Vesper Finance Reviews: DeFi, Simplified?

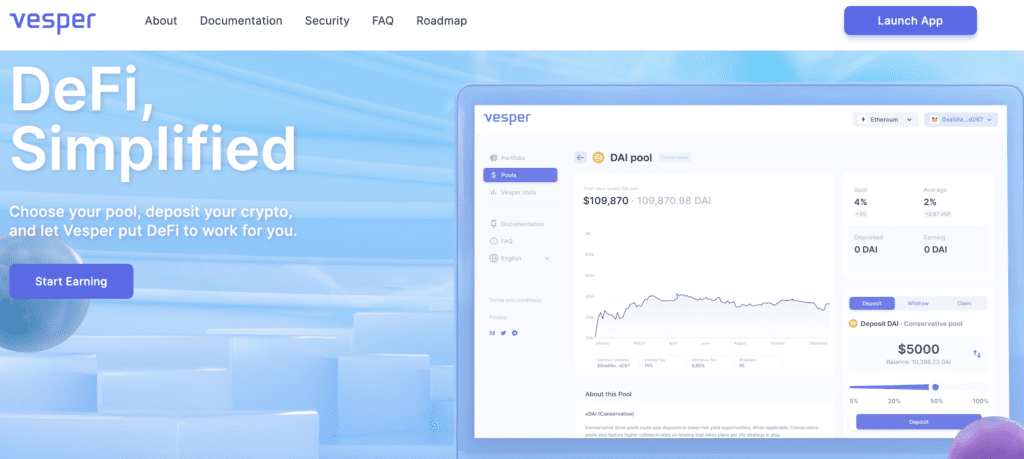

Vesper Finance is a decentralized finance (DeFi) protocol that aims to simplify and optimize yield farming for cryptocurrency investors. Launched in 2021, Vesper provides a user-friendly platform that allows users to access various DeFi pools and strategies to earn passive income on their digital assets.

About Vesper Finance

Vesper is a blockchain-based platform that provides easy-to-use Decentralized Finance (DeFi) products to its users. With Vesper’s DeFi products, achieving your crypto-finance objectives has never been easier. The Vesper token (VSP) is a core economic engine that plays a vital role in facilitating the building and expansion of Vesper’s capabilities and its community.

The Vesper project is founded on three pillars, which are:

Vesper Products: Vesper offers a variety of interest-yielding “Grow Pools” that enable users to passively increase their crypto holdings. By selecting the desired aggressiveness of their strategy and the digital asset held, users can achieve their financial goals without much effort. The Vesper Grow Pools represent the first product on the Vesper platform. However, the team is working tirelessly to develop more products that will be presented over time, providing users with more options to choose from.

Vesper Token: VSP is a utility token that serves as the backbone of Vesper’s ecosystem. It incentivizes participation, facilitates governance, and catalyzes user contribution. Through pool participation, users earn VSP, which can also be used for staking and liquidity provision. Additionally, VSP holders can participate in Vesper’s continuous improvement.

Vesper Community: Vesper is committed to building a user community that sustains and grows the product portfolio, facilitates progressive decentralization, and enables users to build new products while earning a share of that product’s fees. By bringing together a community of like-minded individuals, Vesper aims to create an ecosystem where everyone can benefit and contribute to the growth of the platform.

Vesper is a powerful platform that provides users with easy-to-use DeFi products, a utility token that incentivizes participation and facilitates governance, and a user community that sustains and grows the product portfolio. With the team’s commitment to continuous improvement and the development of more products, Vesper is poised to become a leading platform in the DeFi space.

Vesper Features

- Non-Custodial: Assets are deposited to and deployed automatically via smart contracts. Users always maintain 100% ownership of their funds and can retrieve them at any time.

- Trustless: Assets are algorithmically deployed through the specifications laid out by Vesper pool strategy smart contracts.

- Permissionless: No signup, whitelisting, account verification, or otherwise is required to participate in the Vesper ecosystem.

- Censorship Resistant: Users can always interact with the smart contracts directly, which fundamentally cannot be taken down or tampered with.

- Open Source: Any developer is welcome to build with Vesper. In fact, it’s highly encouraged and heavily incentivized.

- Fraud Resistant: The qualities listed above position Vesper’s ecosystem to minimize the risk of fraudulent activity typically associated with bordered, custodial, trusted, permissioned, closed source, and censored platforms.

- Simple, Easy-to-use: Vesper’s user interface was designed to be as seamless as possible. One-click deposit and withdrawals plus mechanisms for portfolio tracking and miscellaneous Vesper metrics.

- On Ethereum, ‘Layer 2 Positive’: The Vesper ecosystem is deployed on the base (‘Layer 1’) Ethereum blockchain, where it can interact with existing DeFi protocols for yield farming. Layer 2 solutions are under active consideration as potential ways to improve the efficiency of the platform.

DeFi Primitives

- Grow Pools: Grow Pools collect a particular asset (ETH, WBTC, USDC, others) via user deposits and deploy the capital to other DeFi platforms as outlined by the Grow pool’s active strategies. Yield accrued by these strategies are used to buy back more of the deposit asset, which is delivered to pool participants.

- Staking Pool (planned): Token holders can deposit VSP to the vVSP Staking Pool. Revenue generated across all Vesper products is used to buyback VSP from the open market. These tokens are delivered to the staking pool, where depositors earn VSP interest proportionate to the size of their deposit.

- Earn Pools (planned): Mechanically, Directed Pools operate the same as Grow Pools: deploy deposited assets to defined strategy. However, the yield accrued by Directed Pools is allocated to some other purpose. Some examples include:

- Charity Pools: Yield is delivered to a charitable cause.

- VC Pools: Yield is delivered as venture capital to a startup (likely in exchange for the project’s token).

- Growth Pools: Yield from deposit token x is used to purchase token y.

- Income Pools: Similar to Investment Pools, but yield is converted to stablecoin and delivered as a passive income.

All Tokens

- ERC20 Standard: Industry standard for tokens on Ethereum, this enables tokens in the ecosystem to interact with the existing global DeFi ecosystem (Ex: tradeable on Uniswap).

- EIP-712: All tokens support EIP-712 for sharing data via message signing. This is an important component of gas-less approvals.

- EIP-2612 (Gas-less Approvals): All tokens leverage EIP-2612, which enables gas-less approvals, with the help of EIP-712. Users can send tokens to any contracts after signing an approval message, rather than having to broadcast a transaction.

- Multi-Transfer: Inspired by Metronome, all tokens feature a mass pay functionality that enables batched payments in a single transaction.

VSP Token

- Voting Rights: VSP tokens correspond to the voting weight in the Vesper ecosystem, which includes deployment of reserves and approval of new strategies.

- Delegation: Forked from Compound, holders can delegate their VSP voting weight to other accounts.

- Holistic View: Vesper is a single-token ecosystem, with every product (new and future) interfacing with VSP. VSP grants voting rights that span the entire Vesper umbrella and revenue generated by all products are used to buy back VSP off the open market.

- Time-Locked Mintage: The Administrative “mint” function is locked for the first twelve months. This prohibits a supply expansion beyond 10 million until a point in the future where ownership has fully transitioned to the community of VSP holders, where they can decide for themselves whether or not to extend emissions.

Pool Share Token

- “Lego Brick” Modularity: Vesper pool shares are designed as a modular asset that can be plugged into other DeFi platforms. Vesper participants maintain liquid ownership of pool shares and can use them for other functionalities while retaining said ownership. For example:

- Collateral: Vesper pool shares can be applied as collateral to create synthetic assets or to be posted as collateral to take out a loan. This is similar to how yCRV is backed by Grow pool shares (yUSDC + yDAI + yTUSD + yUSDT).

Backend Maintenance

- Sweeping: This is a contract function that swaps non-native ERC20 tokens and deposits them back into the Grow Pool. For example, if the strategy interfaces with Compound, and receives Compound’s COMP token, sweeping will liquidate the COMP and reap the profits from it. This also handles any tokens mistakenly sent to the contract.

- Rebalancing: Pool assets are redistributed (or rebalanced) on activity. This includes, for example, realizing yield and swapping to deposit asset or adjusting strategy positions on entry to or exit from the pool.

Pool Strategies

- Risk Scoring: Every Vesper Grow Pool has a conservative/aggressive score that reflects the overall risk of the strategies employed by the pool including the security of third-party protocols interacted with, number of contract interactions, and collateralization ratios on loans (if applicable).

- Modular: Grow Pool strategies can be modified to integrate additional or alternative actions as well as swapped altogether for better strategies. No action is required on the user’s end and funds transition to updated strategies automatically.

- Upgradeable: As new and better strategies are proposed within the confines of a pool’s defined risk framework, those strategies can be employed without moving funds.

- Multi-Pool: Pool assets can be deployed across n strategies, with any chose percentage allocated to a strategy (e.g. Allocating 90% of your pool to a Conservative strategy, and 10% to an Aggressive strategy.)

- Upgrades: Upgrades utilize the multi-pool feature to execute a rolling transition from an old strategy to a new one. (Ex: Start with 1%/99% new/old, then 5%/95%, etc. up the staircase until 100%/0%.)

- Developer Strategies: A pool can support an unlimited number of strategies. Therefore, developers may spread funds across n pools as a way of testing their strategy.

Web3 UI

- Multi-lingual Support: Like our pool strategies, website content is modular, and users can interact with Vesper in their native language. As more translations are compiled, they can similarly be added alongside available translations.

Participation Rewards

- Merkle Tree Reward: ZK-Rollups and Merkle trees are employed for distributing VSP to recipients. This enables more sophisticated approaches to VSP distribution (weighted averages, for example) and also eliminates much of the gas burden typically associated with claiming rewards.

Vesper Participants

Founders

The team that originally created the Vesper platform. They are compensated with a portion of the originally minted VSP tokens.

Developers

Developers are Vesper community members who contribute strategies to the Vesper platform. They are compensated with a percentage of the fees generated within the strategies they author.

VSP Holders

Members of the Vesper community that hold VSP tokens will be able to cast votes on proposals and receive a share of Vesper revenue by holding and staking VSP tokens.

Pool Participants

Pool participants are Vesper’s core users, making them a critical part of the community from Day 1. They often hold VSP tokens, but regardless they have an important voice in the community that is expressed through both their capital allocations and their participation in community conversations.

Multisig Keyholders

At inception, Vesper pool parameters and contract upgrades are managed by multisig keyholders, whose members include the founding team and external partners. Multisig keyholders execute the decisions made by the VSP community.

The initial composition of the Vesper multisig includes founding team members, and will quickly expand to include external partners. You can learn more about Vesper’s decentralization roadmap in the section on the Decentralization Plan.

Cybersecurity auditors

Before new strategies are deployed to the Vesper platform, they will need to undergo extensive security audits by professional penetration testing firms. There auditors will be paid with Vesper reserve funds, and will ensure that new contracts are held to the highest levels of scrutiny before users interact with them.

Liquidity Providers

Liquidity Providers assist the Vesper community by providing two-sided liquidity to a VSP pair on the Uniswap platform.

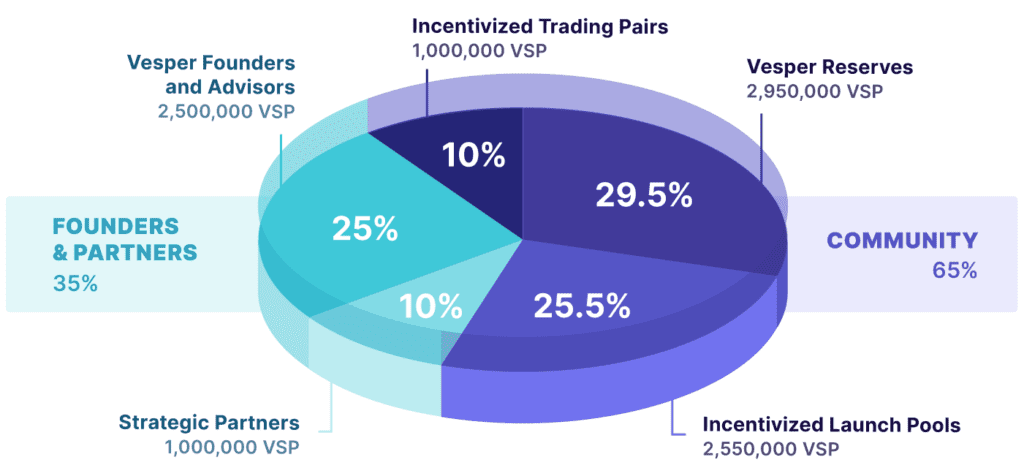

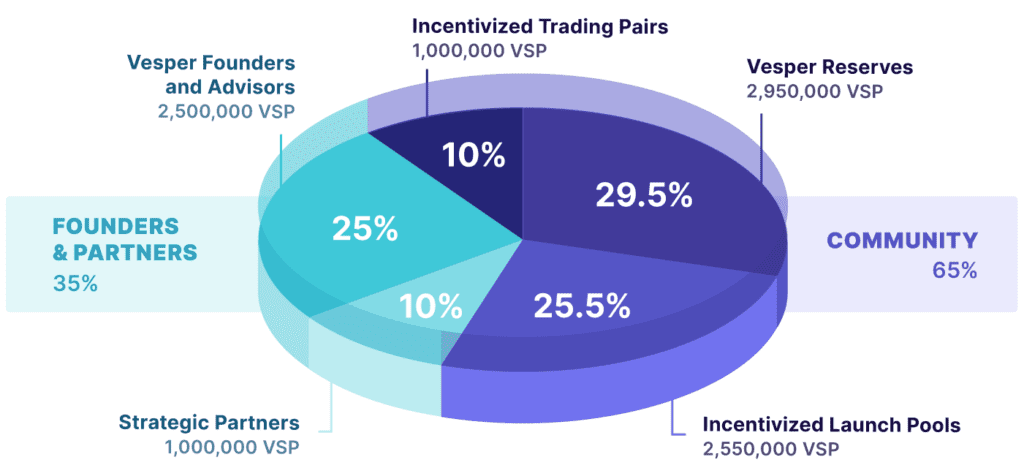

Vesper Finance Token

Vesper Finance has its native governance token called “VSP.” The VSP token plays a crucial role in the Vesper Finance ecosystem, giving holders certain rights and privileges within the platform.

- Governance: VSP token holders have voting power in the governance of the Vesper Finance platform. This means they can participate in key decisions related to the protocol’s development, upgrades, and other changes. The voting process is typically conducted through on-chain voting, allowing the community to collectively steer the direction of the project.

- Fees and Revenue Share: VSP token holders may be entitled to a share of the revenue generated by the Vesper Finance protocol. This is typically distributed to token holders as a form of staking rewards or a share of the fees collected from various activities on the platform, such as yield farming.

- Protocol Upgrades: In some cases, protocol upgrades and changes may require community consensus through voting. VSP token holders may need to approve significant changes or improvements to the Vesper Finance platform.

- Community Participation: Owning VSP tokens provides holders with a sense of ownership and involvement in the Vesper Finance community. It encourages active participation, feedback, and engagement in discussions related to the platform’s growth and development.

Conclusion

Vesper Finance is a DeFi protocol that provides a user-friendly and secure platform for yield farming and passive income generation. With its range of curated strategies and emphasis on community governance, Vesper Finance continues to be an attractive option for cryptocurrency investors seeking to maximize their returns in the DeFi space.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Read more...

Coincu News

Vesper Finance Reviews: DeFi, Simplified?

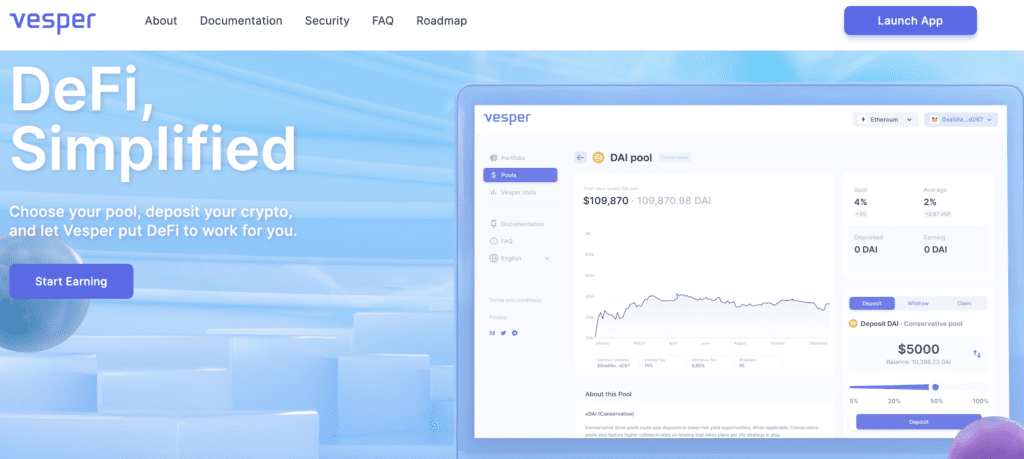

Vesper Finance is a decentralized finance (DeFi) protocol that aims to simplify and optimize yield farming for cryptocurrency investors. Launched in 2021, Vesper provides a user-friendly platform that allows users to access various DeFi pools and strategies to earn passive income on their digital assets.

About Vesper Finance

Vesper is a blockchain-based platform that provides easy-to-use Decentralized Finance (DeFi) products to its users. With Vesper’s DeFi products, achieving your crypto-finance objectives has never been easier. The Vesper token (VSP) is a core economic engine that plays a vital role in facilitating the building and expansion of Vesper’s capabilities and its community.

The Vesper project is founded on three pillars, which are:

Vesper Products: Vesper offers a variety of interest-yielding “Grow Pools” that enable users to passively increase their crypto holdings. By selecting the desired aggressiveness of their strategy and the digital asset held, users can achieve their financial goals without much effort. The Vesper Grow Pools represent the first product on the Vesper platform. However, the team is working tirelessly to develop more products that will be presented over time, providing users with more options to choose from.

Vesper Token: VSP is a utility token that serves as the backbone of Vesper’s ecosystem. It incentivizes participation, facilitates governance, and catalyzes user contribution. Through pool participation, users earn VSP, which can also be used for staking and liquidity provision. Additionally, VSP holders can participate in Vesper’s continuous improvement.

Vesper Community: Vesper is committed to building a user community that sustains and grows the product portfolio, facilitates progressive decentralization, and enables users to build new products while earning a share of that product’s fees. By bringing together a community of like-minded individuals, Vesper aims to create an ecosystem where everyone can benefit and contribute to the growth of the platform.

Vesper is a powerful platform that provides users with easy-to-use DeFi products, a utility token that incentivizes participation and facilitates governance, and a user community that sustains and grows the product portfolio. With the team’s commitment to continuous improvement and the development of more products, Vesper is poised to become a leading platform in the DeFi space.

Vesper Features

- Non-Custodial: Assets are deposited to and deployed automatically via smart contracts. Users always maintain 100% ownership of their funds and can retrieve them at any time.

- Trustless: Assets are algorithmically deployed through the specifications laid out by Vesper pool strategy smart contracts.

- Permissionless: No signup, whitelisting, account verification, or otherwise is required to participate in the Vesper ecosystem.

- Censorship Resistant: Users can always interact with the smart contracts directly, which fundamentally cannot be taken down or tampered with.

- Open Source: Any developer is welcome to build with Vesper. In fact, it’s highly encouraged and heavily incentivized.

- Fraud Resistant: The qualities listed above position Vesper’s ecosystem to minimize the risk of fraudulent activity typically associated with bordered, custodial, trusted, permissioned, closed source, and censored platforms.

- Simple, Easy-to-use: Vesper’s user interface was designed to be as seamless as possible. One-click deposit and withdrawals plus mechanisms for portfolio tracking and miscellaneous Vesper metrics.

- On Ethereum, ‘Layer 2 Positive’: The Vesper ecosystem is deployed on the base (‘Layer 1’) Ethereum blockchain, where it can interact with existing DeFi protocols for yield farming. Layer 2 solutions are under active consideration as potential ways to improve the efficiency of the platform.

DeFi Primitives

- Grow Pools: Grow Pools collect a particular asset (ETH, WBTC, USDC, others) via user deposits and deploy the capital to other DeFi platforms as outlined by the Grow pool’s active strategies. Yield accrued by these strategies are used to buy back more of the deposit asset, which is delivered to pool participants.

- Staking Pool (planned): Token holders can deposit VSP to the vVSP Staking Pool. Revenue generated across all Vesper products is used to buyback VSP from the open market. These tokens are delivered to the staking pool, where depositors earn VSP interest proportionate to the size of their deposit.

- Earn Pools (planned): Mechanically, Directed Pools operate the same as Grow Pools: deploy deposited assets to defined strategy. However, the yield accrued by Directed Pools is allocated to some other purpose. Some examples include:

- Charity Pools: Yield is delivered to a charitable cause.

- VC Pools: Yield is delivered as venture capital to a startup (likely in exchange for the project’s token).

- Growth Pools: Yield from deposit token x is used to purchase token y.

- Income Pools: Similar to Investment Pools, but yield is converted to stablecoin and delivered as a passive income.

All Tokens

- ERC20 Standard: Industry standard for tokens on Ethereum, this enables tokens in the ecosystem to interact with the existing global DeFi ecosystem (Ex: tradeable on Uniswap).

- EIP-712: All tokens support EIP-712 for sharing data via message signing. This is an important component of gas-less approvals.

- EIP-2612 (Gas-less Approvals): All tokens leverage EIP-2612, which enables gas-less approvals, with the help of EIP-712. Users can send tokens to any contracts after signing an approval message, rather than having to broadcast a transaction.

- Multi-Transfer: Inspired by Metronome, all tokens feature a mass pay functionality that enables batched payments in a single transaction.

VSP Token

- Voting Rights: VSP tokens correspond to the voting weight in the Vesper ecosystem, which includes deployment of reserves and approval of new strategies.

- Delegation: Forked from Compound, holders can delegate their VSP voting weight to other accounts.

- Holistic View: Vesper is a single-token ecosystem, with every product (new and future) interfacing with VSP. VSP grants voting rights that span the entire Vesper umbrella and revenue generated by all products are used to buy back VSP off the open market.

- Time-Locked Mintage: The Administrative “mint” function is locked for the first twelve months. This prohibits a supply expansion beyond 10 million until a point in the future where ownership has fully transitioned to the community of VSP holders, where they can decide for themselves whether or not to extend emissions.

Pool Share Token

- “Lego Brick” Modularity: Vesper pool shares are designed as a modular asset that can be plugged into other DeFi platforms. Vesper participants maintain liquid ownership of pool shares and can use them for other functionalities while retaining said ownership. For example:

- Collateral: Vesper pool shares can be applied as collateral to create synthetic assets or to be posted as collateral to take out a loan. This is similar to how yCRV is backed by Grow pool shares (yUSDC + yDAI + yTUSD + yUSDT).

Backend Maintenance

- Sweeping: This is a contract function that swaps non-native ERC20 tokens and deposits them back into the Grow Pool. For example, if the strategy interfaces with Compound, and receives Compound’s COMP token, sweeping will liquidate the COMP and reap the profits from it. This also handles any tokens mistakenly sent to the contract.

- Rebalancing: Pool assets are redistributed (or rebalanced) on activity. This includes, for example, realizing yield and swapping to deposit asset or adjusting strategy positions on entry to or exit from the pool.

Pool Strategies

- Risk Scoring: Every Vesper Grow Pool has a conservative/aggressive score that reflects the overall risk of the strategies employed by the pool including the security of third-party protocols interacted with, number of contract interactions, and collateralization ratios on loans (if applicable).

- Modular: Grow Pool strategies can be modified to integrate additional or alternative actions as well as swapped altogether for better strategies. No action is required on the user’s end and funds transition to updated strategies automatically.

- Upgradeable: As new and better strategies are proposed within the confines of a pool’s defined risk framework, those strategies can be employed without moving funds.

- Multi-Pool: Pool assets can be deployed across n strategies, with any chose percentage allocated to a strategy (e.g. Allocating 90% of your pool to a Conservative strategy, and 10% to an Aggressive strategy.)

- Upgrades: Upgrades utilize the multi-pool feature to execute a rolling transition from an old strategy to a new one. (Ex: Start with 1%/99% new/old, then 5%/95%, etc. up the staircase until 100%/0%.)

- Developer Strategies: A pool can support an unlimited number of strategies. Therefore, developers may spread funds across n pools as a way of testing their strategy.

Web3 UI

- Multi-lingual Support: Like our pool strategies, website content is modular, and users can interact with Vesper in their native language. As more translations are compiled, they can similarly be added alongside available translations.

Participation Rewards

- Merkle Tree Reward: ZK-Rollups and Merkle trees are employed for distributing VSP to recipients. This enables more sophisticated approaches to VSP distribution (weighted averages, for example) and also eliminates much of the gas burden typically associated with claiming rewards.

Vesper Participants

Founders

The team that originally created the Vesper platform. They are compensated with a portion of the originally minted VSP tokens.

Developers

Developers are Vesper community members who contribute strategies to the Vesper platform. They are compensated with a percentage of the fees generated within the strategies they author.

VSP Holders

Members of the Vesper community that hold VSP tokens will be able to cast votes on proposals and receive a share of Vesper revenue by holding and staking VSP tokens.

Pool Participants

Pool participants are Vesper’s core users, making them a critical part of the community from Day 1. They often hold VSP tokens, but regardless they have an important voice in the community that is expressed through both their capital allocations and their participation in community conversations.

Multisig Keyholders

At inception, Vesper pool parameters and contract upgrades are managed by multisig keyholders, whose members include the founding team and external partners. Multisig keyholders execute the decisions made by the VSP community.

The initial composition of the Vesper multisig includes founding team members, and will quickly expand to include external partners. You can learn more about Vesper’s decentralization roadmap in the section on the Decentralization Plan.

Cybersecurity auditors

Before new strategies are deployed to the Vesper platform, they will need to undergo extensive security audits by professional penetration testing firms. There auditors will be paid with Vesper reserve funds, and will ensure that new contracts are held to the highest levels of scrutiny before users interact with them.

Liquidity Providers

Liquidity Providers assist the Vesper community by providing two-sided liquidity to a VSP pair on the Uniswap platform.

Vesper Finance Token

Vesper Finance has its native governance token called “VSP.” The VSP token plays a crucial role in the Vesper Finance ecosystem, giving holders certain rights and privileges within the platform.

- Governance: VSP token holders have voting power in the governance of the Vesper Finance platform. This means they can participate in key decisions related to the protocol’s development, upgrades, and other changes. The voting process is typically conducted through on-chain voting, allowing the community to collectively steer the direction of the project.

- Fees and Revenue Share: VSP token holders may be entitled to a share of the revenue generated by the Vesper Finance protocol. This is typically distributed to token holders as a form of staking rewards or a share of the fees collected from various activities on the platform, such as yield farming.

- Protocol Upgrades: In some cases, protocol upgrades and changes may require community consensus through voting. VSP token holders may need to approve significant changes or improvements to the Vesper Finance platform.

- Community Participation: Owning VSP tokens provides holders with a sense of ownership and involvement in the Vesper Finance community. It encourages active participation, feedback, and engagement in discussions related to the platform’s growth and development.

Conclusion

Vesper Finance is a DeFi protocol that provides a user-friendly and secure platform for yield farming and passive income generation. With its range of curated strategies and emphasis on community governance, Vesper Finance continues to be an attractive option for cryptocurrency investors seeking to maximize their returns in the DeFi space.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Read more...

Coincu News