Table of Contents

- Is There an Actual Need for Decentralized Social Networks?

- SocialFi Landscape and Opportunities There

- General-Purpose Social Infrastructure and its Applications

- Separate Niche-Specific Solutions

- Friend.tech descendants

- Trading-oriented

- SocialFi for Professionals

- Textual

- Video-specific

- Crypto OnlyFans

- Output

Table of Contents

- Is There an Actual Need for Decentralized Social Networks?

- SocialFi Landscape and Opportunities There

- General-Purpose Social Infrastructure and its Applications

- Separate Niche-Specific Solutions

- Friend.tech descendants

- Trading-oriented

- SocialFi for Professionals

- Textual

- Video-specific

- Crypto OnlyFans

- Output

How to Earn on SocialFi Landscape: From Farcaster to Crypto OnlyFans

Key Takeaways:

-

The main purpose of Web3 social networks is bringing financial opportunities, not decentralization.

-

General-purpose social infrastructure includes Nostr, Farcaster, and Lens) overview. There are a bunch of various apps built on top of these, each with its own mechanics.

-

Niche-specific solutions has a lot to offer for various audiences: from traders to OnlyFans lovers.

Is There an Actual Need for Decentralized Social Networks?

This is a more complex question, and the answer is less trivial than it seems at first glance. The basic answer, which you can find in almost every article about the topic, would sound like the following:

“Yes, there is a significant need for decentralized social networks. Traditional social media platforms like Facebook, Instagram, and Twitter operate on centralized servers, leading to issues such as single points of failure, censorship, and central control over user data. While decentralized social networks leverage blockchain to address these problems and offer enhanced privacy, security, and user control.”

But the thing is, most common users don’t face those issues while using Web2 social networks. Censorship doesn’t actually care about the regular staff you post on X (formerly known as Twitter). However, if you are a cypherpunk, decentralizing everything might be an important goal for you, but not for the majority. And what the broader public may truly be missing is the new financial opportunities that Web3 equivalents can offer. That's why this is an article about Social Finance, not Decentralized Social Networks.

SocialFi Landscape and Opportunities There

The web is full of articles covering SocialFi Landscape, and protocols are categorized differently. To avoid copy-pasting, we will focus on financial disclosure. For this purpose, we will divide the landscape into General-Purpose Social Infrastructure and Separate Niche-Specific Solutions.

General-Purpose Social Infrastructure and its Applications

Nostr

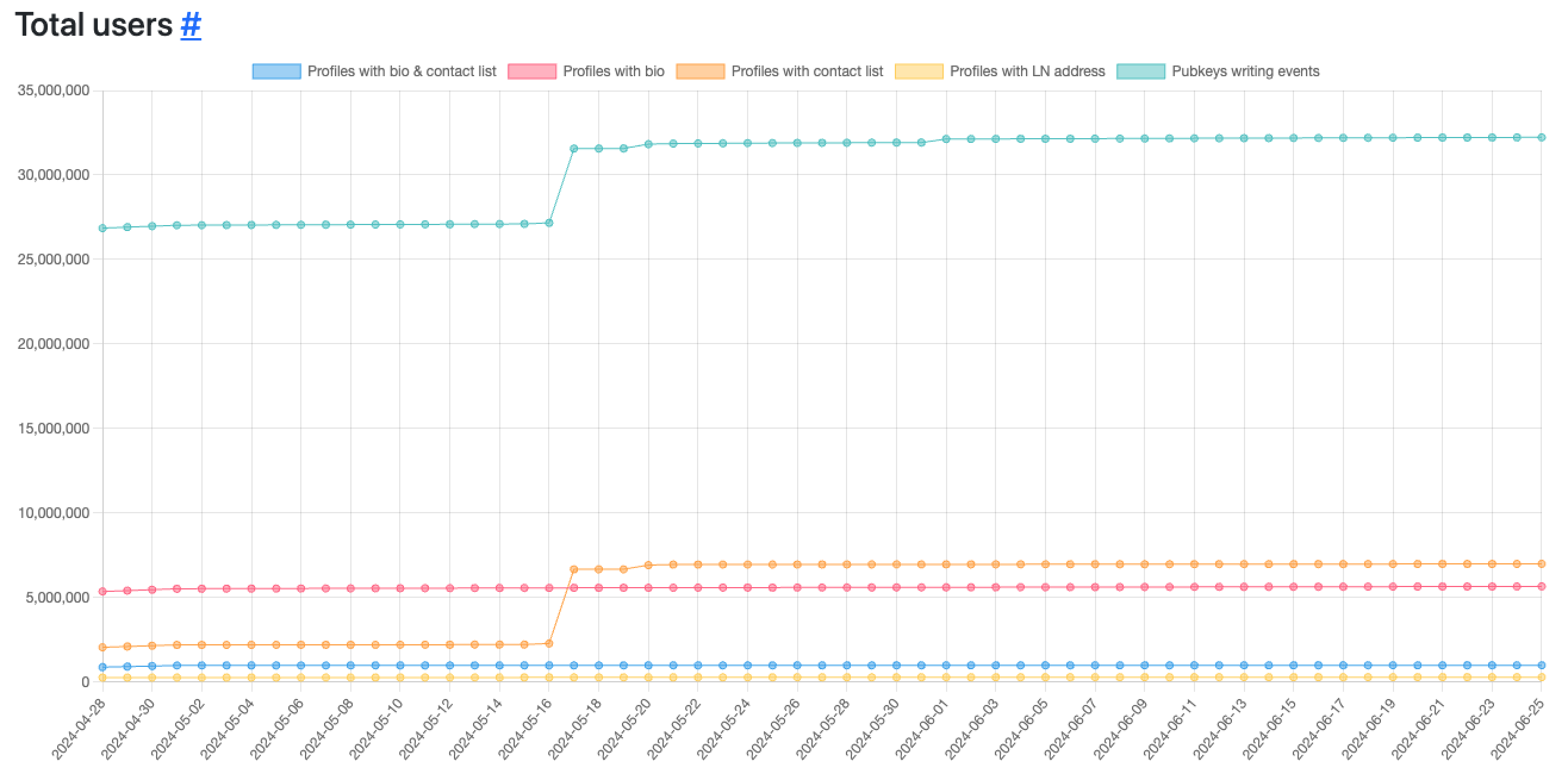

Nostr is a minimalist peer-to-peer messaging system designed to create a decentralized communication architecture. It is not blockchain-based.

Created by the well-known Bitcoin ambassador and Twitter founder Jack Dorsey, Nostr is mainly popular among Bitcoin-maximalists. However, Nostr currently lacks a strong application market drive and financial opportunities. The protocol is still in the conceptual stage, requiring further development and adoption to realize its full potential. Nostr is free to join.

-

There is a bunch of clients for interaction via Nostr, such as Nostter, Coracle, Plebstr. But there are no actual financial opportunities, only chatting.

-

Nostr Assets. Nostr Assets is an independent protocol that introduces wallet features to existing Nostr accounts, allowing users to send and receive Bitcoin-based assets using their public and private keys. The protocol already has its own token, and there are precedents of BRC-20 token airdrops to Nostr Assets users. For example, in December, Nostr Assets Protocol distributed $TREAT and $TRICK tokens via airdrop to $ORDI holders.

Farcaster

Farcaster is a Twitter-like semi-decentralized social protocol built on Optimism.

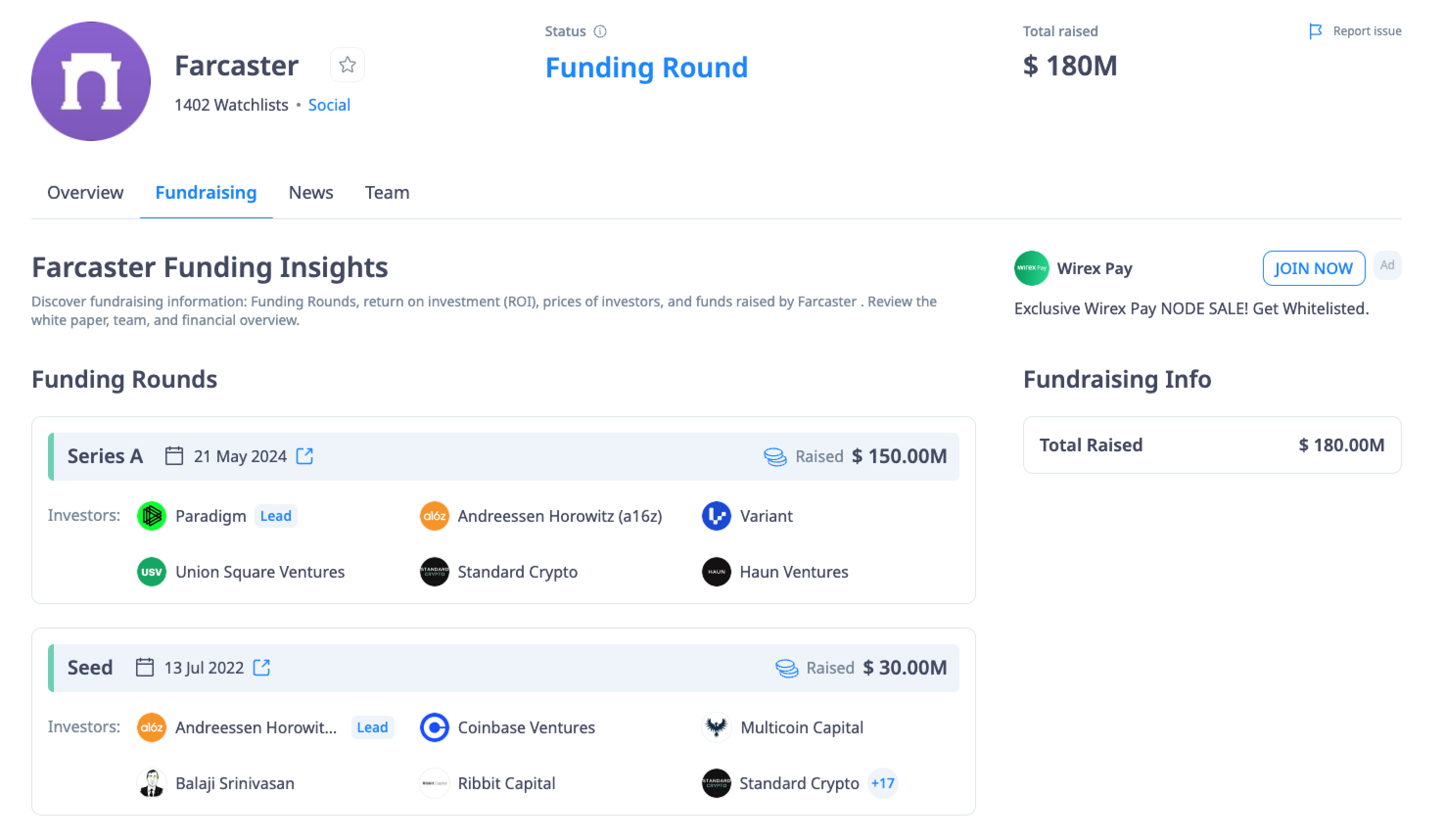

Farcaster uses a dual-layer architecture, with an on-chain protocol for identity management and an off-chain protocol for storage and communication. By combining decentralized backend and Web2-like front-end interactions, Farcaster offers a user-friendly experience; for such reasons, it has gained massive popularity recently. Farcaster requires creating a profile and renting storage units, which cost $5 paid via credit card only. Farcaster raised $180 million overall with the recent huge Series A round led by Paradigm.

Farcaster initially lacked native monetization features and only recently introduced the tipping mechanism. The $DEGEN token, a community-driven meme, became the local unofficial token. Initially distributed via airdrop to users, $DEGEN has organically become a popular method for tipping posts and contributions within the Farcaster ecosystem. Alongside the official point token, Warp, $DEGEN plays a significant role in incentivizing content creation and fostering an internal user-driven economy on the platform.

-

Warpcast. Warpcast is the main client that operates on top of the Farcaster infrastructure. It integrates Farcaster’s features, such as channels and frames. Channels allow for focused discussions and community building, while Frames are mini-applications that provide interactive content directly within the client. The Warpcast client has accumulated more than 400,000 users, indicating its potential for substantial growth.

-

Other clients include Kiosk, Supercast, and Launchcaster.

Lens Protocol

Lens is a decentralized social graph protocol, that puts all the functionality and logic onchain.

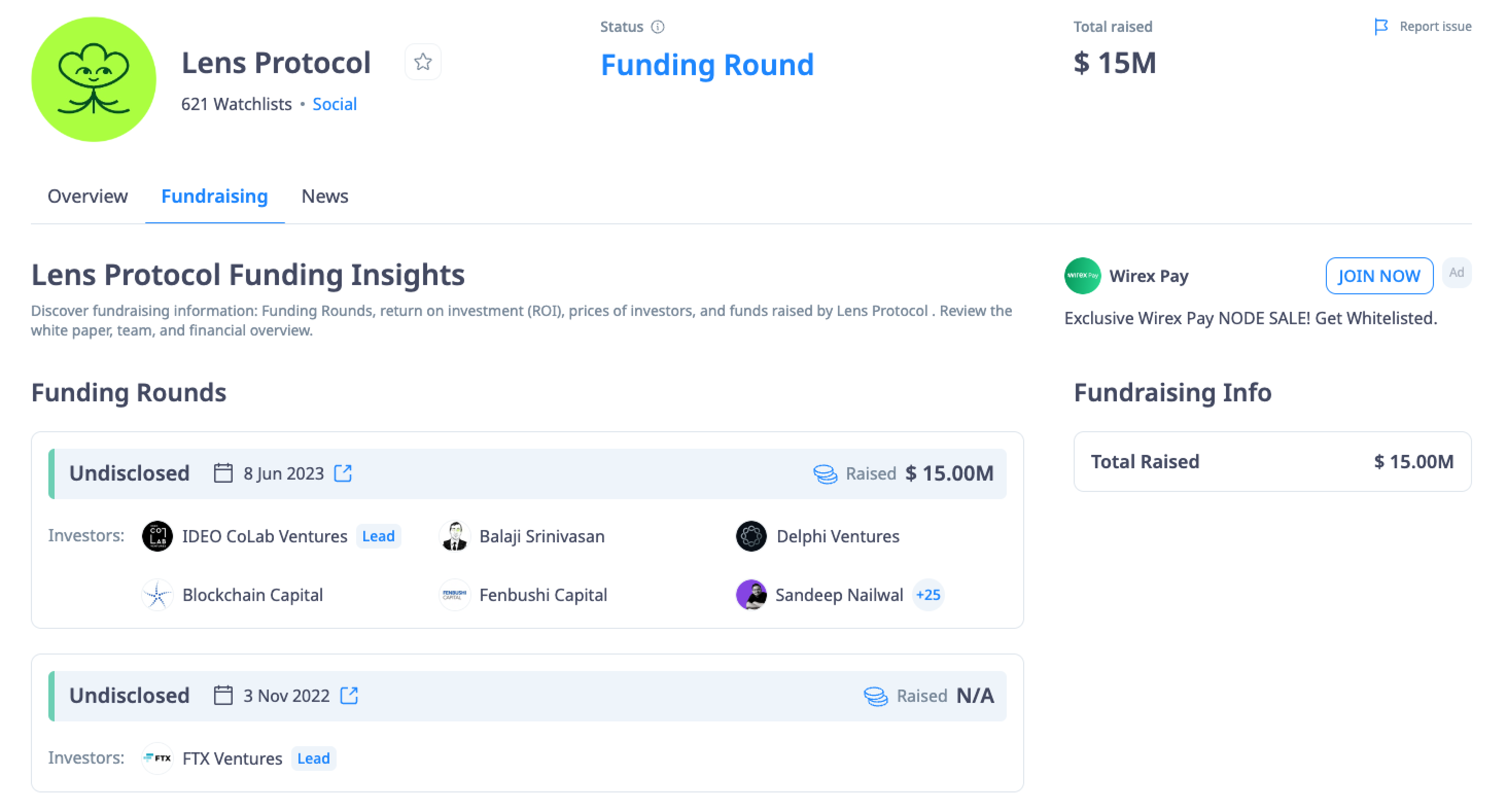

Lens Protocol focuses on fostering a diverse ecosystem of applications built on a shared social graph. All functionality is referred to to as Open Actions, which allow for a variety of interactions directly from a publication, such as tipping, minting, or swapping NFTs, collecting publications, and participating in onchain activities like raffles and polls. These actions are executed through modular smart contracts that integrate with the Lens protocol, allowing developers to create diverse monetization functionalities. Despite its potential, Lens's development is hindered by its dependence on the quality of in-built tokenomics for each app, slowing its ecosystem growth. To join Lens, you have to mint a handle, which currently costs $10 (or 8 MATIC), paid by a credit card or crypto. Built on Polygon, migrating to zkSync to launch hyperchain. Raised $15 million.

Since Lens is designed for experimenting with financial possibilities in SocialFi, they are many and depend on a client. A universal instrument, similar to $DEGEN in Farcaster, is the $BONSAI memcoin. Airdropped to Lens users, it has quickly become the preferred currency for encouraging engagement and paying for Open Actions.

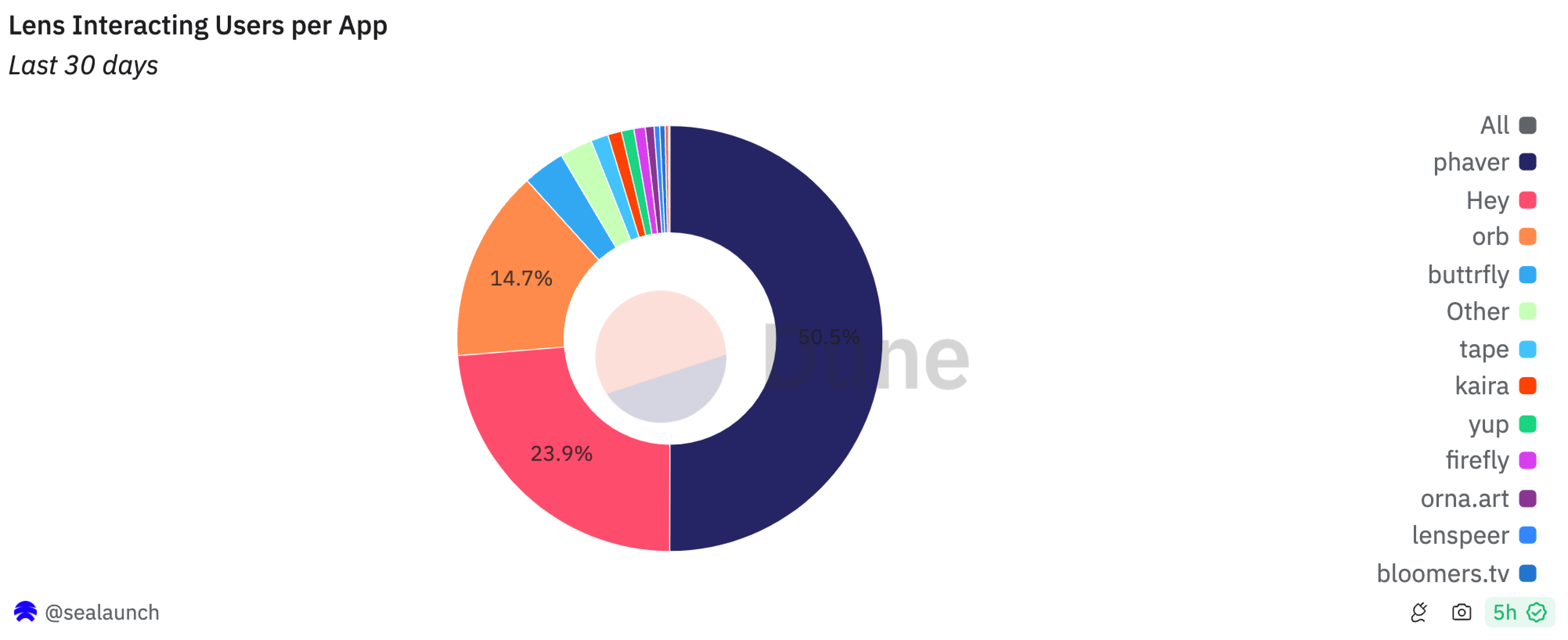

The most popular Lens clients are:

- Phaver. Phaver promotes user engagement through a points system, rewarding interaction within the app. It features token-gated communities and is experimenting with facial recognition for Sybil resistance. There are onboarding tasks that help new users earn points. Raised $7 million.

- Hey. Originally launched as Lenster, Hey is one of the oldest Lens clients. It supports features like collecting, minting, and tipping posts. Hey has introduced creator licenses for collectible content, giving creators various options to own their posts.

- Orb. Orb combines elements of Twitter and Instagram, focusing on both textual and visual content. Users can create clubs around their interests, similar to Farcaster’s channels. However, Orb is currently in a closed-access phase and lacks the ability for users to collect posts, a feature expected in future updates. Raised $2.3 million.

Separate Niche-Specific Solutions

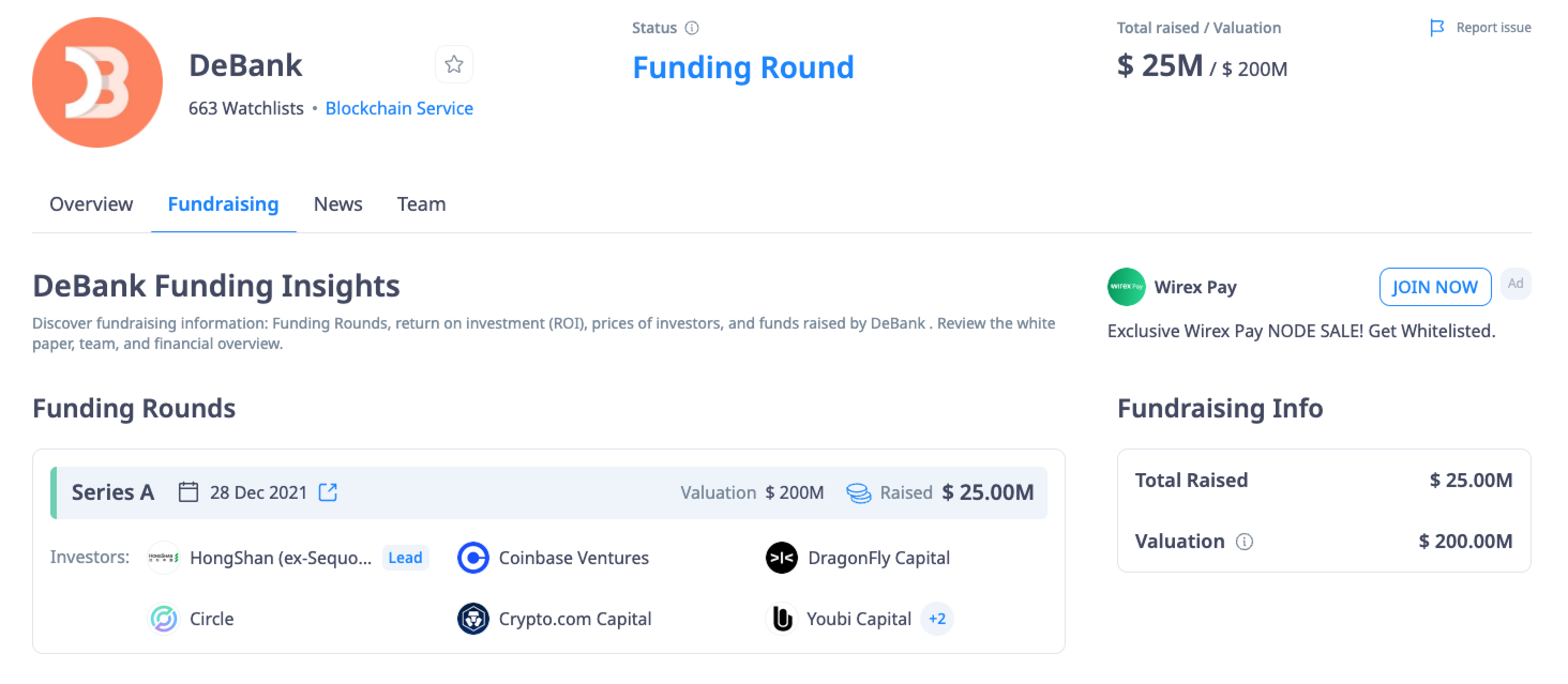

DeBank

Debank is a decentralized finance platform with social Twitter-like mechanics. It provides a comprehensive dashboard for users to monitor their DeFi assets and protocols across multiple EVM networks and interact with other users via chatting and posting. Debank allows users to earn rewards through various activities within its ecosystem. For example, you can earn by promoting content, but only if a content piece has a reward pool. The earnings depend on the user's account level. Raised $25 million.

In addition, the Debank team is developing Rabby Wallet, which is integrated with Debank’s dashboards and is probably the best EVM wallet currently available. Currently, there is a Rabby points farming campaign going on for airdrop.

Friend.tech descendants

Since Friend.tech has already distributed airdrop, there's nothing to catch in the original app for now, though the team recently announced its own L2 network. But Friend.tech has spawned a generation of successors, and now they're more than just copycats. Let's have a look at some of them:

District One

District One is a SocialFi platform on Blast that allows users to earn money by participating in social interactions and games within the app. You can trade personified stocks, stake $OLE token for various rewards, and earn the internal currency called GEM. In addition, you can form clans and participate in group PvP, collecting likes for your clan to get more rewards in the end.

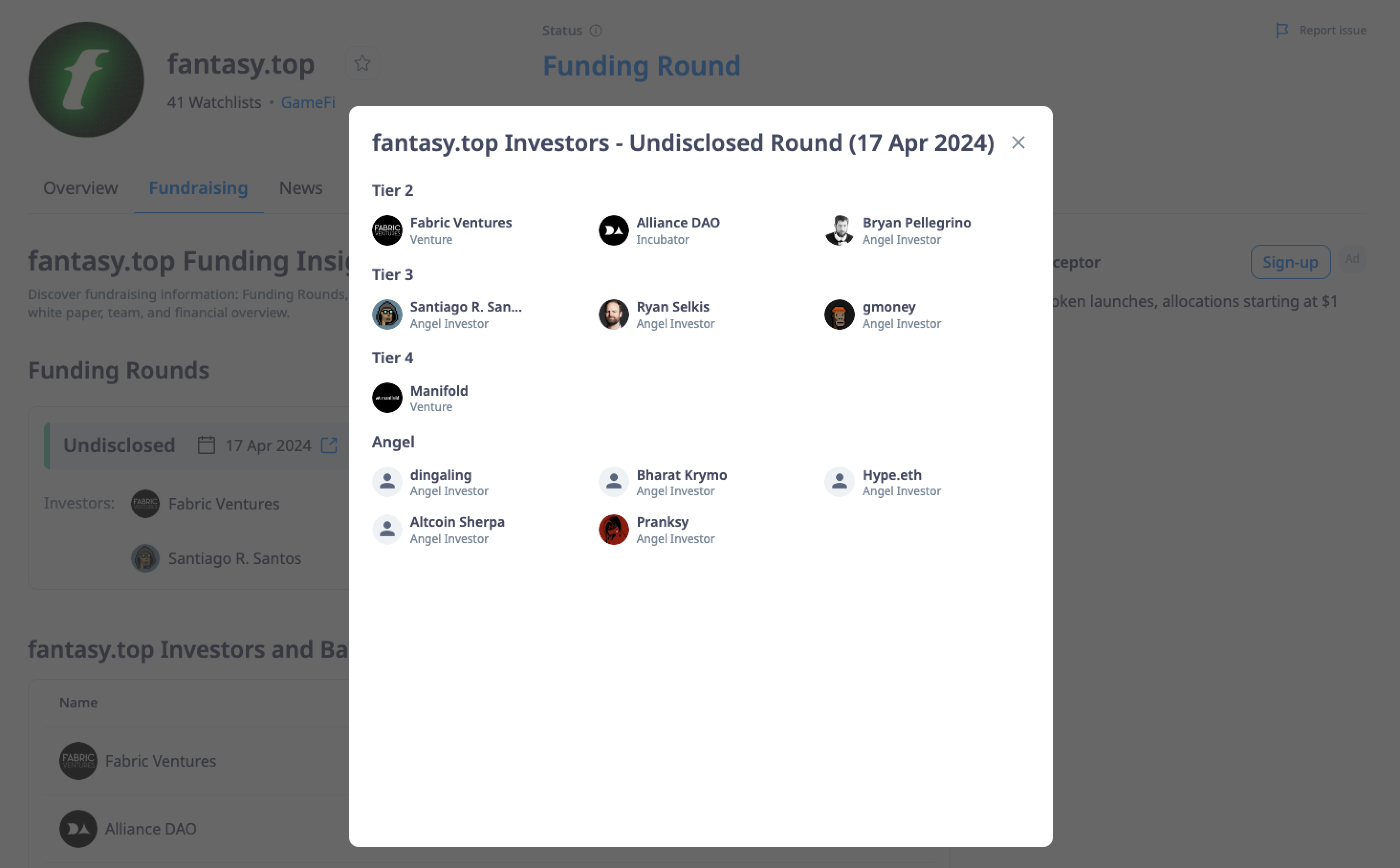

Fantasy.top

Fantasy.top is a SocialFi platform on Blast where you collect and trade NFT cards from Twitter influencers. You can earn points based on their real-time social media engagement and trade cards for profit. The more views, likes, reposts, comments, and followers an influencer gets, the higher their score will be. You can also earn by referring new users and participating in games and tournaments. It's essentially an improved version of Friend.tech with a bunch of new features. Fantasy.top is backed by Bryan Pelegrino and Ryan Selkis, and others.

Trading-oriented

PacBot

PacBot is a Telegram bot with the function of private chat rooms for traders, where you can share and promote trading ideas. It is a modernized version of trading bots like Unibot and Banana, where you can interact with other traders. Users will be eligible for token the airdrop.

SAX Trade

SAX Trade is SocialFi DEX on Blast, where you can trade viral hashtags from Twitter. Each Twitter hashtag can be minted into an ERC-20 token on SAX, with its price moving along a modified Bancor Bonding Curve that changes shape based on the hashtag's popularity.

SocialFi for Professionals

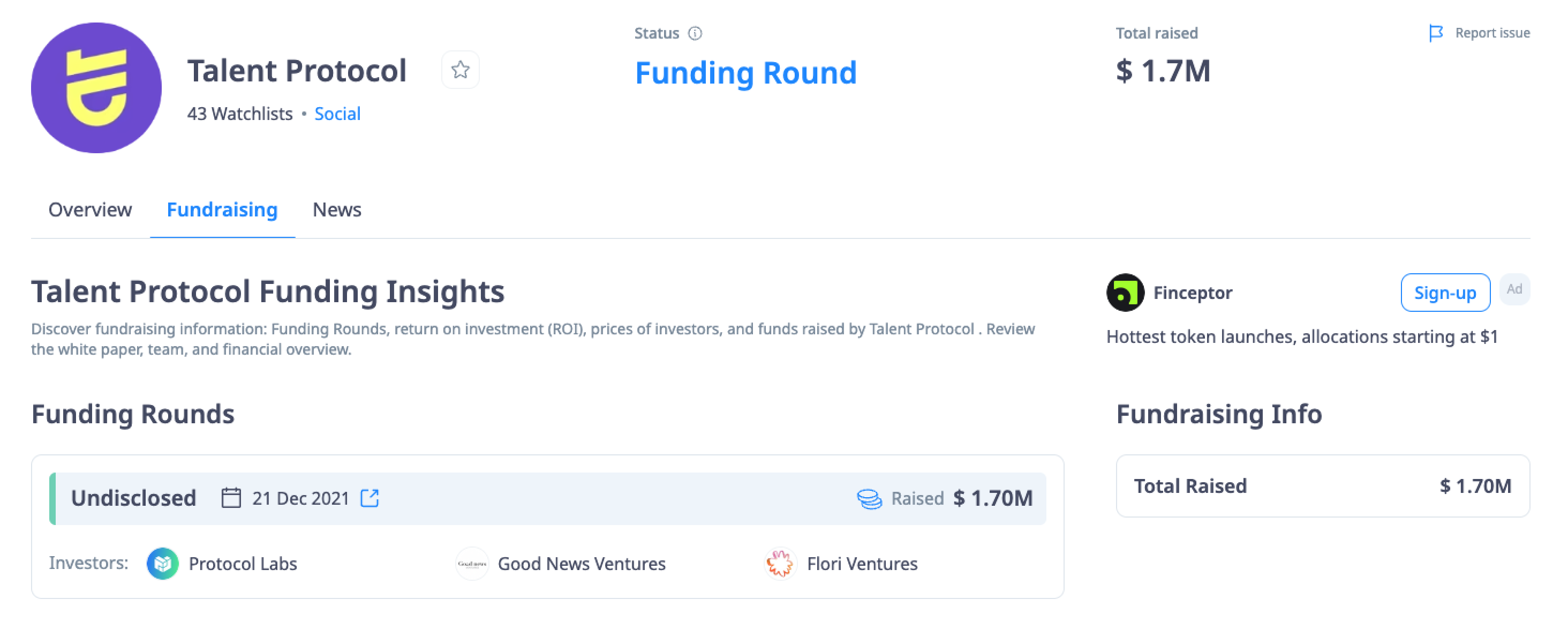

Talent Protocol

Talent Protocol is a Web3 professional network where individuals can build an onchain resume in the form of Talent Passport and launch their own talent token, allowing anyone to invest in their careers. In the future, Talent Passport can be used to filter sybils, like Gitcoin Passport. Raised $1.7 million.

Build.top

Build.top is a social game and token of appreciation platform on Base to reward onchain builders. You can earn BUILD points by nominating other users and receiving nominations from them. Requires Talent Passport.

Textual

Mirror

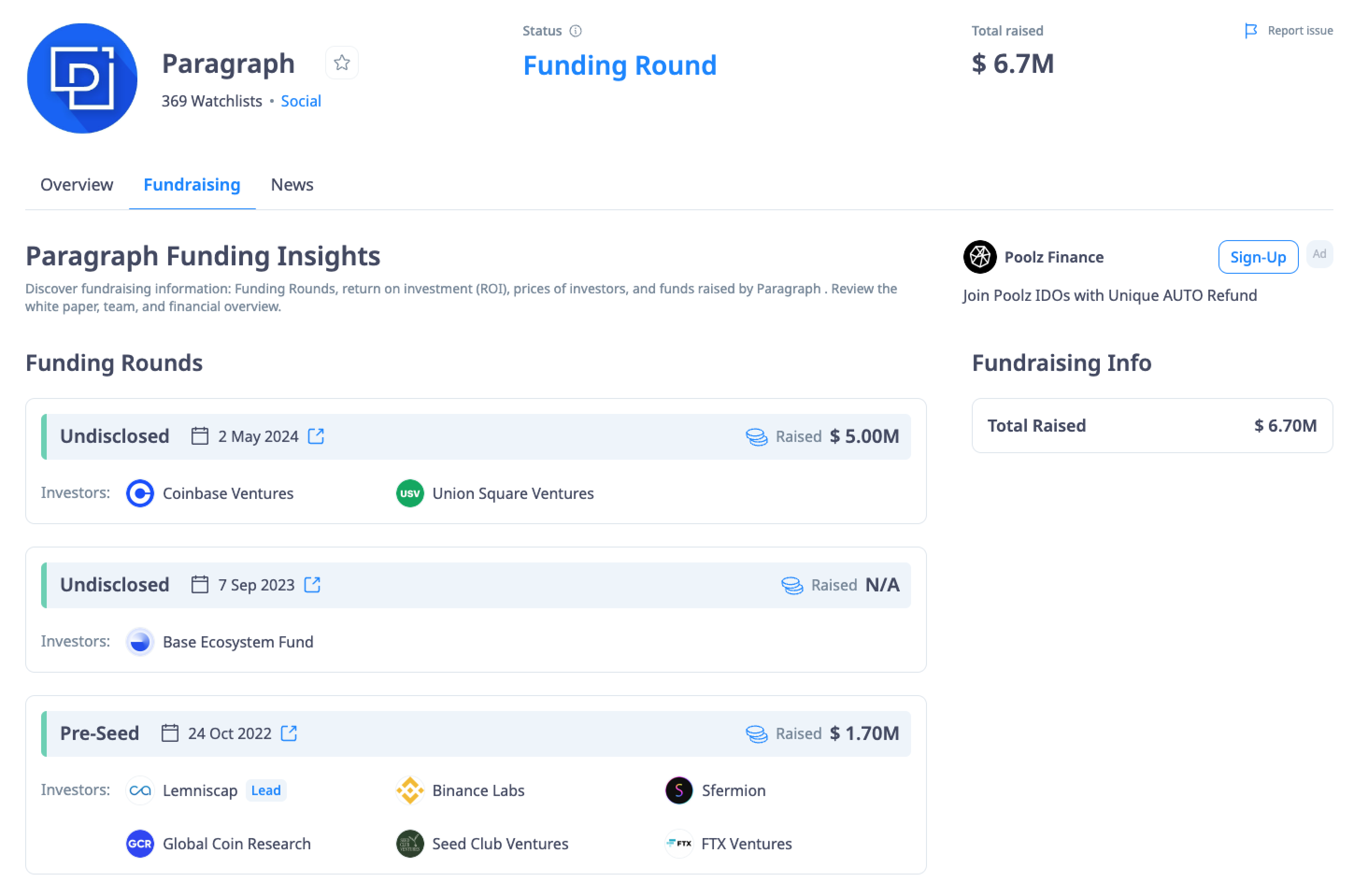

Mirror is a decentralized textual blogging platform that allows creators to publish content with embedded media blocks. It offers several monetization options, including minting content pieces in the form of NFT collectibles, holding auctions for articles, crowdfunding campaigns, and rewards programs. Mirror uses its native token, $WRITE, to reward users for participating in the platform. You can earn $WRITE tokens by voting for applicants in Mirror's weekly WRITE Race, which can be redeemed for Mirror membership or other features. In May 2024, Mirror was sold to its competitor, Paragraph.

Paragraph

Paragraph is a web3-native publishing platform that helps creators build communities, connect with audiences, and monetize content. Released a few years after Mirror, Paragraph offers functionality similar to Mirror but is more comparable to Substack, emphasizing newsletters and ongoing publications rather than one-off articles. Creators can earn money through a referral program by sharing links; they get paid when their audience collects an NFT or creates a new account. Paragraph also integrates with Layer3, allowing creators to embed quests in their content for interactive rewards.

Video-specific

Theta Network

Theta Network is a media and entertainment-focused blockchain. Theta is not really a social network, but an infrastructure that enables existing video and media platforms to drive incremental revenues and reduce content delivery costs. You can share your CPU and GPU powers for AI and video workloads to earn the $TFUEL token. Raised $134 million.

Huddle01

Huddle01 is a decentralized communication platform focused on real-time audio and video communication. The platform offers features like token-gated meetings, NFT avatars, and seamless integration with popular streaming sites. Since it is building the DePIN infrastructure, you can also earn by sharing your unused internet bandwidth to power audio/video calls between users. Raised $2.8 million.

Cheelee

Cheelee is a SocialFi platform, where users get rewards for watching short videos. The platform introduces so-called NFT glasses, which enhance user rewards and engagement, adding a gamified layer to the watching experience. Basically, a crypto version of TokTok. Raised $19.3 million.

Stacked

Stacked is a Web3 video and livestreaming platform, basically a crypto version of Twitch. Raised $12.9 million.

Crypto OnlyFans

It was only a matter of time before crypto would have gotten its OnlyFans equivalents. The most popular ones so far are Only1 on Solana and Early Fans on Blast. The functionality there is similar, and we guess it requires no explanation. The niche has good potential because the original OnlyFans takes a 20% commission fee on all earnings. Probably the best scheme to make money in such apps would be becoming a creator.

Output

The SocialFi landscape offers numerous financial opportunities across various platforms. From general-purpose infrastructures like Farcaster, Lens, and Nostr, to niche-specific solutions such as DeBank, you have multiple ways to explore and earn. All of them have unique financial models to leverage — ranging from tipping and content monetization to trading and professional networking. As the ecosystem evolves, understanding and leveraging these opportunities can unlock significant value for users and creators alike. However, we remain sceptical about Web3 social networks displacing existing counterparts like Twitter and Telegram, especially since they have taken the path of crypto integration. However, niche applications may have long-term potential.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

Table of Contents

- Is There an Actual Need for Decentralized Social Networks?

- SocialFi Landscape and Opportunities There

- General-Purpose Social Infrastructure and its Applications

- Separate Niche-Specific Solutions

- Friend.tech descendants

- Trading-oriented

- SocialFi for Professionals

- Textual

- Video-specific

- Crypto OnlyFans

- Output

Table of Contents

- Is There an Actual Need for Decentralized Social Networks?

- SocialFi Landscape and Opportunities There

- General-Purpose Social Infrastructure and its Applications

- Separate Niche-Specific Solutions

- Friend.tech descendants

- Trading-oriented

- SocialFi for Professionals

- Textual

- Video-specific

- Crypto OnlyFans

- Output