After 85% Crash, Axelar ($AXL) Eyes Recovery With Institutional Backing

Axelar’s native token, $AXL, has begun a steady recovery after plunging to an all-time low of $0.2745 on April 7.

At press time, $AXL has gained 3.72% in the past 24 hours, driven by a 246% surge in trading volume, which helped lift its market capitalization to nearly $370 million.

Founded by Sergey Gorbunov and Georgios Vlachos in 2021, Axelar is a Web3 interoperability protocol designed to simplify cross-chain communication and logic execution for developers.

Its mainnet launched in February 2022, followed by the debut of its General Message Passing (GMP) protocol in May of the same year.

Liquidity Flows Into Axelar But Rarely Stays

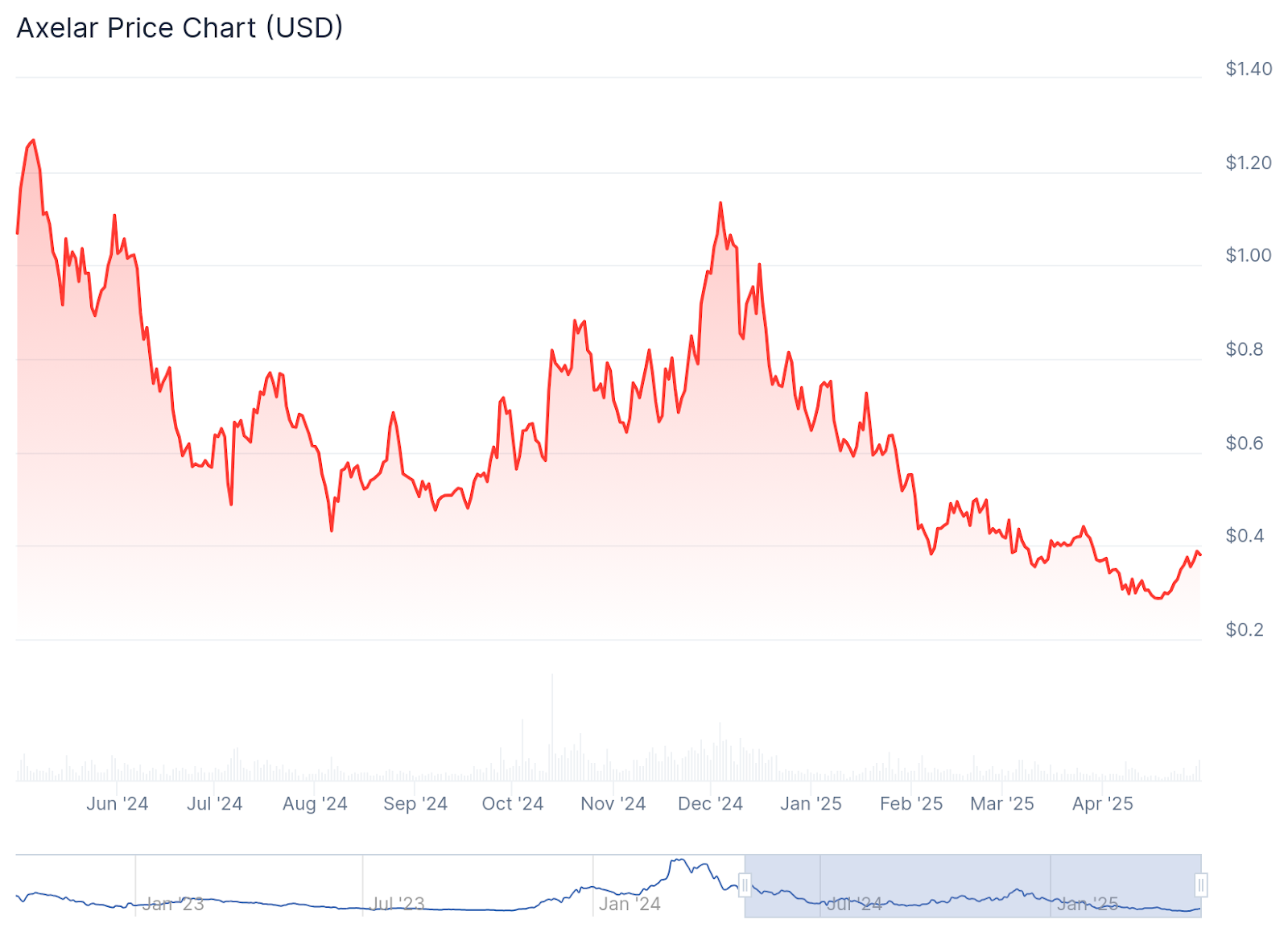

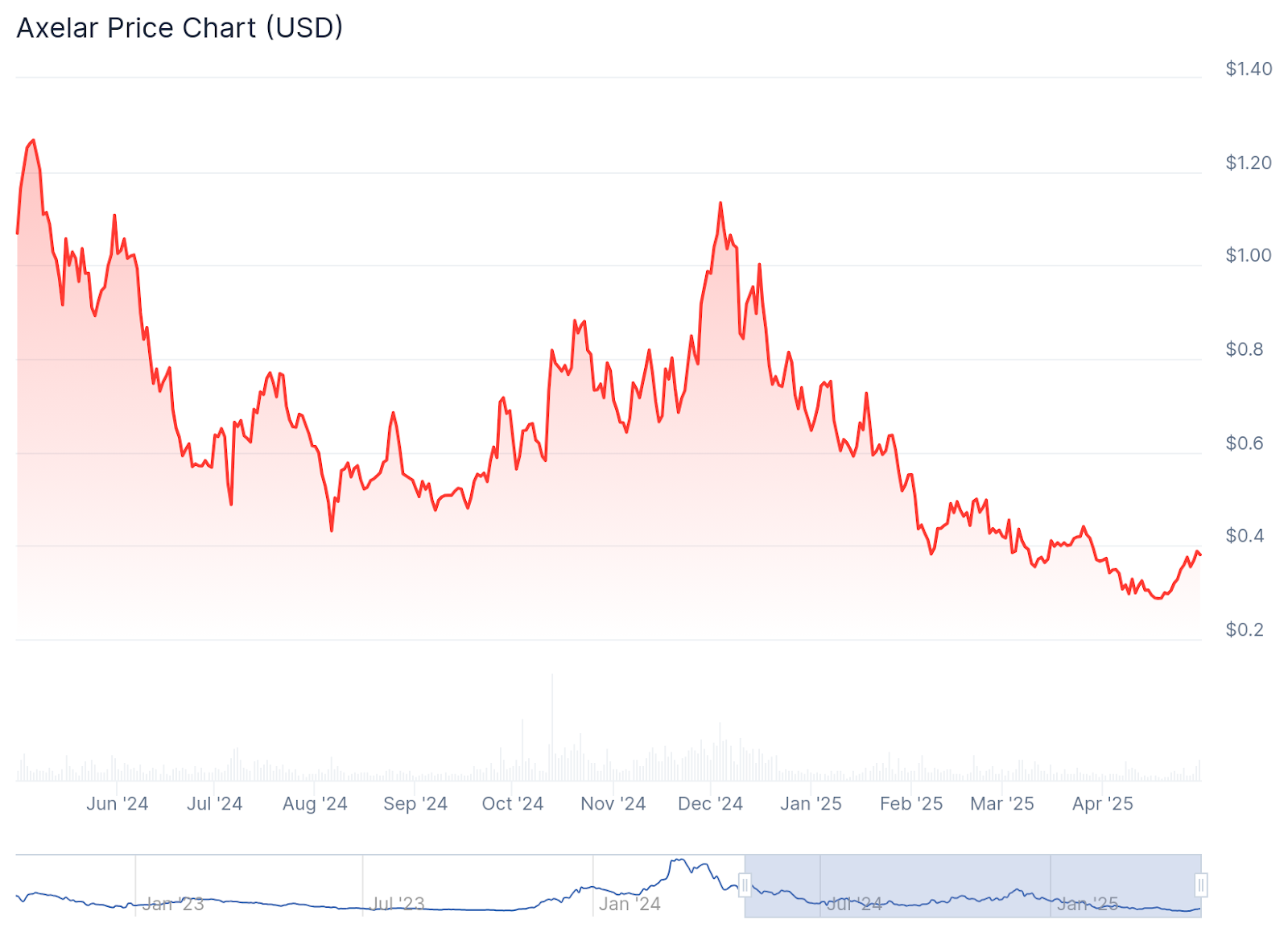

The $AXL token initially gained momentum, rising from around $0.85 in 2022 to a peak of $2.66.

However, it has since shed over 85% of its value from its 2024 high, reflecting broader market volatility and a decline in user activity.

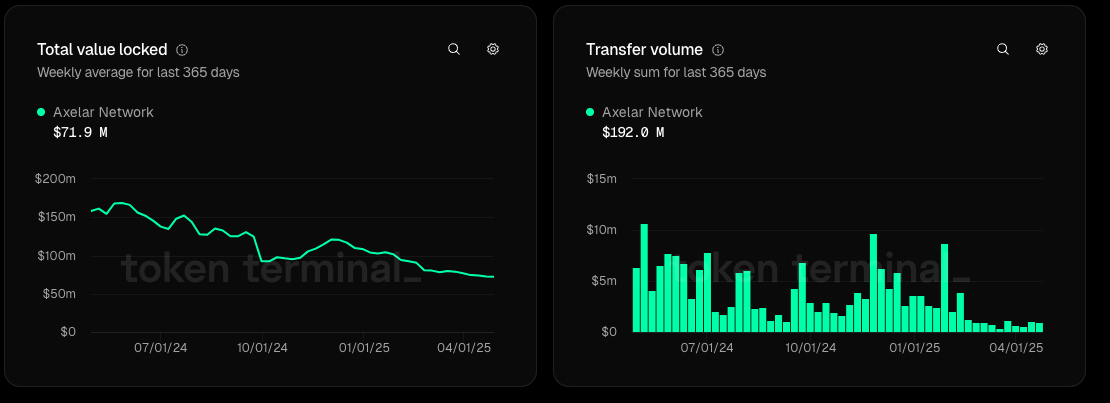

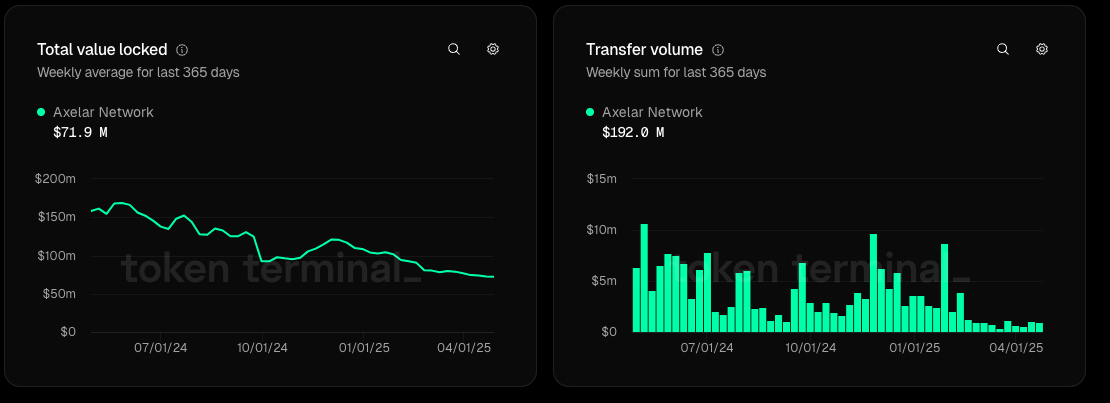

According to Token Terminal data, the total value locked (TVL) on Axelar has dropped to $71.9 million, down sharply from its May 2024 peak of $168 million.

This decline can be attributed to Axelar’s utility as a routing protocol—assets frequently pass through the network rather than remaining locked within it.

In the past year, the total value of assets bridged across Axelar has amounted to just under $192 million.

Despite these figures, Axelar continues to attract key partnerships and industry confidence.

In 2023, Axelar teamed up with Ondo Finance to launch the Ondo Bridge, a cross-chain solution that now supports over $8 billion in fully diluted assets.

Ripple also joined forces with the Axelar Foundation in March 2024 to integrate Axelar’s GMP protocol into the XRP Ledger (XRPL), enhancing interoperability for tokenized real-world assets (RWAs) across more than 55 blockchains.

Mobius Stack Marks a Turning Point in Axelar’s Web3 Interoperability

Further solidifying its role in cross-chain infrastructure, Axelar launched the Mobius Development Stack (MDS) on its mainnet in October 2024.

Regarded as the first comprehensive interoperability platform, MDS bridges private chain environments with public Layer-1 networks such as Solana, Stellar, and Sui.

This upgrade has also positioned Axelar as the first institutional-grade interoperability layer to integrate with Babylon and EigenLayer, providing secure cross-chain functionality among Bitcoin, Ethereum, and other chains.

Technical Resistance Ahead: Can $AXL Push Past $1?

Axelar has broken out of the descending channel that has confined its price since early 2025.

This week’s green candle shows a clear breakout from that channel, closing around $0.3791 with a gain of approximately 6.9%.

The breakout candle is a bullish engulfing pattern on the weekly chart, which indicates a potential trend reversal. It engulfs the previous red candle, showing buyers are gaining control.

The price bounced from the key support area around $0.3178, which it has held multiple times in the past. If this level continues to hold, it confirms a solid base.

The next key resistance is around $1.0421.

This level acted as major support before and could now serve as resistance.

A break above that would open the way to the $2.20 zone, where previous highs were reached.

If the price fails to hold above $0.3178, the breakout could turn into a fakeout and return the price to its downtrend.

The post After 85% Crash, Axelar ($AXL) Eyes Recovery With Institutional Backing appeared first on Cryptonews.

After 85% Crash, Axelar ($AXL) Eyes Recovery With Institutional Backing

Axelar’s native token, $AXL, has begun a steady recovery after plunging to an all-time low of $0.2745 on April 7.

At press time, $AXL has gained 3.72% in the past 24 hours, driven by a 246% surge in trading volume, which helped lift its market capitalization to nearly $370 million.

Founded by Sergey Gorbunov and Georgios Vlachos in 2021, Axelar is a Web3 interoperability protocol designed to simplify cross-chain communication and logic execution for developers.

Its mainnet launched in February 2022, followed by the debut of its General Message Passing (GMP) protocol in May of the same year.

Liquidity Flows Into Axelar But Rarely Stays

The $AXL token initially gained momentum, rising from around $0.85 in 2022 to a peak of $2.66.

However, it has since shed over 85% of its value from its 2024 high, reflecting broader market volatility and a decline in user activity.

According to Token Terminal data, the total value locked (TVL) on Axelar has dropped to $71.9 million, down sharply from its May 2024 peak of $168 million.

This decline can be attributed to Axelar’s utility as a routing protocol—assets frequently pass through the network rather than remaining locked within it.

In the past year, the total value of assets bridged across Axelar has amounted to just under $192 million.

Despite these figures, Axelar continues to attract key partnerships and industry confidence.

In 2023, Axelar teamed up with Ondo Finance to launch the Ondo Bridge, a cross-chain solution that now supports over $8 billion in fully diluted assets.

Ripple also joined forces with the Axelar Foundation in March 2024 to integrate Axelar’s GMP protocol into the XRP Ledger (XRPL), enhancing interoperability for tokenized real-world assets (RWAs) across more than 55 blockchains.

Mobius Stack Marks a Turning Point in Axelar’s Web3 Interoperability

Further solidifying its role in cross-chain infrastructure, Axelar launched the Mobius Development Stack (MDS) on its mainnet in October 2024.

Regarded as the first comprehensive interoperability platform, MDS bridges private chain environments with public Layer-1 networks such as Solana, Stellar, and Sui.

This upgrade has also positioned Axelar as the first institutional-grade interoperability layer to integrate with Babylon and EigenLayer, providing secure cross-chain functionality among Bitcoin, Ethereum, and other chains.

Technical Resistance Ahead: Can $AXL Push Past $1?

Axelar has broken out of the descending channel that has confined its price since early 2025.

This week’s green candle shows a clear breakout from that channel, closing around $0.3791 with a gain of approximately 6.9%.

The breakout candle is a bullish engulfing pattern on the weekly chart, which indicates a potential trend reversal. It engulfs the previous red candle, showing buyers are gaining control.

The price bounced from the key support area around $0.3178, which it has held multiple times in the past. If this level continues to hold, it confirms a solid base.

The next key resistance is around $1.0421.

This level acted as major support before and could now serve as resistance.

A break above that would open the way to the $2.20 zone, where previous highs were reached.

If the price fails to hold above $0.3178, the breakout could turn into a fakeout and return the price to its downtrend.

The post After 85% Crash, Axelar ($AXL) Eyes Recovery With Institutional Backing appeared first on Cryptonews.