Ethereum Surpasses Bitcoin in Spot ETF Inflows. Where Is the Market Headed?

The balance of power in crypto markets seems to be shifting, at least in the short term. While Bitcoin (BTC) has been the main driver of this year’s rally, Ethereum (ETH) is now stealing the spotlight, driven by strong institutional inflows into spot ETFs and signs of a brewing altseason.

Bitcoin Records First Spot ETF Outflow Since Early July

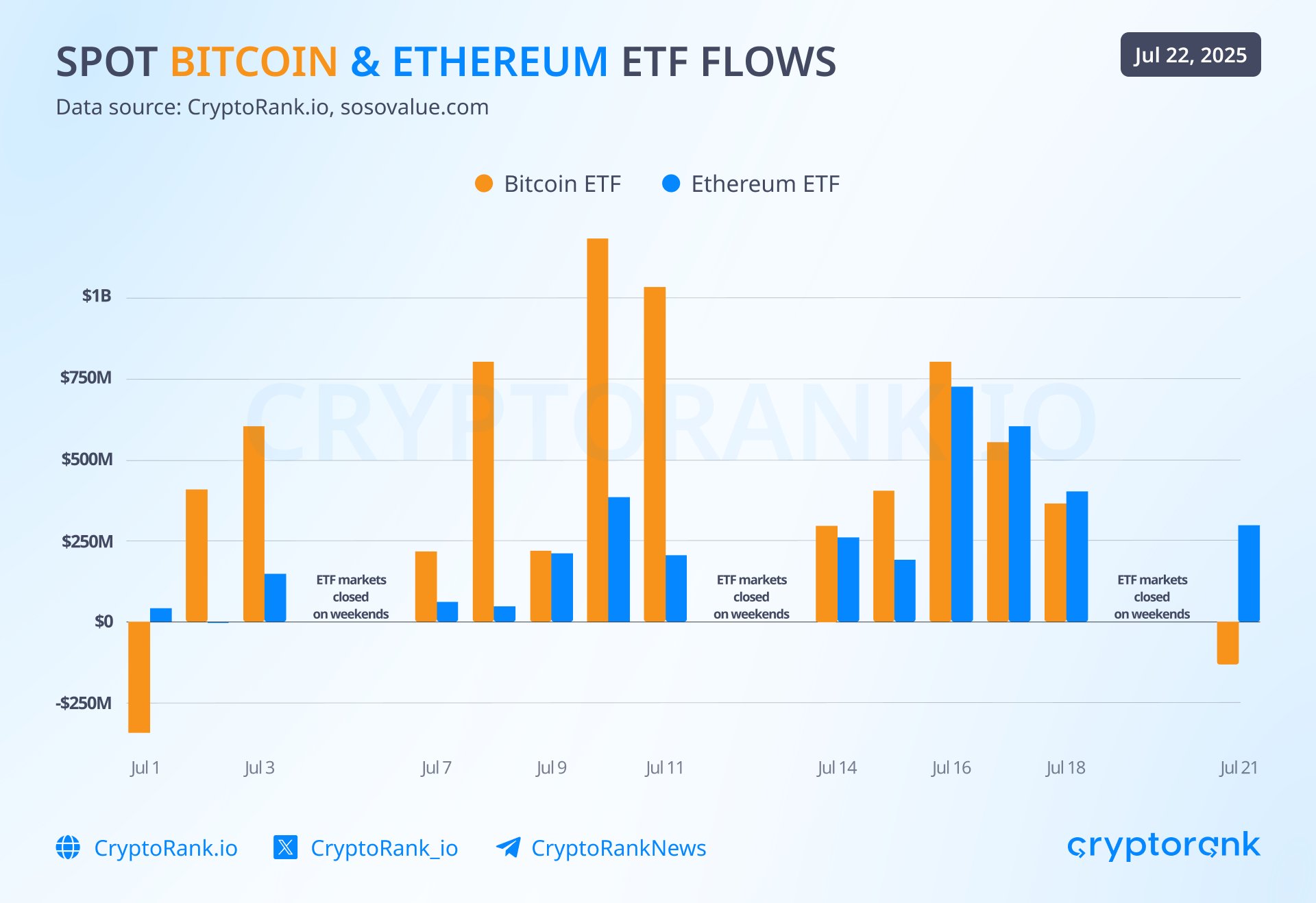

July 21 marked the first day of net outflows for Bitcoin spot ETFs since the start of its latest rally. A total of $131 million exited BTC ETFs, breaking a nearly three-week streak of positive inflows.

This move doesn’t necessarily signal weakening confidence in Bitcoin. Instead, analysts see two primary explanations:

-

Profit-Taking by Institutions: Bitcoin has gained over 10% this month and more than 25% since the start of the year. For institutional investors, taking some profits after such a move is standard risk management.

- Capital Rotation: After hitting a new all-time high earlier this month, Bitcoin’s upward momentum has cooled. With prices consolidating, investors may be reallocating funds into other high-potential assets, particularly large-cap altcoins.

Ethereum ETFs Continue to See Strong Demand

Ethereum is currently the main beneficiary of this rotation. Spot Ethereum ETFs have now posted 12 consecutive days of net inflows, with no signs of slowing down.

-

July 16 set a new record: $726 million flowed into Ethereum ETFs in a single day, and nearly $500 million of that came from BlackRock’s ETHA ETF.

-

Yesterday added another $297 million, extending the streak and pushing cumulative net inflows to $7.78 billion.

This institutional demand is also mirrored in the derivatives market. Over the past week, Ethereum has consistently outperformed Bitcoin in daily derivatives trading volumes as a sign of growing speculative and hedging activity around ETH.

What Does This Mean for the Market?

The factors behind ETH’s momentum appear clear:

-

Capital Rotation: Investors are moving funds from BTC into ETH after Bitcoin’s strong run.

-

ETF FOMO: Persistent inflows are creating a self-reinforcing narrative of institutional demand for Ethereum.

-

Altseason Signals: The Altseason Index (ASI) has been hovering around 60, its highest level in months, indicating that traders are increasingly willing to take on risk outside of Bitcoin.

Meanwhile, Bitcoin’s outflows don’t look bearish. A single day of net withdrawals after weeks of strong inflows is typical in a market where institutions periodically rebalance their portfolios.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.