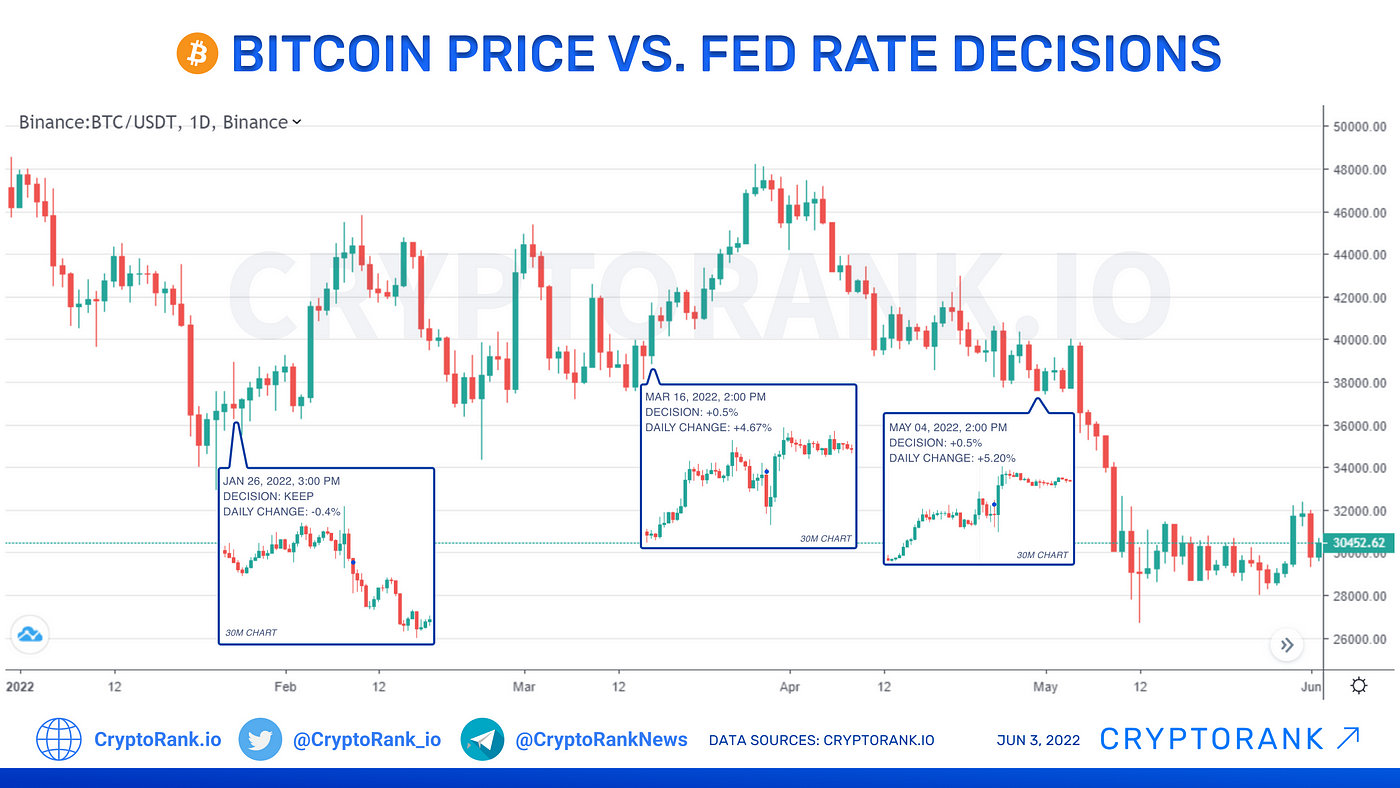

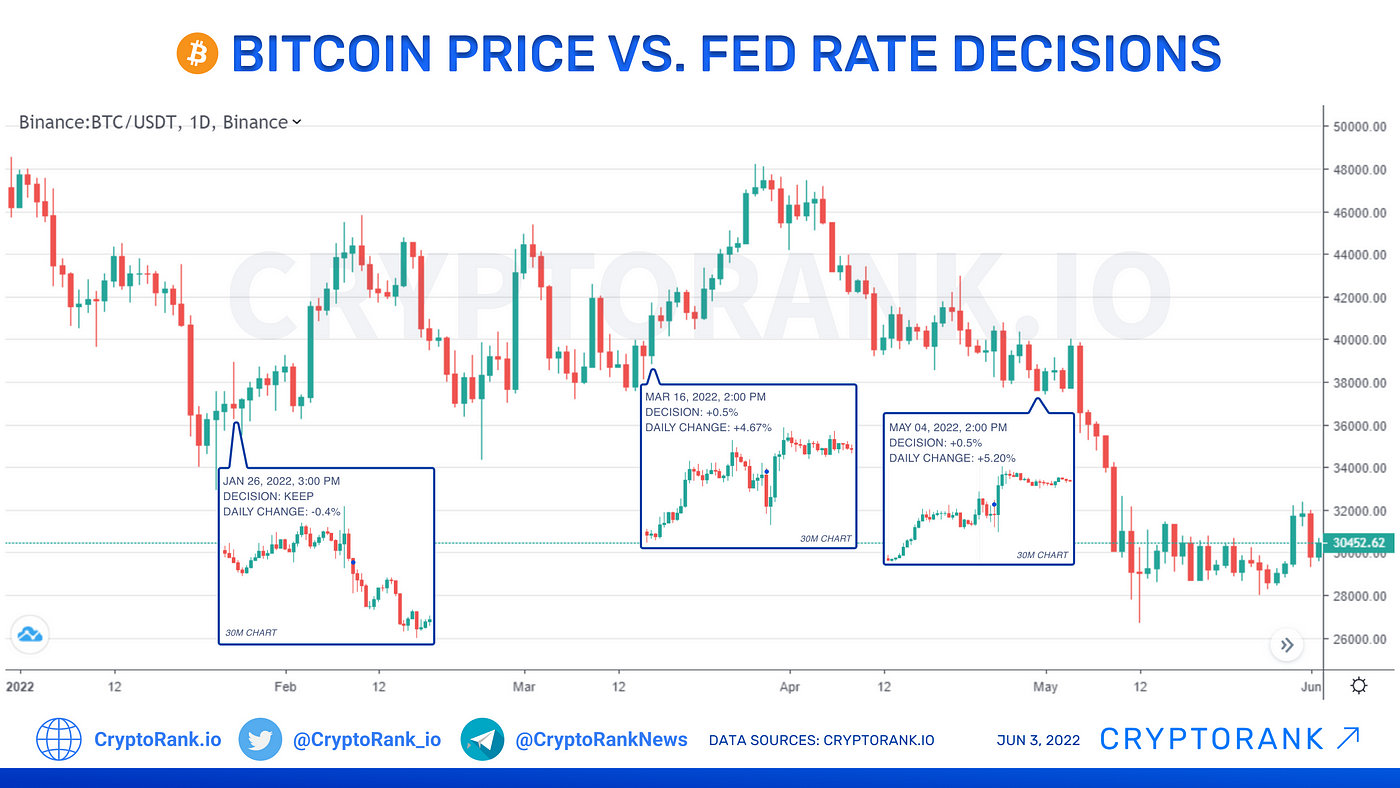

Bitcoin Price vs. Fed Rate Decisions

The Fed rate has a great impact on global financial markets. Indeed, it affects crypto as Bitcoin’s correlation with Nasdaq 100 has recently been increasing.

The Fed rate has a great impact on global financial markets. Indeed, it affects crypto as Bitcoin’s correlation with Nasdaq 100 has recently been increasing. But what is the result of a rate increase?

The spike of the Fed rate should lead to a decrease in financial asset prices. Yet, in practice it might be quite the opposite. However, there is one exception: financial markets may experience increased volatility leading up to decision day, as fears and expectations decide prices.

This also includes Bitcoin. Before the Fed rate announcement, prices were steadily decreasing due to various factors, including the one mentioned above. On days when the rate was increased, prices went up right after the announcement, closing the day in green zone. But in January, when the Fed decided to keep the rate at 0.25%, there were no significant movements as the market expected more decisive action.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of Algona Business Ltd. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results.

Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.