$WCT Peaks at $0.63, Slides 30%—Is Web3’s “Visa” Token in Trouble?

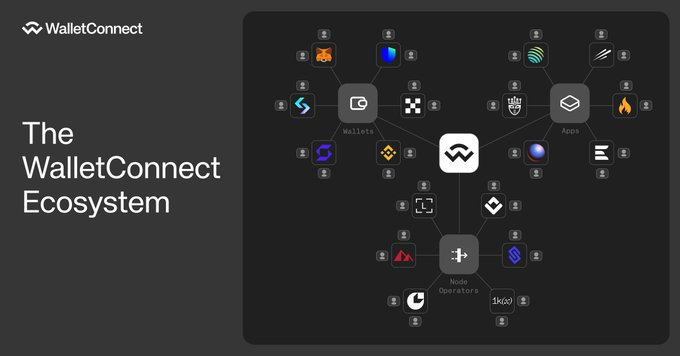

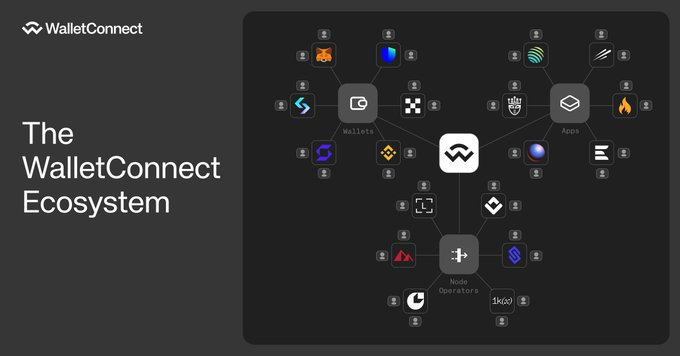

WalletConnect has quietly powered Web3 behind the scenes. The protocol connects decentralized apps (dApps) and crypto wallets together.

Now, with the launch of the network’s $WCT token, the project is stepping into the spotlight and facing its first market test.

Early Sell-Off Crashes $WCT Over 30% From Peak

$WCT debuted on April 15 with serious intent, quickly securing listings on top-tier exchanges, including Binance, Kraken, OKX, and Crypto.com.

Binance, in particular, provided millions of users the opportunity to farm $WCT by locking $BNB, $FDUSD, and $USDC via its LaunchPool.

But, the transition from an established infrastructure to a tokenized ecosystem hasn’t gone as planned.

Despite a promising start, $WCT dropped from its initial price of $0.40 to $0.27, largely due to sell-offs by early airdrop recipients.

On April 16, the token experienced a sharp recovery, rallying to a high of $0.63 before cooling off, now trading over 30% below that peak.

Founder Defends $WCT Launch, Citing ‘Token-Market Fit’

Market observers have questioned whether WalletConnect, widely known as a protocol that bridges digital wallets with decentralized apps (dApps), truly requires a native token.

In response, founder Pedro Gomes justified the launch by citing “token-market fit,” emphasizing the network’s growth and increasing developer participation through SDK integrations.

He also mentioned aligning stakeholders with the platform’s long-term goals, including node operators and wallets.

According to Gomes, the $WCT token will support WalletConnect’s expanding ecosystem through fees, rewards, staking, and governance, incentivizing its over 40 million users and supporting the protocol’s transition into a decentralized infrastructure layer.

Often compared to the “Visa of Web3,” WalletConnect powers over 275 million on-chain connections, including more than 18 million wallet interactions in March alone.

Beyond wallet integration, WalletConnect has also ventured into secure decentralized communication.

In January 2024, the project launched Web3Inbox, a subscription-based notification service enabling wallet-based messaging without reliance on traditional Web2 tools.

Through it, users receive project updates directly in their wallets, eliminating the need for email sign-ups or external platforms.

Trouble Ahead? Bearish Signals Flash Warning

The $WCT/$USDT pair is currently trading near $0.3932, down 9.14% intraday. Price action on the daily chart suggests the formation of a potential Head and Shoulders pattern, a classical bearish reversal setup.

The left shoulder formed after a sharp initial rally, followed by the head at the swing high near $0.65. The right shoulder is now forming slightly below the head, indicating waning bullish momentum.

The neckline appears to lie in the $0.35–$0.36 range. A confirmed breakdown below this region could validate the bearish structure, targeting a retracement toward the $0.28–$0.30 zone.

Meanwhile, the Relative Strength Index (RSI) stands at 40.59, with a signal line at 41.02. This suggests bearish pressure without reaching oversold conditions, leaving room for further downside.

Conversely, if $WCT holds the neckline and rebounds, resistance is expected in the $0.42–$0.45 range.

A breakout above the right shoulder could invalidate the bearish pattern and signal renewed upside momentum.

The post $WCT Peaks at $0.63, Slides 30%—Is Web3’s “Visa” Token in Trouble? appeared first on Cryptonews.

$WCT Peaks at $0.63, Slides 30%—Is Web3’s “Visa” Token in Trouble?

WalletConnect has quietly powered Web3 behind the scenes. The protocol connects decentralized apps (dApps) and crypto wallets together.

Now, with the launch of the network’s $WCT token, the project is stepping into the spotlight and facing its first market test.

Early Sell-Off Crashes $WCT Over 30% From Peak

$WCT debuted on April 15 with serious intent, quickly securing listings on top-tier exchanges, including Binance, Kraken, OKX, and Crypto.com.

Binance, in particular, provided millions of users the opportunity to farm $WCT by locking $BNB, $FDUSD, and $USDC via its LaunchPool.

But, the transition from an established infrastructure to a tokenized ecosystem hasn’t gone as planned.

Despite a promising start, $WCT dropped from its initial price of $0.40 to $0.27, largely due to sell-offs by early airdrop recipients.

On April 16, the token experienced a sharp recovery, rallying to a high of $0.63 before cooling off, now trading over 30% below that peak.

Founder Defends $WCT Launch, Citing ‘Token-Market Fit’

Market observers have questioned whether WalletConnect, widely known as a protocol that bridges digital wallets with decentralized apps (dApps), truly requires a native token.

In response, founder Pedro Gomes justified the launch by citing “token-market fit,” emphasizing the network’s growth and increasing developer participation through SDK integrations.

He also mentioned aligning stakeholders with the platform’s long-term goals, including node operators and wallets.

According to Gomes, the $WCT token will support WalletConnect’s expanding ecosystem through fees, rewards, staking, and governance, incentivizing its over 40 million users and supporting the protocol’s transition into a decentralized infrastructure layer.

Often compared to the “Visa of Web3,” WalletConnect powers over 275 million on-chain connections, including more than 18 million wallet interactions in March alone.

Beyond wallet integration, WalletConnect has also ventured into secure decentralized communication.

In January 2024, the project launched Web3Inbox, a subscription-based notification service enabling wallet-based messaging without reliance on traditional Web2 tools.

Through it, users receive project updates directly in their wallets, eliminating the need for email sign-ups or external platforms.

Trouble Ahead? Bearish Signals Flash Warning

The $WCT/$USDT pair is currently trading near $0.3932, down 9.14% intraday. Price action on the daily chart suggests the formation of a potential Head and Shoulders pattern, a classical bearish reversal setup.

The left shoulder formed after a sharp initial rally, followed by the head at the swing high near $0.65. The right shoulder is now forming slightly below the head, indicating waning bullish momentum.

The neckline appears to lie in the $0.35–$0.36 range. A confirmed breakdown below this region could validate the bearish structure, targeting a retracement toward the $0.28–$0.30 zone.

Meanwhile, the Relative Strength Index (RSI) stands at 40.59, with a signal line at 41.02. This suggests bearish pressure without reaching oversold conditions, leaving room for further downside.

Conversely, if $WCT holds the neckline and rebounds, resistance is expected in the $0.42–$0.45 range.

A breakout above the right shoulder could invalidate the bearish pattern and signal renewed upside momentum.

The post $WCT Peaks at $0.63, Slides 30%—Is Web3’s “Visa” Token in Trouble? appeared first on Cryptonews.