Chinese Digital Yuan vs SWIFT: China’s 7-Second Payments Shake Up Global Finance

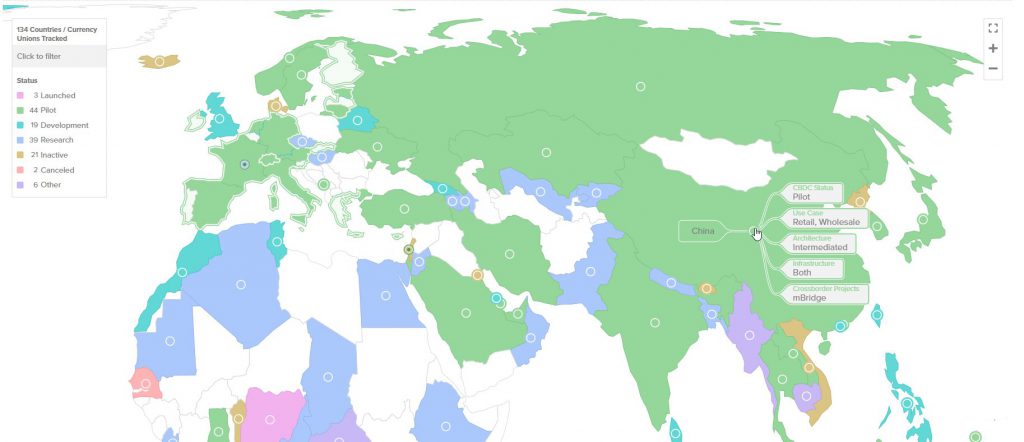

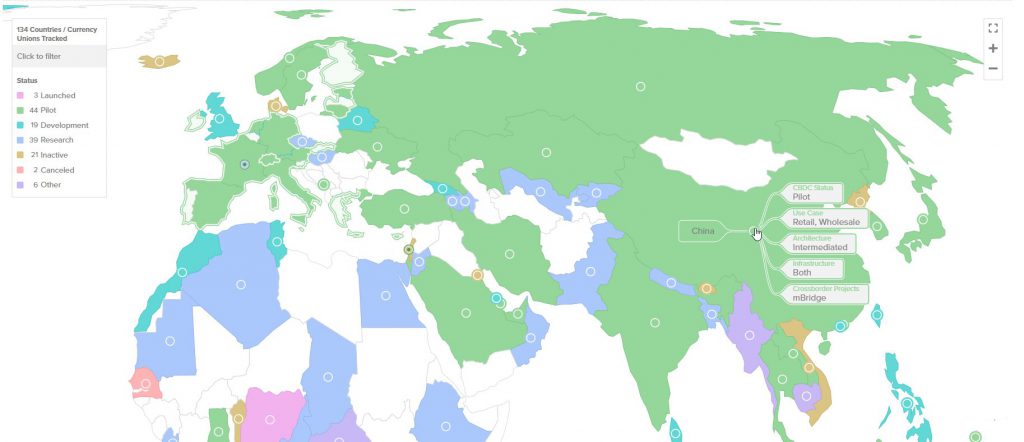

The Chinese digital yuan is, at the time of writing, actually revolutionizing cross-border payments with remarkably fast transaction speeds of just about 7 seconds or so, which is directly challenging the traditional SWIFT system’s long-standing dominance in global finance. This central bank digital currency (CBDC) has now, as of recently, connected China to around 16 countries across Southeast Asia and also the Middle East, potentially allowing approximately 38% of global trade to bypass the old and established SWIFT networks and, of course, US dollar settlements.

Also Read: Morgan Stanley and Charles Schwab Dive Into Crypto While Bitcoin Hits 97K

How China’s CBDC, Blockchain, And SWIFT Race Reshape Finance

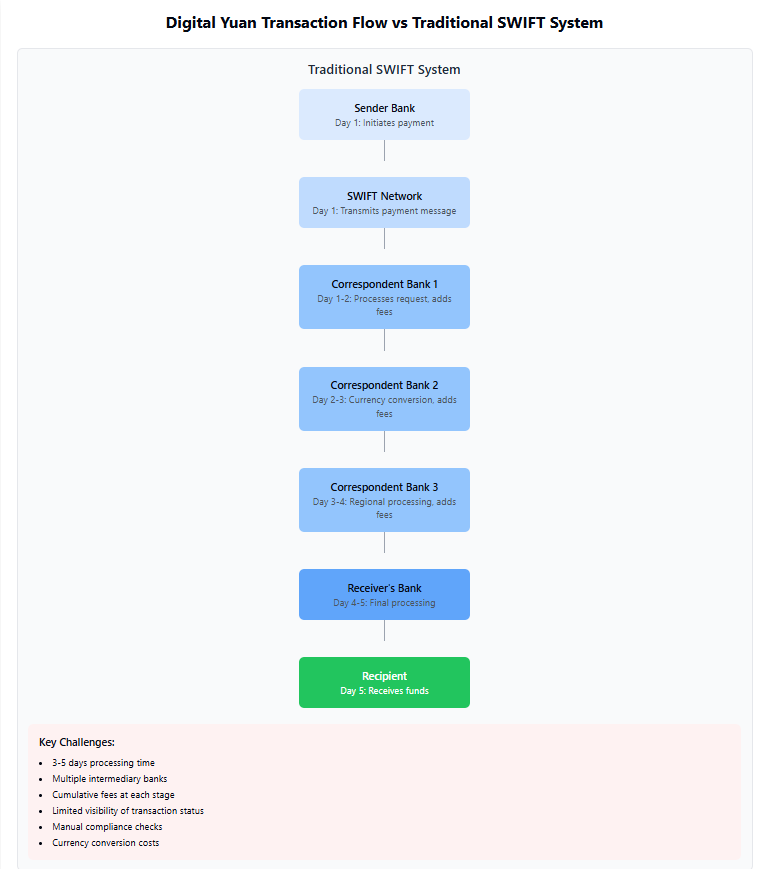

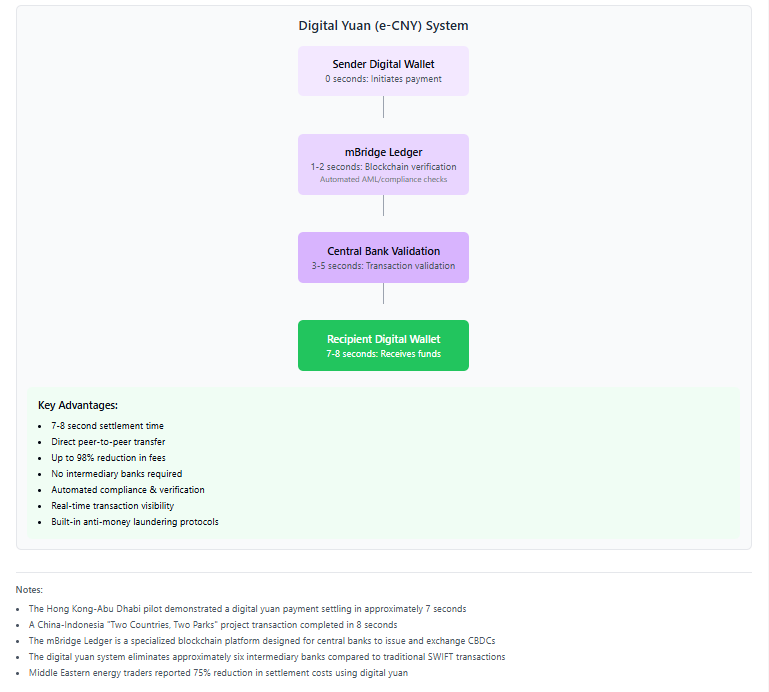

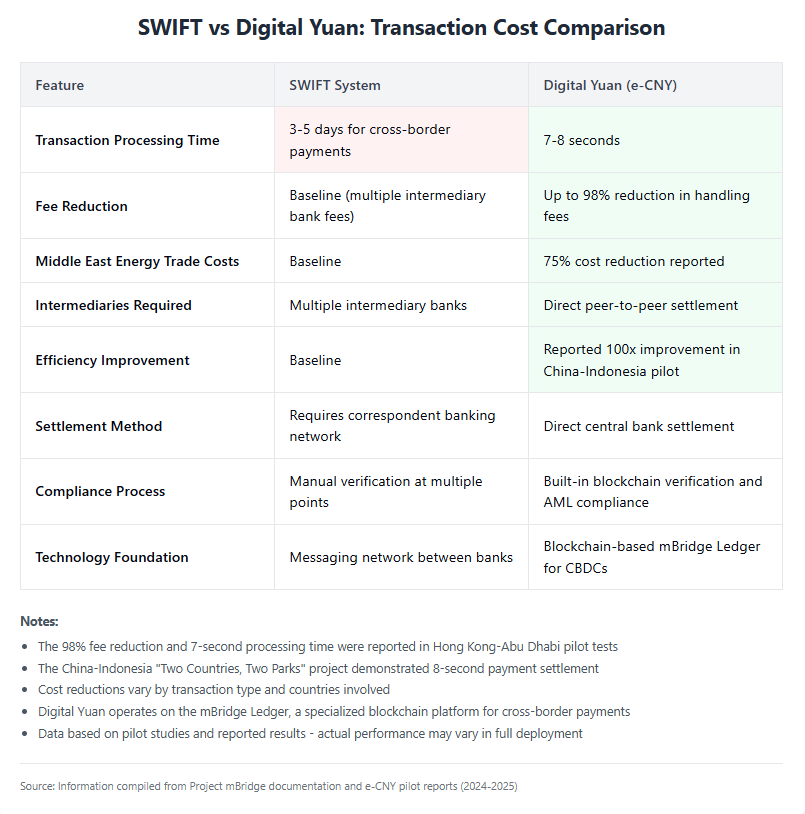

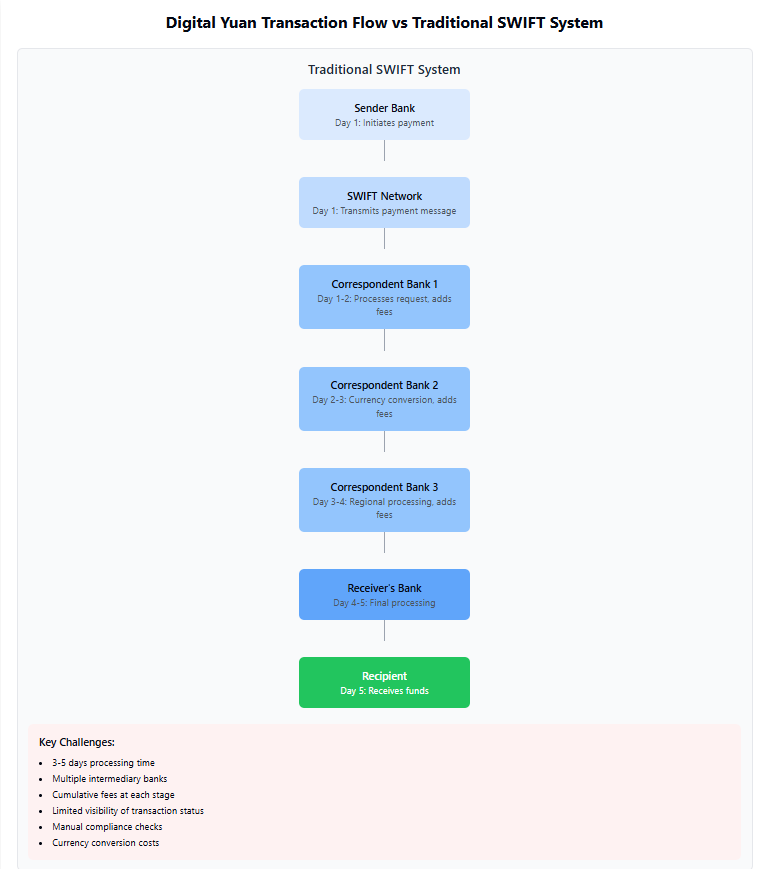

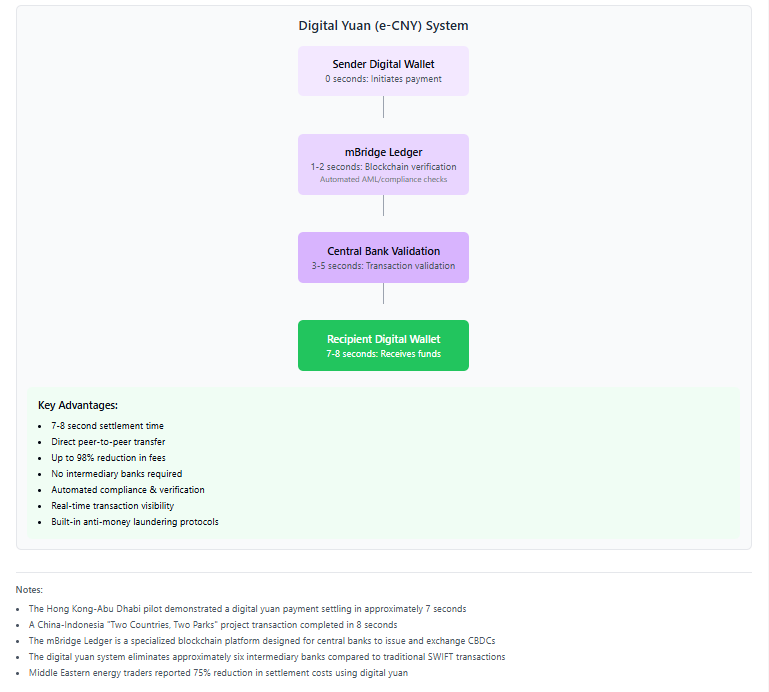

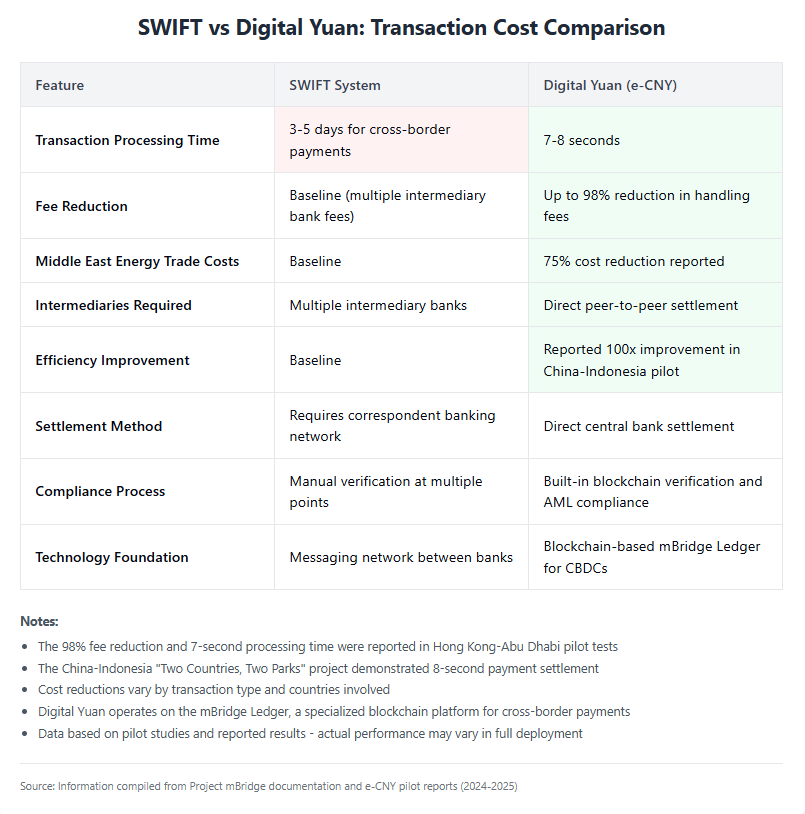

The digital Chinese digital yuan, which is also sometimes referred to as e-CNY, currently offers significantly faster and, frankly, much cheaper cross-border transactions than the traditional methods we’ve been using for decades. While SWIFT transfers typically take several days and also involve somewhat unpredictable fees, the Chinese digital yuan can actually complete transactions in just seconds at a fraction of the cost, which is pretty impressive.

Proshare, an African research firm, stated:

“The People’s Bank of China (PboC) has announced that its digital RMB cross-border settlement system will be fully connected to the ten ASEAN nations and six Middle Eastern countries, implying that about 38% of global trade could bypass the US dollar dominated SWIFT network.”

SWIFT’s Growing Challenges

The SWIFT network, while trusted by over 10,000 financial institutions globally for many years now, faces some significant limitations that are becoming more apparent. Transactions generally require several days to process and, in addition, involve multiple intermediary banks that each charge their own fees, making final costs somewhat unpredictable and often higher than expected. The Chinese digital yuan addresses these pain points directly with its innovative blockchain-based approach.

Also Read: Top 3 Cryptocurrencies That May Rally This Weekend

Digital RMB’s Expanding Influence

The Chinese digital yuan is, right now, gaining quite a bit of traction internationally through various initiatives such as Project mBridge and other similar programs. This collaborative effort aims to solve fundamental problems in cross-border payments using CBDC technology and also blockchain finance innovations that have been developing over recent years.

Michele Marius from ICT/Tech noted:

“Blockchain technology, the internet, and digital currency rails, among other digital systems and technologies, are turning existing power dynamics on their heads and forcing us to question the continued utility and viability of long-entrenched systems.”

With compatibility reportedly found in approximately 87% of countries worldwide, the Chinese digital yuan represents a significant and growing shift in CBDC adoption and cross-border payment capabilities that many analysts are watching closely.

Also Read: Ripple Prediction: XRP Price For May 5, 2025 After 1000% Liquidation

This technological revolution seems to validate regional efforts like Caribbean’s CaribCoin and also Africa’s PAPSS to establish independent payment rails. As blockchain finance continues to develop and CBDC adoption increases across various markets, the Chinese digital yuan stands, at this moment, at the forefront of a fundamental transformation in how money moves across borders.

Chinese Digital Yuan vs SWIFT: China’s 7-Second Payments Shake Up Global Finance

The Chinese digital yuan is, at the time of writing, actually revolutionizing cross-border payments with remarkably fast transaction speeds of just about 7 seconds or so, which is directly challenging the traditional SWIFT system’s long-standing dominance in global finance. This central bank digital currency (CBDC) has now, as of recently, connected China to around 16 countries across Southeast Asia and also the Middle East, potentially allowing approximately 38% of global trade to bypass the old and established SWIFT networks and, of course, US dollar settlements.

Also Read: Morgan Stanley and Charles Schwab Dive Into Crypto While Bitcoin Hits 97K

How China’s CBDC, Blockchain, And SWIFT Race Reshape Finance

The digital Chinese digital yuan, which is also sometimes referred to as e-CNY, currently offers significantly faster and, frankly, much cheaper cross-border transactions than the traditional methods we’ve been using for decades. While SWIFT transfers typically take several days and also involve somewhat unpredictable fees, the Chinese digital yuan can actually complete transactions in just seconds at a fraction of the cost, which is pretty impressive.

Proshare, an African research firm, stated:

“The People’s Bank of China (PboC) has announced that its digital RMB cross-border settlement system will be fully connected to the ten ASEAN nations and six Middle Eastern countries, implying that about 38% of global trade could bypass the US dollar dominated SWIFT network.”

SWIFT’s Growing Challenges

The SWIFT network, while trusted by over 10,000 financial institutions globally for many years now, faces some significant limitations that are becoming more apparent. Transactions generally require several days to process and, in addition, involve multiple intermediary banks that each charge their own fees, making final costs somewhat unpredictable and often higher than expected. The Chinese digital yuan addresses these pain points directly with its innovative blockchain-based approach.

Also Read: Top 3 Cryptocurrencies That May Rally This Weekend

Digital RMB’s Expanding Influence

The Chinese digital yuan is, right now, gaining quite a bit of traction internationally through various initiatives such as Project mBridge and other similar programs. This collaborative effort aims to solve fundamental problems in cross-border payments using CBDC technology and also blockchain finance innovations that have been developing over recent years.

Michele Marius from ICT/Tech noted:

“Blockchain technology, the internet, and digital currency rails, among other digital systems and technologies, are turning existing power dynamics on their heads and forcing us to question the continued utility and viability of long-entrenched systems.”

With compatibility reportedly found in approximately 87% of countries worldwide, the Chinese digital yuan represents a significant and growing shift in CBDC adoption and cross-border payment capabilities that many analysts are watching closely.

Also Read: Ripple Prediction: XRP Price For May 5, 2025 After 1000% Liquidation

This technological revolution seems to validate regional efforts like Caribbean’s CaribCoin and also Africa’s PAPSS to establish independent payment rails. As blockchain finance continues to develop and CBDC adoption increases across various markets, the Chinese digital yuan stands, at this moment, at the forefront of a fundamental transformation in how money moves across borders.