Buy Reliance Industries (RIL) Shares, 25% Upside Target: JP Morgan

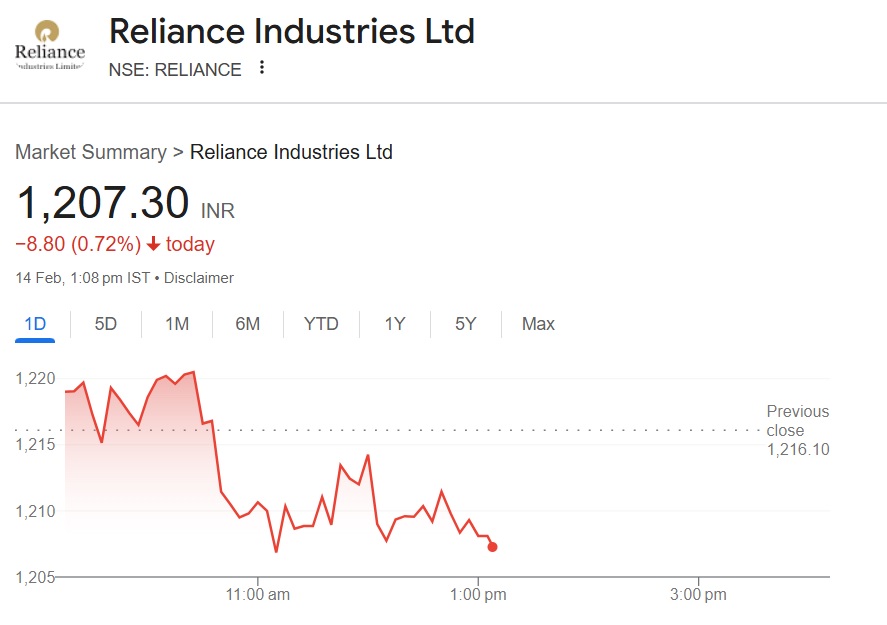

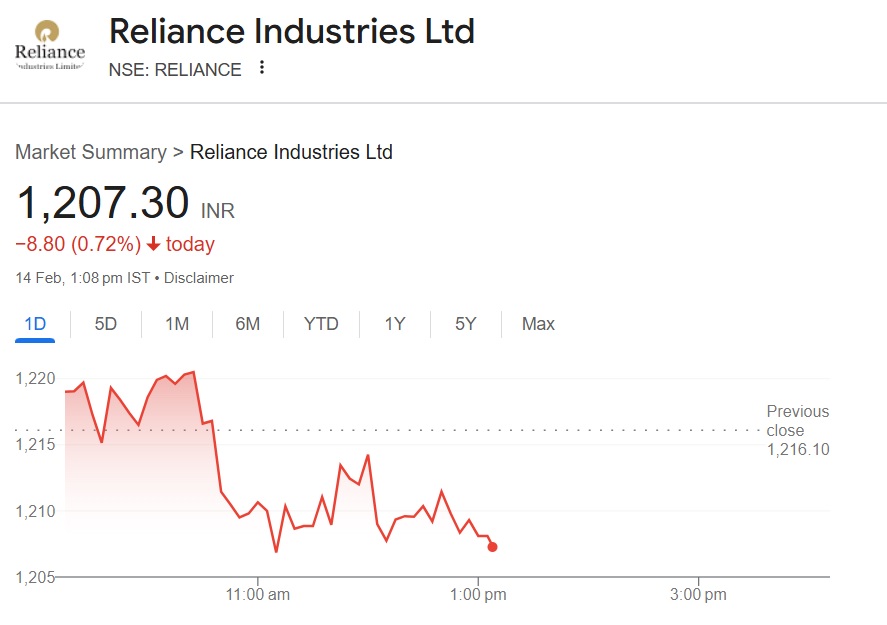

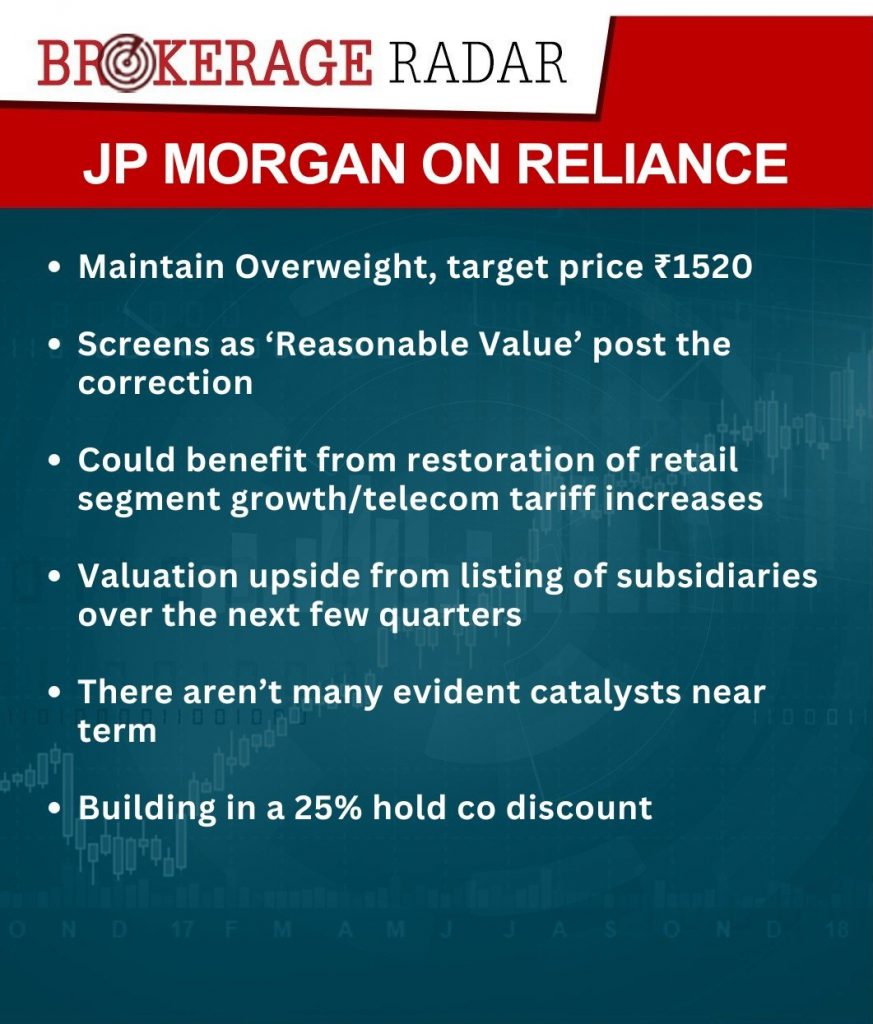

Leading global investment bank JP Morgan remains bullish on Reliance Industries Limited (RIL) shares. The banking giant wrote that the RIL could experience a 25% upside swing and reach a new high of Rs 1,520. The Mukesh Ambani-led multi-billion dollar company is currently trading at the Rs 1,205 mark on Friday’s trading session.

Also Read: Buy NALCO Shares: New Price Target Rs 255, Profit of 33%

RIL shares saw steep corrections as it dipped nearly 18% in the last six months. The stock has been trading in the red for nearly a week now with little to no price spurts. However, JP Morgan wrote that Reliance Industries shares could bottom out after the correction and head north next.

Also Read: AI Stock Upstart (UPST) Rises 31% in a Day: Should You Invest?

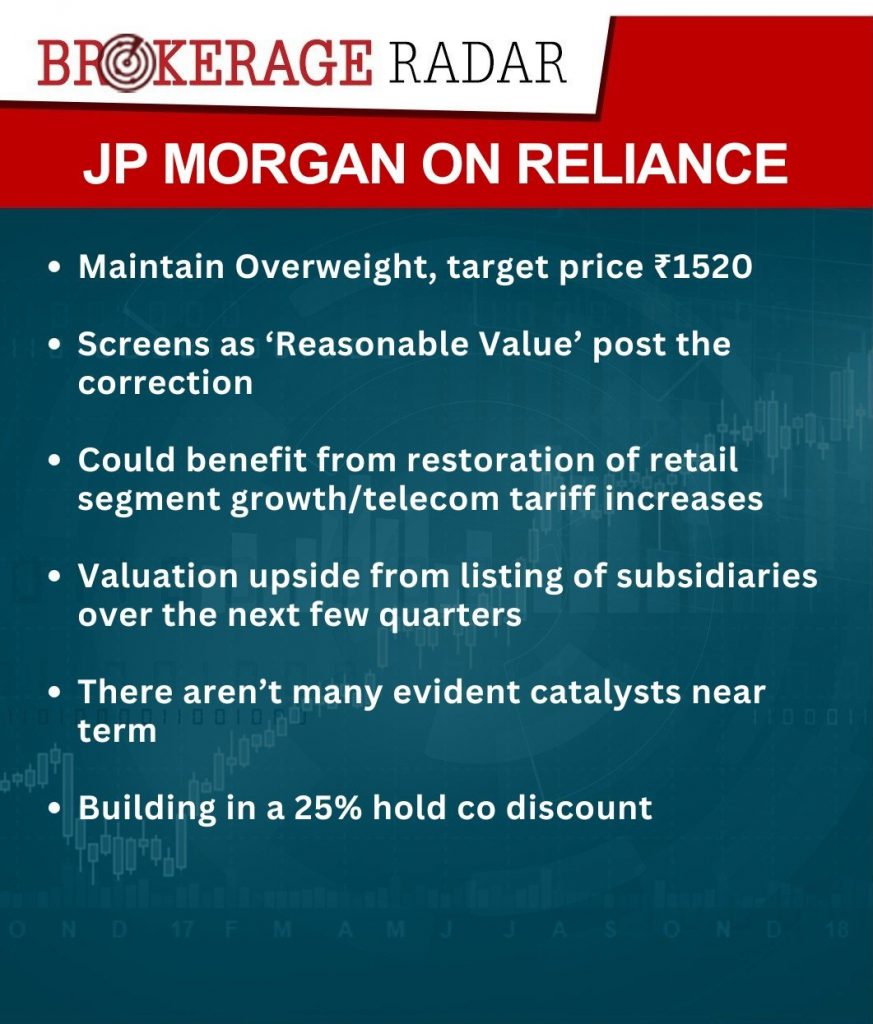

JP Morgan Gives Reliance Industries (RIL) Shares a ‘Buy’ Call

The global bank wrote in a note that RIL shares could hit a high of Rs 1,520 next. That’s an uptick and return on investment (ROI) of approximately 25% from its current price of Rs 1,207. Therefore, an investment of Rs 10,000 could turn into Rs 12,500 if the forecast turns out to be accurate.

Also Read: 3 Oil Stocks That Can Surge If Trump’s ‘Drill Baby Drill’ Policy Goes Live

The bank wrote that Reliance Industries shares are trading at a “reasonable value” after receiving a haircut from the market correction. They wrote that the restoration of the retail segment and increase in telecom tariffs could boost its value hereon. Therefore, a 25% spike in the charts could be a reality in the coming months, wrote JP Morgan.

Also Read: Nvidia (NVDA) to Hit $260B in AI Revenue: What it Means for the Stock

The RIL shares had a 1:1 split in Q4 of 2024 making its price reduce in half. Despite the split, its price began dwindling in the charts as the markets did not support a bullish thesis. Sensex has lost nearly 2,800 points year-to-date making Reliance Industries shares bear the brunt of the downturn. Even Mukesh Ambali-led Jio Financial Services shares remain in the red this year. Read here to know how high Jio Financial shares could surge in the charts in 2025.

Read More

Happy Gilmore 2 Netflix Release Could Push NFLX to $1,600 Target

Buy Reliance Industries (RIL) Shares, 25% Upside Target: JP Morgan

Leading global investment bank JP Morgan remains bullish on Reliance Industries Limited (RIL) shares. The banking giant wrote that the RIL could experience a 25% upside swing and reach a new high of Rs 1,520. The Mukesh Ambani-led multi-billion dollar company is currently trading at the Rs 1,205 mark on Friday’s trading session.

Also Read: Buy NALCO Shares: New Price Target Rs 255, Profit of 33%

RIL shares saw steep corrections as it dipped nearly 18% in the last six months. The stock has been trading in the red for nearly a week now with little to no price spurts. However, JP Morgan wrote that Reliance Industries shares could bottom out after the correction and head north next.

Also Read: AI Stock Upstart (UPST) Rises 31% in a Day: Should You Invest?

JP Morgan Gives Reliance Industries (RIL) Shares a ‘Buy’ Call

The global bank wrote in a note that RIL shares could hit a high of Rs 1,520 next. That’s an uptick and return on investment (ROI) of approximately 25% from its current price of Rs 1,207. Therefore, an investment of Rs 10,000 could turn into Rs 12,500 if the forecast turns out to be accurate.

Also Read: 3 Oil Stocks That Can Surge If Trump’s ‘Drill Baby Drill’ Policy Goes Live

The bank wrote that Reliance Industries shares are trading at a “reasonable value” after receiving a haircut from the market correction. They wrote that the restoration of the retail segment and increase in telecom tariffs could boost its value hereon. Therefore, a 25% spike in the charts could be a reality in the coming months, wrote JP Morgan.

Also Read: Nvidia (NVDA) to Hit $260B in AI Revenue: What it Means for the Stock

The RIL shares had a 1:1 split in Q4 of 2024 making its price reduce in half. Despite the split, its price began dwindling in the charts as the markets did not support a bullish thesis. Sensex has lost nearly 2,800 points year-to-date making Reliance Industries shares bear the brunt of the downturn. Even Mukesh Ambali-led Jio Financial Services shares remain in the red this year. Read here to know how high Jio Financial shares could surge in the charts in 2025.

Read More