Bitcoin Sharpe-Like Ratio Shows Market In Wait-and-See Mode At $119,000

As Bitcoin (BTC) steadily makes its way toward its current all-time high (ATH) of $124,128, optimism seems to be returning to the market. However, fresh data from Binance shows that BTC’s gains barely outweigh the risks posed by the digital asset’s volatility.

Bitcoin Maintaining A Risk-Reward Balance

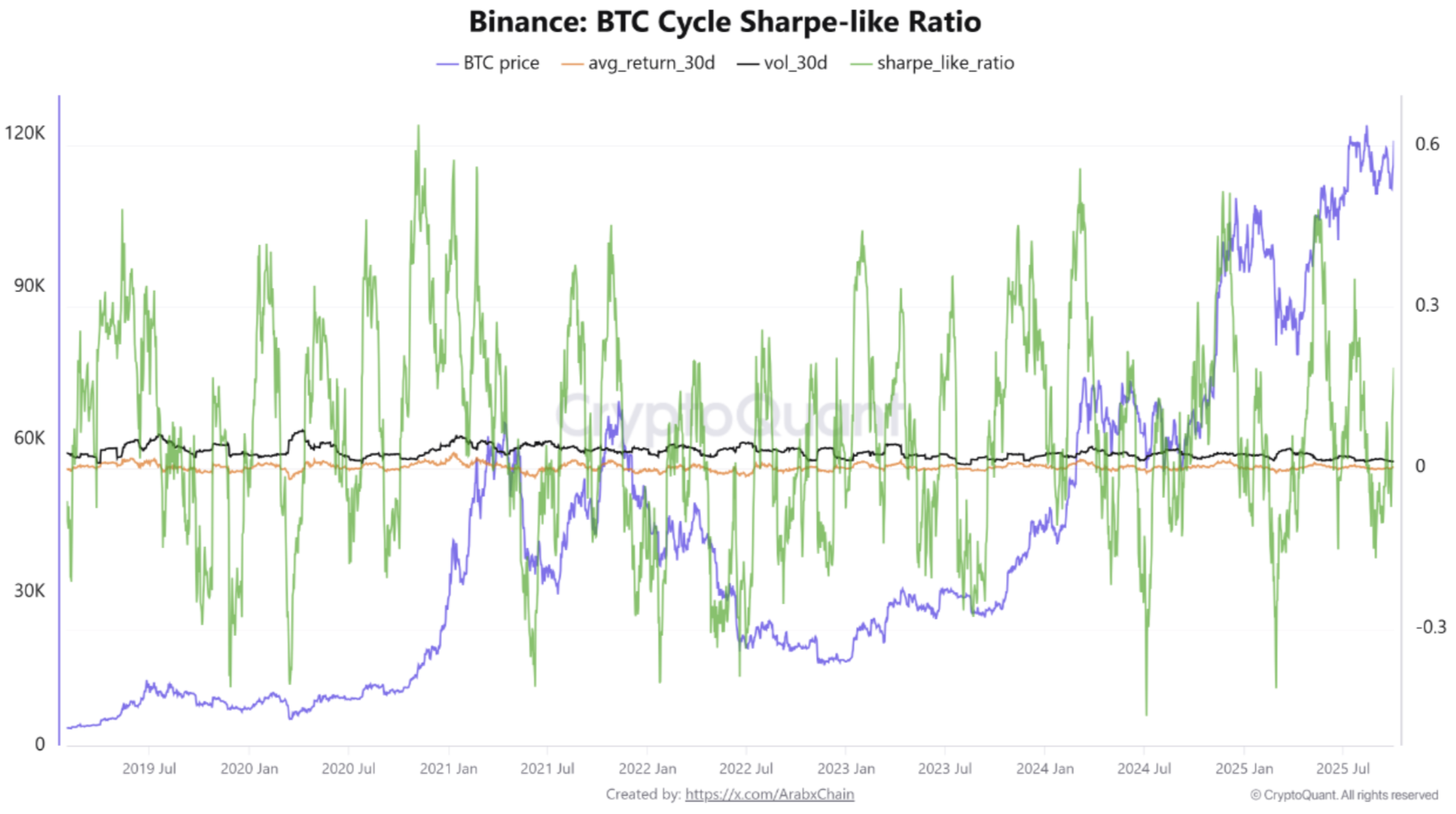

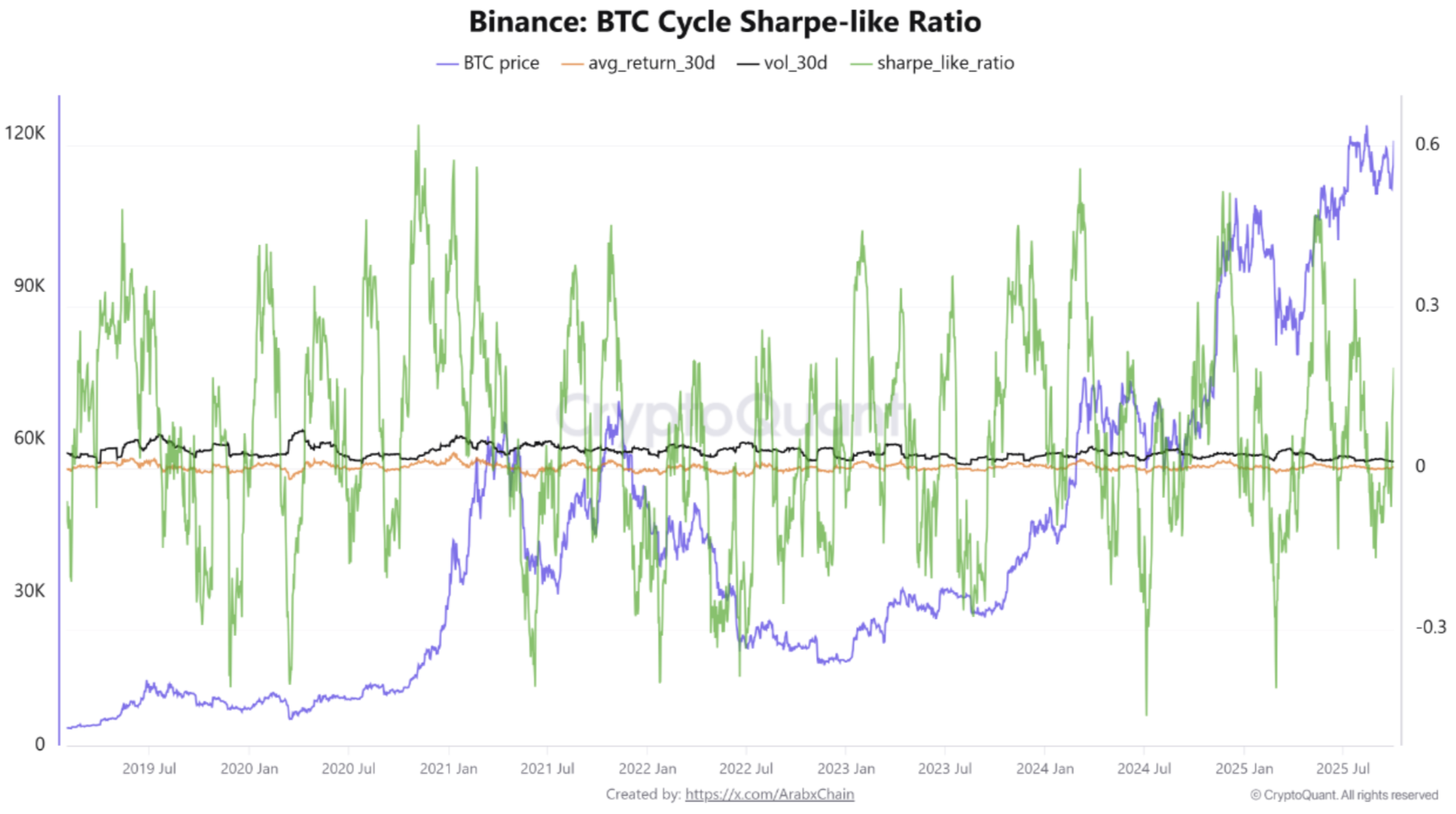

According to a CryptoQuant Quicktake post by contributor Arab Chain, latest data from Binance – the world’s leading cryptocurrency trading platform in terms of liquidity – suggests that BTC is currently maintaining a risk-reward balance.

Specifically, the Sharpe-like ratio on Binance currently stands at 0.18, a figure very close to neutral territory. To explain, a Sharpe-like ratio measures how much return an investment generates relative to the risk it takes, similar to the Sharpe ratio but often using adjusted benchmarks or risk measures.

When the Sharpe-like ratio is above 0.5, investing in Bitcoin becomes attractive since the potential returns outweigh the risks. On the contrary, a negative reading of the ratio discourages investors from taking risks, since volatility exceeds returns.

During 2024, when the cryptocurrency market was largely weak and volatile, the Sharpe-like ratio spent most of the time in the negative territory. In contrast, the ratio reached elevated levels, signaling a strong uptrend, at the beginning of 2025.

Currently, the Bitcoin market is trading between the two extremes – the market is neither dangerous nor in a powerful uptrend. Notably, the market appears to be in a phase of equilibrium and accumulation, as it trades close to $119,000. Arab Chain added:

The latest figures show that the 30-day average return stands at just 0.26%, highlighting that the market is not delivering outsized gains; investors entering now are likely to see only modest profits relative to risk. Meanwhile, 30-day volatility is around 1.37%, which indicates a natural, moderate level of price fluctuation – not excessively calm but not alarmingly unstable either.

BTC Needs A Catalyst For Next Leg Up

The CryptoQuant analyst added that the BTC market is currently awaiting a bullish catalyst or strong inflows to extend its uptrend. However, if the Sharpe-like ratio falls below zero again, then a period of price correction may follow.

On the flipside, the ratio sustaining above 0.5 for several days – coupled with a price breakout above the $120,000 to $122,000 range on healthy volume – would suggest a fresh upward trend for the top cryptocurrency by market cap.

Recent on-chain data hints toward a potential rally setup for BTC. Notably, the short-term holder (STH) spent output profit ratio (SOPR) recently recovered slightly to 0.995.

That said, Bitcoin must defend the important $90,000 support level to avoid entering a new bear market. At press time, BTC trades at $118,788, up 1.3% in the past 24 hours.

Read More

Bitcoin Weak-Hand Selling Slows: STH-SOPR Reset Hints At Potential Rally Setup

Bitcoin Sharpe-Like Ratio Shows Market In Wait-and-See Mode At $119,000

As Bitcoin (BTC) steadily makes its way toward its current all-time high (ATH) of $124,128, optimism seems to be returning to the market. However, fresh data from Binance shows that BTC’s gains barely outweigh the risks posed by the digital asset’s volatility.

Bitcoin Maintaining A Risk-Reward Balance

According to a CryptoQuant Quicktake post by contributor Arab Chain, latest data from Binance – the world’s leading cryptocurrency trading platform in terms of liquidity – suggests that BTC is currently maintaining a risk-reward balance.

Specifically, the Sharpe-like ratio on Binance currently stands at 0.18, a figure very close to neutral territory. To explain, a Sharpe-like ratio measures how much return an investment generates relative to the risk it takes, similar to the Sharpe ratio but often using adjusted benchmarks or risk measures.

When the Sharpe-like ratio is above 0.5, investing in Bitcoin becomes attractive since the potential returns outweigh the risks. On the contrary, a negative reading of the ratio discourages investors from taking risks, since volatility exceeds returns.

During 2024, when the cryptocurrency market was largely weak and volatile, the Sharpe-like ratio spent most of the time in the negative territory. In contrast, the ratio reached elevated levels, signaling a strong uptrend, at the beginning of 2025.

Currently, the Bitcoin market is trading between the two extremes – the market is neither dangerous nor in a powerful uptrend. Notably, the market appears to be in a phase of equilibrium and accumulation, as it trades close to $119,000. Arab Chain added:

The latest figures show that the 30-day average return stands at just 0.26%, highlighting that the market is not delivering outsized gains; investors entering now are likely to see only modest profits relative to risk. Meanwhile, 30-day volatility is around 1.37%, which indicates a natural, moderate level of price fluctuation – not excessively calm but not alarmingly unstable either.

BTC Needs A Catalyst For Next Leg Up

The CryptoQuant analyst added that the BTC market is currently awaiting a bullish catalyst or strong inflows to extend its uptrend. However, if the Sharpe-like ratio falls below zero again, then a period of price correction may follow.

On the flipside, the ratio sustaining above 0.5 for several days – coupled with a price breakout above the $120,000 to $122,000 range on healthy volume – would suggest a fresh upward trend for the top cryptocurrency by market cap.

Recent on-chain data hints toward a potential rally setup for BTC. Notably, the short-term holder (STH) spent output profit ratio (SOPR) recently recovered slightly to 0.995.

That said, Bitcoin must defend the important $90,000 support level to avoid entering a new bear market. At press time, BTC trades at $118,788, up 1.3% in the past 24 hours.

Read More