Senator Lummis Says Trump Supports Her BITCOIN Act That Could Erase U.S. Debt

Bitcoin Magazine

Senator Lummis Says Trump Supports Her BITCOIN Act That Could Erase U.S. Debt

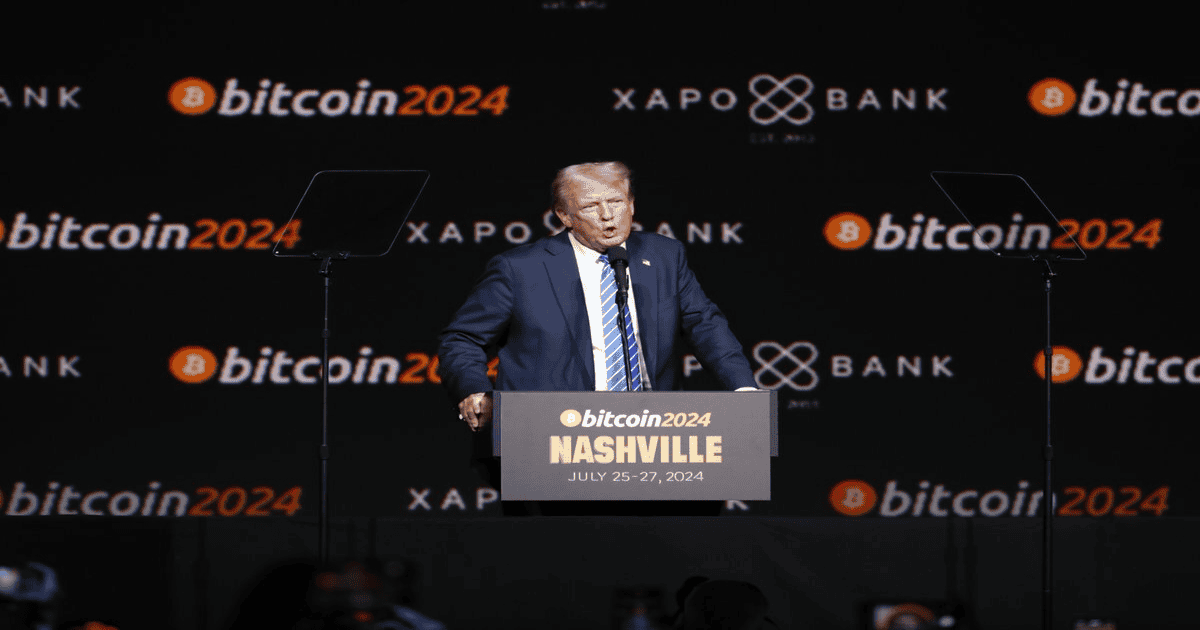

In a powerful address on Capitol Hill today, Senator Cynthia Lummis made her stance clear: the United States is out of time—and out of traditional options. “The BITCOIN Act is the only solution to our nation’s $36T debt,” she said, while mentioning she has President Donald Trump’s support for her initiative. “I’m grateful for a forward-thinking president who not only recognizes this, but acts on it.”

If enacted into law, the BITCOIN Act would see the U.S. purchase 200,000 bitcoin per year for five years—creating a 1,000,000 BTC reserve held for at least two decades.

Lummis laid out three paths for America: collapse under a default, spiral into hyperinflation, or use Bitcoin and technology to climb out. Her money is on crypto. She believes Bitcoin’s fixed supply makes it capable of restoring long-term monetary discipline. “The system is built on trust. If we don’t pay back what we owe, that trust disappears,” she said. “We’d hit something worse than the Great Depression.”

Inflation, she warned, will devastate working Americans if money printing continues. “We’re talking Zimbabwe, Weimar Republic levels,” Lummis said. “Everything becomes unaffordable. That’s not a future I want Americans to face.”

Lummis is offering a deflationary alternative. “Technology boosts productivity and cuts costs. It gives us room to grow faster than our debt,” she explained, pointing to AI, robots, and crypto as the tools needed to turn the economy around. “They’re the only real weapons we’ve got.”

The BITCOIN Act, first introduced last summer and reintroduced at the 2025 “Bitcoin for America” Summit, has seen growing bipartisan support in both the House and Senate.

Congressman Nick Begich is leading the charge in the House. His version of the bill mirrors Lummis’ Senate proposal and signals growing alignment between chambers on Bitcoin policy. “Americans deserve a fiscal and monetary foundation built on assets that represent discipline, structure, and confidence,” he tweeted today. “Bitcoin delivers on all three, and I am proud to lead this effort in the House with The BITCOIN Act.”

President Trump has already signed an executive order earlier this year creating a federal Bitcoin reserve, using BTC seized through forfeitures to establish an estimated 200,000 BTC stockpile—costing taxpayers nothing. Executive Director Bo Hines confirmed the reserve will add to the reserve using “budget neutral ways that don’t cost the taxpayer a dime,” potentially including tariff revenue.

While Trump’s executive order marks the U.S. as the world’s largest sovereign Bitcoin holder, it could be overturned by future administrations. That’s why Lummis insists legislation—not just executive action—is essential to locking in a long-term national Bitcoin strategy. Lummis’ BITCOIN Act would cement the program into law and ensure the country accumulates far more.

Asset manager VanEck estimates that if the U.S. follows this roadmap, the Bitcoin reserve could offset up to $21 trillion of national debt by 2049.

Lummis closed with a warning about the dollar’s fate. “It didn’t vanish. It just lost power,” she said, comparing it to the British pound. “Buy real assets or get left behind.”

This post Senator Lummis Says Trump Supports Her BITCOIN Act That Could Erase U.S. Debt first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

Senator Lummis Says Trump Supports Her BITCOIN Act That Could Erase U.S. Debt

Bitcoin Magazine

Senator Lummis Says Trump Supports Her BITCOIN Act That Could Erase U.S. Debt

In a powerful address on Capitol Hill today, Senator Cynthia Lummis made her stance clear: the United States is out of time—and out of traditional options. “The BITCOIN Act is the only solution to our nation’s $36T debt,” she said, while mentioning she has President Donald Trump’s support for her initiative. “I’m grateful for a forward-thinking president who not only recognizes this, but acts on it.”

If enacted into law, the BITCOIN Act would see the U.S. purchase 200,000 bitcoin per year for five years—creating a 1,000,000 BTC reserve held for at least two decades.

Lummis laid out three paths for America: collapse under a default, spiral into hyperinflation, or use Bitcoin and technology to climb out. Her money is on crypto. She believes Bitcoin’s fixed supply makes it capable of restoring long-term monetary discipline. “The system is built on trust. If we don’t pay back what we owe, that trust disappears,” she said. “We’d hit something worse than the Great Depression.”

Inflation, she warned, will devastate working Americans if money printing continues. “We’re talking Zimbabwe, Weimar Republic levels,” Lummis said. “Everything becomes unaffordable. That’s not a future I want Americans to face.”

Lummis is offering a deflationary alternative. “Technology boosts productivity and cuts costs. It gives us room to grow faster than our debt,” she explained, pointing to AI, robots, and crypto as the tools needed to turn the economy around. “They’re the only real weapons we’ve got.”

The BITCOIN Act, first introduced last summer and reintroduced at the 2025 “Bitcoin for America” Summit, has seen growing bipartisan support in both the House and Senate.

Congressman Nick Begich is leading the charge in the House. His version of the bill mirrors Lummis’ Senate proposal and signals growing alignment between chambers on Bitcoin policy. “Americans deserve a fiscal and monetary foundation built on assets that represent discipline, structure, and confidence,” he tweeted today. “Bitcoin delivers on all three, and I am proud to lead this effort in the House with The BITCOIN Act.”

President Trump has already signed an executive order earlier this year creating a federal Bitcoin reserve, using BTC seized through forfeitures to establish an estimated 200,000 BTC stockpile—costing taxpayers nothing. Executive Director Bo Hines confirmed the reserve will add to the reserve using “budget neutral ways that don’t cost the taxpayer a dime,” potentially including tariff revenue.

While Trump’s executive order marks the U.S. as the world’s largest sovereign Bitcoin holder, it could be overturned by future administrations. That’s why Lummis insists legislation—not just executive action—is essential to locking in a long-term national Bitcoin strategy. Lummis’ BITCOIN Act would cement the program into law and ensure the country accumulates far more.

Asset manager VanEck estimates that if the U.S. follows this roadmap, the Bitcoin reserve could offset up to $21 trillion of national debt by 2049.

Lummis closed with a warning about the dollar’s fate. “It didn’t vanish. It just lost power,” she said, comparing it to the British pound. “Buy real assets or get left behind.”

This post Senator Lummis Says Trump Supports Her BITCOIN Act That Could Erase U.S. Debt first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

Senator Cynthia Lummis says President Trump supports her Strategic Bitcoin Reserve bill to buy 1,000,000 BTC

Senator Cynthia Lummis says President Trump supports her Strategic Bitcoin Reserve bill to buy 1,000,000 BTC