State of Venture Capital in Crypto, Q3 2025

The U.S. Crypto Policy Is the Main VC Rebound Driver

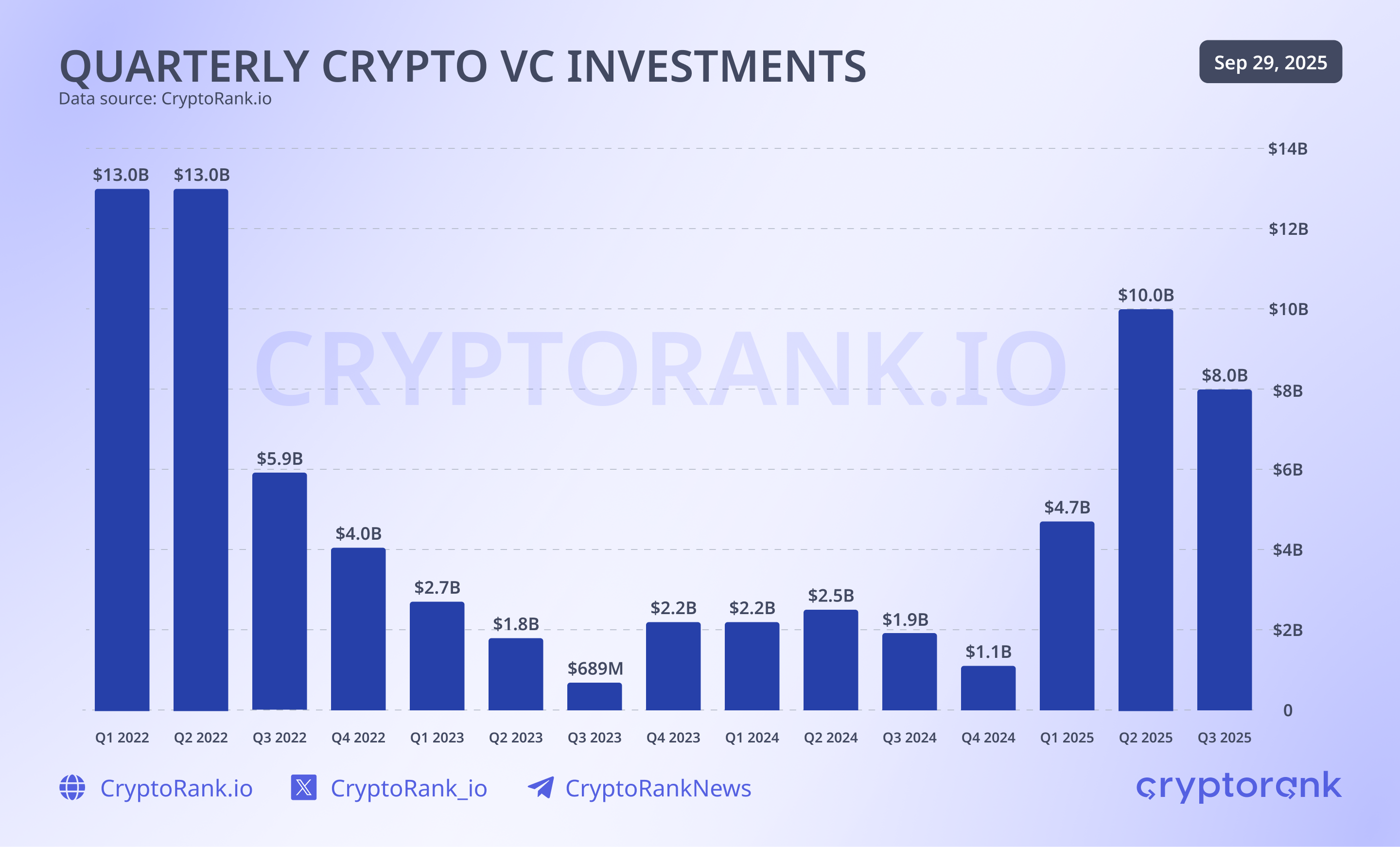

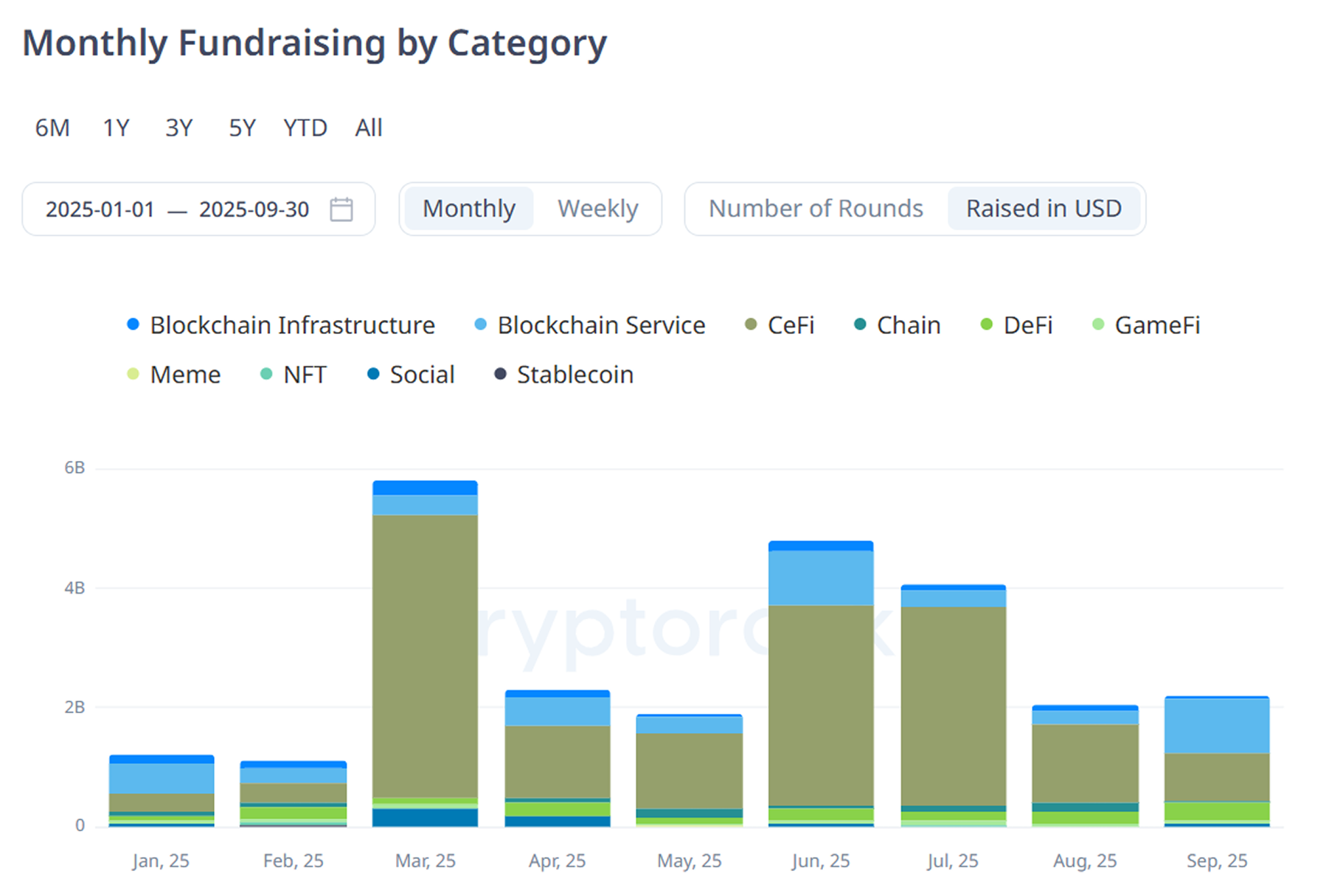

According to data from our fundraising dashboard, total crypto venture funding reached 8 billion dollars in Q3, slightly below the 10 billion dollars recorded in Q2 but still among the strongest quarters since 2021. The modest decline signals a healthy normalization after two consecutive quarters of growth rather than a reversal of momentum.

Behind this new stability lies more than market dynamics, it is shaped by policy. The Trump administration’s pro-crypto agenda has significantly reshaped investor sentiment. Washington’s introduction of clear federal guidelines for digital assets, a national stablecoin framework, and tax incentives for compliant entities has reduced the uncertainty that once kept institutional capital on the sidelines.

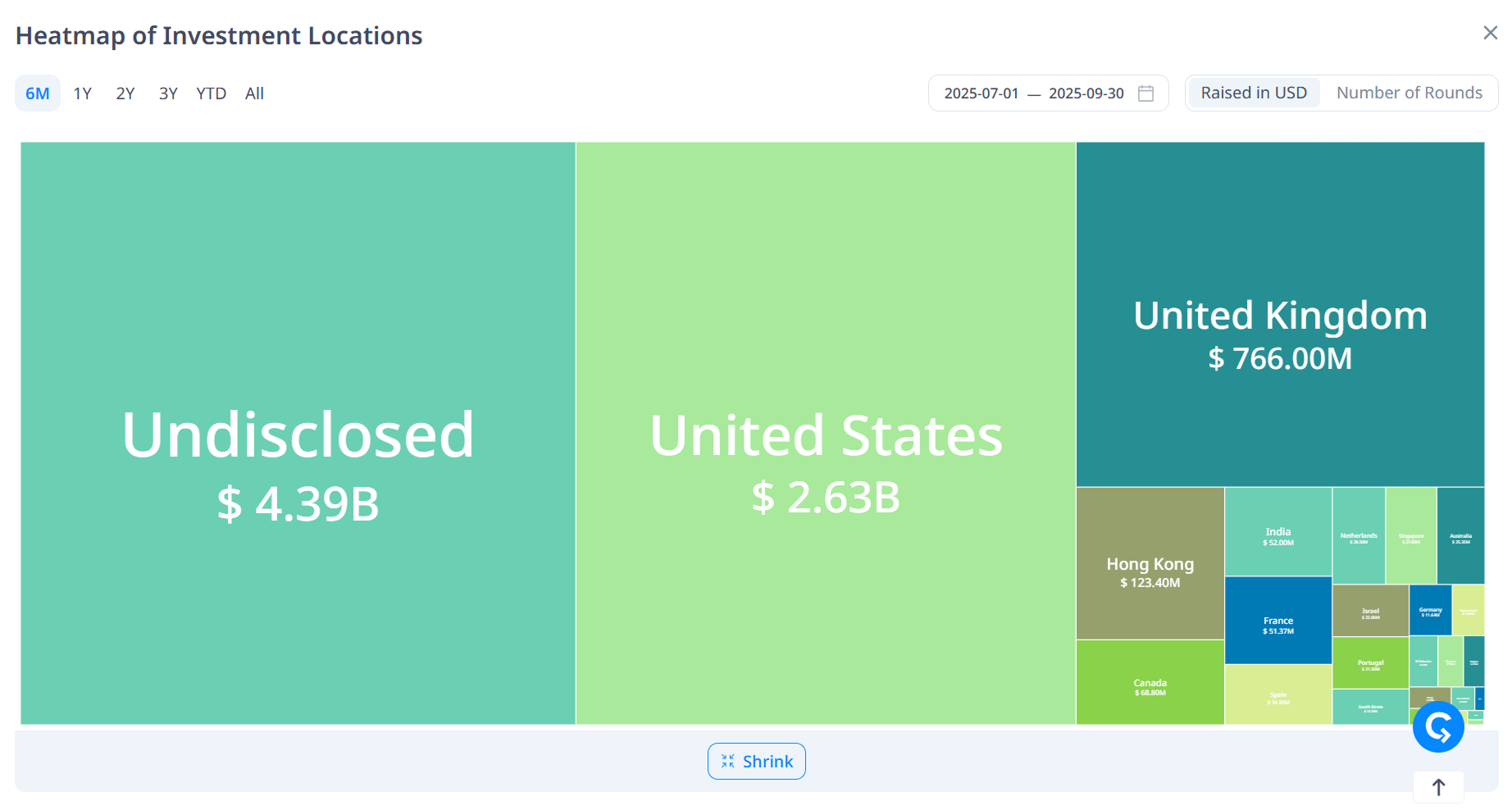

For several years, a lack of regulatory clarity discouraged traditional investors from entering the market. Now regulation has become a growth driver. U.S.-based venture firms, responsible for roughly one-third of global VC deployment this quarter, are investing with renewed confidence.

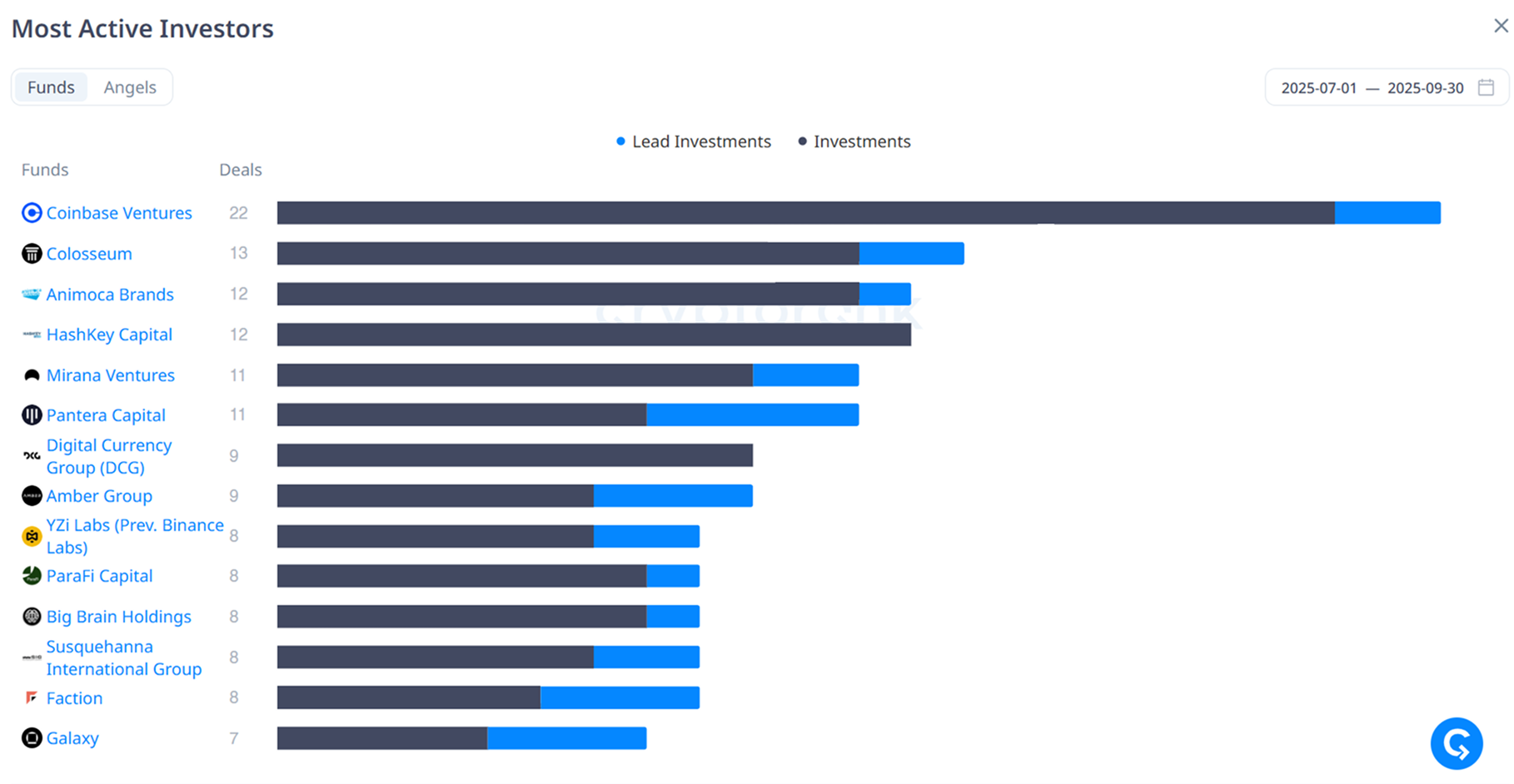

That confidence is reflected in the leadership tables as well. Coinbase Ventures, the most active investor of Q3 with 22 deals, was joined by several other U.S.-backed funds among the top performers. The message is clear: policy certainty is fueling the American crypto venture capital.

Capital Structure: Early Stages Continue to Lead

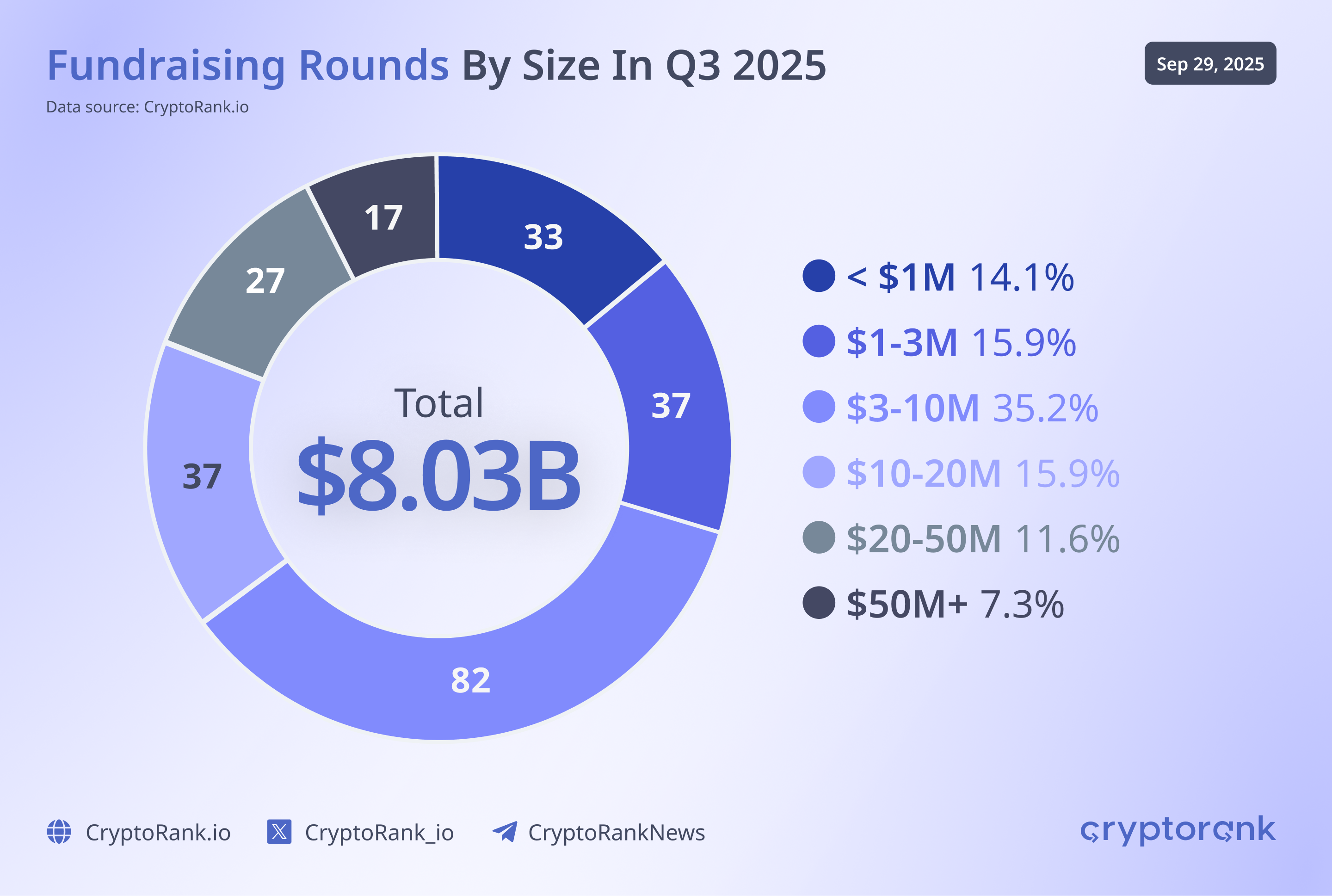

A closer look at deal composition shows how investor behavior has matured. Of the 275 rounds tracked this quarter, more than two-thirds were below 10 million dollars, with the 3 to 10 million dollar bracket dominating at 35.2 percent.

This is not a reflection of capital scarcity but of disciplined risk management. Funds now distribute exposure across multiple early-stage teams rather than making all-in bets on single narratives. The focus has shifted from hypergrowth to validated innovation.

At the same time, large rounds are returning selectively. Around 7 percent of all deals exceeded 50 million dollars, mainly in infrastructure and exchange platforms. These outliers show that conviction capital still exists; it is simply more targeted.

The overall pattern marks a structural change. Venture investors are behaving less like traders chasing momentum and more like portfolio managers balancing experimentation with conviction.

Sector Focus: CeFi Leads the Profit-Driven Revival

Sector data reveals a clear pattern of priorities. CeFi and Blockchain Infrastructure absorbed more than 60 percent of all Q3 funding, while DeFi and Chain-related projects accounted for about 25 percent. The once-hyped categories such as GameFi, NFTs, and SocialFi collectively fell below 10 percent, replaced by a focus on revenue, compliance, and scalability.

This preference for CeFi is deliberate. After years of token-based experimentation, investors are shifting toward companies that can generate real and predictable cash flow such as exchanges, custody providers, and payment processors. These firms offer something increasingly rare in crypto: measurable profitability.

A major shift within CeFi is the rise of IPOs as an alternative to token launches. Web3 startups are increasingly listing on Nasdaq, HKEX, or other traditional exchanges, where they gain access to deeper liquidity and higher valuations. For venture funds, IPOs provide clearer exit opportunities and stronger pricing power than token unlocks.

This convergence of crypto and traditional finance marks a new stage of maturity. CeFi’s dominance reflects not just profitability but credibility. Crypto companies are no longer content to exist on the periphery of global finance; they are stepping directly into it.

Top Deals: The Return of Institutional Checks

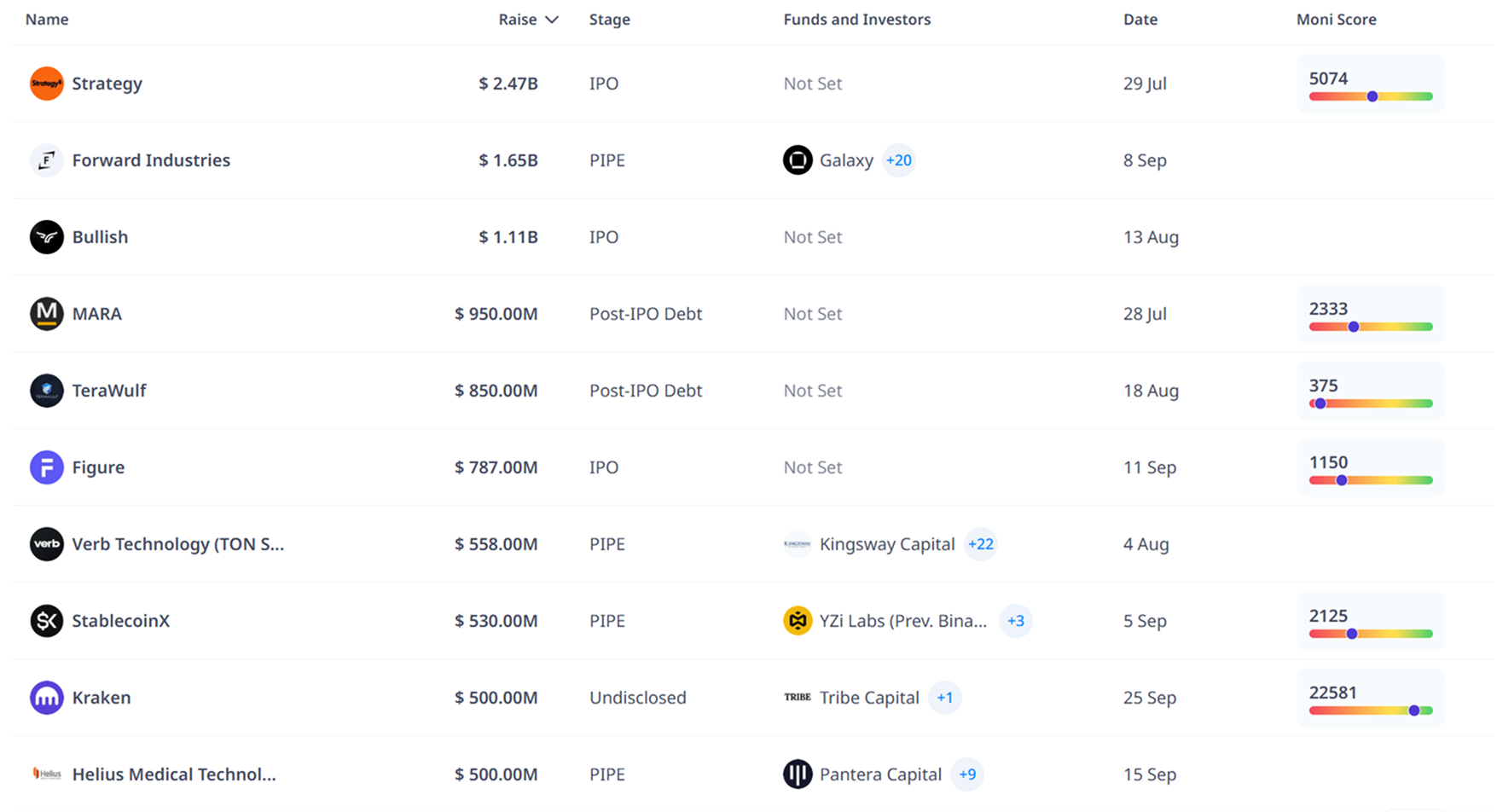

Institutional capital returned decisively in Q3. Strategy’s 2.47 billion dollar IPO of preferred stock, Forward Industries’ 1.65 billion dollar PIPE, and Bullish Exchange’s 1.11 billion dollar IPO were the standout deals of the quarter. They were followed by MARA Digital’s 950 million dollar debt raise, TeraWulf’s 850 million dollar financing, and Kraken’s 500 million dollar private round.

These transactions highlight that large-scale, balance-sheet-driven companies are once again attracting deep-pocketed investors. They also signal a broader structural change, as equity, debt, and hybrid funding models gradually replace speculative token raises.

For institutional allocators, this is the bridge they needed to gain exposure to crypto’s growth without the volatility of tokens.

Outlook: The Blueprint for a Sustainable Cycle

As 2025 enters its final quarter, projections place total annual VC inflows between 18 and 25 billion dollars, which would make this year the strongest since 2021. However, the foundations are very different now. Capital is institutional, compliant, and performance-oriented, and both investors and founders are acting with greater foresight.

Q3 2025 proved that crypto no longer depends on euphoria to expand. With regulatory clarity, predictable macro conditions, and IPOs providing credible exits, the industry is evolving from a speculative market into a structured, global economy.

For the first time in its history, regulation is creating opportunity instead of resistance. Combined with easing inflation, stable interest rates, and consistent ETF inflows, the environment now rewards disciplined builders. Predictability has become the new alpha, and institutional investors are responding.

Coinbase Ventures

Coinbase Ventures