Here’s What’s Driving the Current Bitcoin (BTC) Correction, According to On-Chain Analyst Willy Woo

Popular on-chain analyst Willy Woo is breaking down the drivers powering the current Bitcoin (BTC) drawdown.

Woo tells his 1.1 million followers on the social media platform X that Bitcoin OGs, or early, long-term BTC holders, are heavily unloading their stacks.

The analyst shares a chart showing that BTC’s coin days destroyed metric is on a steep rise, suggesting that long-dormant coins are moving, possibly to crypto exchanges where they could be sold on the open market.

“First, let me tell you who is selling. The OGs. They are selling. They have more BTC than all the ETFs (exchange-traded funds) put together… 10x more. And they sell into every bull market. This pattern is as old as the Genesis block.”

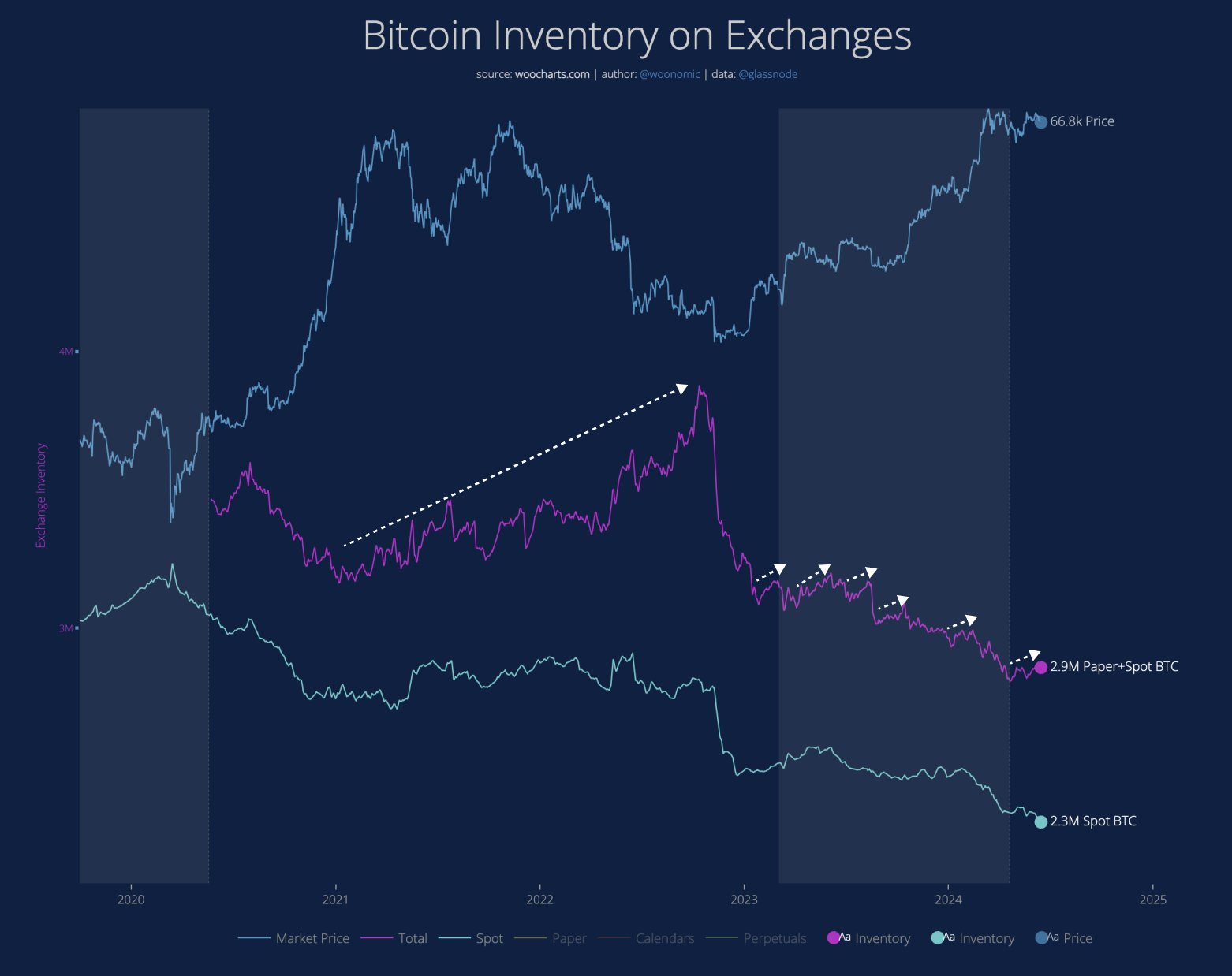

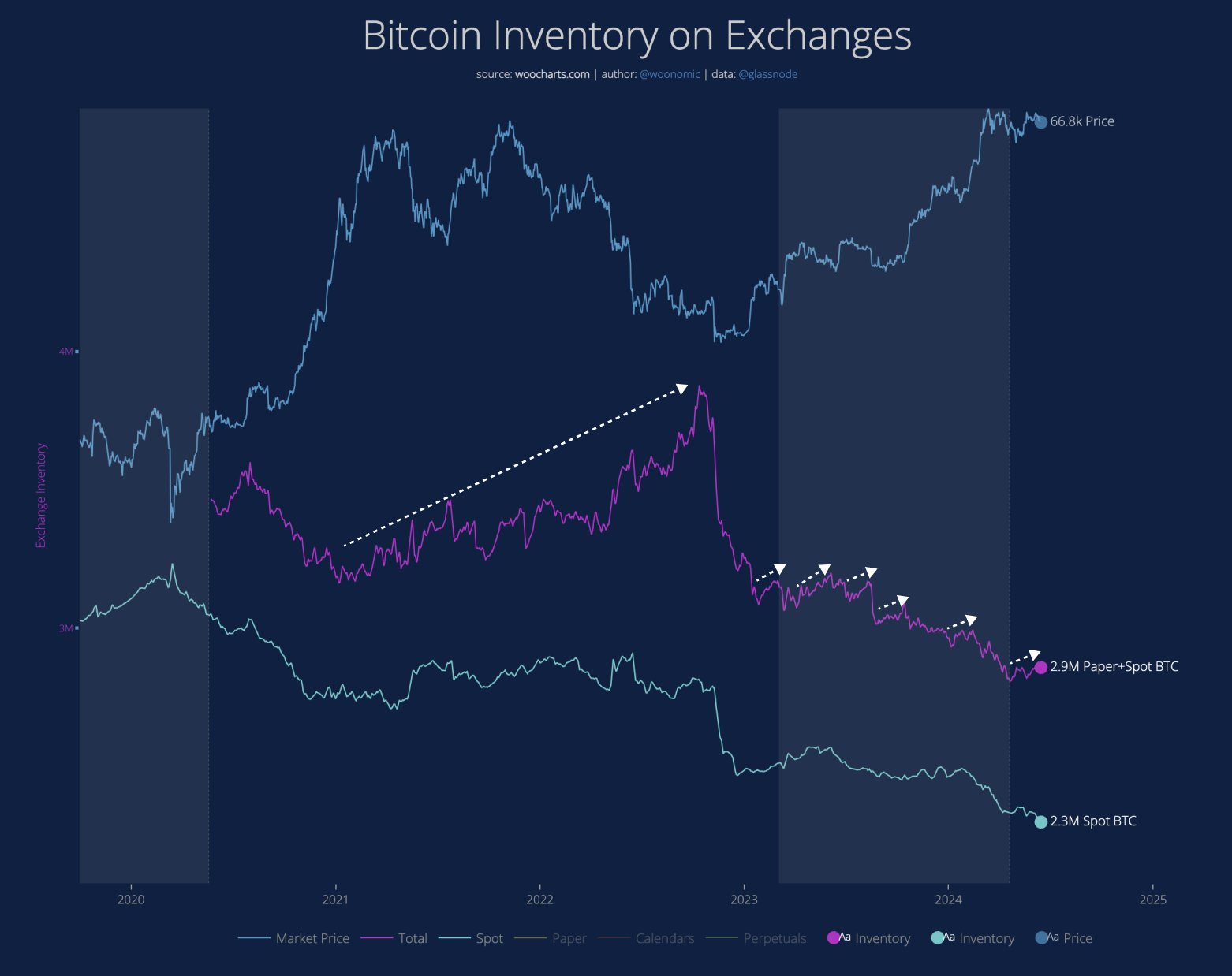

While long-term holders offload some of their Bitcoin, Woo says that the selling is being exacerbated by the futures markets or what he calls paper BTC.

“Paper BTC has flooded the market since 2017. Futures markets. If you wanted to buy BTC, it used to be you had to buy real BTC. You can now buy paper BTC. Thus a no-coiner can sell you that paper. Together you have made a synthetic BTC.

That would-be demand for BTC gets diverted to paper BTC, fulfilled by counter traders who have no BTC to sell, they just have USD to back their bet.

In the old days, BTC would go on an exponential run because the only sellers were a trickle from the OGs and an even smaller amount from miners with their newly mined coins. Today the magic of paper BTC is what you want to watch.”

Woo shares a chart showing that while the supply of spot market BTC has been on a long-term downtrend, the supply of paper BTC appears to be witnessing an uptick.

“The 2022 bear market was dictated by a flood of paper BTC when spot holders didn’t really sell. In this current bull, I have marked where paper increased, these were times when the price didn’t rally. We are in one of these right now.”

At time of writing, Bitcoin is worth $66,286.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Here’s What’s Driving the Current Bitcoin (BTC) Correction, According to On-Chain Analyst Willy Woo appeared first on The Daily Hodl.

Here’s What’s Driving the Current Bitcoin (BTC) Correction, According to On-Chain Analyst Willy Woo

Popular on-chain analyst Willy Woo is breaking down the drivers powering the current Bitcoin (BTC) drawdown.

Woo tells his 1.1 million followers on the social media platform X that Bitcoin OGs, or early, long-term BTC holders, are heavily unloading their stacks.

The analyst shares a chart showing that BTC’s coin days destroyed metric is on a steep rise, suggesting that long-dormant coins are moving, possibly to crypto exchanges where they could be sold on the open market.

“First, let me tell you who is selling. The OGs. They are selling. They have more BTC than all the ETFs (exchange-traded funds) put together… 10x more. And they sell into every bull market. This pattern is as old as the Genesis block.”

While long-term holders offload some of their Bitcoin, Woo says that the selling is being exacerbated by the futures markets or what he calls paper BTC.

“Paper BTC has flooded the market since 2017. Futures markets. If you wanted to buy BTC, it used to be you had to buy real BTC. You can now buy paper BTC. Thus a no-coiner can sell you that paper. Together you have made a synthetic BTC.

That would-be demand for BTC gets diverted to paper BTC, fulfilled by counter traders who have no BTC to sell, they just have USD to back their bet.

In the old days, BTC would go on an exponential run because the only sellers were a trickle from the OGs and an even smaller amount from miners with their newly mined coins. Today the magic of paper BTC is what you want to watch.”

Woo shares a chart showing that while the supply of spot market BTC has been on a long-term downtrend, the supply of paper BTC appears to be witnessing an uptick.

“The 2022 bear market was dictated by a flood of paper BTC when spot holders didn’t really sell. In this current bull, I have marked where paper increased, these were times when the price didn’t rally. We are in one of these right now.”

At time of writing, Bitcoin is worth $66,286.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Here’s What’s Driving the Current Bitcoin (BTC) Correction, According to On-Chain Analyst Willy Woo appeared first on The Daily Hodl.