Inside Successful TGEs: 2024–2025 launch research by FORMULA

Key insights

-

Web3 startups raised $41B since early 2024, yet only a narrow slice of tokens sustained price and liquidity after listing.

-

From 200+ launches, just eight projects — including Mind Network, WalletConnect, Cookie DAO, Ethena, StakeStone, Giza, Initia, and Fartcoin — stood out for both ROI and real market depth, with ATH returns from 114% to over 18,000%.

-

5 out of 8 “successful” TGEs had at least two years of brand and community groundwork; without that, only very strong narratives (synthetic dollars, AI, or pure memes) compensated.

-

Capital raised showed no direct correlation with either community size or ROI — money helped projects extend their reach, while loyalty depended on product-market fit and long-term engagement.

-

Top performers converged on similar execution patterns: diversified media strategies, analytics-driven unlocks (≤25% at TGE, monthly tranches ≤4%), and early use of three levers against sell pressure — liquidity depth, holding incentives, and active communities.

FORMULA by Cointelegraph has released a new data-driven report on what separates resilient token launches from the crowd — using 200+ TGEs from 2024–2025 and a deep dive into eight of the best-performing cases.

From 200+ TGEs to a benchmark set

The research focuses on launches between January 2024 and January 2025 — the period when record fundraising met a much more selective secondary market.

To qualify as “successful” in this study, a TGE had to meet three benchmarks at launch:

- price resilience (launch price matching the all-time low),

- daily trading volume of at least $5M, and

- verified on-chain liquidity of $1M+ across DEXs.

FORMULA explicitly notes that this “price resilience” is an aspirational benchmark — by the time the study was completed, several tokens in the sample had already traded below their initial price. The point is to outline how “good” performance appeared at launch under current market conditions.

From this broader universe, eight projects were selected for closer analysis based on scale, visibility, and measurable outcomes. Their ATH performance from initial price ranged from triple-digit gains to an outlier above 18,000%:

- Mind Network (359%)

- WalletConnect (322%)

- Ethena (114%)

- Giza (603%)

- Fartcoin (18,564%)

- Cookie DAO (3,265)

- StakeStone (1,245%)

- Initia (114%)

Brand groundwork vs. narrative shortcuts

One of the clearest patterns: most resilient TGEs were not “cold starts.”

5 out of 8 cases with strong launch metrics had at least two years of visible brand and community groundwork behind them — live products since 2018 in WalletConnect’s case, long-running ecosystems and partnerships for Mind Network and StakeStone, and structured pre-TGE education and AMAs for Cookie DAO.

Founders repeatedly emphasized that credibility grew from shipped products and existing user bases, that partnership networks needed to be established before the TGE, and that pre-TGE education helped filter out pure airdrop hunters while strengthening long-term holder retention.

At the same time, the data shows that a strong community is not an absolute requirement for a successful TGE. Several projects demonstrated that sharp positioning, clear messaging, and well-timed execution can still generate meaningful traction at launch.

The report highlights three examples:

- Ethena’s “synthetic dollar with instant yield” positioning,

- StakeStone’s framing as a universal standard for cross-chain yield, and

- Fartcoin’s memetic + AI narrative stack.

In all three cases, the narrative did two things at once: explained the product in one line and created enough temporary trust for users and market makers to engage at scale.

Capital drives visibility, conviction emerges from user engagement

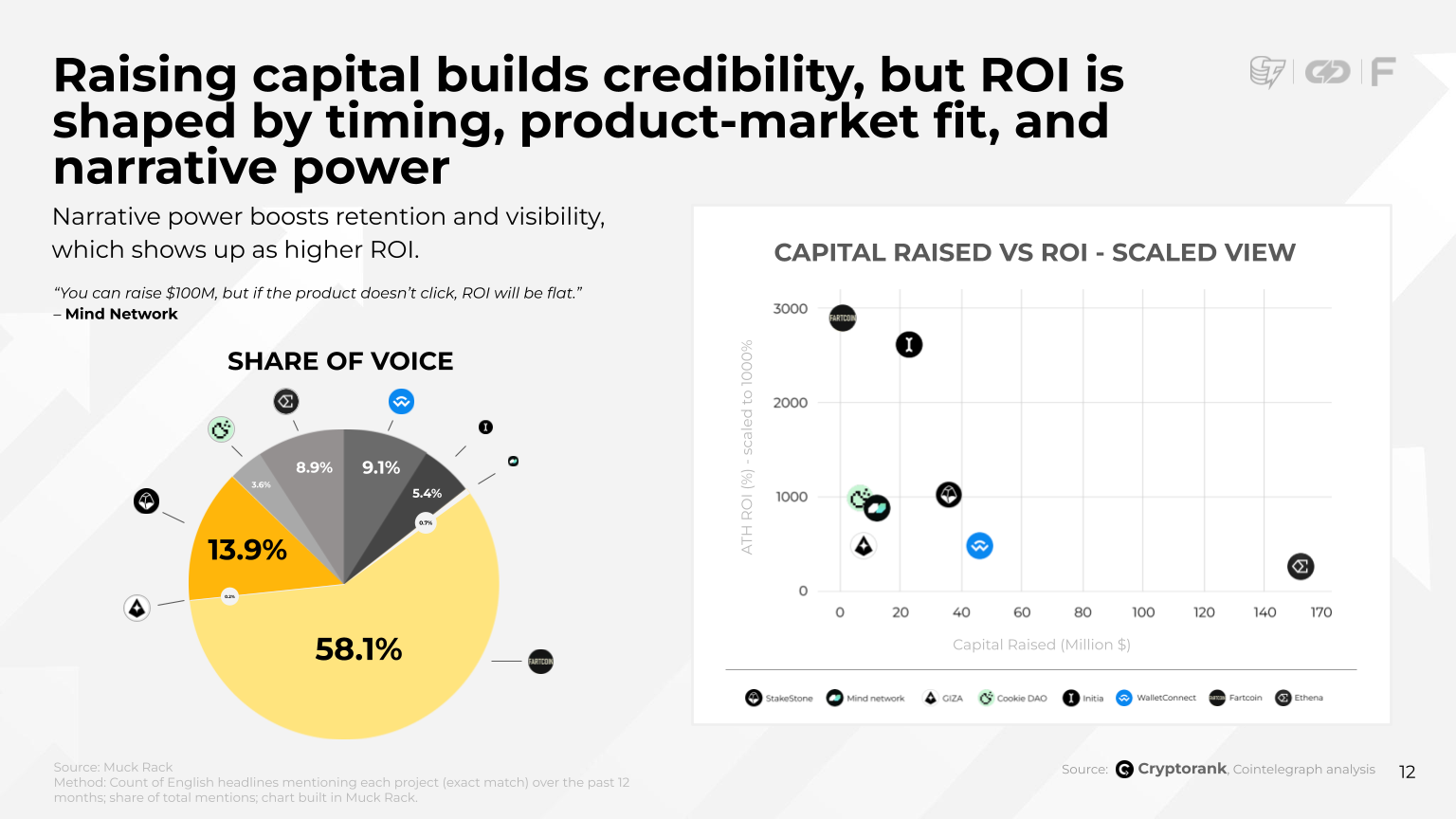

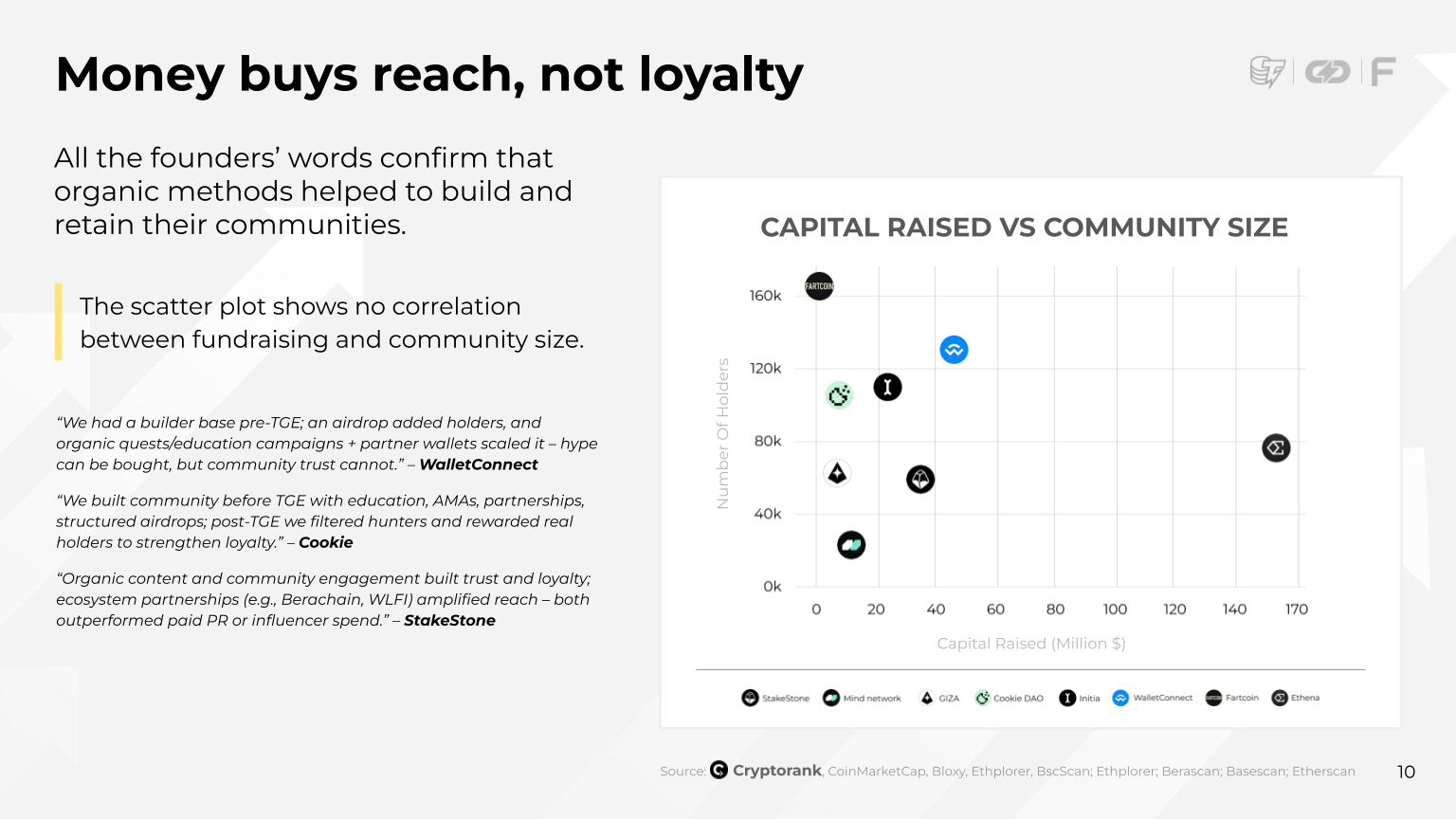

The study overlays fundraising data with on-chain holder stats and ROI — and the scatter plots are blunt. There is no clear correlation between capital raised and the number of token holders, and no clean linear relationship between the size of the round and ATH ROI.

High fundraising rounds helped with credibility and listings, and founders interviewed by FORMULA described them as “amplifiers” that strengthened visibility without determining the final outcomes. Product–market fit, time-to-market, and the narrative around the token had a more visible impact on post-TGE performance.

As the Founder and CEO of Mind Network put it in the report, “You can raise $100M, but if the product doesn’t click, ROI will be flat.”

Media plays a central role in shaping market reaction

Across the sample, the research team mapped price action against media coverage. Result: the largest price spikes were consistently preceded by waves of PR announcements and feature coverage.

The content mix also mattered. Projects that maintained visibility after TGE did so by expanding beyond launch news and adding analytical breakdowns and explainers, ecosystem updates and integrations, and, in some cases, thought-leadership content and listicles.

The data shows that projects using 4–6 distinct content formats over time sustained mentions and interest longer than those relying purely on press releases. Volume of coverage mattered less than diversity and depth.

Traffic data backs this up: 63% of growth in the analyzed TGEs came from direct channels — primarily crypto analytics platforms and social networks, amplified by founder-led accounts and dashboards on analytical tools like CryptoRank and CoinGecko.

Tier-1 listings: an indicator of scaled interest

All eight benchmark projects are listed on Tier-1 exchanges today — but several reached that point only after launching on Tier-2/Tier-3 platforms and proving traction.

Based on cross-project comparisons, the report identifies three rough KPI ranges that tended to precede Tier-1 listings:

- market cap above $500M,

- daily trading volume above $50M, and

- more than 100,000 token holders — maintained for at least two weeks.

These are not official requirements, and each exchange applies its own criteria. The pattern simply suggests that Tier-1 access acts as a validation layer for existing demand and liquidity, serving as confirmation of traction instead of functioning as a magic unlock for weak projects.

Several founders also highlight the role of launchpads and ecosystem programs as effective substitutes for Tier-1 exposure in the earliest phases.

Unlock design: where tokenomics meets user behavior

FORMULA uses CryptoRank data to examine initial unlocks, vesting frequency, and post-unlock price behavior across the sample.

Two design choices showed up repeatedly in top performers. First, initial unlocks were typically limited to up to 25% of the total supply, providing sufficient liquidity for trading while keeping supply expansion controlled. Second, monthly unlocks with small tranches (≤4%) aligned with typical market liquidity and user behavior, supporting a more balanced distribution over time.

Daily or very frequent unlocks worked only where demand was exceptionally deep. Full unlocks at TGE created predictable selling pressure unless paired with extremely strong staking or lock mechanisms.

To reduce post-unlock selling, all projects in the benchmark set combined three levers from day one:

- Depth levers — expanding liquidity via listings, trading fee programs, airdrops, and partner campaigns.

- Holding levers — staking, LP incentives, lockdrops, and transparent tokenomics.

- Community levers — quests, research participation, KOL-driven education, and consistent founder visibility.

The outcome was a clear shift: unlock events increasingly functioned as growth milestones, with market behavior reflecting development stages.

How the research was built

“Inside Successful TGEs: Data-driven lessons from 2024’s top token launches” combines three layers of evidence:

-

Market data: price, volume, unlocks, liquidity, and holder concentration from platforms including CryptoRank, CoinGecko, CoinMarketCap, and major block explorers.

-

Attention data: media coverage timelines, content formats, and share-of-voice analysis using tools such as Muck Rack and Similarweb.

-

Founder and CMO interviews: qualitative insights from teams behind Mind Network, WalletConnect, Cookie DAO, StakeStone, and others, used to test whether the “official story” matched on-chain behavior.

Throughout the report, FORMULA treats these findings as benchmarks and patterns. The goal is to give teams concrete starting points for their own launch design, from narrative and content planning to unlock structure and exchange strategy.

Who the insights are for

The report is designed for founders and CMOs planning a TGE in the next 12–18 months, as well as for funds and analysts building internal playbooks for evaluating new launches.

Alongside insights, it includes checklists for TGE readiness, examples of media and traffic patterns that preceded strong performance, and practical benchmarks for unlocks and community growth.

Access the full report

“Inside Successful TGEs: Data-driven lessons from 2024’s top token launches” is available now, with extended charts, case studies, and methodology notes.

For teams who want to turn the findings into an execution plan, FORMULA by Cointelegraph offers workshops, narrative design, PR strategy, and go-to-market support around TGEs and token liquidity alongside the full package of TGE products.