Why Is Crypto Down Today? – September 15, 2025

The crypto market is down today, with the cryptocurrency market capitalization dropping 0.4% to $4.15 trillion. Most of the top 100 coins have decreased over the past 24 hours. At the same time, the total crypto trading volume is at $130 billion.

Crypto Winners & Losers

At the time of writing, nine of the top 10 coins per market capitalization have decreased over the past 24 hours.

Bitcoin (BTC) appreciated 0.5% at the time of writing, currently trading at $116,309. This is the only increase in the category. The coin seems poised to decrease as well.

Ethereum (ETH) is down 0.6%, now trading at $4,642. It’s the third-best gainer in the category.

The highest decrease is 4.5% by Dogecoin (DOGE), currently standing at $0.2769.

It’s followed by Solana (SOL), which is down 2.2%, now trading at $241.

When it comes to the top 100 coins, of the 14 green coins, Monero (XMR) is up the most: 5.4% to the price of $303.

Flare (FLR) appreciated 4.9% to $0.02405, while the rest of the green coins are up 1% and less.

On the other side, Worldcoin (WLD)’s 8% drop to $1.59 is the highest in the category.

Pump.fun (PUMP) follows with a decrease of 6.7% to the price of $0.007828.

Meanwhile, Alex Thorn, head of firmwide research at Galaxy Digital, argued that the United States could soon launch its Strategic Bitcoin Reserve (SBR), potentially before the end of 2025. “The market seems to be completely underpricing the likelihood of such an announcement,” he noted.

‘The Bull Run’s Not Over’

Sean Dawson, head of research at onchain options platform Derive.xyz, argued that we haven’t reached the top of this cycle, despite growing speculation and the increased volatility in the coming weeks.

“While some are worried that ‘the music is about to stop,’ the reality is more nuanced,” he writes. “We may see volatility and consolidation in September, driven by fiscal year-end flows and some profit-taking among ETH DATs. But the structural backdrop – falling rates, institutional positioning, and bullish derivatives markets – suggests there’s still substantial upside ahead. This is likely not the cycle top.”

On average, BTC returns -2.9% in September. This is largely due to natural selling pressure around the US financial year-end, Dawson explains. “We’re already seeing signs of that pressure in the data. I’d argue we’re only halfway through what could be a very powerful Q4 rally.”

Meanwhile, options markets are showing sustained bullish sentiment, Dawson continues. For BTC, open interest is stacked around $140,000, $150,000, $160,000. and $200,000 strikes for the 26 December expiry. Call open interest outnumbers puts nearly 2.5 to 1 (64K vs. 26K). For ETH, there’s a broad spread of bullish strikes from $4,000 to $7,000.

“That positioning matters – option boards let us derive the market’s consensus probability of price outcomes,” Dawson writes. “And right now, they’re saying there’s a 40% chance ETH closes above $5,000 by year-end, and 20% chance it settles above $6,000. For BTC, the market gives a 37% probability of $125,000 or higher by the same time.”

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC trades at $116,309. The price moved from the intraday low of $114,915 to the high of $116,689, before slightly correcting to the current point.

Looking at the weekly prices, the range from $110,870 to $116,705, meaning that the coin is not far from the intraweek high.

The price has been moving to test the $117,500 level. Clearing that would potentially lead it to $119,500, followed by $122,200 and $124,500. However, as the market has turned red, if BTC falls below $114,800, it could move towards the $110,856 level, which is its critical structural floor.

Ethereum is currently trading at $4,548. It initially fell from the day’s high of $4,674 to the low of $4,581 before climbing back to the current level.

It’s 7-day range stands between $4,286 and $4,762. It’s currently up 8% in a week.

The nest support level currently stands at $4,425. On the other side, if the price takes $4,760, further resistance levels stand at $4,945 and $5,135.

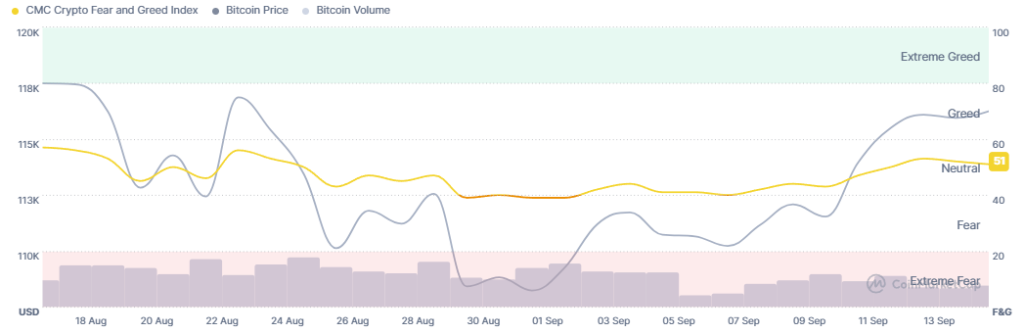

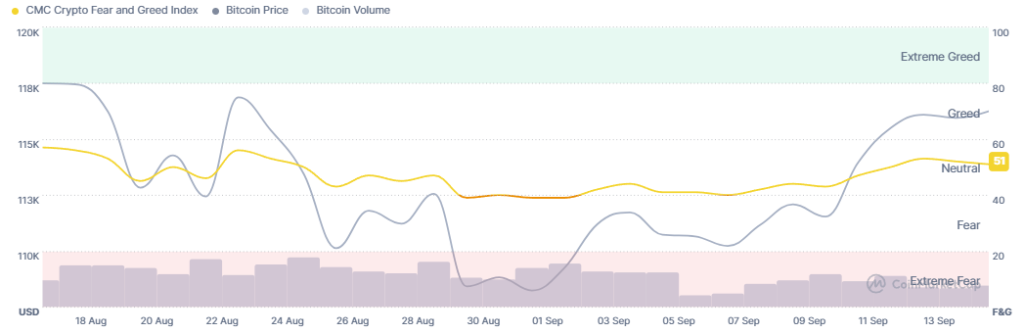

Meanwhile, the crypto market sentiment has seen increased slightly over the past few days. The crypto fear and greed index moves between 50 and 53, standing at 51 today.

The sentiment overall remains bullish, even if investors are cautious, largely supported by fundamentals and technicals.

Moreover, the US BTC spot exchange-traded funds (ETFs) recorded another day of significant inflows on the last day of trading, 12 September, of $642.35 million. The cumulative net inflow has reached $56.83 billion.

Six of the 12 ETFs saw inflows, and there were no outflows. Fidelity and BlackRock saw the highest positive flows of $315.18 million and $264.71 million, respectively.

Additionally, the US ETH ETFs recorded inflows on Friday of $405.55 million. Five of the nine funds saw inflows, and one saw outflows. The total net inflow has reached $13.36 billion.

Of this, Fidelity saw the highest green amount of $168.23 million, followed by BlackRock’s $165.56 million. Seven funds recorded inflows, and there were no outflows.

Meanwhile, Pakistan has invited international crypto exchanges and virtual asset service providers to apply for licenses to operate under its newly formed regulatory authority. The Pakistan Virtual Assets Regulatory Authority (PVARA) was created under the Virtual Assets Ordinance 2025.

Speaking of exchanges, Coinbase is working to stay ahead of new competitors by expanding beyond trading into custody, derivatives, and stablecoins.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has decreased over the past day, while the stock market saw a mixed picture on its previous day of trading. By the closing time on Friday, the S&P 500 was down by 0.048%, the Nasdaq-100 increased by 0.42%, and the Dow Jones Industrial Average fell 0.59%. The stock market posted weekly gains ahead of the US Federal Reserve’s interest rate decision set for Wednesday.

- Is this drop sustainable?

The market has entered a consolidation phase, so the prices will likely move within a relatively tight range. There are likely more drops to be expected in the short term, with a possible rally in the mid-term.

The post Why Is Crypto Down Today? – September 15, 2025 appeared first on Cryptonews.

Why Is Crypto Down Today? – September 15, 2025

The crypto market is down today, with the cryptocurrency market capitalization dropping 0.4% to $4.15 trillion. Most of the top 100 coins have decreased over the past 24 hours. At the same time, the total crypto trading volume is at $130 billion.

Crypto Winners & Losers

At the time of writing, nine of the top 10 coins per market capitalization have decreased over the past 24 hours.

Bitcoin (BTC) appreciated 0.5% at the time of writing, currently trading at $116,309. This is the only increase in the category. The coin seems poised to decrease as well.

Ethereum (ETH) is down 0.6%, now trading at $4,642. It’s the third-best gainer in the category.

The highest decrease is 4.5% by Dogecoin (DOGE), currently standing at $0.2769.

It’s followed by Solana (SOL), which is down 2.2%, now trading at $241.

When it comes to the top 100 coins, of the 14 green coins, Monero (XMR) is up the most: 5.4% to the price of $303.

Flare (FLR) appreciated 4.9% to $0.02405, while the rest of the green coins are up 1% and less.

On the other side, Worldcoin (WLD)’s 8% drop to $1.59 is the highest in the category.

Pump.fun (PUMP) follows with a decrease of 6.7% to the price of $0.007828.

Meanwhile, Alex Thorn, head of firmwide research at Galaxy Digital, argued that the United States could soon launch its Strategic Bitcoin Reserve (SBR), potentially before the end of 2025. “The market seems to be completely underpricing the likelihood of such an announcement,” he noted.

‘The Bull Run’s Not Over’

Sean Dawson, head of research at onchain options platform Derive.xyz, argued that we haven’t reached the top of this cycle, despite growing speculation and the increased volatility in the coming weeks.

“While some are worried that ‘the music is about to stop,’ the reality is more nuanced,” he writes. “We may see volatility and consolidation in September, driven by fiscal year-end flows and some profit-taking among ETH DATs. But the structural backdrop – falling rates, institutional positioning, and bullish derivatives markets – suggests there’s still substantial upside ahead. This is likely not the cycle top.”

On average, BTC returns -2.9% in September. This is largely due to natural selling pressure around the US financial year-end, Dawson explains. “We’re already seeing signs of that pressure in the data. I’d argue we’re only halfway through what could be a very powerful Q4 rally.”

Meanwhile, options markets are showing sustained bullish sentiment, Dawson continues. For BTC, open interest is stacked around $140,000, $150,000, $160,000. and $200,000 strikes for the 26 December expiry. Call open interest outnumbers puts nearly 2.5 to 1 (64K vs. 26K). For ETH, there’s a broad spread of bullish strikes from $4,000 to $7,000.

“That positioning matters – option boards let us derive the market’s consensus probability of price outcomes,” Dawson writes. “And right now, they’re saying there’s a 40% chance ETH closes above $5,000 by year-end, and 20% chance it settles above $6,000. For BTC, the market gives a 37% probability of $125,000 or higher by the same time.”

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC trades at $116,309. The price moved from the intraday low of $114,915 to the high of $116,689, before slightly correcting to the current point.

Looking at the weekly prices, the range from $110,870 to $116,705, meaning that the coin is not far from the intraweek high.

The price has been moving to test the $117,500 level. Clearing that would potentially lead it to $119,500, followed by $122,200 and $124,500. However, as the market has turned red, if BTC falls below $114,800, it could move towards the $110,856 level, which is its critical structural floor.

Ethereum is currently trading at $4,548. It initially fell from the day’s high of $4,674 to the low of $4,581 before climbing back to the current level.

It’s 7-day range stands between $4,286 and $4,762. It’s currently up 8% in a week.

The nest support level currently stands at $4,425. On the other side, if the price takes $4,760, further resistance levels stand at $4,945 and $5,135.

Meanwhile, the crypto market sentiment has seen increased slightly over the past few days. The crypto fear and greed index moves between 50 and 53, standing at 51 today.

The sentiment overall remains bullish, even if investors are cautious, largely supported by fundamentals and technicals.

Moreover, the US BTC spot exchange-traded funds (ETFs) recorded another day of significant inflows on the last day of trading, 12 September, of $642.35 million. The cumulative net inflow has reached $56.83 billion.

Six of the 12 ETFs saw inflows, and there were no outflows. Fidelity and BlackRock saw the highest positive flows of $315.18 million and $264.71 million, respectively.

Additionally, the US ETH ETFs recorded inflows on Friday of $405.55 million. Five of the nine funds saw inflows, and one saw outflows. The total net inflow has reached $13.36 billion.

Of this, Fidelity saw the highest green amount of $168.23 million, followed by BlackRock’s $165.56 million. Seven funds recorded inflows, and there were no outflows.

Meanwhile, Pakistan has invited international crypto exchanges and virtual asset service providers to apply for licenses to operate under its newly formed regulatory authority. The Pakistan Virtual Assets Regulatory Authority (PVARA) was created under the Virtual Assets Ordinance 2025.

Speaking of exchanges, Coinbase is working to stay ahead of new competitors by expanding beyond trading into custody, derivatives, and stablecoins.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has decreased over the past day, while the stock market saw a mixed picture on its previous day of trading. By the closing time on Friday, the S&P 500 was down by 0.048%, the Nasdaq-100 increased by 0.42%, and the Dow Jones Industrial Average fell 0.59%. The stock market posted weekly gains ahead of the US Federal Reserve’s interest rate decision set for Wednesday.

- Is this drop sustainable?

The market has entered a consolidation phase, so the prices will likely move within a relatively tight range. There are likely more drops to be expected in the short term, with a possible rally in the mid-term.

The post Why Is Crypto Down Today? – September 15, 2025 appeared first on Cryptonews.

Pakistan is consulting with global regulators to build a “Pakistan-first” crypto framework, Crypto Council CEO

Pakistan is consulting with global regulators to build a “Pakistan-first” crypto framework, Crypto Council CEO