SharpLink Gaming’s $400M Ethereum Play Signals Aggressive Push Into Crypto Treasury Dominance

- SharpLink Gaming announced a $400M institutional deal to expand ETH holdings, aiming for over $3B in value.

- Stock dipped 6.6% on the news but remains up nearly 190% in 2025 after aggressive ETH accumulation.

- Company has raised almost $1B in a week, holding 598,800 ETH as Ethereum trades near its highest level in years.

SharpLink Gaming, once known primarily as a sports betting marketing firm, has been making waves in the crypto space — and not in a small way. The company announced a $400 million deal with five institutional investors to bulk up its Ether (ETH) holdings, with expectations of exceeding $3 billion in value. Shares for this latest sale went for $21.76 each, and the deal was set to close the following day, pending final conditions.

This move cements SharpLink’s position as the second-largest public ETH holder, right behind BitMine Immersion Technologies. With Ethereum co-founder Joseph Lubin serving as chair, the firm has leaned heavily into the crypto treasury play, joining a growing list of companies raising significant capital for digital asset accumulation.

Stock Volatility Follows the News

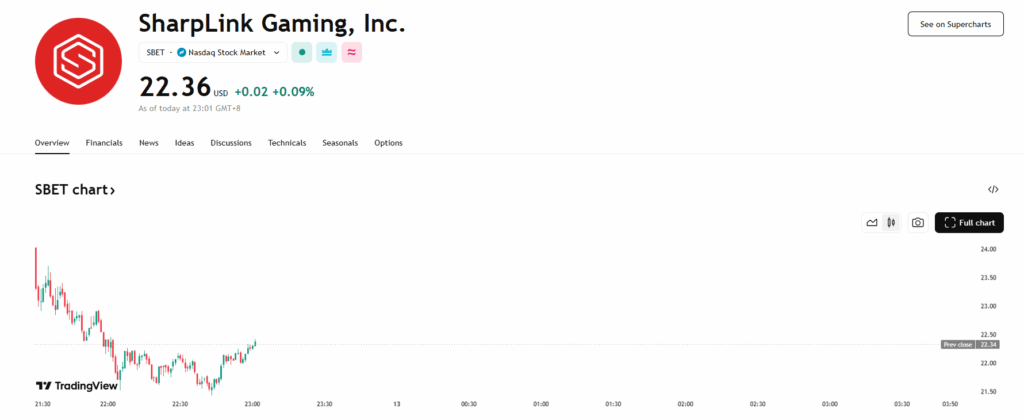

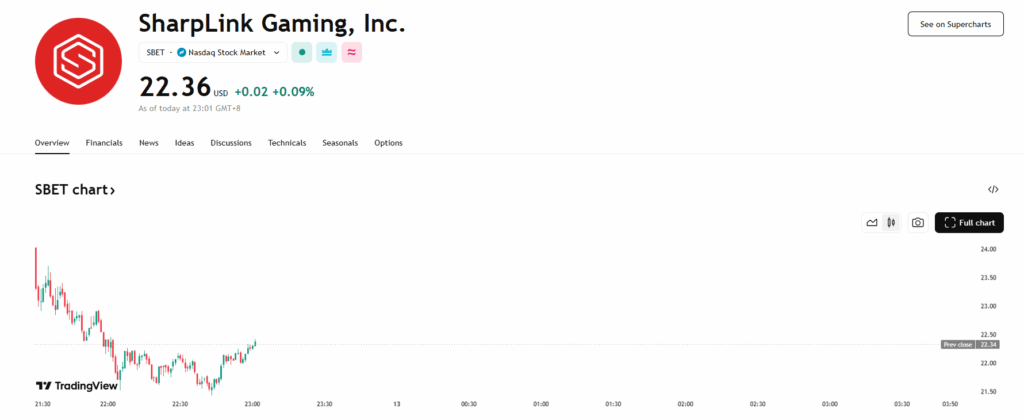

The market’s reaction was mixed. SharpLink’s stock (SBET) closed Monday down over 6.6% at $22.34, though it clawed back nearly 3.5% in after-hours trading to $23.10. This came after shares had climbed above $28 earlier in the day — a surge partly fueled by recent momentum. Despite the dip, SBET remains up 17.5% in just five trading days and a staggering 189% year-to-date, largely thanks to its ETH buying spree since May.

SharpLink’s trading history hasn’t been without drama. In mid-June, the company’s stock plummeted 73% in a single after-hours session after filing to potentially resell 58.7 million shares — prompting Lubin to publicly clarify it was routine procedure.

Nearly $1 Billion Raised in One Week

The $400 million raise wasn’t a standalone event. In fact, SharpLink has pulled in close to $900 million over the past week alone. This includes a $200 million deal announced just last Thursday and another $264.5 million from an earlier at-the-market offering on August 5. Co-CEO Joseph Chalom said the rapid capital influx “underscores the market’s confidence” in their ETH treasury strategy and Ethereum’s long-term potential.

Currently, SharpLink holds 598,800 ETH worth roughly $2.57 billion, with BitMine’s 1.15 million ETH ($5 billion) still ahead in the rankings. There’s also $200 million in fresh capital still waiting to be deployed.

Ethereum’s Price Adds Fuel

ETH itself has been on a tear, climbing from below $3,000 to over $4,300 in just the past month — a 44.5% gain. While it’s trading flat over the last 24 hours, it’s now only about 12% shy of its all-time high of $4,878 from November 2021. This resurgence has only added more weight to SharpLink’s bullish strategy.

The post SharpLink Gaming’s $400M Ethereum Play Signals Aggressive Push Into Crypto Treasury Dominance first appeared on BlockNews.

SharpLink Gaming’s $400M Ethereum Play Signals Aggressive Push Into Crypto Treasury Dominance

- SharpLink Gaming announced a $400M institutional deal to expand ETH holdings, aiming for over $3B in value.

- Stock dipped 6.6% on the news but remains up nearly 190% in 2025 after aggressive ETH accumulation.

- Company has raised almost $1B in a week, holding 598,800 ETH as Ethereum trades near its highest level in years.

SharpLink Gaming, once known primarily as a sports betting marketing firm, has been making waves in the crypto space — and not in a small way. The company announced a $400 million deal with five institutional investors to bulk up its Ether (ETH) holdings, with expectations of exceeding $3 billion in value. Shares for this latest sale went for $21.76 each, and the deal was set to close the following day, pending final conditions.

This move cements SharpLink’s position as the second-largest public ETH holder, right behind BitMine Immersion Technologies. With Ethereum co-founder Joseph Lubin serving as chair, the firm has leaned heavily into the crypto treasury play, joining a growing list of companies raising significant capital for digital asset accumulation.

Stock Volatility Follows the News

The market’s reaction was mixed. SharpLink’s stock (SBET) closed Monday down over 6.6% at $22.34, though it clawed back nearly 3.5% in after-hours trading to $23.10. This came after shares had climbed above $28 earlier in the day — a surge partly fueled by recent momentum. Despite the dip, SBET remains up 17.5% in just five trading days and a staggering 189% year-to-date, largely thanks to its ETH buying spree since May.

SharpLink’s trading history hasn’t been without drama. In mid-June, the company’s stock plummeted 73% in a single after-hours session after filing to potentially resell 58.7 million shares — prompting Lubin to publicly clarify it was routine procedure.

Nearly $1 Billion Raised in One Week

The $400 million raise wasn’t a standalone event. In fact, SharpLink has pulled in close to $900 million over the past week alone. This includes a $200 million deal announced just last Thursday and another $264.5 million from an earlier at-the-market offering on August 5. Co-CEO Joseph Chalom said the rapid capital influx “underscores the market’s confidence” in their ETH treasury strategy and Ethereum’s long-term potential.

Currently, SharpLink holds 598,800 ETH worth roughly $2.57 billion, with BitMine’s 1.15 million ETH ($5 billion) still ahead in the rankings. There’s also $200 million in fresh capital still waiting to be deployed.

Ethereum’s Price Adds Fuel

ETH itself has been on a tear, climbing from below $3,000 to over $4,300 in just the past month — a 44.5% gain. While it’s trading flat over the last 24 hours, it’s now only about 12% shy of its all-time high of $4,878 from November 2021. This resurgence has only added more weight to SharpLink’s bullish strategy.

The post SharpLink Gaming’s $400M Ethereum Play Signals Aggressive Push Into Crypto Treasury Dominance first appeared on BlockNews.