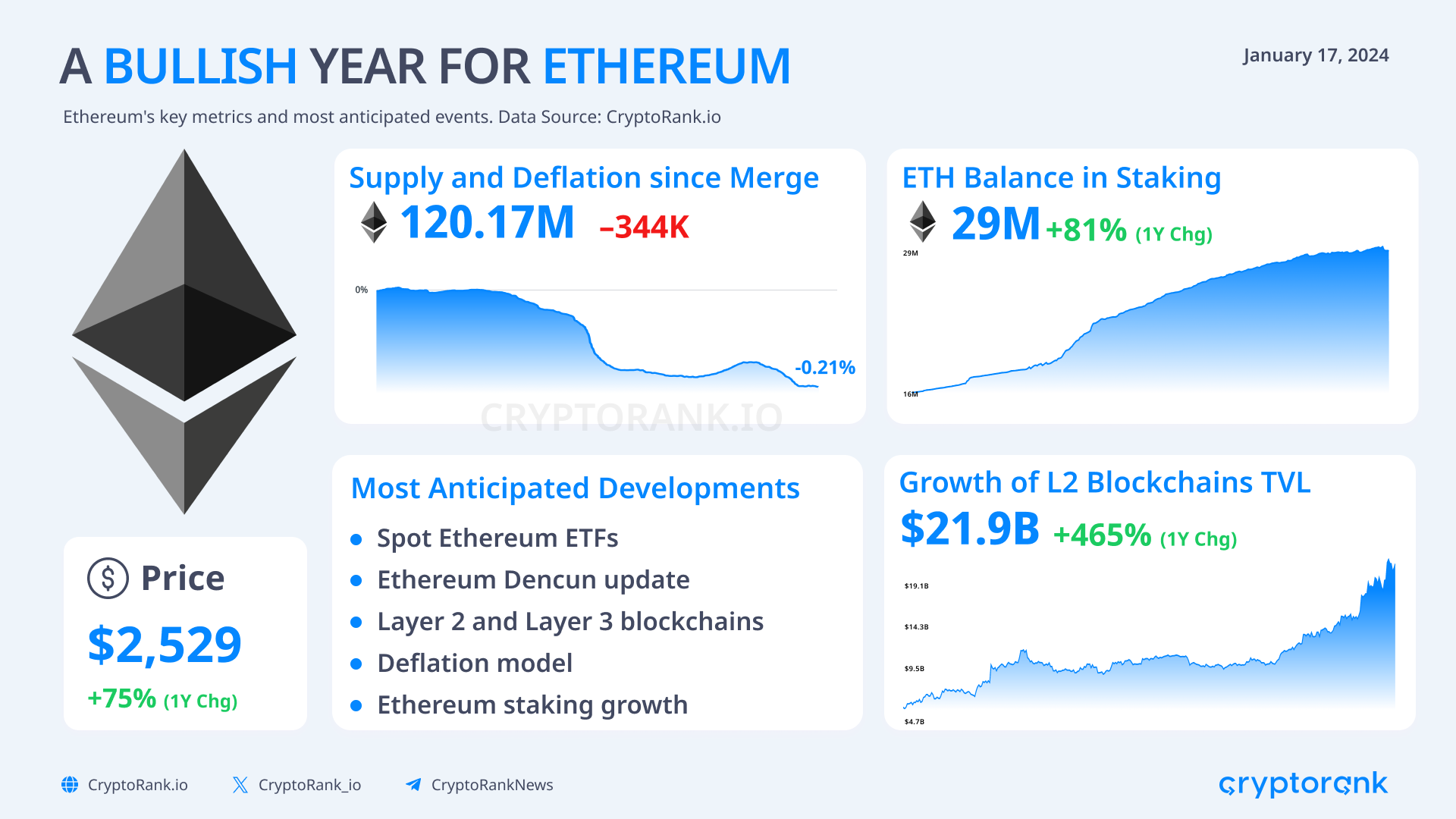

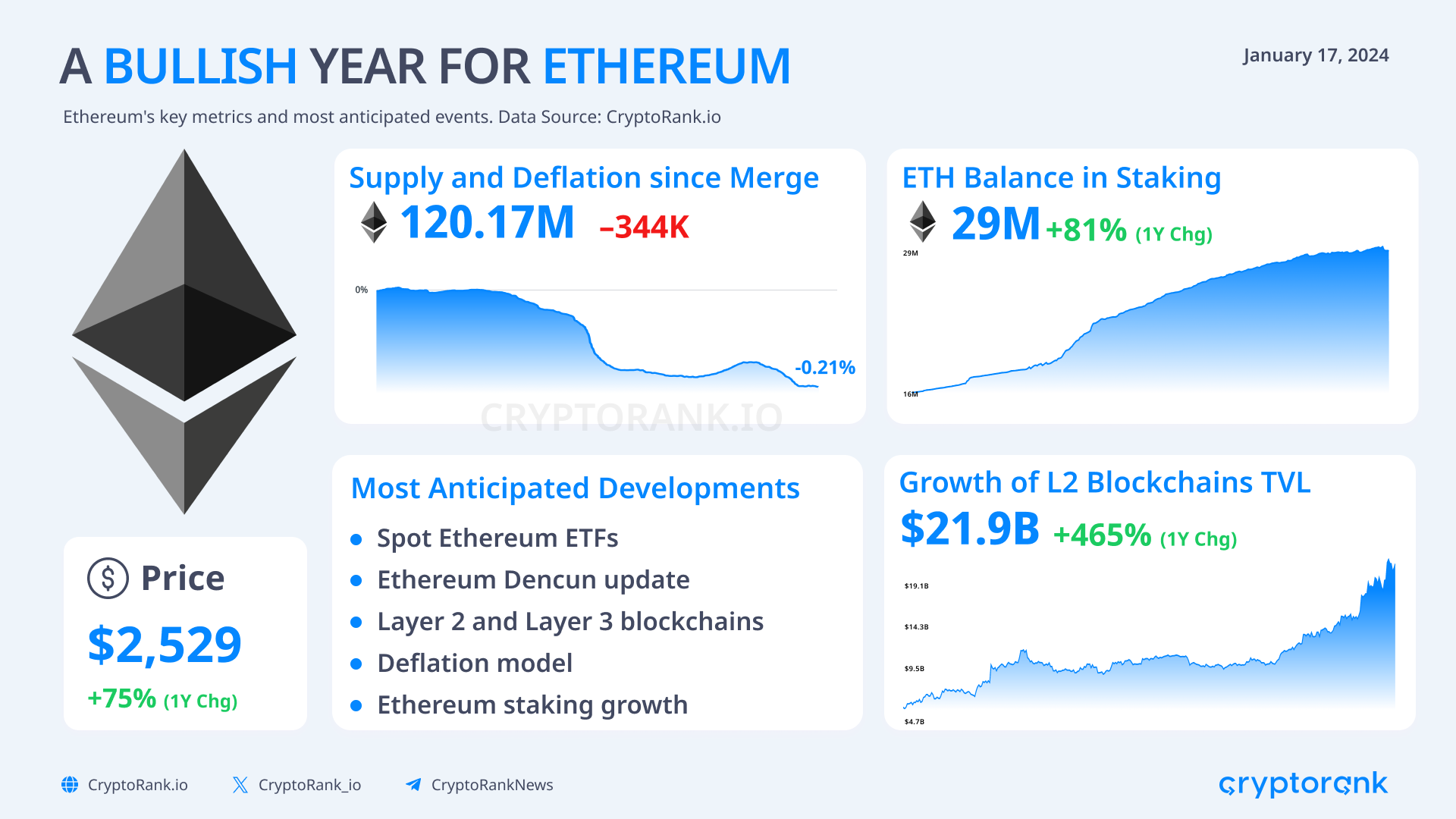

A Bullish Year for Ethereum?

Ethereum has come a long way: ICO, hardforks, hacker attacks, transition from the Proof-of-Work consensus algorithm to Proof-of-Stake. In its 10th anniversary year, Ethereum is ready to conquer new heights.

Spot Ethereum ETFs / Institutional Adoption

The adoption of the Spot Bitcoin ETF was a historic event for the cryptocurrency world, with the market reacting by pouring liquidity into Ethereum. After all, it is Spot Ethereum ETFs that could be next in line.

Grayscale, ARK Invest, Hashdex, VanEck, BlackRock, and Fidelity have already submitted their applications. BlackRock CEO Larry Fink is fueling the interest as well. Importantly, the SEC considers ETH a commodity, not a security.

Ethereum Dencun and Danksharding

On January 17, the long-awaited Dencun update was launched on the Ethereum test network. It will include the following important upgrades:

-

EIP-484 — the most important update. It includes the long-awaited Proto-Danksharding, which will reduce the size of commissions for rollups;

-

EIP-4788 — aims to improve the efficiency of cross-chain bridges and staking pools;

-

EIP-1153 — aims to optimize on-chain data storage;

-

EIP-5656 — improves EVM performance;

-

EIP-6780 — needed to remove some of the old code that can interfere with smart contracts.

The update is highly anticipated by Uniswap to run v4 of their protocol, and many Layer 2 blockchainss, such as Starknet, Optimism, Aribtrum, and zkSync Era. According to the roadmap, the update will hit mainnet as early as spring 2024.

Layer 2 and Layer 3 Blockchains

Many new blockchains built on top of Ethereum will be launched in 2024, and existing blockchains will continue to grow.

The total TVL of Layer 2 blockchains has doubled in the last 3 months alone and is already at $22B.

Anticipated L2 token releases this year are zkSync, StarkNet, Manta Network, Taiko, and many others. The release of tokens will certainly catalyze the development of ecosystems around these blockchains, and accordingly, the Ethereum ecosystem will grow as well.

It's also important to note the scaling of Layer 2 itself. Solutions such as OP Stack, Arbitrum Orbit, Polygon CDK, and ZK Stack allow you to run your own rollups in just a few clicks. Celestia, Espresso, Caldera, and others also come in handy for this.

The major growth of ecosystems around Layer 2 is inevitable, and so is the demand for native tokens of these blockchains and ETH itself.

Deflationary Model

The transition to Proof-of-Stake was a historically important event not only for Ethereum but for the entire cryptocurrency market.

After the Ethereum update, it has became a deflationary asset. During this time, 1.3M ETH was burned and the net change in coin supply decreased by 342 thousand coins. It's an appealing model, especially considering the perpetual inflation seen in other assets and sectors.

Ethereum Staking

After Ethereum switched to Proof-of-Stake, the number of staked coins has been steadily increasing. As of today, it already amounts to 30M. What’s important here is the emergence of more LSDFi projects that offer liquid tokens in exchange for your staked Ethereum. Read more about it in our previous articles:

-

Liquid Staking Derivatives — The Undercovered Narrative

-

Liquid Restaked Tokens — The Future of DeFi?

Conclusion

2024 will be a great year for Ethereum: the ecosystem continues to grow, and technical innovations and updates will only catalyze this growth. The interest of major financial market players will also be an important catalyst for Ethereum this year. On top of that, the circulating supply of the coin will continue to decrease.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

In This Insight

Coins

Read More