South Korea’s Biggest Exchanges Help Regulators Hunt ‘Undeclared Crypto Operators’

South Korea’s five biggest crypto exchanges will team up with financial regulators to search for “undeclared crypto operators.”

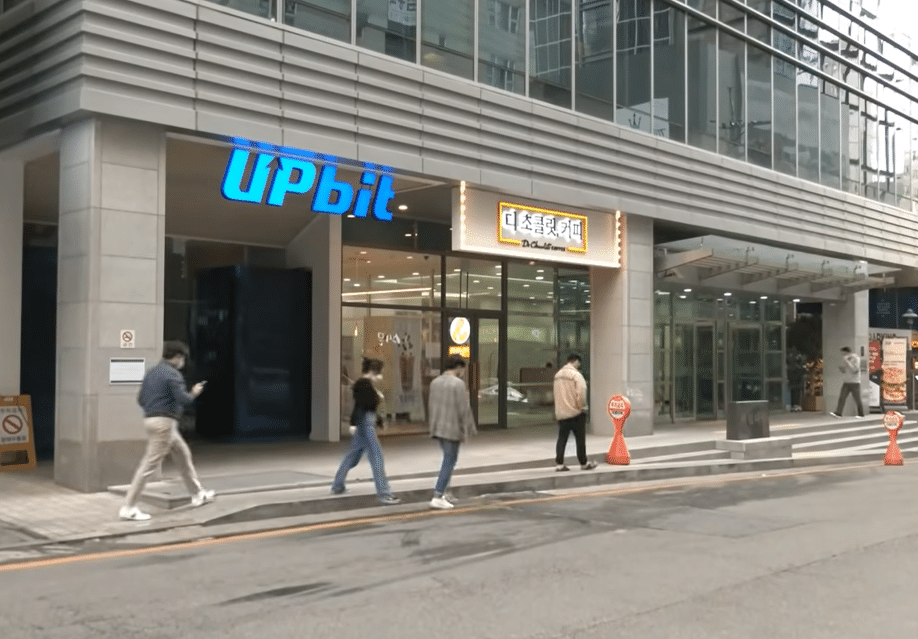

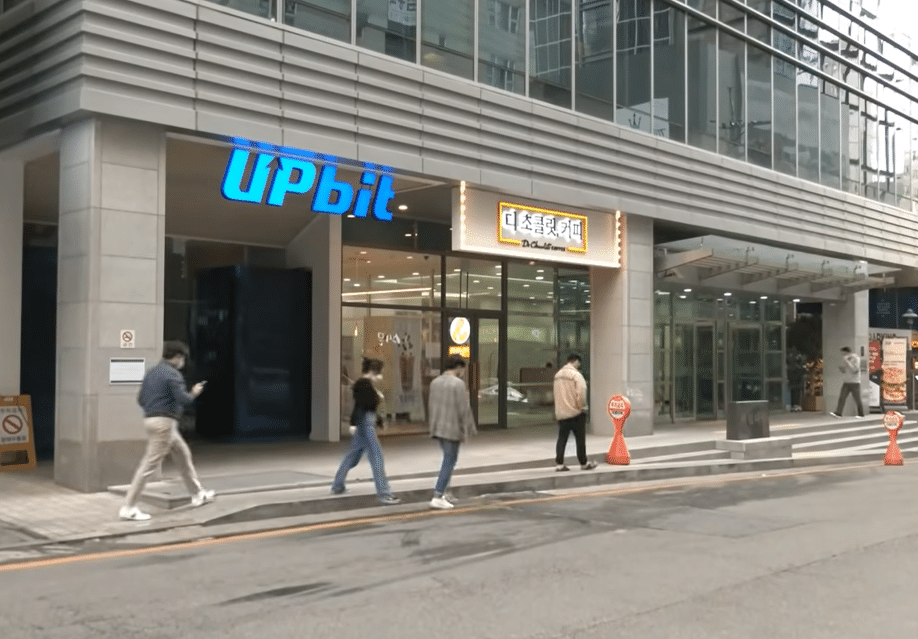

According to News1, the announcement was made by the Digital Asset Exchange Association (DAXA), which comprises the exchanges Upbit, Bithumb, Coinone, Korbit, and Gopax.

Trial of Bithumb Operator’s CEO Begins

The trial of Lee Sang-jun, the CEO of the crypto exchange @BithumbOfficial’s parent company, has begun in Seoul, South Korea.#CryptoNews #Seoulhttps://t.co/hnU4yerCIj

— Cryptonews.com (@cryptonews) November 22, 2023

DAXA will team up with the Financial Intelligence Unit (FIU), which answers to the Financial Services Commission – the nation’s top financial regulator.

The parties have asked members of the public to come forward with anonymous tipoffs about “undeclared virtual asset business operators.”

South Korea’s crypto exchange industry is one of the most tightly regulated crypto sectors in the world.

Currently, only the five DAXA members have operating permits that allow them to offer crypto-to-fiat trading pairs.

This has given rise to several “unofficial” South Korean crypto trading platforms.

Many of these platforms advertise their services in crypto-themed public chat rooms and social media sites.

Will South Korean Crypto Exchanges Help Close Down Illegal Crypto Firms?

DAX and the FIU asked whistleblowers to provide “business-related information” on these “unregistered platforms.”

They also called for whistleblowers to provide “evidence of unreported business activities.”

DAXA said it would carry out “initial reviews” of whistleblower reports and would pass on relevant information to the FIU.

However, DAXA and the FIU are not only targetting “unreported” South Korea-based crypto firms.

The bodies said their targets were “domestic and overseas virtual asset business operators who do not report their activities under the Specific Financial Information Act.”

This means that overseas platforms that “target South Koreans” could also be in DAXA and the FIU’s crosshairs.

The parties also asked whistleblowers to provide “reasons for suspecting” that “undeclared businesses” target South Korea-based users.

The FIU will likely send firms it suspects of breaking South Korean crypto law “cease and desist”-type orders.

Firms that fail to respond to these orders could face legal action, particularly if they have a presence in South Korea. A DAXA spokesperson said:

“The FIU has said that it plans to take all necessary measures, including notifying investigative agencies.”

Over the weekend, a Chinese government minister called on Seoul and Tokyo to streamline its blockchain and IT policy with Beijing’s efforts.

The post South Korea’s Biggest Exchanges Help Regulators Hunt ‘Undeclared Crypto Operators’ appeared first on Cryptonews.

South Korea’s Biggest Exchanges Help Regulators Hunt ‘Undeclared Crypto Operators’

South Korea’s five biggest crypto exchanges will team up with financial regulators to search for “undeclared crypto operators.”

According to News1, the announcement was made by the Digital Asset Exchange Association (DAXA), which comprises the exchanges Upbit, Bithumb, Coinone, Korbit, and Gopax.

Trial of Bithumb Operator’s CEO Begins

The trial of Lee Sang-jun, the CEO of the crypto exchange @BithumbOfficial’s parent company, has begun in Seoul, South Korea.#CryptoNews #Seoulhttps://t.co/hnU4yerCIj

— Cryptonews.com (@cryptonews) November 22, 2023

DAXA will team up with the Financial Intelligence Unit (FIU), which answers to the Financial Services Commission – the nation’s top financial regulator.

The parties have asked members of the public to come forward with anonymous tipoffs about “undeclared virtual asset business operators.”

South Korea’s crypto exchange industry is one of the most tightly regulated crypto sectors in the world.

Currently, only the five DAXA members have operating permits that allow them to offer crypto-to-fiat trading pairs.

This has given rise to several “unofficial” South Korean crypto trading platforms.

Many of these platforms advertise their services in crypto-themed public chat rooms and social media sites.

Will South Korean Crypto Exchanges Help Close Down Illegal Crypto Firms?

DAX and the FIU asked whistleblowers to provide “business-related information” on these “unregistered platforms.”

They also called for whistleblowers to provide “evidence of unreported business activities.”

DAXA said it would carry out “initial reviews” of whistleblower reports and would pass on relevant information to the FIU.

However, DAXA and the FIU are not only targetting “unreported” South Korea-based crypto firms.

The bodies said their targets were “domestic and overseas virtual asset business operators who do not report their activities under the Specific Financial Information Act.”

This means that overseas platforms that “target South Koreans” could also be in DAXA and the FIU’s crosshairs.

The parties also asked whistleblowers to provide “reasons for suspecting” that “undeclared businesses” target South Korea-based users.

The FIU will likely send firms it suspects of breaking South Korean crypto law “cease and desist”-type orders.

Firms that fail to respond to these orders could face legal action, particularly if they have a presence in South Korea. A DAXA spokesperson said:

“The FIU has said that it plans to take all necessary measures, including notifying investigative agencies.”

Over the weekend, a Chinese government minister called on Seoul and Tokyo to streamline its blockchain and IT policy with Beijing’s efforts.

The post South Korea’s Biggest Exchanges Help Regulators Hunt ‘Undeclared Crypto Operators’ appeared first on Cryptonews.

Insights

Insights