$35B Stablecoin Surge as USD Collapses in Egypt, Nigeria, Argentina

Share:

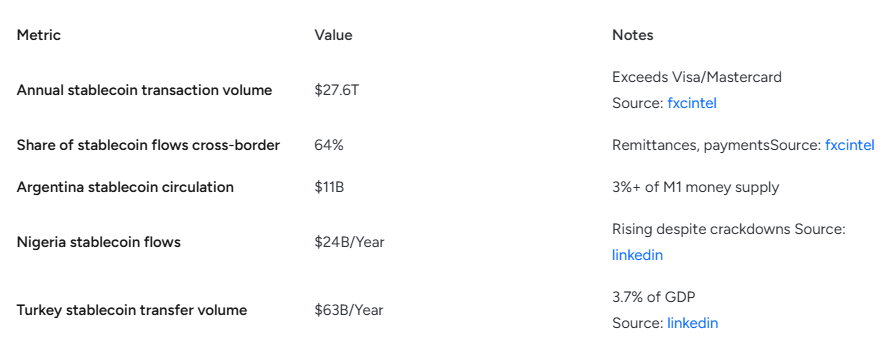

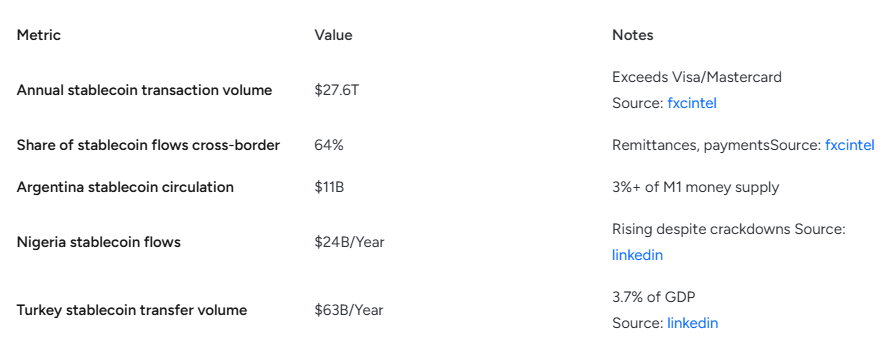

Stablecoin’s adoption surge has actually reached over $35 billion in transaction volumes right now as USD crises are devastating Egypt, Nigeria, and Argentina. Citizens across these nations have been turning to digital dollars to escape the hyperinflation and currency devaluation that’s taking place.

The USD crisis in Egypt and USD crisis in Nigeria have been pushed forward as local currencies lose their purchasing powerful and Argentina stablecoins adoption has now reached figures close to 3% of the entire M1 money supply. Emerging markets crypto solutions are substituting traditional banking because financial systems are seeing some complete transitions due to he high take-up of stablecoins.

How Stablecoin Adoption Surge Solves USD Crisis in Egypt, Nigeria & Argentina

Argentina’s $11B Digital Economy Actually Growing

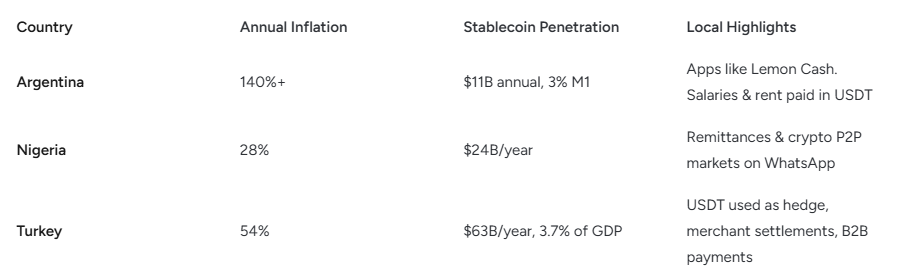

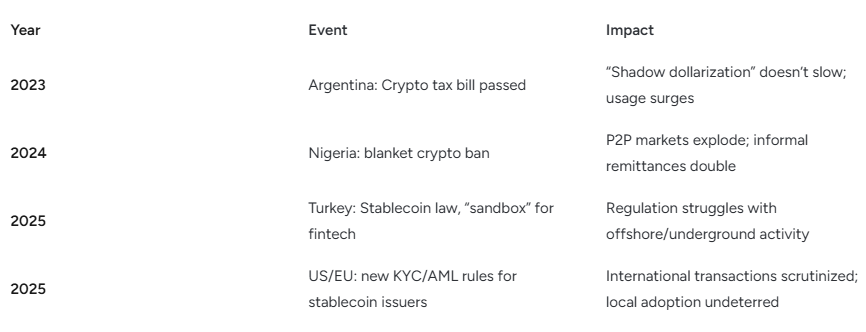

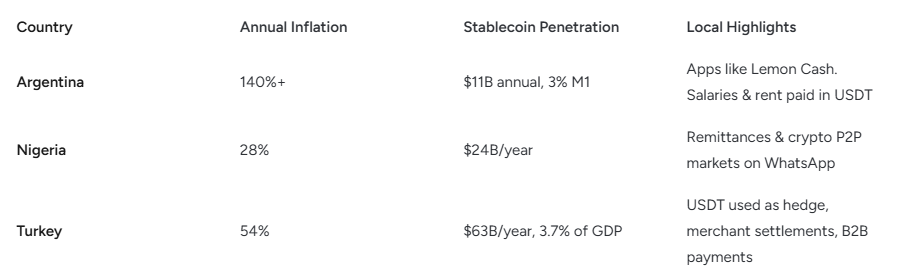

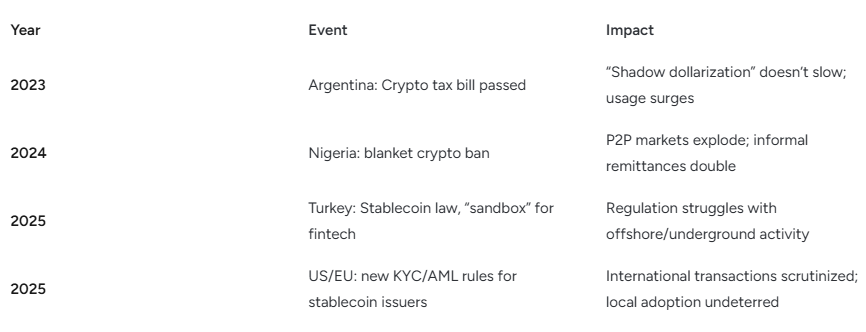

Argentina is facing 140% inflation right now while stablecoin adoption surge reaches $11 billion annually. Citizens have been using apps like Lemon Cash for salaries and even rent payments in USDT. Argentina’s stablecoin adoption has grown despite regulatory pressure that’s been imposed, with the USD crisis in Egypt and similar situations driving demand for stable value storage.

Nigeria’s $24B Underground Market Thrives

Nigeria actually processes $24 billion in stablecoin flows yearly despite government bans that were implemented. The USD crisis of Nigeria has intensified as the naira weakened significantly, pushing citizens toward WhatsApp P2P markets. These emerging markets crypto solutions like remittances have doubled as traditional systems are failing people.

Also Read: Bitget Launches First-Ever RWA Index Perpetuals – Trade TSLA & NVDA

Turkey’s Growing 3.7% GDP Share Right Now

Turkey’s stablecoin transfers have hit $63 billion annually, which represents 3.7% of GDP. USDT serves as the primary hedge against lira devaluation that’s been happening. The stablecoin adoption surge mirrors the USD crisis of Egypt and also the USD crisis in Nigeria patterns, with merchants accepting digital dollars for B2B payments and transactions.

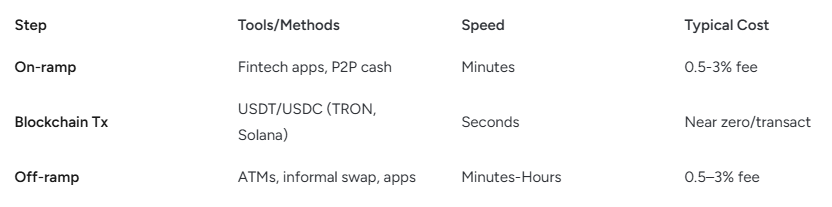

Technical Infrastructure Being Used

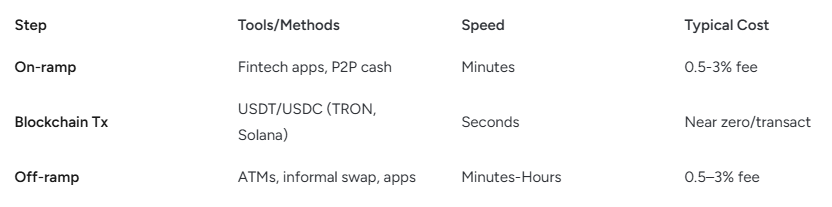

This stablecoin adoption surge relies on multiple access points that have been developed. On-ramp services charge 0.5-3% fees with minute-long processing times. Blockchain transactions complete in seconds at near-zero cost actually. Argentina’s stablecoin adoption and emerging markets crypto solutions benefit from this efficient infrastructure that’s available instantly.

Also Read: US DOJ Says It Won’t Target Decentralized Crypto Platforms Devs

Market Leaders and Usage Patterns

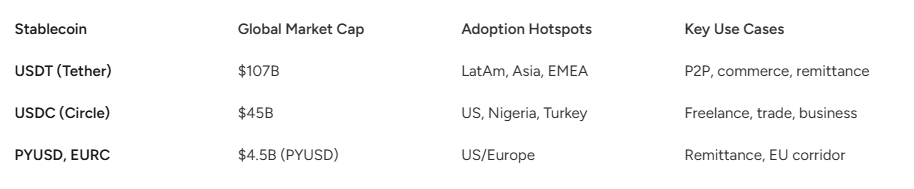

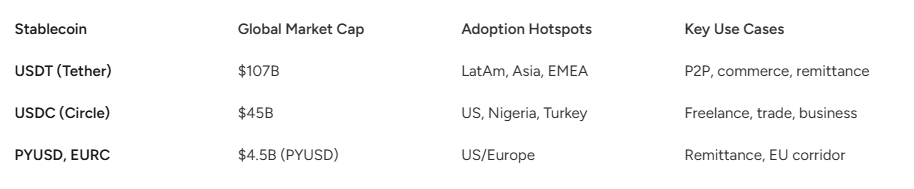

USDT dominates with $107 billion market cap across Latin America and EMEA for P2P commerce that’s taking place as we speak. USDC holds $45 billion, popular in Nigeria and Turkey for freelance payments. The stablecoin adoption surge has made these assets essential infrastructure as the USD crisis in Egypt and the USD crisis of Nigeria continue at the time of writing.

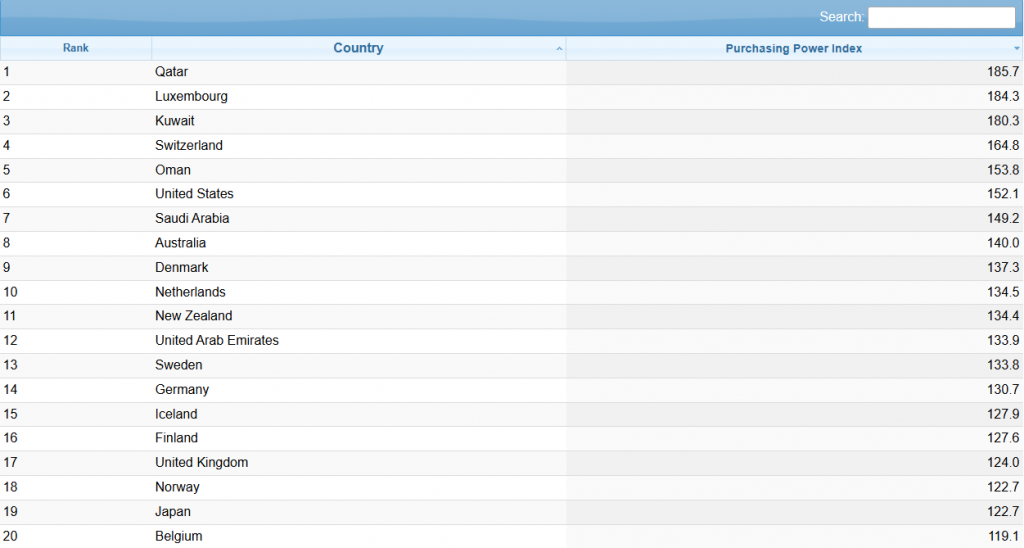

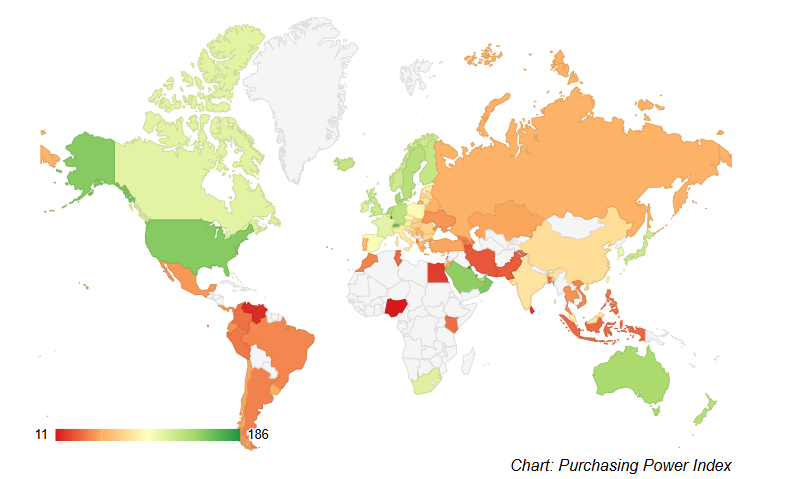

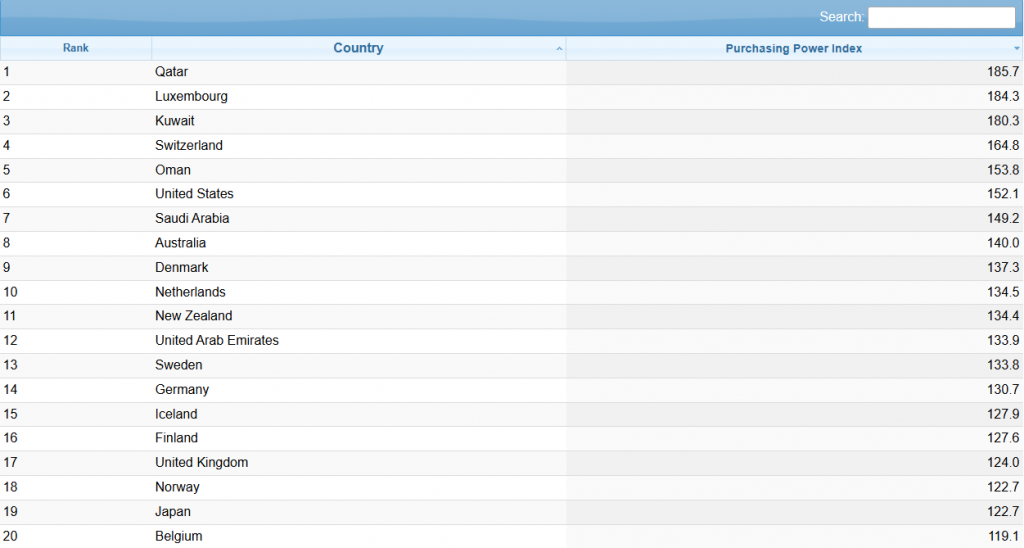

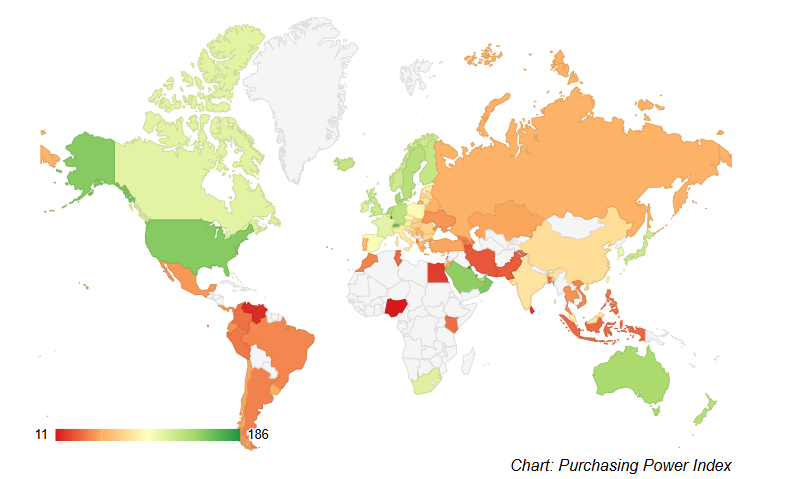

The purchasing power gap between developed and emerging markets drives continued stablecoin adoption surge right now. Qatar and Luxembourg maintain 180+ purchasing power indices while emerging markets struggle below 100.

This disparity fuels demand for Argentina stablecoin adoption and other emerging markets crypto solutions as citizens seek wealth preservation during the ongoing USD crisis in Egypt and the USD crisis of Nigeria as well, as they are still unfolding.

Read More

$35B Stablecoin Surge as USD Collapses in Egypt, Nigeria, Argentina

Share:

Stablecoin’s adoption surge has actually reached over $35 billion in transaction volumes right now as USD crises are devastating Egypt, Nigeria, and Argentina. Citizens across these nations have been turning to digital dollars to escape the hyperinflation and currency devaluation that’s taking place.

The USD crisis in Egypt and USD crisis in Nigeria have been pushed forward as local currencies lose their purchasing powerful and Argentina stablecoins adoption has now reached figures close to 3% of the entire M1 money supply. Emerging markets crypto solutions are substituting traditional banking because financial systems are seeing some complete transitions due to he high take-up of stablecoins.

How Stablecoin Adoption Surge Solves USD Crisis in Egypt, Nigeria & Argentina

Argentina’s $11B Digital Economy Actually Growing

Argentina is facing 140% inflation right now while stablecoin adoption surge reaches $11 billion annually. Citizens have been using apps like Lemon Cash for salaries and even rent payments in USDT. Argentina’s stablecoin adoption has grown despite regulatory pressure that’s been imposed, with the USD crisis in Egypt and similar situations driving demand for stable value storage.

Nigeria’s $24B Underground Market Thrives

Nigeria actually processes $24 billion in stablecoin flows yearly despite government bans that were implemented. The USD crisis of Nigeria has intensified as the naira weakened significantly, pushing citizens toward WhatsApp P2P markets. These emerging markets crypto solutions like remittances have doubled as traditional systems are failing people.

Also Read: Bitget Launches First-Ever RWA Index Perpetuals – Trade TSLA & NVDA

Turkey’s Growing 3.7% GDP Share Right Now

Turkey’s stablecoin transfers have hit $63 billion annually, which represents 3.7% of GDP. USDT serves as the primary hedge against lira devaluation that’s been happening. The stablecoin adoption surge mirrors the USD crisis of Egypt and also the USD crisis in Nigeria patterns, with merchants accepting digital dollars for B2B payments and transactions.

Technical Infrastructure Being Used

This stablecoin adoption surge relies on multiple access points that have been developed. On-ramp services charge 0.5-3% fees with minute-long processing times. Blockchain transactions complete in seconds at near-zero cost actually. Argentina’s stablecoin adoption and emerging markets crypto solutions benefit from this efficient infrastructure that’s available instantly.

Also Read: US DOJ Says It Won’t Target Decentralized Crypto Platforms Devs

Market Leaders and Usage Patterns

USDT dominates with $107 billion market cap across Latin America and EMEA for P2P commerce that’s taking place as we speak. USDC holds $45 billion, popular in Nigeria and Turkey for freelance payments. The stablecoin adoption surge has made these assets essential infrastructure as the USD crisis in Egypt and the USD crisis of Nigeria continue at the time of writing.

The purchasing power gap between developed and emerging markets drives continued stablecoin adoption surge right now. Qatar and Luxembourg maintain 180+ purchasing power indices while emerging markets struggle below 100.

This disparity fuels demand for Argentina stablecoin adoption and other emerging markets crypto solutions as citizens seek wealth preservation during the ongoing USD crisis in Egypt and the USD crisis of Nigeria as well, as they are still unfolding.

Read More