125.3M to $2.44B, and the growth is exponential.

Data source: CryptoRank.io, DefiLlama. At the time of writing, RWA is the 8th largest DeFi category by TVL according to the DefiLlama data (Note that DefilLama data do not include Maker, FRAX and some other protocols due to its methodology).

While adding additional value to the blockchain, RWA also provides new and sustainable investment opportunities. Using RWA protocols, investors get the exposure to the traditional financial markets without intermediaries and with lower marginal costs. For example, you can invest in tokenized US treasuries on-chain and earn sustainable yield with lower risks. Note that investing in US Treasuries now is more profitable in comparison with APY (Annual Percentage Yield), suggested by the leading DeFi protocols.

Data source: CryptoRank.io, Nanoly, RWA.xyz

Tokenized Treasuries is one of the most interesting instruments in RWA. Tokenizing US Treasuries opens this market for new investors and lowers barriers to this low-risk asset. US Treasuries are considered as one of the most trustable securities in the world. Rising interest rates in the US make investing in treasuries a very profitable strategy. Tokenization of this asset provides crypto investors an exposure to this instrument, thus increasing investment opportunities with lower risks.

Several notable projects provide users access to the tokenized treasuries via its infrastructure: Franklin Templeton, Maple, Ondo Finance, Matrixdock, and others.

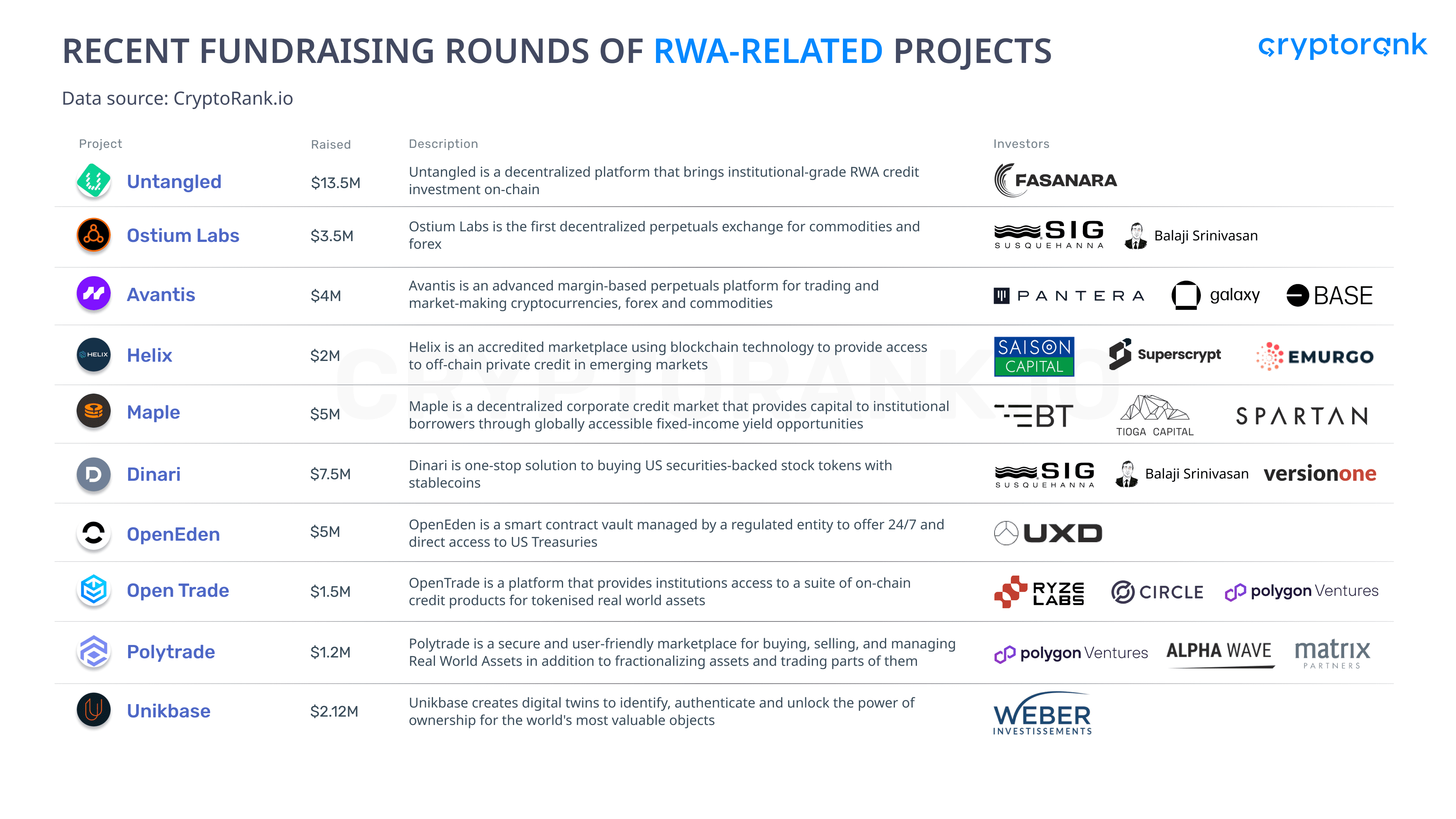

Recent Fundraising Rounds of RWA-Related Projects

RWA-based projects are a popular category for investors. Take a look at the recent investments in RWA projects.

Data source: cryptorank.io/funding-rounds

Let’s discuss the most notable projects with recent fundraising rounds:

-

Maple. Maple is one of the leading RWA protocols that provides capital to institutional borrowers. Maple recently received $5M from Blocktower Capital, The Spartan Group, Framework Ventures and other investors to expand its presence in the Asia-Pacific region.

-

Avantis. Avantis develops an advanced margin-based perpetuals platform for trading and market-making cryptocurrencies, forex and commodities. Avantis has raised $4M from Pantera Capital, Galaxy, Base Ecosystem Fund, and others to foster the development of its product.

-

Ostium Labs. Ostium Labs aims to provide transparent and flexible alternatives for trading assets like oil, bitcoin, foreign exchange pairs, and more. The project received $3.5M from Balaji Srinivasan and several funds to develop a protocol for digitized commodities perpetual swaps.

State of On-chain Private Credits

Lending became a popular DeFi segment with plenty of investment strategies both for lenders and borrowers. RWA brings additional opportunities to this sector:

- For Borrowers: Borrowers can use real assets as a collateral for borrowing crypto (stablecoins or other tokens) to develop their business. This is similar to traditional credits that financial institutions provide to companies for their business needs. Blockchain simplifies this process and decreases marginal costs. Companies can borrow funds directly from retail investors on-chain without intermediaries.

- For Lenders: Retail investors get an exposure to companies from the real sector, lend them their funds, and profit with an attractive APY suggested by the leading RWA lending protocols. This strategy may be profitable, but is also risky due to lack of security mechanics and regulatory tools to deal with defaults of borrowers.

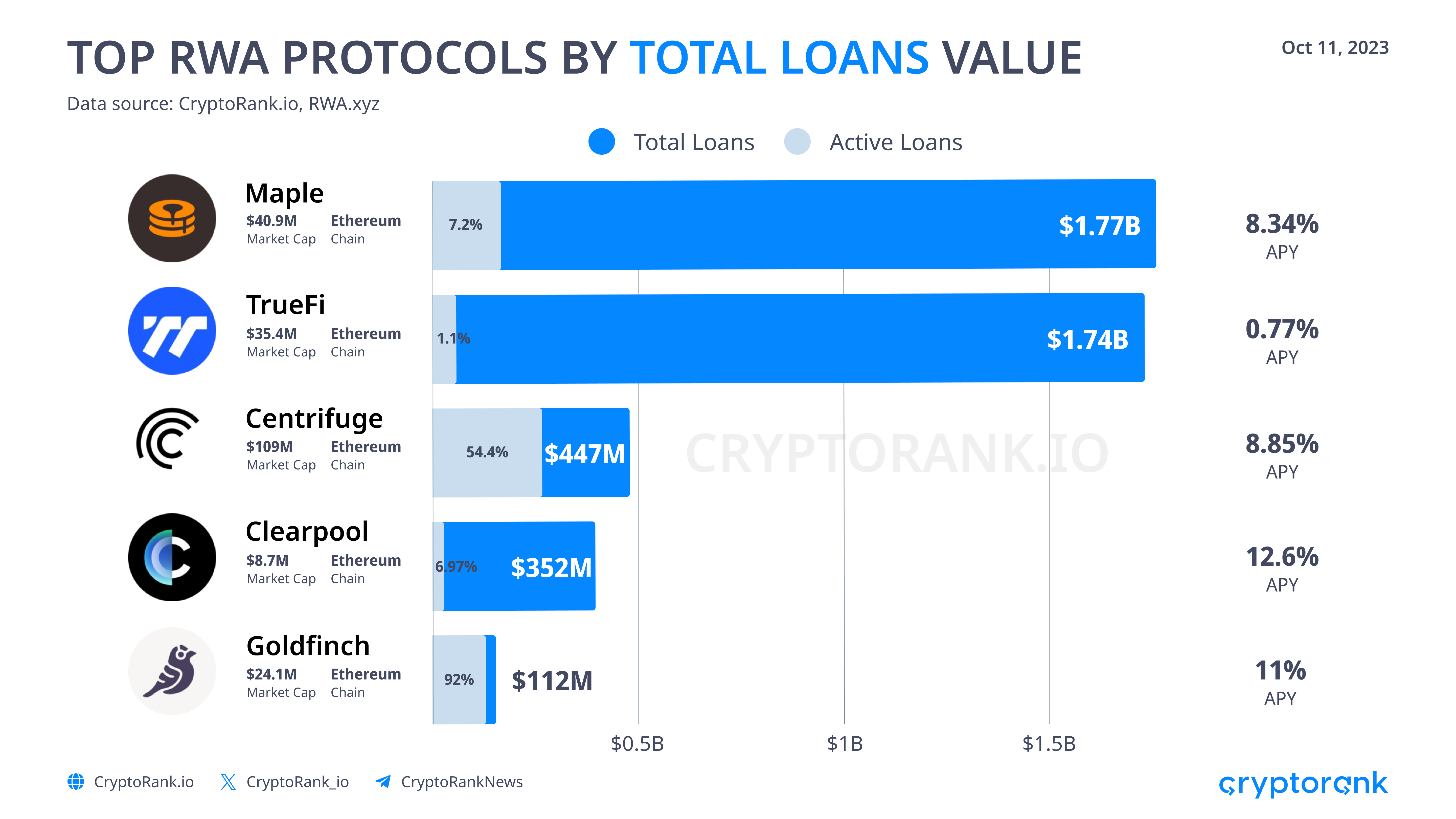

The leading RWA lending protocols already reached an important milestone - more than $1B of total loans value.

Data source: CryptoRank.io, RWA.xyz

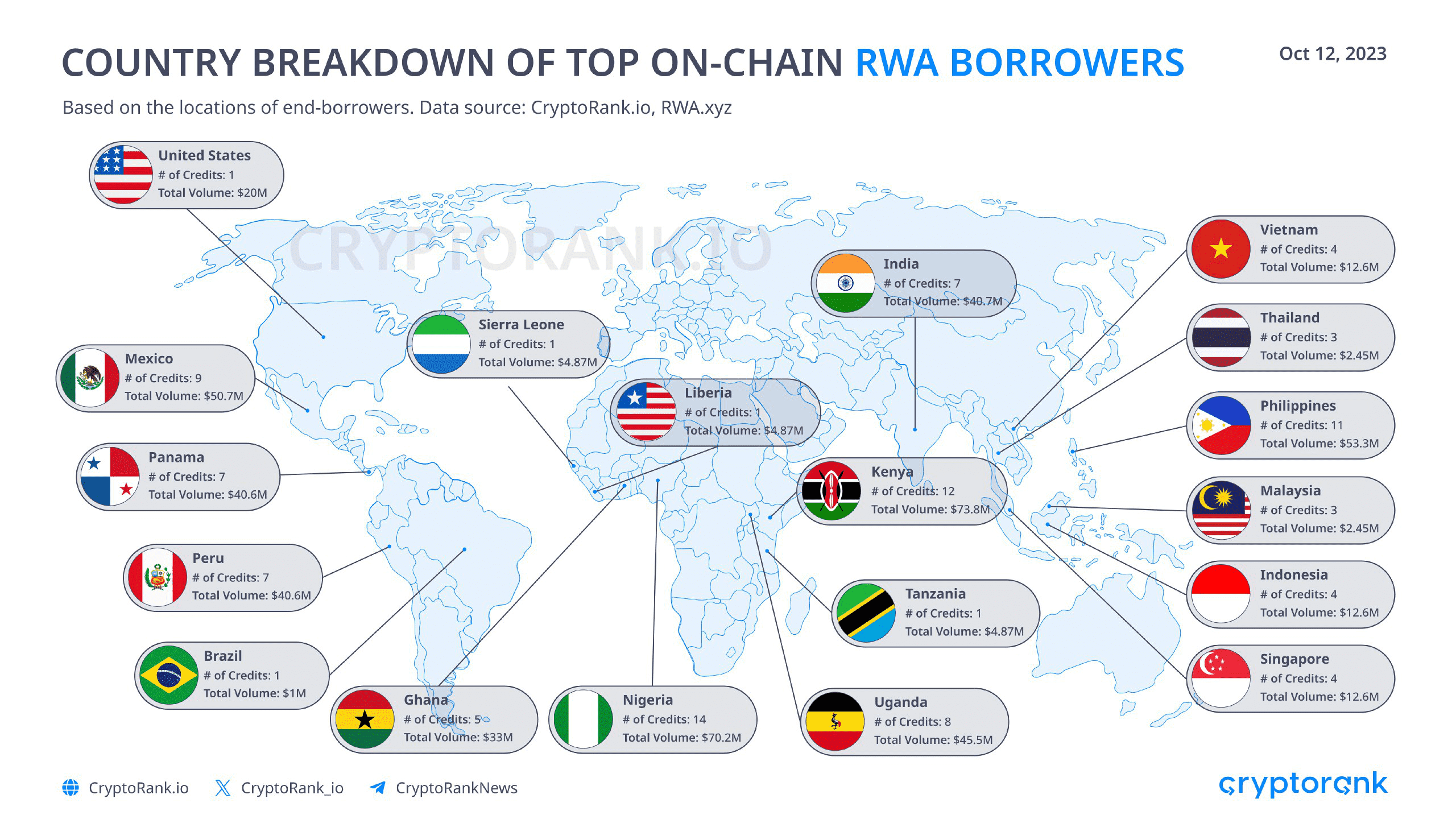

Developing Economies Lead the Adoption of On-chain Private Lending

Companies located in developing economies are the most active borrowers in RWA protocols. While traditional credit markets sometimes are not available in these areas, on-chain RWA-backed loans present a viable alternative to get funds for the development of your business. Africa and South-Asia based startups lead by the borrowed funds on RWA lending platforms.

Goldfinch grabs the lion’s share of on-chain private credits in African and South-East Asian countries. The largest inflow of on-chain credits is in fintech companies and carbon-related projects.

Data source: CryptoRank.io, RWA.xyz

The Bottom Line

RWA (Real World Assets) is a prominent DeFi (Decentralized Finance) trend in 2023, with the potential to bring billions of dollars into the Web3 ecosystem. RWA protocols enable the integration of everyday assets with blockchain technology through the process of tokenization.

There are various strategies available to participate in RWA protocols, each with different risk levels and potential yields. One such strategy involves investing in tokenized US Treasuries, which offer attractive APY with low risk. The wide range of instruments attracts many users, including both retail and institutional investors, who play a crucial role in the global adoption of cryptocurrencies.