Chainalysis Flags $75B in Illicit Crypto as Governments Eye Strategic Reserves

Blockchain analytics firm Chainalysis says more than $75 billion in illicit crypto sits untouched across public blockchains.

According to the firm’s latest report, criminal-linked wallets currently hold nearly $15 billion in digital assets, with another $60 billion in wallets connected indirectly to scams, hacks, or darknet markets.

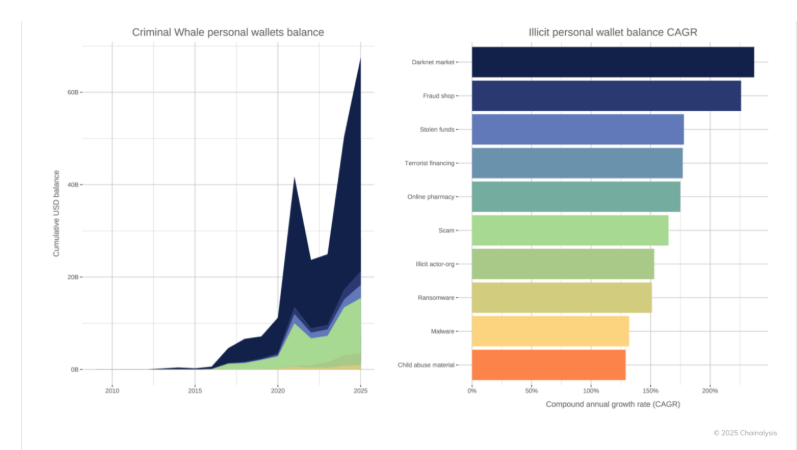

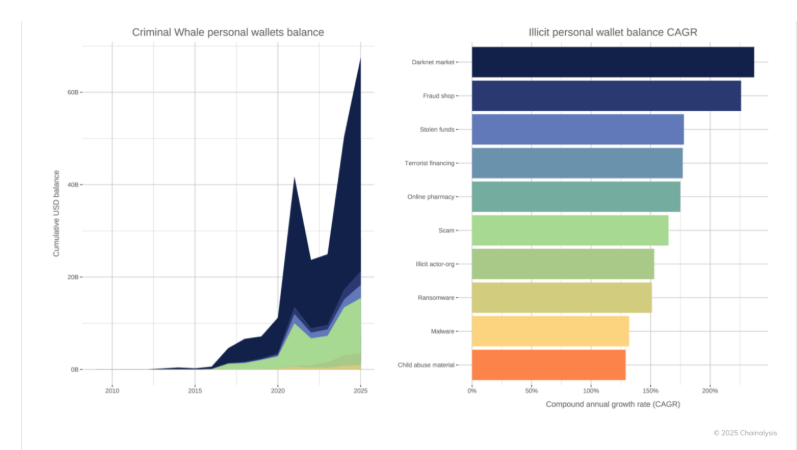

Criminal wallet balances | Source: Chainalysis

Chainalysis also found darknet administrators alone control over $46 billion in crypto, accounting for the bulk of the shadow economy.

While Bitcoin BTC $120 374 24h volatility: 2.2% Market cap: $2.40 T Vol. 24h: $68.05 B remains the dominant asset held by illicit actors by value, Ethereum ETH $4 294 24h volatility: 4.5% Market cap: $518.38 B Vol. 24h: $43.32 B and stablecoin balances have grown rapidly due to their rising adoption and relative price stability.

Governments Could Target Illicit Crypto For Strategic Reserves

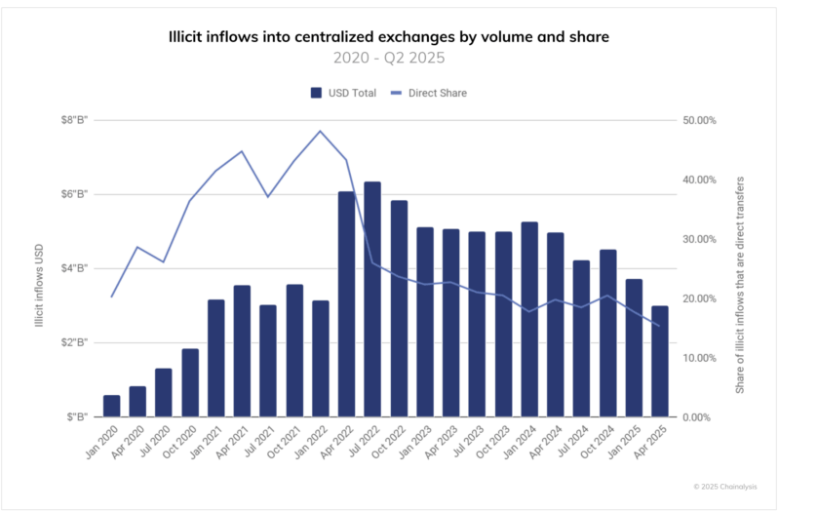

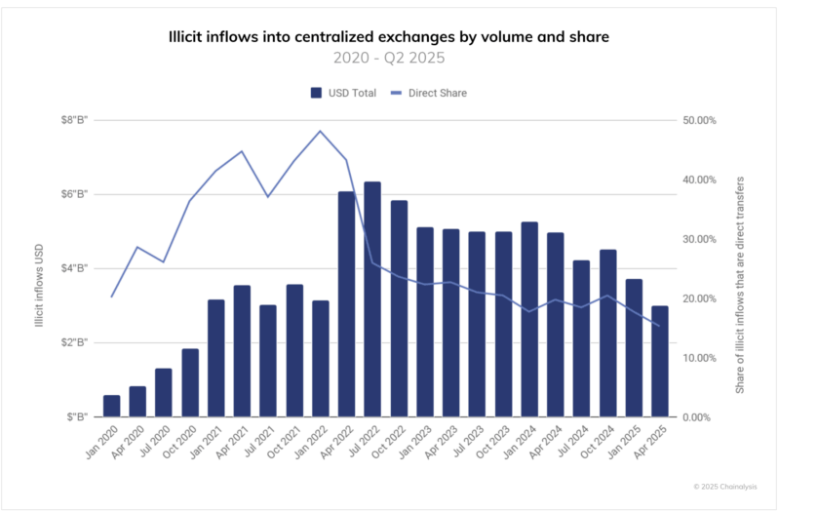

Chainalysis data shows inflows from illicit sources to centralized crypto exchanges (CEXs) have averaged $14 billion annually since 2020 but are trending downward. In the first half of 2025 alone, about $7 billion in illegal crypto funds hit exchanges, a sharp decline from 2022 levels.

Illicit Fund Flows on Centralized Exchanges | Source: Chainalysis

The report attributes this to criminals increasingly using crypto as a payment method and store of value, avoiding fiat conversion. Direct transfers to exchanges have plummeted from 40% in July 2022 to 15% in 2025, as illicit actors turn to crypto mixers and cross-chain bridges.

Stablecoins, which can be frozen by issuers, are the least concentrated, as criminals diversify holdings to avoid total losses from asset freezes.

Trump issued executive orders to establish the US Strategic Bitcoin Reserve (SBR) and Digital Asset Stockpile (DAS), creating frameworks for the government to confiscate and manage seized crypto funds.

With sovereign nations like El Salvador and Bhutan officially adopting crypto reserves in recent years, Chainalysis argues that coordinated seizures of illicit crypto could strengthen the national treasury.

The firm has already helped global authorities including Spain and the US seize $12.6 billion in illegal funds through forensic investigations.

Maxi Doge Presale Nears $3M as Chainalysis Investigates Illicit Actors

As Chainalysis investigations aid governments to clamp down on illicit actors, improved market sentiment has seen traders rotate toward early-stage projects like Maxi Doge (MAXI), a meme-driven ecosystem offering traders up to 1000% in leverage.

Maxi Doge Presale

The Maxi Doge presale has raised over $2.7 million of its $3 million target, underscoring strong retail demand ahead of its official launch. Currently priced at $0.00026, early investors can still secure MAXI tokens via the official presale website before the next price tier activates in 48 hours.

The post Chainalysis Flags $75B in Illicit Crypto as Governments Eye Strategic Reserves appeared first on Coinspeaker.

Chainalysis Flags $75B in Illicit Crypto as Governments Eye Strategic Reserves

Blockchain analytics firm Chainalysis says more than $75 billion in illicit crypto sits untouched across public blockchains.

According to the firm’s latest report, criminal-linked wallets currently hold nearly $15 billion in digital assets, with another $60 billion in wallets connected indirectly to scams, hacks, or darknet markets.

Criminal wallet balances | Source: Chainalysis

Chainalysis also found darknet administrators alone control over $46 billion in crypto, accounting for the bulk of the shadow economy.

While Bitcoin BTC $120 374 24h volatility: 2.2% Market cap: $2.40 T Vol. 24h: $68.05 B remains the dominant asset held by illicit actors by value, Ethereum ETH $4 294 24h volatility: 4.5% Market cap: $518.38 B Vol. 24h: $43.32 B and stablecoin balances have grown rapidly due to their rising adoption and relative price stability.

Governments Could Target Illicit Crypto For Strategic Reserves

Chainalysis data shows inflows from illicit sources to centralized crypto exchanges (CEXs) have averaged $14 billion annually since 2020 but are trending downward. In the first half of 2025 alone, about $7 billion in illegal crypto funds hit exchanges, a sharp decline from 2022 levels.

Illicit Fund Flows on Centralized Exchanges | Source: Chainalysis

The report attributes this to criminals increasingly using crypto as a payment method and store of value, avoiding fiat conversion. Direct transfers to exchanges have plummeted from 40% in July 2022 to 15% in 2025, as illicit actors turn to crypto mixers and cross-chain bridges.

Stablecoins, which can be frozen by issuers, are the least concentrated, as criminals diversify holdings to avoid total losses from asset freezes.

Trump issued executive orders to establish the US Strategic Bitcoin Reserve (SBR) and Digital Asset Stockpile (DAS), creating frameworks for the government to confiscate and manage seized crypto funds.

With sovereign nations like El Salvador and Bhutan officially adopting crypto reserves in recent years, Chainalysis argues that coordinated seizures of illicit crypto could strengthen the national treasury.

The firm has already helped global authorities including Spain and the US seize $12.6 billion in illegal funds through forensic investigations.

Maxi Doge Presale Nears $3M as Chainalysis Investigates Illicit Actors

As Chainalysis investigations aid governments to clamp down on illicit actors, improved market sentiment has seen traders rotate toward early-stage projects like Maxi Doge (MAXI), a meme-driven ecosystem offering traders up to 1000% in leverage.

Maxi Doge Presale

The Maxi Doge presale has raised over $2.7 million of its $3 million target, underscoring strong retail demand ahead of its official launch. Currently priced at $0.00026, early investors can still secure MAXI tokens via the official presale website before the next price tier activates in 48 hours.

The post Chainalysis Flags $75B in Illicit Crypto as Governments Eye Strategic Reserves appeared first on Coinspeaker.