Why Is Crypto Up Today? – May 26, 2025

All top 10 coins and 99 of the top 100 coins per market cap have seen their prices increase since this time yesterday. Per analysts, the rally is the result of institutional adoption, growing regulatory clarity, and favourable macroeconomic factors. At the same time, the cryptocurrency market capitalization is unchanged over the past day, currently standing at $3.58 trillion. The total crypto trading volume is at $95 billion – the lowest it’s been in days.

TLDR:

Crypto Winners & Losers

At the time of writing, all the top 10 coins per market capitalization have appreciated over the past day. Bitcoin (BTC) is up 2.3%, now trading at $110,080. The coin hit its all-time high of $111,814 on 22 May, falling 1.6% since. Its current level is its intraday high.

Ethereum (ETH) appreciated 3.6%, now changing hands at $2,581. Its daily high is $2,585.

The category’s best performer, for the sixth day in a row, is Cardano (ADA). It’s up 5.1% to $0.7736.

Cardano’s Ouroboros Leios upgrade is currently in development, with the launch expected next year. It should significantly boost the chain’s scalability and allow the network to handle tens of thousands of transactions per second.

Meanwhile, Cardano supporters are working on expanding the ecosystem.

Of the top 100 coins, only one is red today. Tokenize Xchange (TKX) has decreased by 2.2% to the current price of $32.77.

At the same time, Hyperliquid (HYPE) is this category’s highest gainer. It’s up 11.7% to $38.88.

However, the crypto market is evidently still highly influenced by the macroeconomic developments. It’s particularly, even worryingly so, sensitive to US policy shifts. On Sunday, US President Donald Trump decided to delay the introduction of 50% tariffs on EU imports until 9 July. This has eased the general market concerns around a potential trade war. At the same time, the capital is migrating into risk assets.

Bitcoin is on the Path to $150,000

According to Ruslan Lienkha, chief of markets at YouHodler, “Bitcoin already possesses sufficient internal catalysts” to reach the $150,000 level. Factors that provide strong structural support include post-halving supply constraints, continued institutional adoption, and the expansion of Bitcoin ETF inflows.

“Given these fundamentals, even a stable and moderately positive macroeconomic environment over the medium term could propel Bitcoin toward the $150K mark.”

Furthermore, Lienkha noted that most of BTC’s free float is in retail wallets. Therefore, retail investors remain dominant in market dynamics. However, “it’s increasingly common to see Bitcoin allocated as a small but strategic component in diversified investment portfolios.” This shows that its adoption among institutions is still in the early stages, but there is growing recognition of the coin as a legitimate asset class and a potential long-term store of value.

He commented that the sustainability of Bitcoin’s bullish momentum “largely hinges on the broader sentiment across financial markets, particularly the performance of US equities.” As long as the US stock market remains stable, Bitcoin will likely maintain its upward trajectory, he argued.

But he noted emerging risks in the bond market. A broader sell-off in the bond market could spill over into crypto.

However, Alice Liu, the Head of Research at CoinMarketCap, argued that crypto is decupling and moving independently from traditional markets. Despite major macro shockwaves, including the US credit downgrade, the weakest Treasury demand in 20 years, and S&P dropping 2% in a day, Bitcoin still hit an all-time high. This shows “crypto’s increasing role as an alternative store of value during sovereign debt concerns.”

That said, Lienkha added that Bitcoin is “indeed maturing and gradually gaining recognition as a distinct asset class,” but that it still “has a considerable journey before it can be fully classified as a hedge.”

Reduced volatility and growing institutional interest are encouraging signs, but the current stability may be a temporary pause and not a permanent shift. “Actual safe-haven status requires consistent performance across multiple market cycles and crises, which Bitcoin has yet to fully demonstrate,” Lienkha said.

Levels & Events to Watch Next

After hitting the all-time high of $111,814 last Thursday, BTC saw a relatively minor pullback to $110,594. Notably, it’s up from the daily low of $106,815. Overall, it has increased by some 6.6% over the past week. Key resistance levels remain at $112,000, followed by $115,000, and then the critical $120,000 level. Support levels to keep an eye on are $107,000 and $100,000. Should it follow further, it may hit $92,000.

Furthermore, ETH “appears to be gearing up for a comeback,” Liu says. The recent Pectra upgrade raised validator caps 64-fold, reduced layer-2 settlement costs, and improved usability. Overall, the coin is up 42.3% in a month.

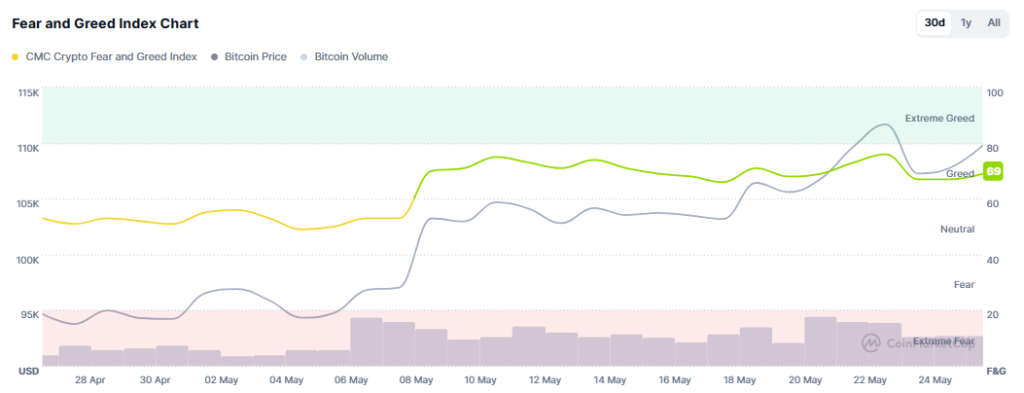

Notably, the Fear and Greed Index has decreased from 76 to 69, suggesting growing bullishness. Investors are buying, expecting the prices to rally further.

Moreover, spot Bitcoin ETFs have seen yet another day of inflows, today standing at $211.74 million. Spot Ethereum ETFs recorded $58.63 million in net inflows.

Meanwhile, lawmakers close to Lee Jae Myung, the frontrunner in the South Korean presidential elections, have called for fast-tracking the rollout of a KRW stablecoin. Min Byoung Dug, a lawmaker for the Democratic Party and the chairman of the party’s Digital Asset Committee, said that “South Korea is an internet powerhouse. We need to take the lead in institutionalizing stablecoins before US dollar-based stablecoins become firmly established. That is the only way we can secure a sure position in the global battle for stablecoin hegemony.” Additionally, candidate Lee claimed he would boost the stock market and economic recovery.

However, in the US, major crypto exchange Coinbase is facing a class action lawsuit as shareholders claim it failed to disclose a data breach and a regulatory violation. These incidents, they allege, pushed the company’s stock price down. The developments surrounding recent lawsuits aimed at Coinbase may affect the crypto market as well.

Quick FAQ

- Why did crypto move against stocks today?

The stock market is down yet again today, while crypto continues climbing. The S&P 500 is down 0.67%, the Nasdaq-100 decreased by 0.93%, and the Dow Jones Industrial Average fell 0.61%. Trump’s Friday tariff threats have put the markets on edge again, says Kate Leaman, chief market analyst at AvaTrade. This fuels investors’ worries about rising global trade tensions. However, Trump has changed his mind yet again on Sunday, so this is likely to reflect on the stocks today. Leaman argues that whether the tariffs become reality or not, “the market is already pricing in the risk.”

- Is this rally sustainable?

The current developments affecting the market continue to be favorable, in addition to the overall positive sentiment. Currently, the rally seems sustainable. However, profit-taking often comes after a period of fast gains, which may lead to short-term pullbacks.

The post Why Is Crypto Up Today? – May 26, 2025 appeared first on Cryptonews.

Why Is Crypto Up Today? – May 26, 2025

All top 10 coins and 99 of the top 100 coins per market cap have seen their prices increase since this time yesterday. Per analysts, the rally is the result of institutional adoption, growing regulatory clarity, and favourable macroeconomic factors. At the same time, the cryptocurrency market capitalization is unchanged over the past day, currently standing at $3.58 trillion. The total crypto trading volume is at $95 billion – the lowest it’s been in days.

TLDR:

Crypto Winners & Losers

At the time of writing, all the top 10 coins per market capitalization have appreciated over the past day. Bitcoin (BTC) is up 2.3%, now trading at $110,080. The coin hit its all-time high of $111,814 on 22 May, falling 1.6% since. Its current level is its intraday high.

Ethereum (ETH) appreciated 3.6%, now changing hands at $2,581. Its daily high is $2,585.

The category’s best performer, for the sixth day in a row, is Cardano (ADA). It’s up 5.1% to $0.7736.

Cardano’s Ouroboros Leios upgrade is currently in development, with the launch expected next year. It should significantly boost the chain’s scalability and allow the network to handle tens of thousands of transactions per second.

Meanwhile, Cardano supporters are working on expanding the ecosystem.

Of the top 100 coins, only one is red today. Tokenize Xchange (TKX) has decreased by 2.2% to the current price of $32.77.

At the same time, Hyperliquid (HYPE) is this category’s highest gainer. It’s up 11.7% to $38.88.

However, the crypto market is evidently still highly influenced by the macroeconomic developments. It’s particularly, even worryingly so, sensitive to US policy shifts. On Sunday, US President Donald Trump decided to delay the introduction of 50% tariffs on EU imports until 9 July. This has eased the general market concerns around a potential trade war. At the same time, the capital is migrating into risk assets.

Bitcoin is on the Path to $150,000

According to Ruslan Lienkha, chief of markets at YouHodler, “Bitcoin already possesses sufficient internal catalysts” to reach the $150,000 level. Factors that provide strong structural support include post-halving supply constraints, continued institutional adoption, and the expansion of Bitcoin ETF inflows.

“Given these fundamentals, even a stable and moderately positive macroeconomic environment over the medium term could propel Bitcoin toward the $150K mark.”

Furthermore, Lienkha noted that most of BTC’s free float is in retail wallets. Therefore, retail investors remain dominant in market dynamics. However, “it’s increasingly common to see Bitcoin allocated as a small but strategic component in diversified investment portfolios.” This shows that its adoption among institutions is still in the early stages, but there is growing recognition of the coin as a legitimate asset class and a potential long-term store of value.

He commented that the sustainability of Bitcoin’s bullish momentum “largely hinges on the broader sentiment across financial markets, particularly the performance of US equities.” As long as the US stock market remains stable, Bitcoin will likely maintain its upward trajectory, he argued.

But he noted emerging risks in the bond market. A broader sell-off in the bond market could spill over into crypto.

However, Alice Liu, the Head of Research at CoinMarketCap, argued that crypto is decupling and moving independently from traditional markets. Despite major macro shockwaves, including the US credit downgrade, the weakest Treasury demand in 20 years, and S&P dropping 2% in a day, Bitcoin still hit an all-time high. This shows “crypto’s increasing role as an alternative store of value during sovereign debt concerns.”

That said, Lienkha added that Bitcoin is “indeed maturing and gradually gaining recognition as a distinct asset class,” but that it still “has a considerable journey before it can be fully classified as a hedge.”

Reduced volatility and growing institutional interest are encouraging signs, but the current stability may be a temporary pause and not a permanent shift. “Actual safe-haven status requires consistent performance across multiple market cycles and crises, which Bitcoin has yet to fully demonstrate,” Lienkha said.

Levels & Events to Watch Next

After hitting the all-time high of $111,814 last Thursday, BTC saw a relatively minor pullback to $110,594. Notably, it’s up from the daily low of $106,815. Overall, it has increased by some 6.6% over the past week. Key resistance levels remain at $112,000, followed by $115,000, and then the critical $120,000 level. Support levels to keep an eye on are $107,000 and $100,000. Should it follow further, it may hit $92,000.

Furthermore, ETH “appears to be gearing up for a comeback,” Liu says. The recent Pectra upgrade raised validator caps 64-fold, reduced layer-2 settlement costs, and improved usability. Overall, the coin is up 42.3% in a month.

Notably, the Fear and Greed Index has decreased from 76 to 69, suggesting growing bullishness. Investors are buying, expecting the prices to rally further.

Moreover, spot Bitcoin ETFs have seen yet another day of inflows, today standing at $211.74 million. Spot Ethereum ETFs recorded $58.63 million in net inflows.

Meanwhile, lawmakers close to Lee Jae Myung, the frontrunner in the South Korean presidential elections, have called for fast-tracking the rollout of a KRW stablecoin. Min Byoung Dug, a lawmaker for the Democratic Party and the chairman of the party’s Digital Asset Committee, said that “South Korea is an internet powerhouse. We need to take the lead in institutionalizing stablecoins before US dollar-based stablecoins become firmly established. That is the only way we can secure a sure position in the global battle for stablecoin hegemony.” Additionally, candidate Lee claimed he would boost the stock market and economic recovery.

However, in the US, major crypto exchange Coinbase is facing a class action lawsuit as shareholders claim it failed to disclose a data breach and a regulatory violation. These incidents, they allege, pushed the company’s stock price down. The developments surrounding recent lawsuits aimed at Coinbase may affect the crypto market as well.

Quick FAQ

- Why did crypto move against stocks today?

The stock market is down yet again today, while crypto continues climbing. The S&P 500 is down 0.67%, the Nasdaq-100 decreased by 0.93%, and the Dow Jones Industrial Average fell 0.61%. Trump’s Friday tariff threats have put the markets on edge again, says Kate Leaman, chief market analyst at AvaTrade. This fuels investors’ worries about rising global trade tensions. However, Trump has changed his mind yet again on Sunday, so this is likely to reflect on the stocks today. Leaman argues that whether the tariffs become reality or not, “the market is already pricing in the risk.”

- Is this rally sustainable?

The current developments affecting the market continue to be favorable, in addition to the overall positive sentiment. Currently, the rally seems sustainable. However, profit-taking often comes after a period of fast gains, which may lead to short-term pullbacks.

The post Why Is Crypto Up Today? – May 26, 2025 appeared first on Cryptonews.

![[LIVE] Crypto News Today: Latest Updates for July 18, 2025 –XRP Hits All-Time High Above $3.6, ETH Trades at $3.6K as Crypto Bills Clear House](https://cimg.co/wp-content/uploads/2025/07/18033504/1752809703-july-18.jpg)