Bitcoin rallies to $65,000, triggering over $120 million in liquidations in 24 hours

Quick Take

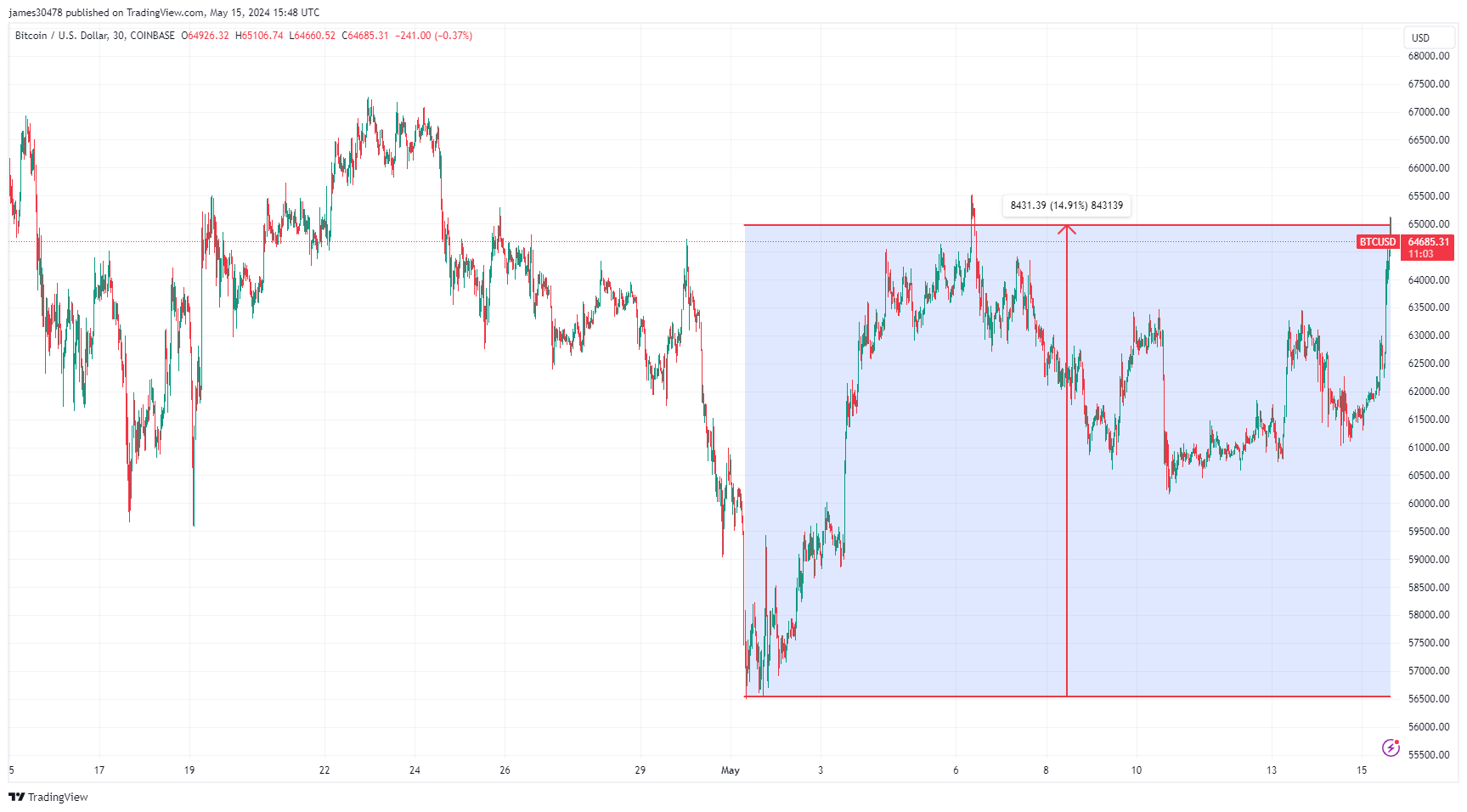

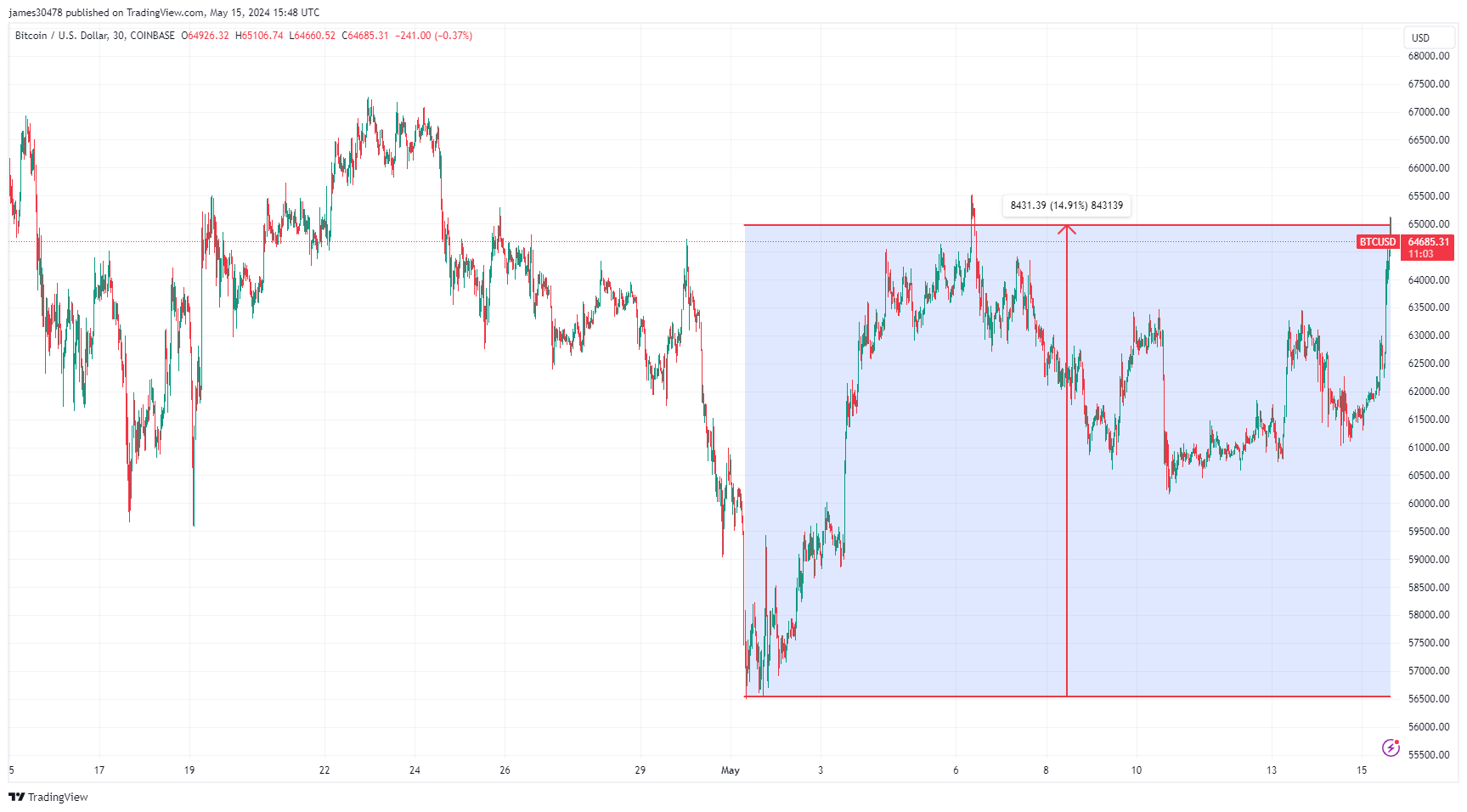

Bitcoin’s recent surge to $65,000, a level last seen on May 6, has sparked significant volatility in the digital assets market. Bitcoin has now seen a roughly 15% rally from the lows of May 1.

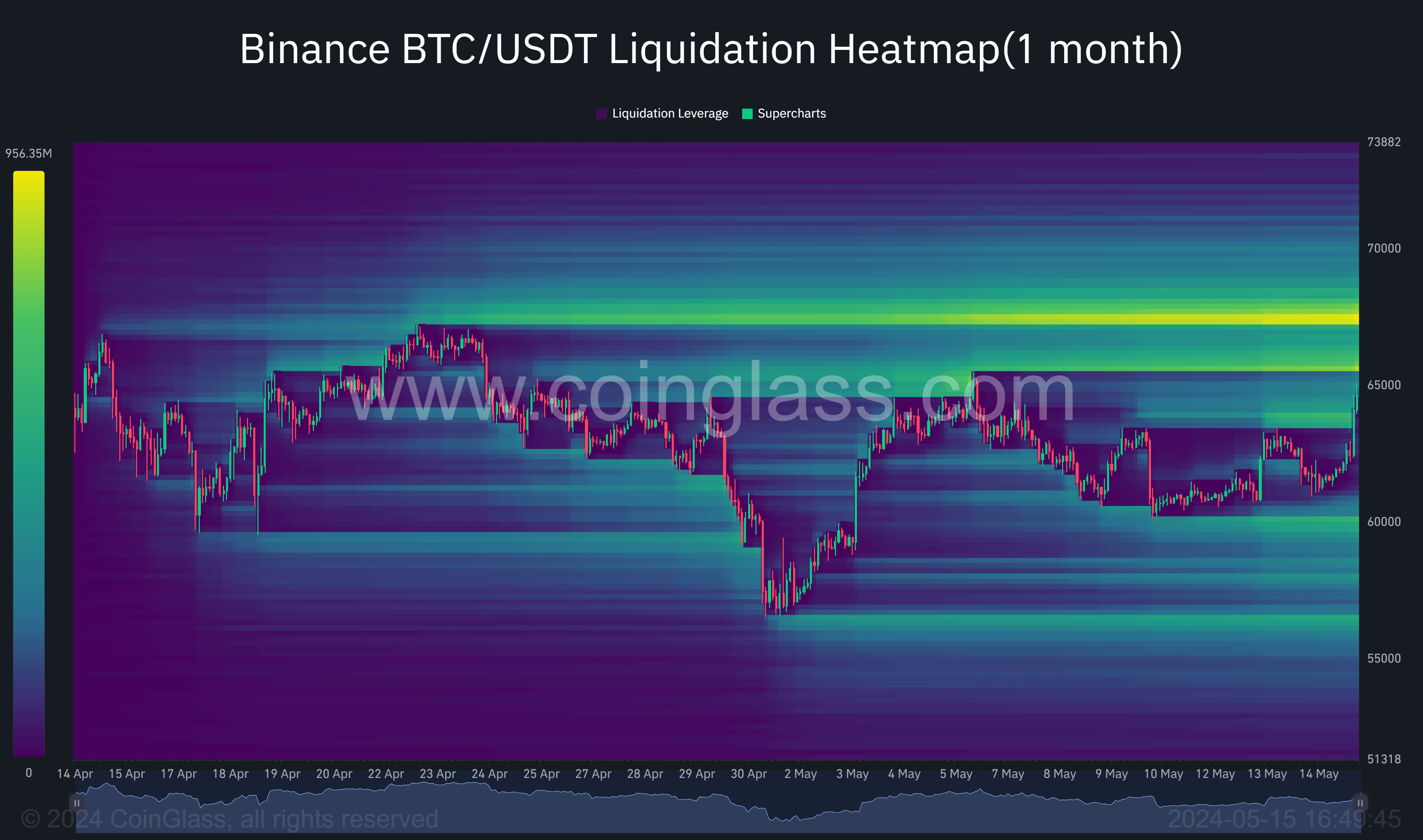

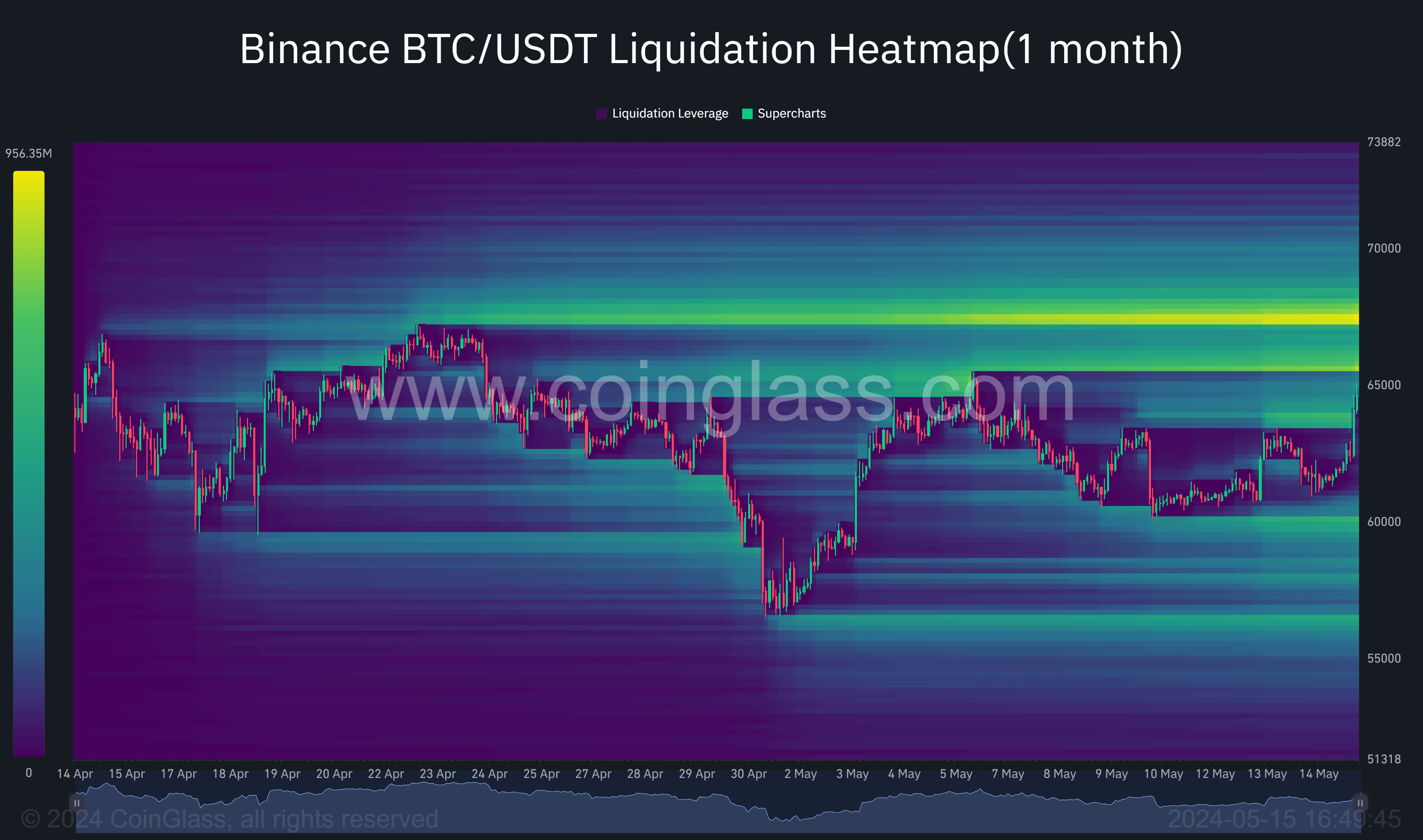

Coinglass data shows that Bitcoin is now up over 5% on May 15, which has resulted in over $120 million worth of liquidations in the past 24 hours in the digital asset ecosystem. Both long ($54 million) and short positions ($66 million) were affected. While Bitcoin has borne the brunt of these liquidations ($37 million), it has slightly retraced and is hovering below the $65,000 mark.

Interestingly, a substantial amount of leverage is positioned above $65,000, with hundreds of millions of dollars worth of leverage concentrated around the $67,500 level, just shy of $1 billion, according to Coinglass data.

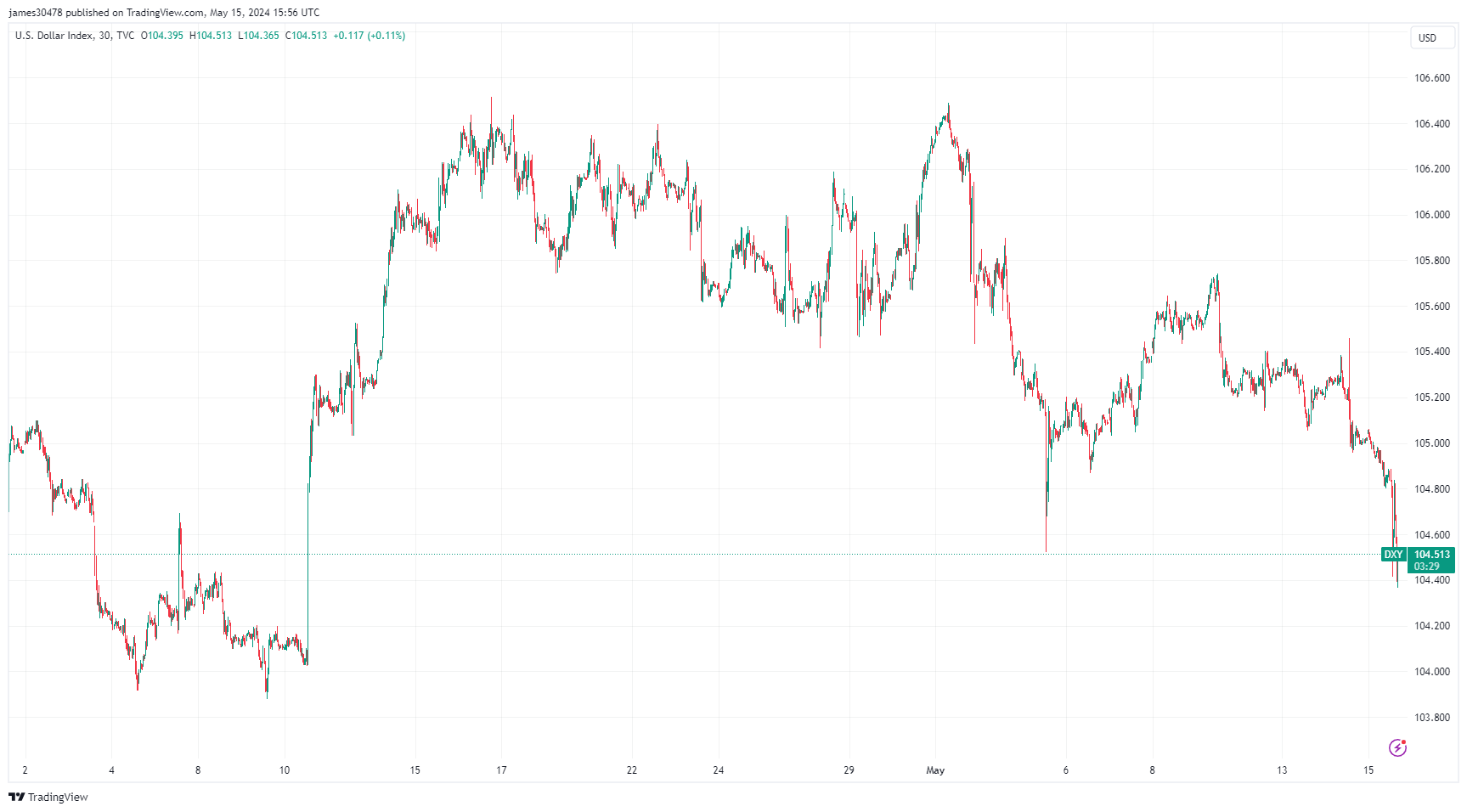

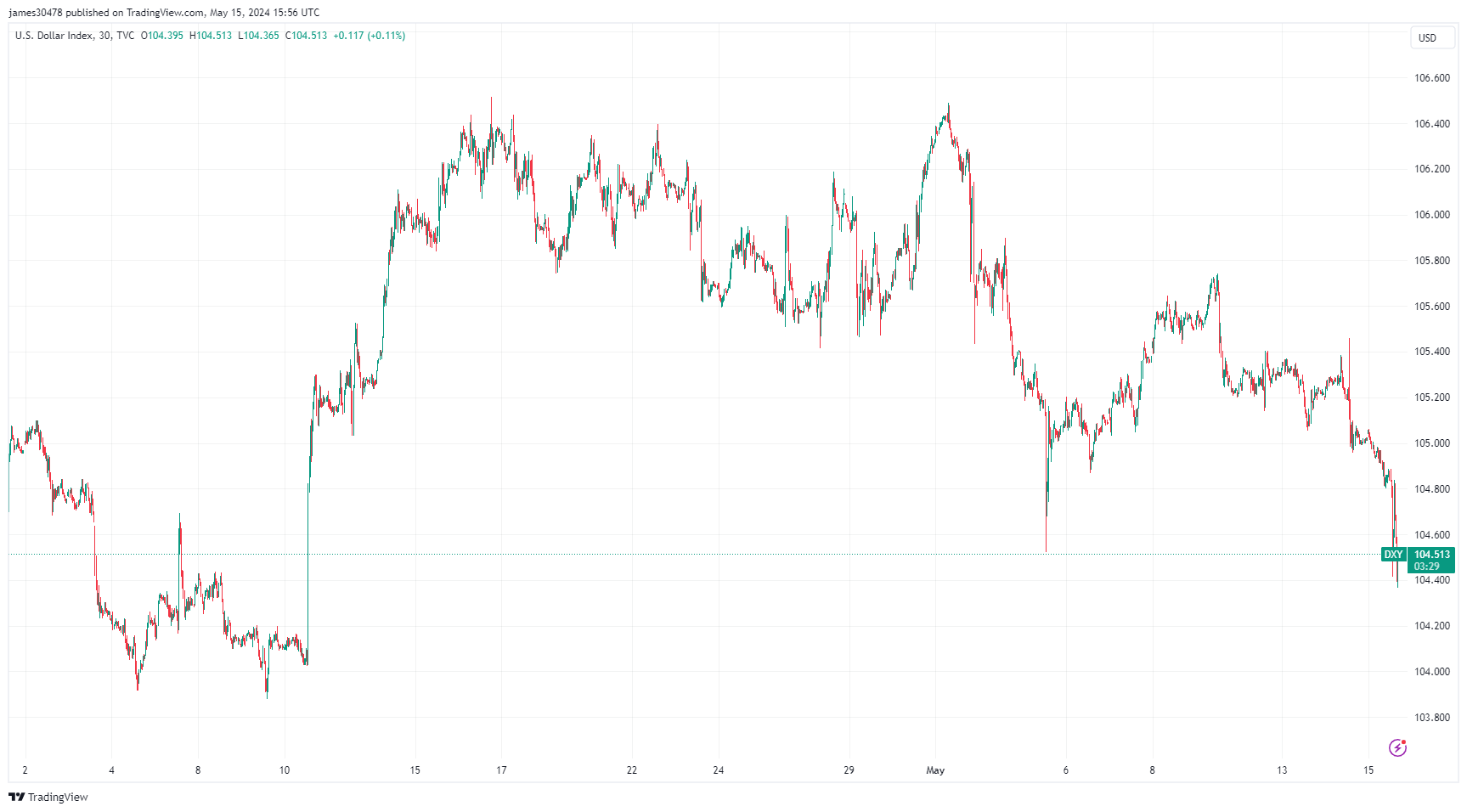

The tailwinds propelling Bitcoin’s ascent include the weakening of the US Dollar Index (DXY), which has broken below 105 after US CPI came in line with expectations.

The post Bitcoin rallies to $65,000, triggering over $120 million in liquidations in 24 hours appeared first on CryptoSlate.

Bitcoin rallies to $65,000, triggering over $120 million in liquidations in 24 hours

Quick Take

Bitcoin’s recent surge to $65,000, a level last seen on May 6, has sparked significant volatility in the digital assets market. Bitcoin has now seen a roughly 15% rally from the lows of May 1.

Coinglass data shows that Bitcoin is now up over 5% on May 15, which has resulted in over $120 million worth of liquidations in the past 24 hours in the digital asset ecosystem. Both long ($54 million) and short positions ($66 million) were affected. While Bitcoin has borne the brunt of these liquidations ($37 million), it has slightly retraced and is hovering below the $65,000 mark.

Interestingly, a substantial amount of leverage is positioned above $65,000, with hundreds of millions of dollars worth of leverage concentrated around the $67,500 level, just shy of $1 billion, according to Coinglass data.

The tailwinds propelling Bitcoin’s ascent include the weakening of the US Dollar Index (DXY), which has broken below 105 after US CPI came in line with expectations.

The post Bitcoin rallies to $65,000, triggering over $120 million in liquidations in 24 hours appeared first on CryptoSlate.