Uniswap Rallies 24% in 48-Hour V-Bounce – Can Bulls Defy Looming $7.60 Test?

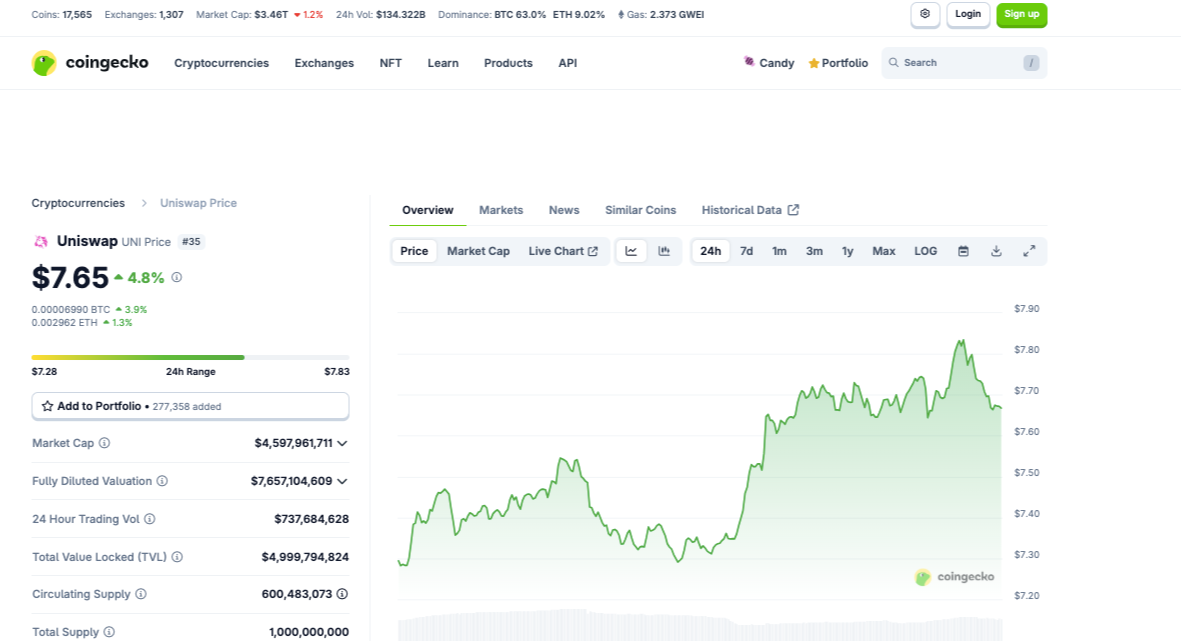

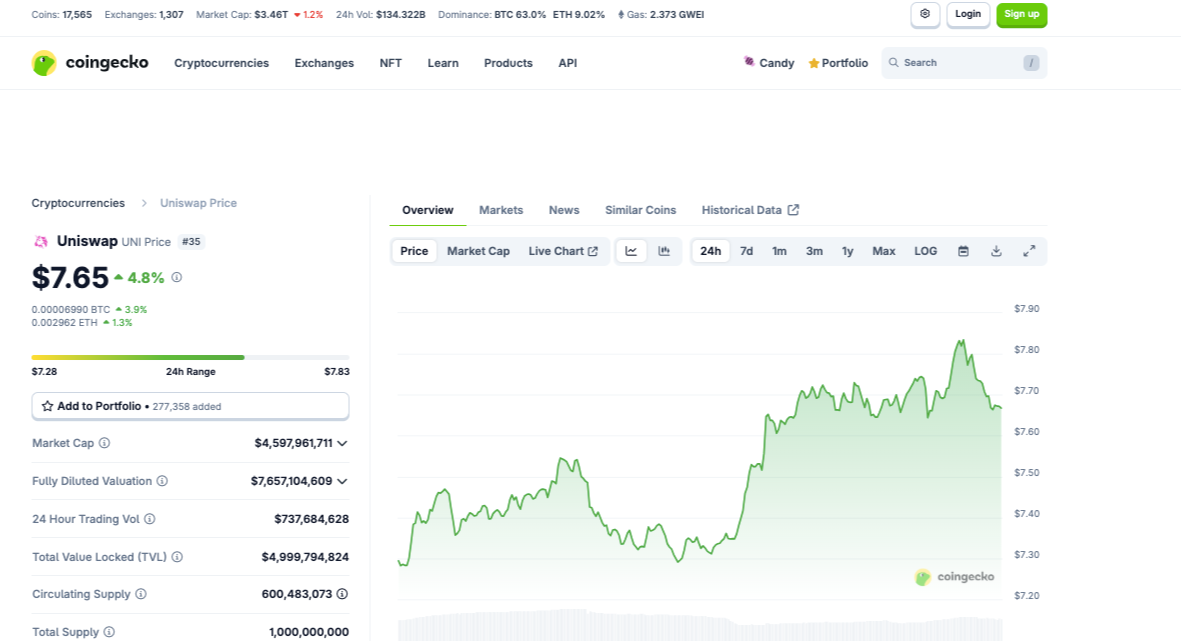

Uniswap ($UNI) climbed 15% this week, pushing past $7.73 as traders renewed their focus on the DeFi leader. The steady rise marks a clear recovery from June’s low of $6.26, supported by a consistent daily trading volume of over $350 million.

The upward move coincides with Uniswap v4’s strong adoption, handling billions in trades post-launch, while improving regulatory clarity draws more institutional attention to the protocol’s ecosystem.

From Regulatory Clarity to Record Volume: Why Uniswap Is Leading the Next DeFi Wave

Uniswap remains one of the most compelling DeFi protocols to watch and buy, thanks to its relentless pace of innovation and growing institutional interest.

Institutional investors are also flocking to the protocol. The January 2025 launch of Uniswap v4 marked a turning point. This upgrade completely redesigned the architecture by consolidating liquidity pools into a single PoolManager contract and adding ERC-6909 support.

The ERC-6909 token standard supports both fungible and non-fungible tokens, offering flexibility. Interestingly, “hooks” now allow developers to inject custom logic into pools, unlocking new layers of automation, risk management, and smart routing in DeFi.

The impact has been immediate. According to blockchain data researcher Sean Kennedy, Uniswap v4 has already crossed $1 billion in total value locked (TVL) and processed over $86 billion in trading volume within six months, indicating rapid adoption.

Beyond v4, Uniswap is also generating substantial on-chain revenue. As of mid-2025, it consistently ranks among the top fee-generating DeXs, with a 7-day average of approximately $2.3 million in daily fees, according to CryptoFees.

It remains the largest DEX by cumulative volume, surpassing $3 trillion in all-time trades across Ethereum and Layer 2 networks, including Arbitrum, Optimism, and Base.

Meanwhile, in a major policy shift, the U.S. SEC indicated in early 2025 that some decentralized protocols could be exempt from securities registration, offering regulatory breathing space for Uniswap and potentially sparking a “DeFi Summer 2.0.”

For investors, Uniswap is more than just a DEX. It’s the backbone of infrastructure for decentralized finance. Its technical superiority, expanding cross-chain reach, and favorable regulatory developments make it one of the most promising assets in the current crypto cycle.

V-Shaped Rebound or Bull Trap? $UNI’s 24% Surge Faces Key Test

The $UNI/USDT 1-hour chart presents a classic V-shaped recovery after a pronounced sell-off, now showing signs of near-term bullish exhaustion following its vertical rally.

From late June through early July, Uniswap consolidated between $7.00 and $7.30 before a steep sell-off on July 1 drove the price down to $6.26.

The subsequent rebound was explosive, as the asset jumped 24% to $7.74 in under 48 hours, forming a near-perfect V-bottom reversal. This suggests strong bullish momentum, likely fueled by short covering and opportunistic buying at oversold levels.

However, the recovery’s sustainability is now in question. The current session’s price ($7.684) sits just below the rally’s high ($7.745), accompanied by declining volume—a sign of fading participation.

The MACD (12,26) tells a similar story. While a bullish crossover initially supported the rally, the MACD line (0.108) has now dipped below the signal line (0.148), and the histogram (+0.140) is losing upward momentum.

The convergence of weak volume, bearish MACD divergence, and rejection near $7.75 suggests profit-taking or buyer fatigue.

A firm close above $7.8 with increasing volume could invalidate bull exhaustion, while a failure to hold $7.6 could open $UNI to a more substantial pullback toward $7.4, where dip buyers may enter.

While the V-bottom structure remains technically bullish, the confluence of weak volume, bearish MACD crossover, and rejection at highs warrants caution. Traders should await confirmation at the key levels above or prepare for a pullback to higher-probability support.

The post Uniswap Rallies 24% in 48-Hour V-Bounce – Can Bulls Defy Looming $7.60 Test? appeared first on Cryptonews.

Uniswap Rallies 24% in 48-Hour V-Bounce – Can Bulls Defy Looming $7.60 Test?

Uniswap ($UNI) climbed 15% this week, pushing past $7.73 as traders renewed their focus on the DeFi leader. The steady rise marks a clear recovery from June’s low of $6.26, supported by a consistent daily trading volume of over $350 million.

The upward move coincides with Uniswap v4’s strong adoption, handling billions in trades post-launch, while improving regulatory clarity draws more institutional attention to the protocol’s ecosystem.

From Regulatory Clarity to Record Volume: Why Uniswap Is Leading the Next DeFi Wave

Uniswap remains one of the most compelling DeFi protocols to watch and buy, thanks to its relentless pace of innovation and growing institutional interest.

Institutional investors are also flocking to the protocol. The January 2025 launch of Uniswap v4 marked a turning point. This upgrade completely redesigned the architecture by consolidating liquidity pools into a single PoolManager contract and adding ERC-6909 support.

The ERC-6909 token standard supports both fungible and non-fungible tokens, offering flexibility. Interestingly, “hooks” now allow developers to inject custom logic into pools, unlocking new layers of automation, risk management, and smart routing in DeFi.

The impact has been immediate. According to blockchain data researcher Sean Kennedy, Uniswap v4 has already crossed $1 billion in total value locked (TVL) and processed over $86 billion in trading volume within six months, indicating rapid adoption.

Beyond v4, Uniswap is also generating substantial on-chain revenue. As of mid-2025, it consistently ranks among the top fee-generating DeXs, with a 7-day average of approximately $2.3 million in daily fees, according to CryptoFees.

It remains the largest DEX by cumulative volume, surpassing $3 trillion in all-time trades across Ethereum and Layer 2 networks, including Arbitrum, Optimism, and Base.

Meanwhile, in a major policy shift, the U.S. SEC indicated in early 2025 that some decentralized protocols could be exempt from securities registration, offering regulatory breathing space for Uniswap and potentially sparking a “DeFi Summer 2.0.”

For investors, Uniswap is more than just a DEX. It’s the backbone of infrastructure for decentralized finance. Its technical superiority, expanding cross-chain reach, and favorable regulatory developments make it one of the most promising assets in the current crypto cycle.

V-Shaped Rebound or Bull Trap? $UNI’s 24% Surge Faces Key Test

The $UNI/USDT 1-hour chart presents a classic V-shaped recovery after a pronounced sell-off, now showing signs of near-term bullish exhaustion following its vertical rally.

From late June through early July, Uniswap consolidated between $7.00 and $7.30 before a steep sell-off on July 1 drove the price down to $6.26.

The subsequent rebound was explosive, as the asset jumped 24% to $7.74 in under 48 hours, forming a near-perfect V-bottom reversal. This suggests strong bullish momentum, likely fueled by short covering and opportunistic buying at oversold levels.

However, the recovery’s sustainability is now in question. The current session’s price ($7.684) sits just below the rally’s high ($7.745), accompanied by declining volume—a sign of fading participation.

The MACD (12,26) tells a similar story. While a bullish crossover initially supported the rally, the MACD line (0.108) has now dipped below the signal line (0.148), and the histogram (+0.140) is losing upward momentum.

The convergence of weak volume, bearish MACD divergence, and rejection near $7.75 suggests profit-taking or buyer fatigue.

A firm close above $7.8 with increasing volume could invalidate bull exhaustion, while a failure to hold $7.6 could open $UNI to a more substantial pullback toward $7.4, where dip buyers may enter.

While the V-bottom structure remains technically bullish, the confluence of weak volume, bearish MACD crossover, and rejection at highs warrants caution. Traders should await confirmation at the key levels above or prepare for a pullback to higher-probability support.

The post Uniswap Rallies 24% in 48-Hour V-Bounce – Can Bulls Defy Looming $7.60 Test? appeared first on Cryptonews.

UniSwap v4 just surpassed $1B in TVL & over $86B in all-time v4 volume since launching January 31st

UniSwap v4 just surpassed $1B in TVL & over $86B in all-time v4 volume since launching January 31st