How to Market Play Token Unlocks?

Key Takeaways:

-

Smaller unlock events (0% to 1% increase in circulating supply) do not significantly impact token prices, while larger unlocks (over 1% increase) indicate price drops as unlock size increases.

-

The actual price action of a particular token is more affected by current market sentiment, token fundamentals, the existence of a narrative around a particular token, and market making.

-

The most important token unlock events can be tracked weekly on CryptoRank social media channels, such as Telegram and X (Twitter).

-

There's no one-size-fits-all strategy for trading token unlocks; success lies in the ability to adapt, anticipate, wait, and act at the right time.

Data on Actual Impact of Token Unlocks

According to the recent analysis of over 5000 token unlocks made by 6th Man Ventures, smaller unlock events (0% to 1% increase in circulating supply) do not significantly impact token prices, while larger unlocks (over 1% increase) indicate price drops as unlock size increases. Tokens mostly vested (over 70% of supply) experienced lower volatility and higher relative prices compared to those early in their vesting periods. Tokens with higher allocations to private groups showed slightly better performance, than those with higher allocations to public groups.

Although large token unlocks do cause price pressure, the actual price action of a particular token is more affected by current market sentiment, token fundamentals, the existence of a narrative around a particular token, and market making. Each case might be unique, but that doesn't mean there can't be illustrative examples and conclusions.

Two Basic Scenarios

For the sake of clarity, we will examine cases with large token unlocks as examples. We can distinguish two basic scenarios of price action after a large token unlock: Pump & Dump scenario, Dump & Pump scenario.

Dump & Pump Scenario

An illustrative example here would be the December unlock of 15% of $DYDX Maximum Supply (47.7% of Market Cap). On the chart, we can see the price pressure on the day of unlocking on December 1, at which time the price dipped to $2.7. But the next day the short squeeze occurred, and the price at one point surged to $3.2, which resulted in an over 15% upside.

It's important to note here that a month earlier, dYdX announced a tokenomics change and the launch of an alpha mainnet in Cosmos, making $DYDX the native token for all transactional payments. This, coupled with Bitcoin's bullish sentiment, has led to the price doubling. The price decline started after all the news had played out. Without this, the price action on the token unlock event probably would have been different.

What does this kind of price action indicate to us? The fact that the vast majority of market participants considered it obvious that the price will fall due to the massive token unlock, and bet on it. This was reinforced by the news effect after all the news coverage stopped. When there were too many short positions piled up, a sharp buy-back followed, and the shorts were liquidated. In the market, obvious things often turn out to be a trap.

Pump & Dump Scenario

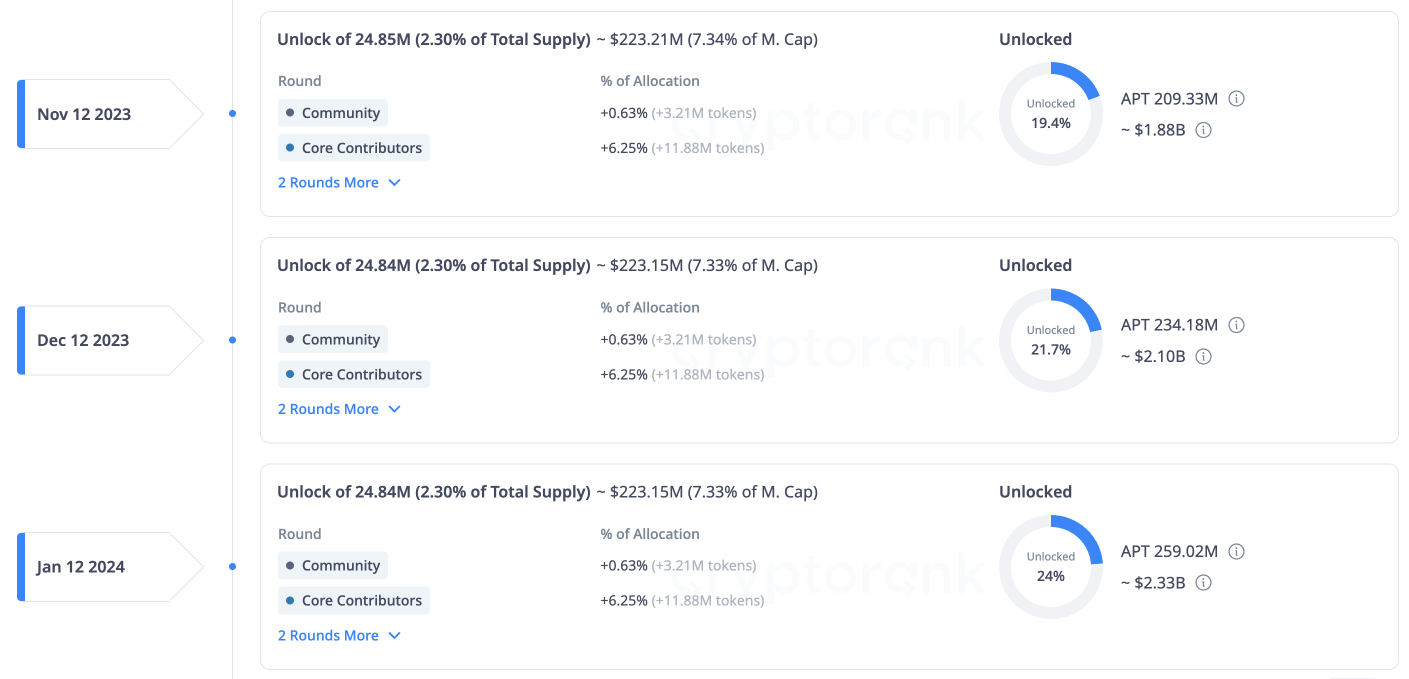

A great example of Pump & Dump scenario comes from Aptos, where 3 major unlocks have happened within a month interval. Unlike the dYdX case, the $APT price was not influenced by any major ecosystem updates. All three events have a similar price action: a few days before the unlock, the price sits at local lows and some preliminary liquidation of shorts is noticed; this is preparation. Then the price rises, and the growth culminates in the event itself. The scenario of the third token unlock event was disrupted by the large Bitcoin price drop due to the sell the ETF approval news, so on the 12th $APT fell following $BTC. Otherwise, we could have expected a repeat of the previous scenario.

What do Pump & Dump Scenario and Dump & Pump Scenario have in common?

Both in the cases of $DYDX and $APT there was a short squeeze, although it happened in different ways. In the Aptos case, there was a preparation phase, and the token unlock event itself was the growth culmination, followed by the dump. And in the dYdX case, there was no preparation phase (unless the ecosystem upgrade is considered a preparation phase), and the token unlock event was the culmination of the dump, and only then the short squeeze followed. Both cases share a multi-day price decline after the short squeeze. Thus, the best opportunity comes right after the short squeeze pumps; the only thing left to do is to determine the ceilings of these pumps.

Other possible scenarios

There is also a Dump & Dump scenario, when the token just falls endlessly, and token unlocks events only make the situation worse. Basically, there is no point in considering this scenario, as the project is more dead than alive, and there is nothing to get out from this token.

Guide with Tips

So, every case is unique, and the price always behaves a little differently as there are a huge number of factors that impact it. Nevertheless, it is still possible to derive basic rules:

-

First, one should assess the overall market sentiment. If the market is hot, events are likely to be accompanied by volatility, which can be used to make money.

-

One should choose only highly liquid tokens with good fundamentals. A shady low cap can go in the Dump & Dump scenario, even if all other indicators speak in the favour of growth.

-

One should rather pick tokens that have already experienced major token unlock events, so that one can draw conclusions from the previous price action and apply them to the next events.

-

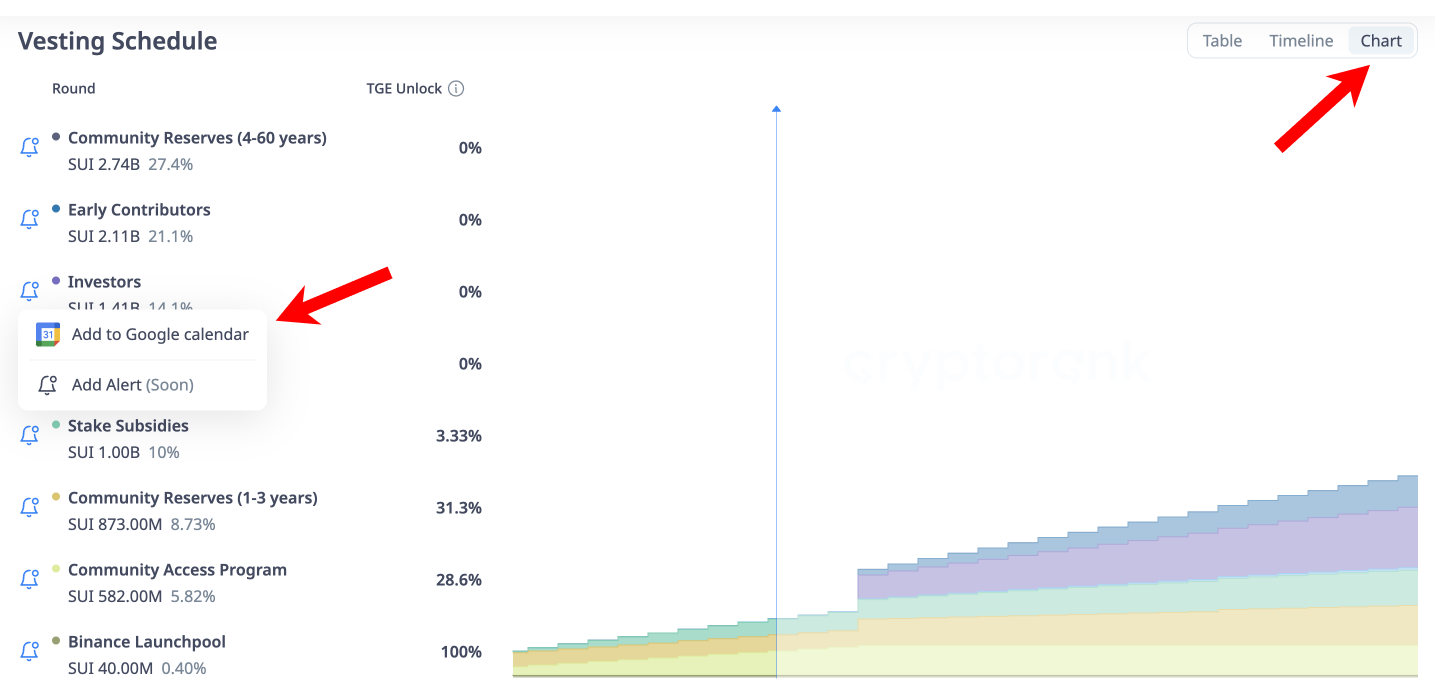

One should study the tokenomics and vesting schedule of the specific project. One can do this via CryptoRank on the token page in the "Vesting" section.

-

There's nothing obvious on the market. If something seems obvious, and so acts the crowd, it is better to wait until the crowd gets liquidated (by short or long squeeze), and then act. There is no point in trying to anticipate the crowd's actions and act in spite of them, because the crowd's actions are obvious only after the fact.

One can put event reminders on the calendar to never miss them. In the "Vesting" section on CryptoRank, one can see whose tokens will be unlocked and click on the "bell" icon to add a reminder to the Google calendar. Also, one can switch the interface to chart mode to visually see when there will be a major unlock.

Output

Market play on token unlock events requires a nuanced understanding of market dynamics and the ability to anticipate various scenarios. While larger unlocks generally exert downward pressure on token prices, the actual impact depends on a multitude of factors including market sentiment, token fundamentals, and the presence of a compelling narrative. We have highlighted Dump & Pump and Pump & Dump scenarios just for more illustrative examples, however, it's crucial to approach each unlock event as a unique situation, armed with deep research and a clear strategy.

By assessing overall market sentiment, focusing on tokens with solid fundamentals, and being mindful of vesting schedules and liquidity, traders can maximize their chances of success. We post the most important token unlock events weekly on our social media channels, so subscribe on Telegram and X (Twitter) so you don't miss out. Ultimately, there's no one-size-fits-all strategy for trading token unlocks; success lies in the ability to adapt, anticipate, wait, and act at the right time.