Fed’s Dovish Tone Fuels Bitcoin Rally, Digital Assets Rise

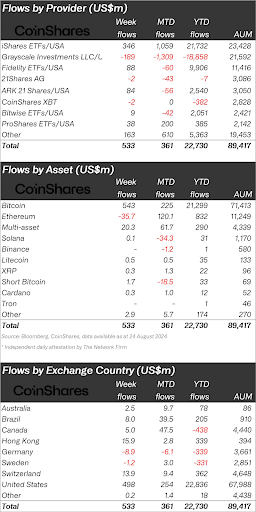

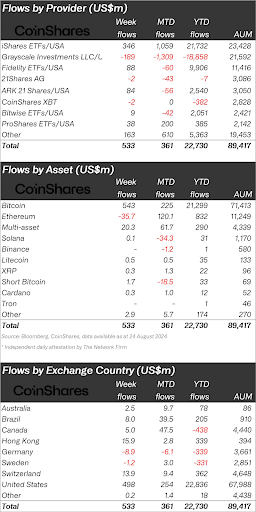

- Bitcoin led with $543 million inflows after Powell hinted at possible rate cuts in September.

- Ethereum faced $36M outflows despite new ETFs drawing $3.1B in investments this month.

- U.S. led with $498M in digital asset inflows, reflecting its dominance in the market.

Digital asset investments saw a big jump last week with inflows hitting $533 million.

This was the largest influx in five weeks and coincided with Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole Symposium. Powell’s hint that the first interest rate cut could come as early as September triggered a major market reaction, particularly for Bitcoin.

Bitcoin was the clear frontrunner, attracting $543 million in inflows. This underscores how sensitive Bitcoin is to changes in interest rate expectations. Most of these inflows happened on Friday, right after Powell’s dovish comments. This pattern shows Bitcoin’s strong link to macroeconomic indicators and investor sentiment about future monetary policy.

However, Ethereum did not fare as well. The digital asset saw outflows of $36 million last week. While new Ethereum ETFs have brought in $3.1 billion in inflows …

The post Fed’s Dovish Tone Fuels Bitcoin Rally, Digital Assets Rise appeared first on Coin Edition.

Fed’s Dovish Tone Fuels Bitcoin Rally, Digital Assets Rise

- Bitcoin led with $543 million inflows after Powell hinted at possible rate cuts in September.

- Ethereum faced $36M outflows despite new ETFs drawing $3.1B in investments this month.

- U.S. led with $498M in digital asset inflows, reflecting its dominance in the market.

Digital asset investments saw a big jump last week with inflows hitting $533 million.

This was the largest influx in five weeks and coincided with Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole Symposium. Powell’s hint that the first interest rate cut could come as early as September triggered a major market reaction, particularly for Bitcoin.

Bitcoin was the clear frontrunner, attracting $543 million in inflows. This underscores how sensitive Bitcoin is to changes in interest rate expectations. Most of these inflows happened on Friday, right after Powell’s dovish comments. This pattern shows Bitcoin’s strong link to macroeconomic indicators and investor sentiment about future monetary policy.

However, Ethereum did not fare as well. The digital asset saw outflows of $36 million last week. While new Ethereum ETFs have brought in $3.1 billion in inflows …

The post Fed’s Dovish Tone Fuels Bitcoin Rally, Digital Assets Rise appeared first on Coin Edition.

![[LIVE] Crypto News Today: Latest Updates for Sep 1, 2025 – Crypto Market Slumps as Bitcoin Falls Below $108K, GameFi Leads Losses](https://cimg.co/wp-content/uploads/2025/09/01043443/1756701283-crypto-news-today-live.jpg)