Polkadot (DOT) and ORDI Breakout: 100%+ Price Surge Ahead?

Share:

- Polkadot’s breakout signals a potential rally, targeting $8.80–$9.00 upside.

- ORDI’s breakout suggests a strong upward trend, aiming for $100.00 target price.

- Continued momentum for DOT and ORDI relies on maintaining key support levels.

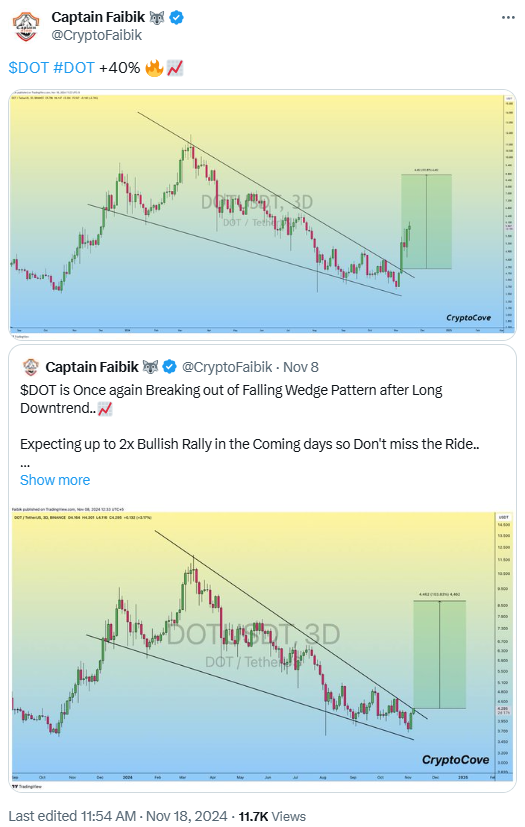

Polkadot (DOT) and ORDI show impressive bullish potential, according to technical analysis by Captain Faibik. Both assets broke out from descending channels, signaling possible trend reversals. These breakouts, confirmed by strong bullish momentum, suggest both tokens could rally significantly.

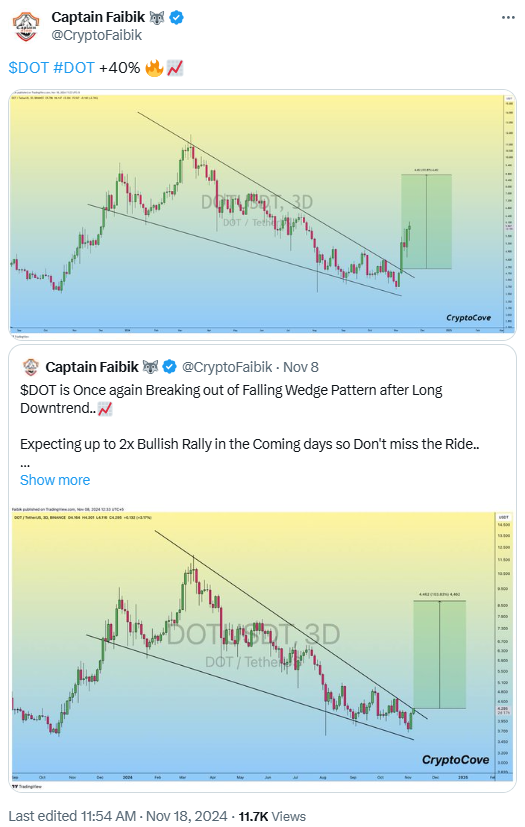

Polkadot (DOT) Breakout Analysis

Polkadot has seen a positive shift after breaking out from a descending channel on its 3-day timeframe. Previously, the price was moving within a bearish channel, characterized by two parallel downward sloping lines. The breakout occurred when the price closed above the upper boundary of the channel.

After the breakout, consecutive bullish candles confirmed the strong buying momentum. This trend pushed DOT to key support and resistance levels, with the breakout zone around $4.15 to $4.50 now acting as crucial support. This area could be a foundation for further upward movement if retes…

The post Polkadot (DOT) and ORDI Breakout: 100%+ Price Surge Ahead? appeared first on Coin Edition.

Polkadot (DOT) and ORDI Breakout: 100%+ Price Surge Ahead?

Share:

- Polkadot’s breakout signals a potential rally, targeting $8.80–$9.00 upside.

- ORDI’s breakout suggests a strong upward trend, aiming for $100.00 target price.

- Continued momentum for DOT and ORDI relies on maintaining key support levels.

Polkadot (DOT) and ORDI show impressive bullish potential, according to technical analysis by Captain Faibik. Both assets broke out from descending channels, signaling possible trend reversals. These breakouts, confirmed by strong bullish momentum, suggest both tokens could rally significantly.

Polkadot (DOT) Breakout Analysis

Polkadot has seen a positive shift after breaking out from a descending channel on its 3-day timeframe. Previously, the price was moving within a bearish channel, characterized by two parallel downward sloping lines. The breakout occurred when the price closed above the upper boundary of the channel.

After the breakout, consecutive bullish candles confirmed the strong buying momentum. This trend pushed DOT to key support and resistance levels, with the breakout zone around $4.15 to $4.50 now acting as crucial support. This area could be a foundation for further upward movement if retes…

The post Polkadot (DOT) and ORDI Breakout: 100%+ Price Surge Ahead? appeared first on Coin Edition.