Hyperliquid’s fully onchain liquidations cannot be compared with underreported CEX liquidations Hyperliquid is a blockchain where every order, trade, and liquidation happens onchain. Anyone can permissionlessly verify the chain’s execution, including all liquidations and their

HYPE jumps 10% as founder slams Binance for hidden liquidations

Digital assets are regaining momentum after last week’s sudden crash, which saw crypto facing nearly $20 billion in liquidations.

Meanwhile, experts and analysts likely spent the weekend exploring what triggered the largest flash crash in the asset class’s history.

Meanwhile, Hyperliquid founder Jeff has joined those attacking Binance for its role in the massive October 10 slide.

Jeff took it to X to publicly accuse Binance of hiding the scale of liquidation, warning that centralized exchanges are undermining the integrity of the whole cryptocurrency industry.

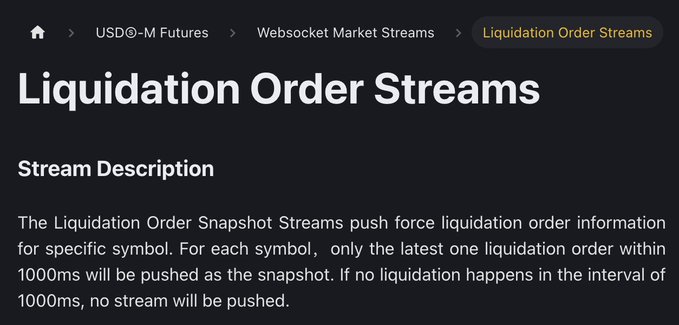

He believes Binance’s reporting approach could mean 100x underreporting during intensified trading periods.

Indeed, markets suffer enormous liquidations during wild swings.

Thus, closing multiple positions in a second and only recording one can paint a distorted picture of the market for analysts and traders.

According to Jeff, such narratives undermine trust in a sector that thrives on neutrality and transparency. He said:

On Binance, even if there are thousands of liquidation orders in the same second, only one is reported. Because liquidations happen in bursts, this could easily be 100x underreporting under some conditions.

These claims come as the cryptocurrency community debates whether they can trust data from top exchanges, especially when billions vanish during sudden dips.

Some believe Binance manipulated the market, and it’s responsible for the current market weakness.

Others are questioning why the native token BNB remained stable amid relentless dips.

Decentralized exchanges are experiencing optimism as industry players rally against CEXs.

Hyperliquid’s coin HYPE has rebounded from $36 to $40 over the previous day, an 11% jump.

It has cooled to $38 at press time, with dwindling trading volumes signaling prevailing weakness.

Nevertheless, caution remains paramount as the ongoing market revival could be a dead cat bounce.

Hyperliquid’s transparency model

Jeff highlighted how Hyperliquid differs from CEX. Unlike traditional exchanges, the DEX runs fully on-chain.

All liquidations, orders, and trades happen on the blockchain, allowing anyone to view them anytime.

With such a mode, users can verify individual transactions and the fairness and solvency of the whole market in real time.

The founder anticipates an industry that prioritizes fairness, openness, and verifiability as digital assets integrate with the global financial sector.

Hopefully, the industry will see transparency and neutrality as important features of the new financial system, and others will follow.

A glimpse of the latest crypto crash: what happened?

While headlines attributed the massive dips to Trump’s 100% tariffs on China, analysts emphasize that Binance was the real perpetrator.

They discovered that a recognized market maker sent $700 million to Binance hours before the bloodbath.

Meanwhile, the exchange’s order books started hollowing out, with zero bids, no depth, and no walls. That created a setup for free falls.

Notably, BTC’s 1-minute candlesticks revealed massive Bitcoin dumps within minutes.

Nonetheless, liquidation pressure surged to terminal velocity when Bitcoin crashed to $108,000.

Reports suggest Binance’s market maker withdrew liquidity and stopped defending price declines.

That catalyzed the market slump that unexpectedly vaporized billions.

Binance has offered $283 million to compensate victims of forced liquidation in the latest flash crash.

The post HYPE jumps 10% as founder slams Binance for hidden liquidations appeared first on Invezz

Read More

CAKE soars 25% as PancakeSwap announces $750 Prediction Season rewards

HYPE jumps 10% as founder slams Binance for hidden liquidations

Digital assets are regaining momentum after last week’s sudden crash, which saw crypto facing nearly $20 billion in liquidations.

Meanwhile, experts and analysts likely spent the weekend exploring what triggered the largest flash crash in the asset class’s history.

Meanwhile, Hyperliquid founder Jeff has joined those attacking Binance for its role in the massive October 10 slide.

Jeff took it to X to publicly accuse Binance of hiding the scale of liquidation, warning that centralized exchanges are undermining the integrity of the whole cryptocurrency industry.

Hyperliquid’s fully onchain liquidations cannot be compared with underreported CEX liquidations Hyperliquid is a blockchain where every order, trade, and liquidation happens onchain. Anyone can permissionlessly verify the chain’s execution, including all liquidations and their

He believes Binance’s reporting approach could mean 100x underreporting during intensified trading periods.

Indeed, markets suffer enormous liquidations during wild swings.

Thus, closing multiple positions in a second and only recording one can paint a distorted picture of the market for analysts and traders.

According to Jeff, such narratives undermine trust in a sector that thrives on neutrality and transparency. He said:

On Binance, even if there are thousands of liquidation orders in the same second, only one is reported. Because liquidations happen in bursts, this could easily be 100x underreporting under some conditions.

These claims come as the cryptocurrency community debates whether they can trust data from top exchanges, especially when billions vanish during sudden dips.

Some believe Binance manipulated the market, and it’s responsible for the current market weakness.

Others are questioning why the native token BNB remained stable amid relentless dips.

Decentralized exchanges are experiencing optimism as industry players rally against CEXs.

Hyperliquid’s coin HYPE has rebounded from $36 to $40 over the previous day, an 11% jump.

It has cooled to $38 at press time, with dwindling trading volumes signaling prevailing weakness.

Nevertheless, caution remains paramount as the ongoing market revival could be a dead cat bounce.

Hyperliquid’s transparency model

Jeff highlighted how Hyperliquid differs from CEX. Unlike traditional exchanges, the DEX runs fully on-chain.

All liquidations, orders, and trades happen on the blockchain, allowing anyone to view them anytime.

With such a mode, users can verify individual transactions and the fairness and solvency of the whole market in real time.

The founder anticipates an industry that prioritizes fairness, openness, and verifiability as digital assets integrate with the global financial sector.

Hopefully, the industry will see transparency and neutrality as important features of the new financial system, and others will follow.

A glimpse of the latest crypto crash: what happened?

While headlines attributed the massive dips to Trump’s 100% tariffs on China, analysts emphasize that Binance was the real perpetrator.

They discovered that a recognized market maker sent $700 million to Binance hours before the bloodbath.

Meanwhile, the exchange’s order books started hollowing out, with zero bids, no depth, and no walls. That created a setup for free falls.

Notably, BTC’s 1-minute candlesticks revealed massive Bitcoin dumps within minutes.

Nonetheless, liquidation pressure surged to terminal velocity when Bitcoin crashed to $108,000.

Reports suggest Binance’s market maker withdrew liquidity and stopped defending price declines.

That catalyzed the market slump that unexpectedly vaporized billions.

Binance has offered $283 million to compensate victims of forced liquidation in the latest flash crash.

The post HYPE jumps 10% as founder slams Binance for hidden liquidations appeared first on Invezz

Read More