Stablecoin Chain Prospects: The Plasma Case

Plasma positions itself as an L1 chain specifically designed for stablecoins, offering zero-fee USDT transfers, high throughput, and a convenient payment infrastructure.

Currently, the network’s activity metrics are far from its initial goals, and the XPL token has dropped 90% from its ATH. Let’s break down what happened.

On-chain Metrics

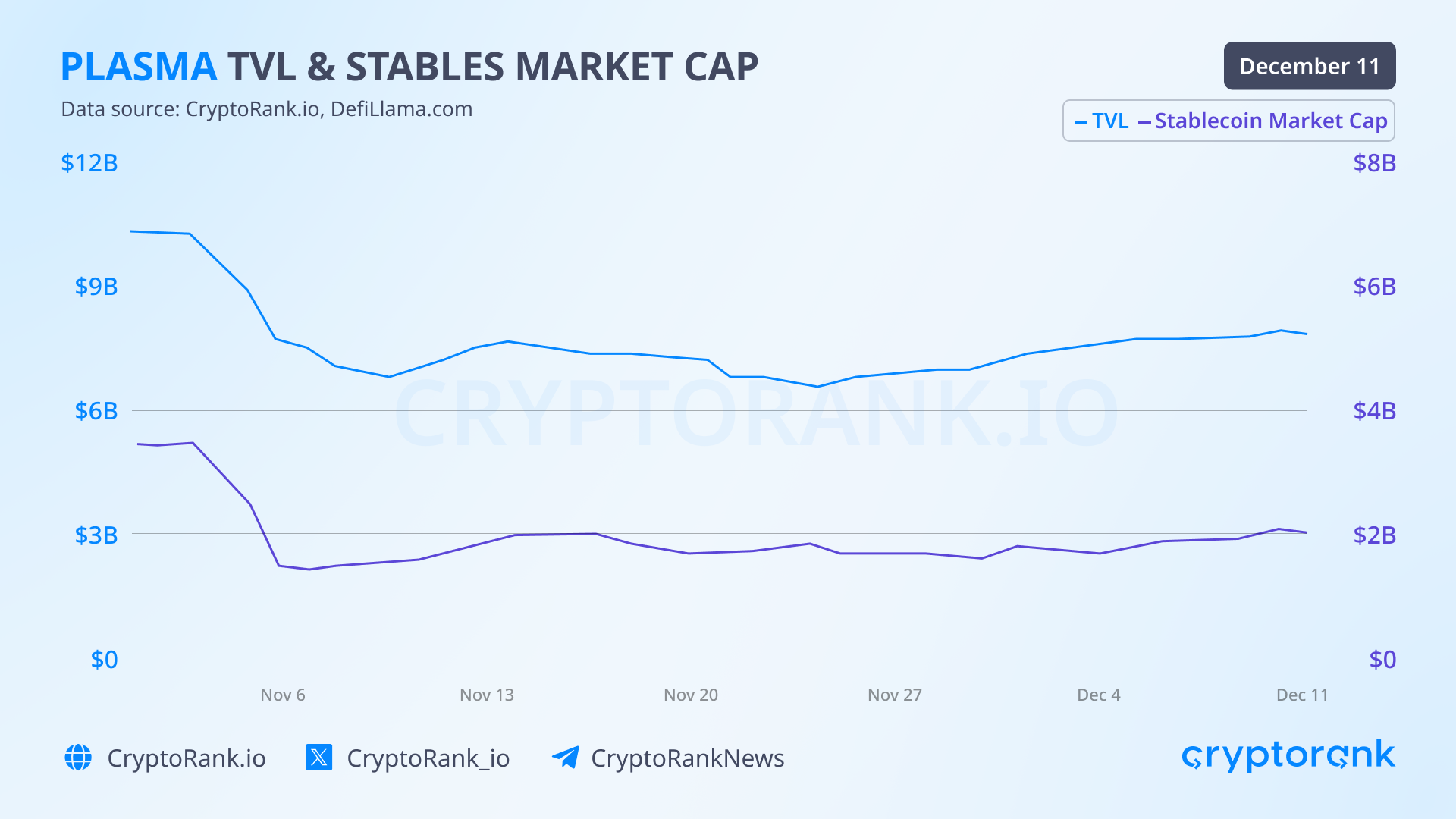

Plasma had a solid launch: the project’s TVL reached $14 billion within 5 days, immediately placing the chain in the top 10. Stablecoin market cap reached $6 billion, with around 80% USDT dominance.

However, once the initial hype and user interest faded, the metrics began to decline. TVL is now at $7.8 billion – 45% below September levels – and stablecoin market cap has dropped even more, by 70%.

Plasma now processes only 9 transactions per second. For comparison, Tron handles around 450 TPS at the time of writing.

The XPL Token

The token launched strongly, reaching a $3 billion market cap within a few days and delivering high returns to sale participants. Additionally, the team distributed 9,394 XPL (~$10K) to anyone who invested at least $1. This powerful start and large airdrop created strong positive sentiment around the project. However, things soon changed.

The price of XPL began to fall, and the community started accusing the team of selling their tokens. The project’s founder denied the accusations, but the community still has questions about the use of the 800 million XPL allocated for ecosystem development.

Due to uncertainty, the token entered a prolonged decline, and its current market cap is around $300 million – 90% below the peak.

Other Stablecoin Chains

Stable is an L1 chain designed for stablecoin transactions and uses USDT for gas fees. The mainnet launched this week, and many projects supported the network from day one; TVL has now reached $800 million.

However, the network currently processes only 0.2 transactions per second. The token’s market cap is similar to XPL – around $260 million. Interestingly, the token dropped 20% during the first 24 hours of trading.

Arc is an L1 chain from Circle, with USDC used as the gas token. The project is in public testnet, with mainnet planned for 2026. There have been reports suggesting a possible launch of a native ARC token.

Tempo is a network launched by Stripe and Paradigm, which raised $500 million at a $5 billion valuation in October. As with previous examples, gas fees can be paid in stablecoins. A public testnet launched today with participation from UBS, MasterCard, and Kalshi.

What are stablecoin networks lacking

Most stablecoin chains share similar positioning and benefits: cheap transactions, high throughput (thousands of TPS), and stablecoin gas payments.

However, they all face the same major problem – a lack of users. The current 9 TPS on Plasma or 0.2 TPS on Stable sharply contrast with marketing claims and stated goals.

If we look at Tron – the leading network for stablecoin transfers – the gap becomes obvious. Tron is near its ATH in monthly transactions at 300 million, and November’s monthly fees totaled $29.5 million. This is the lowest since 2023, yet still far ahead of competing blockchains. Notably, 84% of fees came from USDT transactions.

At the moment, there is no clear reason why regular users would move from familiar networks to new chains.

Prospects

One of the key opportunities for stablecoin chains today appears to be B2B adoption. Companies are increasingly searching for ways to reduce costs and speed up international payments, automate settlements, and minimize reliance on banks.

With strong partnerships, new networks have a chance to capture part of this market. However, each player will face competition both within the stablecoin-chain segment and from other L1 blockchains that will not easily give up their positions.

Paradigm

Paradigm