Solana Price Prediction: SOL Staking Deposits Cross $730M as VanEck Lists SOL ETF on DTCC

Solana traded as low as $143 on Wednesday June 18, on course to register a third consecutive day in decline. Amid a 9% price dip, on-chain metrics show that Solana’s key stakeholders are positioning for long-term recovery rather than join the sell-off.

Solana Price Consolidates Above $145 as VanEck Lists SOL ETF on DTCC

Solana SOL $147.6 24h volatility: 0.2% Market cap: $77.91 B Vol. 24h: $4.16 B price continues its underwhelming weekly timeframe performance on Wednesday, trading as low as $143 on Binance. However, the 4th ranked cryptocurrency rebounded above $145 as US trading opened as recent developments surrounding SOL ETFs boosted market sentiment.

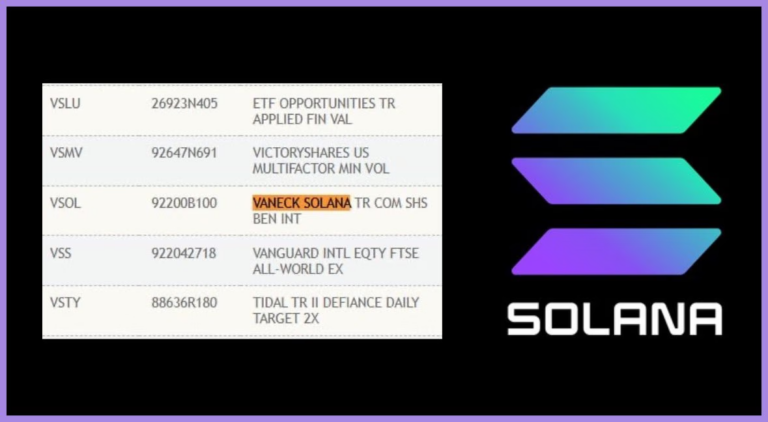

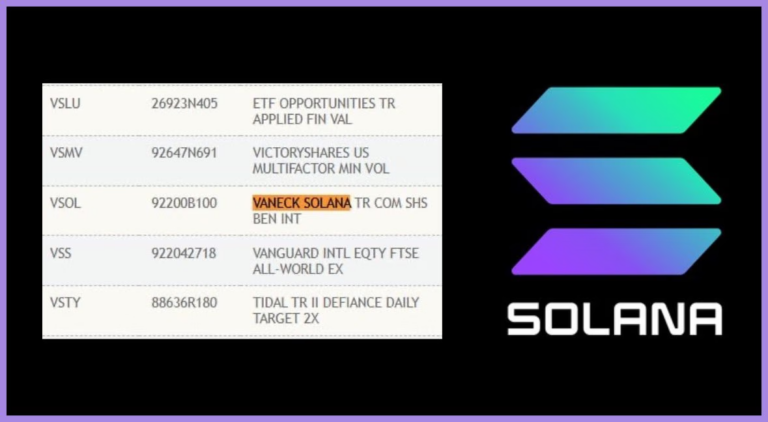

Solana ETFs Active and Pre Launch Source: DTCC

According to DTCC data, the US-based asset manager has now listed SOL ETF on the Depository Trust & Clearing Corporation (DTTC), a financial market infrastructure company that provides clearing, settlement services for derivatives assets.

Following the US SEC’s recent decision to extend ongoing altcoin ETF review timelines till H2 2025, DTCC has now listed Vaneck’s Solana ETF (VSOL) under its “active and pre-launch” securities.

While the DTCC listing does not constitute regulatory clearance, Solana’s mild price rebound above $145 at press time on Wednesday signals mild-positive impact as global altcoin markets remain subdued under rising geopolitical tensions.

Geopolitical Crisis Triggers $730M SOL Staking Inflows

Further emphasizing Solana’s rebound prospects, key stakeholders within the ecosystem appear hesitant to sell despite the underwhelming 9% price dip recorded in the past week.

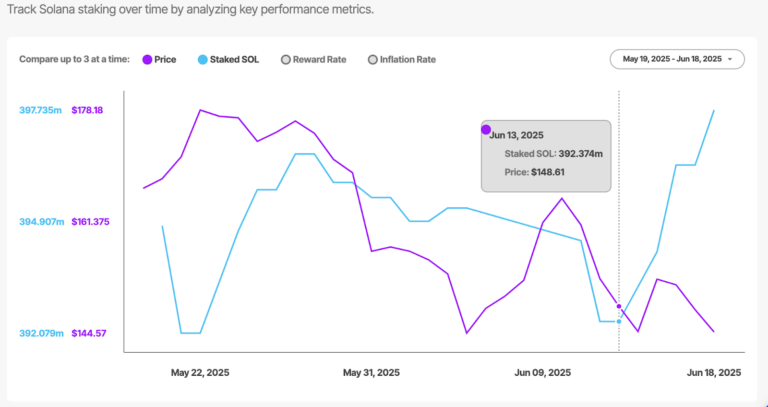

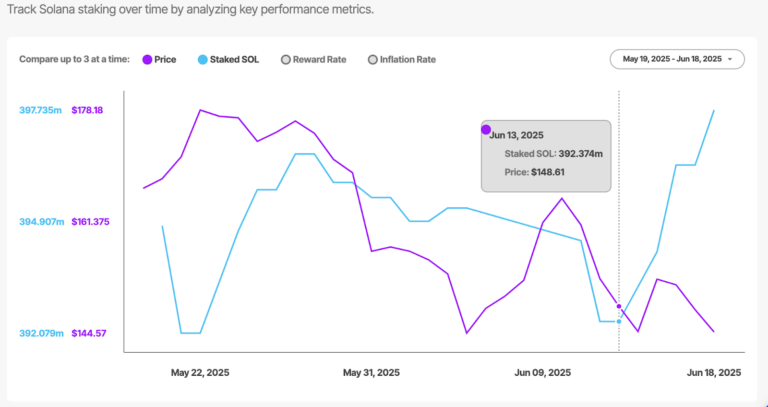

Confirming this narrative, live data from StakingRewards, shows persistent deposits into Solana’s Proof-of-Stake contracts since the geopolitical crisis between Israel and Iran escalated on June 13.

Solana Staking Deposit, June 2025 | Source: StakingRewards

As depicted above, total staking deposits stood at 392.4 million SOL as on June 13. Since then, that figure has now climbed to 397.7 million SOL at the time of publication on June 18.

Effectively, Solana’s key stakeholders have deposited over 5.3 million SOL, valued at approximately $730 million at current prices.

For any Proof-of-Stake network, increased staking during a market-wide downswing can be interpreted as an early rebound signal for two key reasons.

First, it reflects rising investor confidence in the network’s long-term value despite short-term losses. Second, staking deposits effectively reduce circulating supply, which can intensify upward pressure when demand returns.

Combined, these factors suggest SOL price may be gearing up for a bullish pivot in the coming trading sessions.

Solana Price Forecast: ETF News Fails to Avert $140 Breakdown Risks

Solana (SOL) slumped below $145 on Wednesday, June 18, marking a 9% decline over three consecutive red candles. Solana’s short-term price forecast signals still lean predominantly bearish despite the positive macro signals from VanEck’s SOL ETF listing on the DTCC and $730 million Solana staking inflows amid Middle East tensions.

Solana (SOL) Daily Chart | Source TradingView

The daily chart shows SOL trading below the Bollinger Bands mid-line ($153), while failing to hold the lower band at $141.76 suggests continued bearish pressure. RSI at 40.85 signals weak momentum with room for further declines before reaching oversold conditions.

If bears maintain dominance, multi-day closes below $140 could trigger a deeper breakdown towards the $130 level, especially if trading volume continues to rise on red candles.

Conversely, SOL price must reclaim $153 and flip it into support for bulls to regain footing. A breakout above $164.23 (upper BB) would signal trend reversal and re-attract buyers. Until then, strategic traders remain cautious of short-term volatility despite bullish longer-term catalysts.

As Solana Struggles for Support, Best Wallet ($BEST) Steals the Spotlight

While SOL dips below $145 amid sustained selling pressure and geopolitical market uncertainty, investors are shifting focus toward utility-driven presale tokens like Best Wallet ($BEST).

Best Wallet Presale

Best Wallet is a next-generation non-custodial wallet designed to revolutionize how users interact with decentralized finance. It offers seamless access to Web3 tools, reduced transaction fees, and exclusive early access to new crypto projects, all powered by the $BEST token.

Currently priced at $0.025205, the $BEST presale has already raised over $13.4 million. Token holders can also enjoy boosted staking rewards through the in-app aggregator.

To join the presale, head to the official Best Wallet site and connect a supported wallet — or buy directly in-app for a frictionless onboarding experience.

The post Solana Price Prediction: SOL Staking Deposits Cross $730M as VanEck Lists SOL ETF on DTCC appeared first on Coinspeaker.

Solana Price Prediction: SOL Staking Deposits Cross $730M as VanEck Lists SOL ETF on DTCC

Solana traded as low as $143 on Wednesday June 18, on course to register a third consecutive day in decline. Amid a 9% price dip, on-chain metrics show that Solana’s key stakeholders are positioning for long-term recovery rather than join the sell-off.

Solana Price Consolidates Above $145 as VanEck Lists SOL ETF on DTCC

Solana SOL $147.6 24h volatility: 0.2% Market cap: $77.91 B Vol. 24h: $4.16 B price continues its underwhelming weekly timeframe performance on Wednesday, trading as low as $143 on Binance. However, the 4th ranked cryptocurrency rebounded above $145 as US trading opened as recent developments surrounding SOL ETFs boosted market sentiment.

Solana ETFs Active and Pre Launch Source: DTCC

According to DTCC data, the US-based asset manager has now listed SOL ETF on the Depository Trust & Clearing Corporation (DTTC), a financial market infrastructure company that provides clearing, settlement services for derivatives assets.

Following the US SEC’s recent decision to extend ongoing altcoin ETF review timelines till H2 2025, DTCC has now listed Vaneck’s Solana ETF (VSOL) under its “active and pre-launch” securities.

While the DTCC listing does not constitute regulatory clearance, Solana’s mild price rebound above $145 at press time on Wednesday signals mild-positive impact as global altcoin markets remain subdued under rising geopolitical tensions.

Geopolitical Crisis Triggers $730M SOL Staking Inflows

Further emphasizing Solana’s rebound prospects, key stakeholders within the ecosystem appear hesitant to sell despite the underwhelming 9% price dip recorded in the past week.

Confirming this narrative, live data from StakingRewards, shows persistent deposits into Solana’s Proof-of-Stake contracts since the geopolitical crisis between Israel and Iran escalated on June 13.

Solana Staking Deposit, June 2025 | Source: StakingRewards

As depicted above, total staking deposits stood at 392.4 million SOL as on June 13. Since then, that figure has now climbed to 397.7 million SOL at the time of publication on June 18.

Effectively, Solana’s key stakeholders have deposited over 5.3 million SOL, valued at approximately $730 million at current prices.

For any Proof-of-Stake network, increased staking during a market-wide downswing can be interpreted as an early rebound signal for two key reasons.

First, it reflects rising investor confidence in the network’s long-term value despite short-term losses. Second, staking deposits effectively reduce circulating supply, which can intensify upward pressure when demand returns.

Combined, these factors suggest SOL price may be gearing up for a bullish pivot in the coming trading sessions.

Solana Price Forecast: ETF News Fails to Avert $140 Breakdown Risks

Solana (SOL) slumped below $145 on Wednesday, June 18, marking a 9% decline over three consecutive red candles. Solana’s short-term price forecast signals still lean predominantly bearish despite the positive macro signals from VanEck’s SOL ETF listing on the DTCC and $730 million Solana staking inflows amid Middle East tensions.

Solana (SOL) Daily Chart | Source TradingView

The daily chart shows SOL trading below the Bollinger Bands mid-line ($153), while failing to hold the lower band at $141.76 suggests continued bearish pressure. RSI at 40.85 signals weak momentum with room for further declines before reaching oversold conditions.

If bears maintain dominance, multi-day closes below $140 could trigger a deeper breakdown towards the $130 level, especially if trading volume continues to rise on red candles.

Conversely, SOL price must reclaim $153 and flip it into support for bulls to regain footing. A breakout above $164.23 (upper BB) would signal trend reversal and re-attract buyers. Until then, strategic traders remain cautious of short-term volatility despite bullish longer-term catalysts.

As Solana Struggles for Support, Best Wallet ($BEST) Steals the Spotlight

While SOL dips below $145 amid sustained selling pressure and geopolitical market uncertainty, investors are shifting focus toward utility-driven presale tokens like Best Wallet ($BEST).

Best Wallet Presale

Best Wallet is a next-generation non-custodial wallet designed to revolutionize how users interact with decentralized finance. It offers seamless access to Web3 tools, reduced transaction fees, and exclusive early access to new crypto projects, all powered by the $BEST token.

Currently priced at $0.025205, the $BEST presale has already raised over $13.4 million. Token holders can also enjoy boosted staking rewards through the in-app aggregator.

To join the presale, head to the official Best Wallet site and connect a supported wallet — or buy directly in-app for a frictionless onboarding experience.

The post Solana Price Prediction: SOL Staking Deposits Cross $730M as VanEck Lists SOL ETF on DTCC appeared first on Coinspeaker.