Received Airdrop? What’s Next: Hold or Sell?

In this article, we want to discuss a rather important question regarding asset price behavior after listing and reconsider the bear market axiom, according to which you should “sell on the first candlestick.”

To fully understand this issue, we analyzed the nine biggest airdrops of this year. The main focus of the analysis was primarily on asset prices during and after the token generation event (TGE). We compiled the obtained data into the table, which we’ll use to draw conclusions.

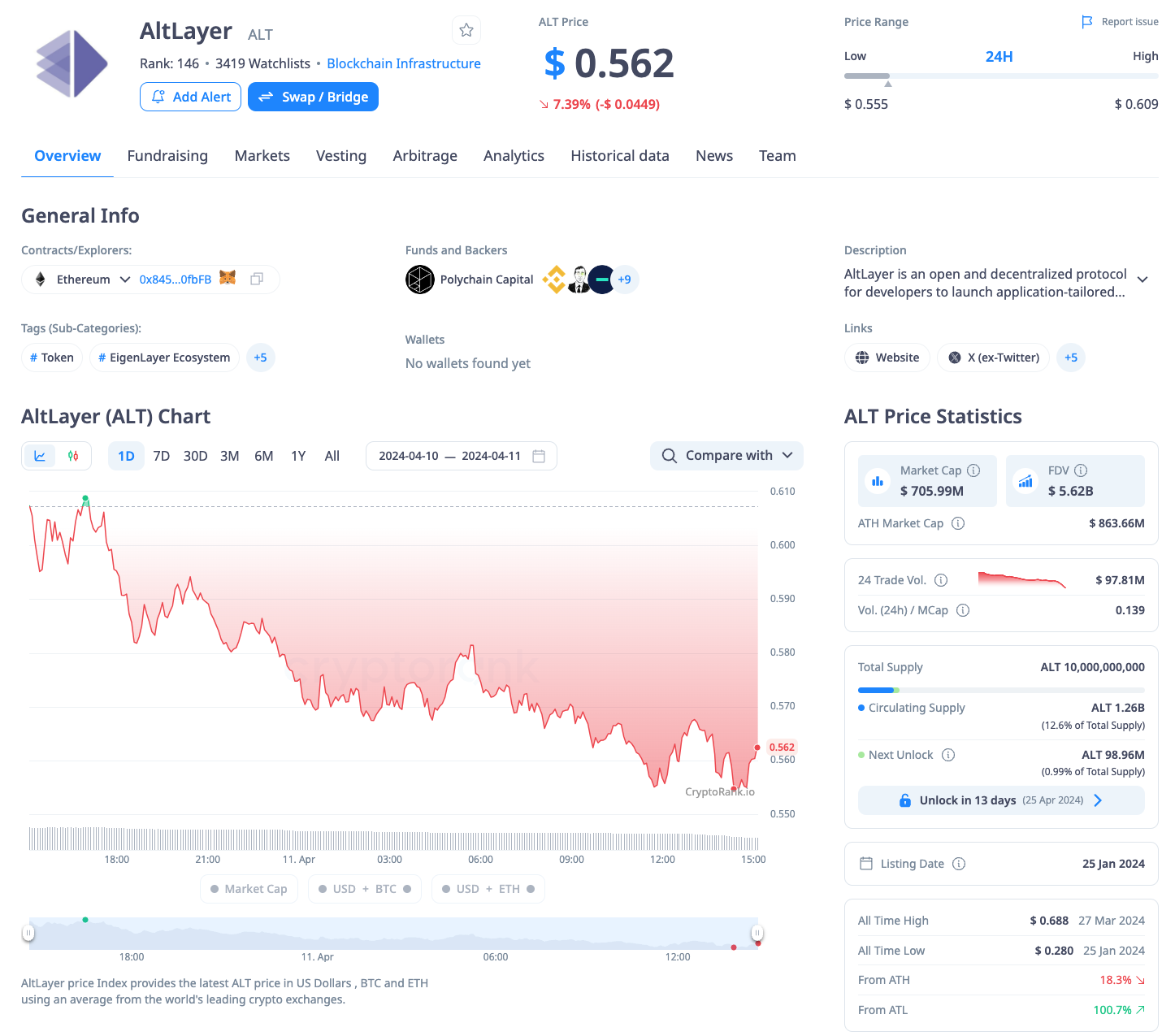

AltLayer

AltLayer is a protocol that serves as a modular framework for the settlement layer, making it easy to create and deploy rollups (Rollups-as-a-Service).

Active users of the project, as well as stakers of ATOM, TIA, and PYTH, received an airdrop that they could sell on the listing day (January 25) at an average price of $0.35 per token.

The most patient holders could wait for the ATH, which was reached on March 27, and sell $ALT for $0.688, which is almost x2.

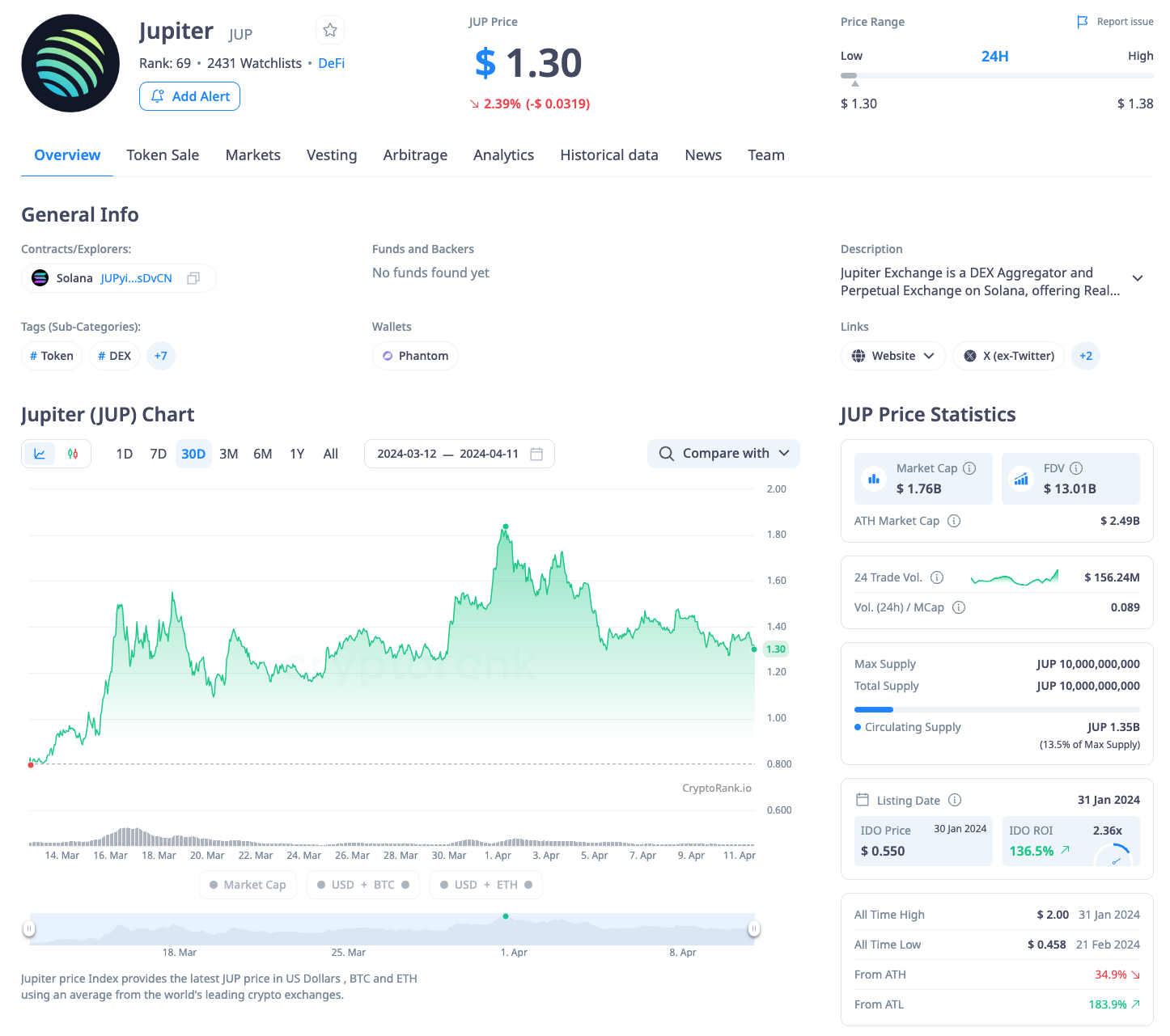

Jupiter

Jupiter is one of the largest liquidity aggregators on the Solana network, offering a variety of other products.

Over 955,000 wallets received the airdrop, so it’s no wonder that on January 31, the day of claiming and listing, the network couldn’t handle the peak load and went down for two hours.

$JUP started trading at $0.6 and reached a modest $0.66 on the first day.

However, the asset reached its peak price on April 1, showing almost x3 of its listing price.

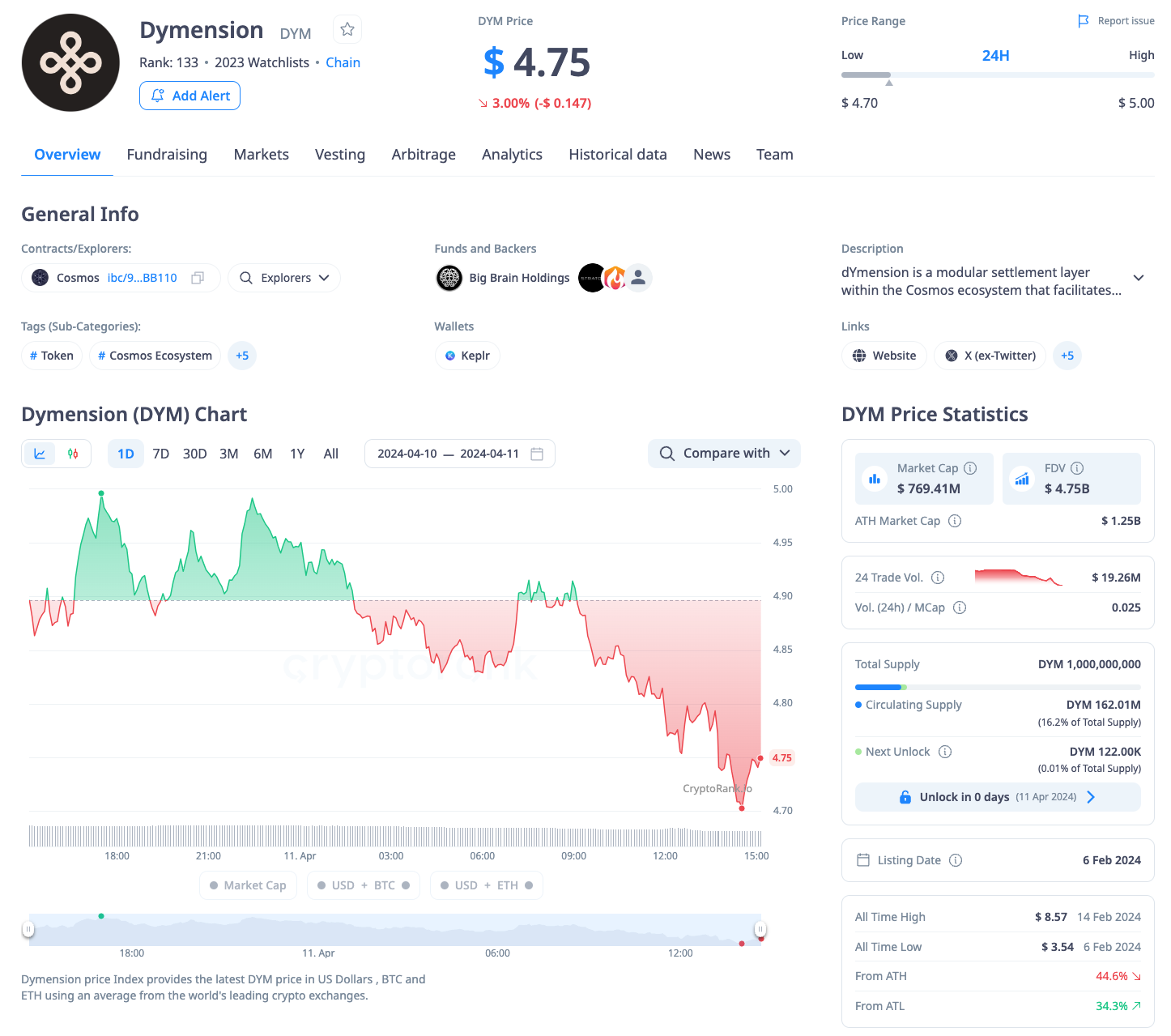

Dymension

Dymension is the modular settlement layer from the Cosmos ecosystem that simplifies the development and launch of rollups (Rollups-as-a-Service).

Active users of L2 blockchains, as well as stakers of ATOM, TIA, and PYTH got the project’s airdrop.

In OTC markets, $DYM tokens were sold for $2-$3. On the first day of trading, the price reached $5.7. But as with AltLayer, the real peak came a bit later — on February 14, DYM was trading at $8.57.

Pixels

Pixels is a pixel graphics Play-to-Earn game with an open world, where users can take on the role of a farmer. With the latest update, besides farming, the game introduced animal husbandry and many other interesting mechanics.

![]()

The project distributed an airdrop to all active participants who made it to the leaderboard of the first and second gaming seasons.

Before listing in the pre-market, $PIXEL tokens were trading at $0.4-$0.6, which generally aligned with the $0.5 listing price. On February 19, the first day of trading, the price reached $0.697 but then began to gradually decline. We could see the maximum possible price of $1.02 per $PIXEL three weeks later, on March 11.

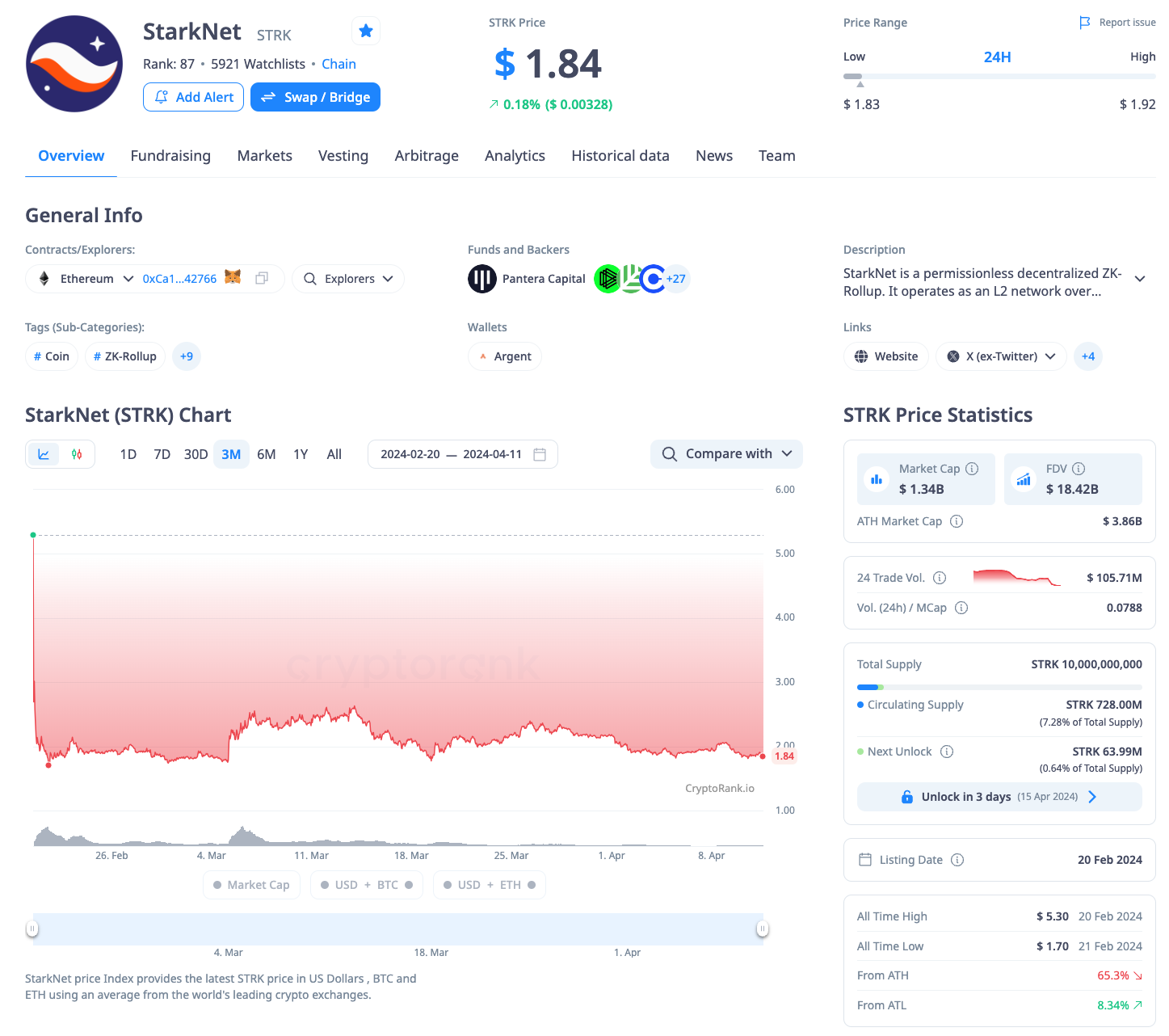

Starknet

Starknet is the first Ethereum’s L2 network, built with zk-STARK technology.

Unlike many other large L2 networks, the project surprised with a relatively quick market launch, though it also faced a strong wave of hate from the community due to irrational selection criteria for the airdrop and searching sybil wallets across AI clusters. Nevertheless, this didn’t stop the team from conducting the listing. On the first day, the price of $STRK hit ~$2.4. But the ATH occurred on March 13, with STRK approaching $2.68.

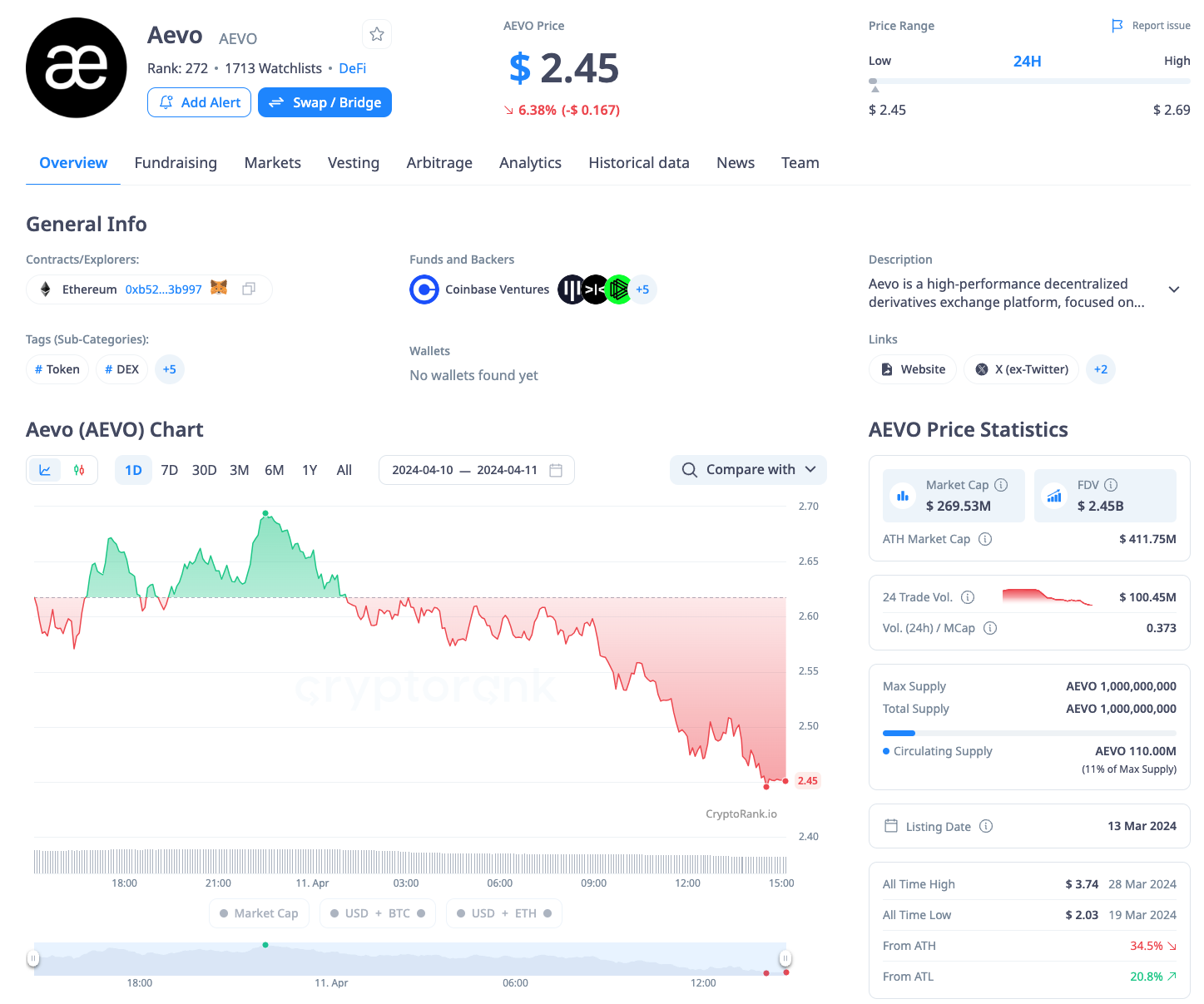

AEVO

AEVO is a decentralized derivatives exchange, which is an L2 rollup based on OP Stack. Its order book functions off-chain. Prior to AEVO, the project team had already created a fairly successful financial product called Ribbon Finance.

The project distributed the airdrop for certain trading volumes and entered the market on March 13, with an average price of $3.2 for $AEVO on the first day of trading.

The asset peaked at $3.74 just over two weeks after listing. By the way, you can still get $AEVO tokens almost for free by simply trading derivatives on the platform.

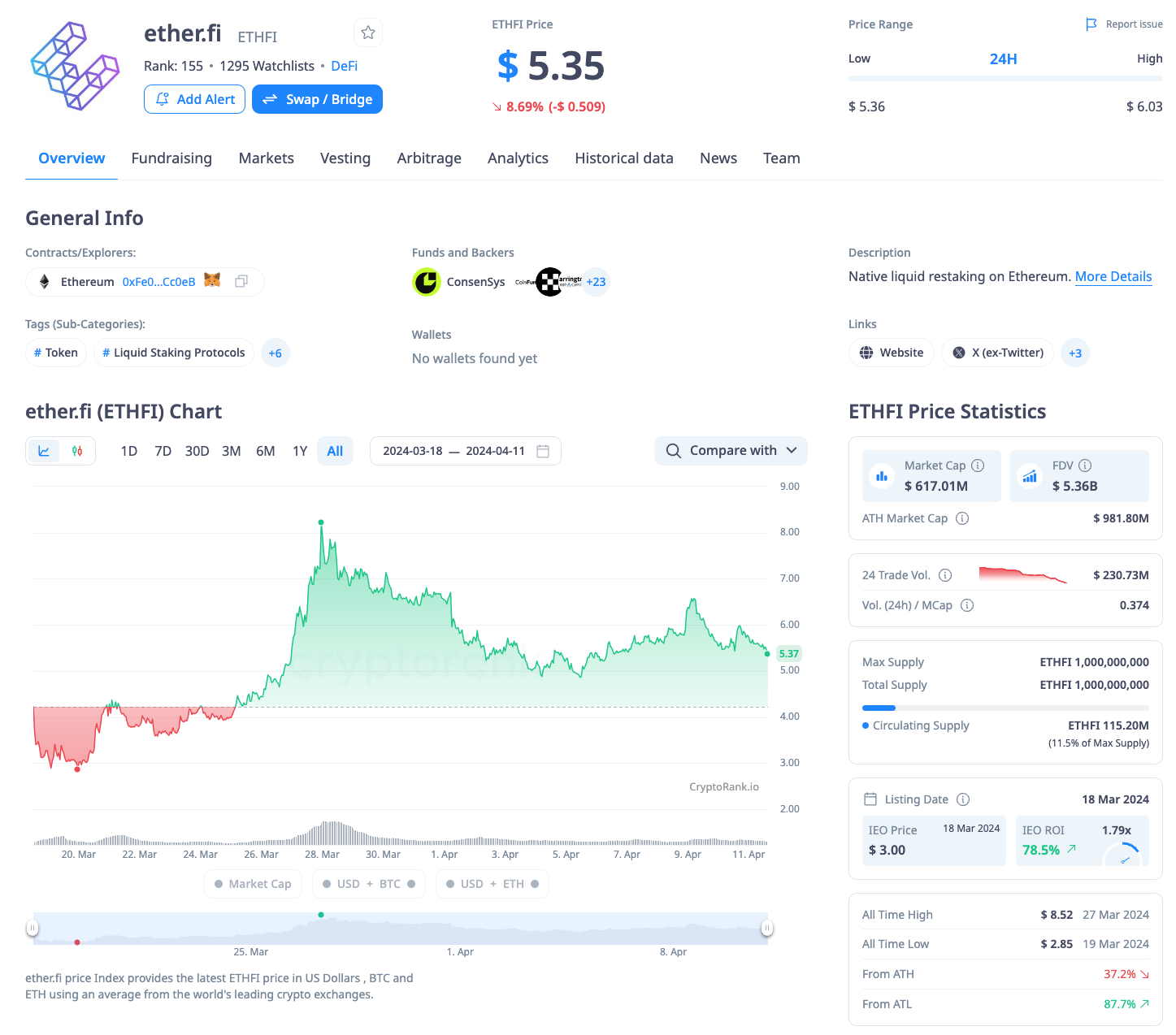

EtherFi

EtherFi is a protocol for Liquid Restaking (LRT), where you can earn yields on restaked ETH and gain EigenLayer points.

The project distributed the airdrop and listed on March 18. On the first day of trading, $ETHFI could be sold for $3.3, but as in previous cases, the peak price came a little later. Ten days later, on March 27, $ETHFI hit $8.52 at its peak.

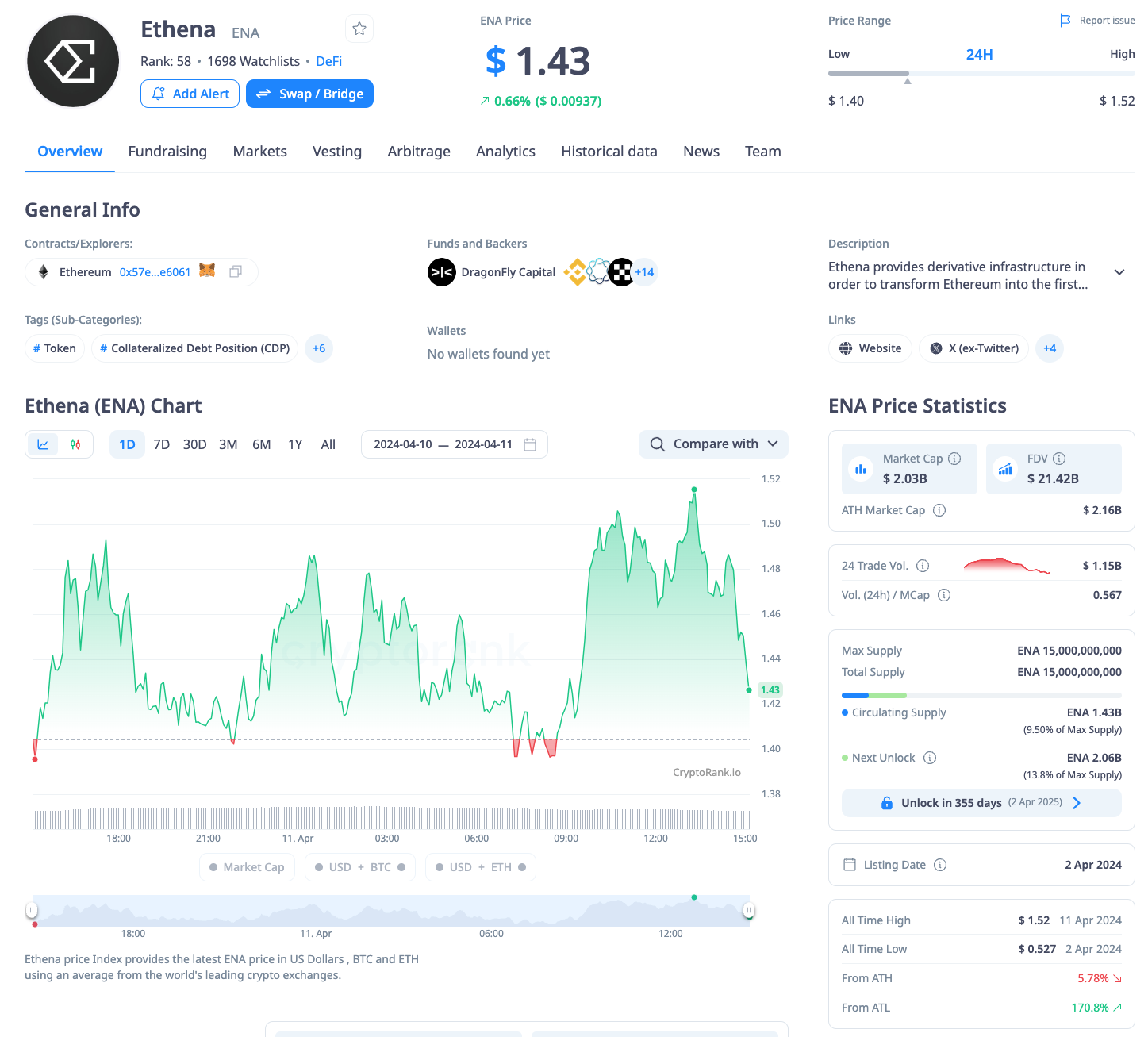

Ethena

Ethena is a CDP protocol that built its own synthetic stablecoin USDe with a unique hedging system, which was first mentioned in an essay by the well-known Arthur Hayes.

The project distributed the airdrop and entered the market earlier this week. Trading of ENA started at around $0.55 on April 2. The next day, the price jumped to ~$1.3. It’s too early to assess the results — the coin is highly volatile and fluctuates around $1. Just like with AEVO, you can still participate in the second season and get ENA tokens by providing liquidity to the protocol.

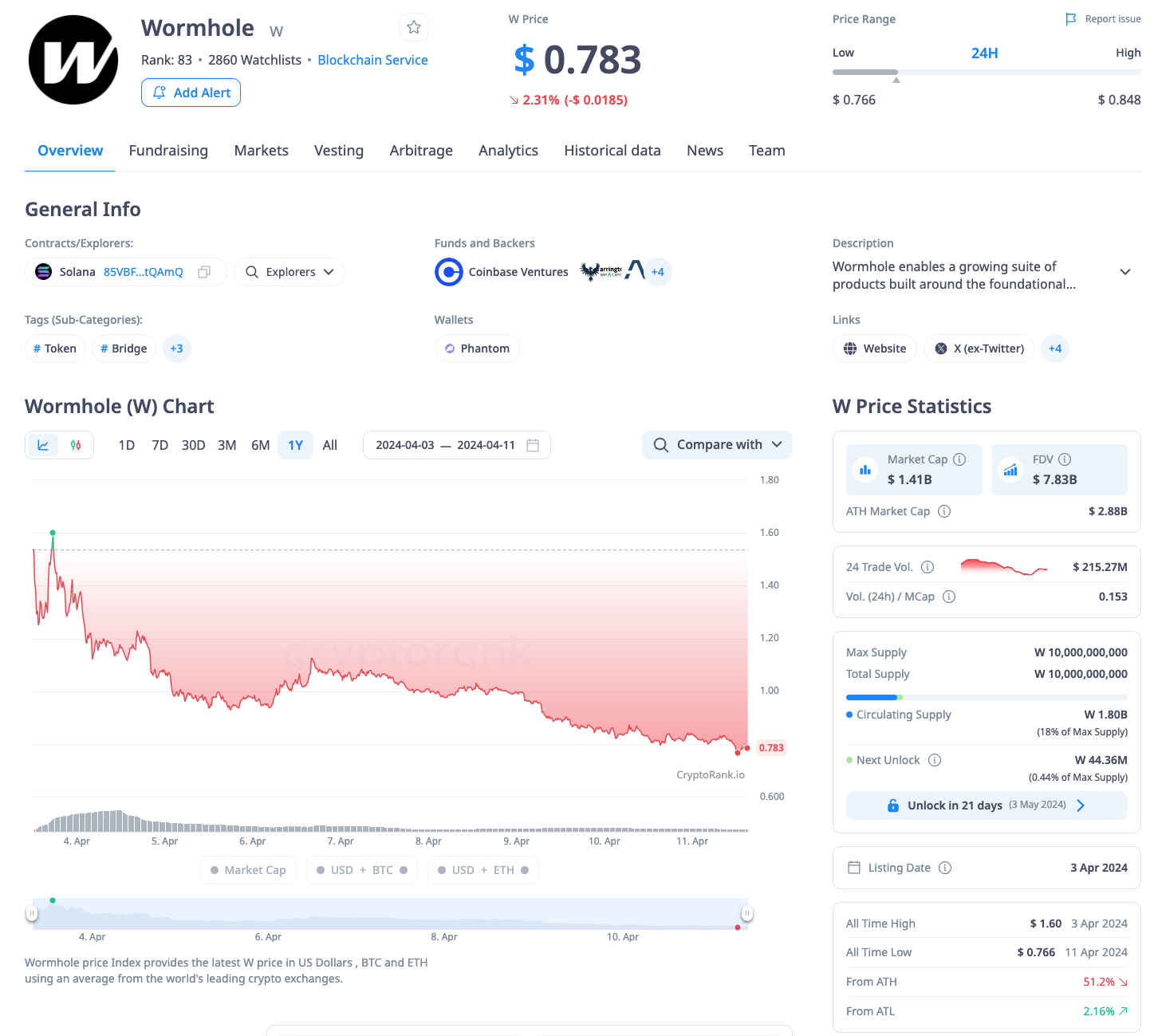

Wormhole

Wormhole is a cross-chain messaging protocol for moving funds between EVM and non-EVM blockchains.

The project is a direct competitor to LayerZero, and while everyone was waiting for the airdrop from the latter, Wormhole just went ahead and started one. The listing took place on April 3, when $W tokens could be sold for ~$1.6. That’s the ATH now. Whether it was worth selling or better to wait is an open question.

Conclusion

Seven out of the nine projects showed the peak asset price not on the listing day, but some time later. Namely:

-

Two projects (AltLayer and Jupiter) needed more than a month;

-

Two projects (Pixels and Starknet) needed just over three weeks;

-

AEVO reached the ATH in two weeks;

-

Two projects (Dymension and EtherFi) took just over a week.

It’s hard to objectively analyze the remaining two projects (Ethena and Wormhole), but there’s a high probability that their ATH prices are still ahead.

Based on all of the aforementioned information and considering the upcoming Bitcoin halving, it can be argued that the axiom of selling an airdrop on the first day of trading in a bullish market is simply not relevant.

However, it’s important not to perceive this article as financial advice. Each individual case is unique and requires individual analysis. The price of an asset can be influenced by many factors, including overall market sentiment, the project’s product and marketing strategy, actions of market makers, etc. In these conditions, it’s likely that the best solution would be to develop your own strategy and strictly adhere to it.

Read More