Tron’s Justin Sun announces TRX CA on Solana blockchain

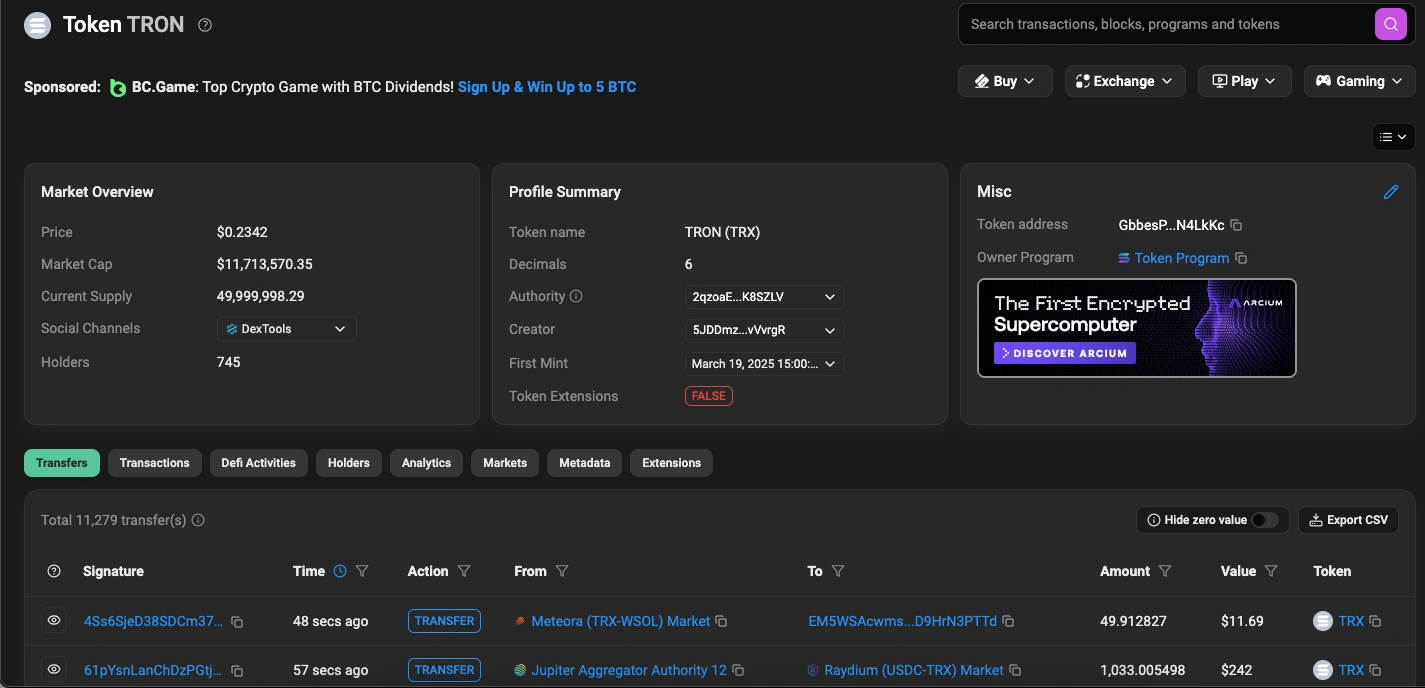

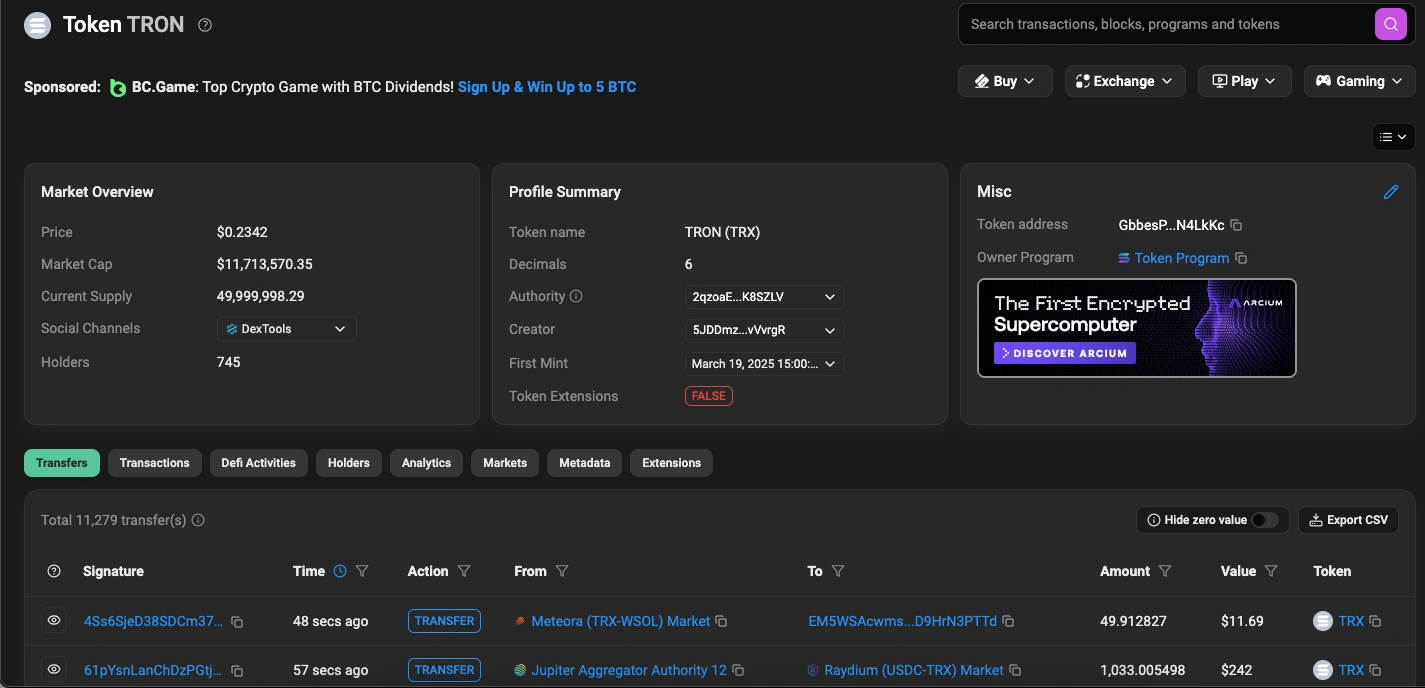

Tron has been having a great day. Its founder Justin Sun took to X, formerly Twitter, with an update to a tweet he shared days before; “TRX on SOL is now live!” He wrote before adding that “All liquidity is ready!” and sharing the Contract Address (CA) which is GbbesPbaYh5uiAZSYNXTc7w9jty1rpg3P9L4JeN4LkKc.

In subsequent tweets, Sun was quick to clarify that his account was not hacked and that he had in fact shared the contact address of TRX on SOL. “TRX can now be purchased on the SOL chain,” he concluded.

The next tweet he shared contained what Sun called a 1:1 back address, presumably for holders of TRX who wish to convert to the SOL version.

The news follows Sun’s announcement on March 18

Sun initially announced plans for Tron’s token to become available on the Solana blockchain on Tuesday, March 18. “TRX will be soon on Solana. Ready to buy and collaborate,” Sun wrote.

While some community members can’t see the importance of integrating TRX into SOL, the move has the potential to unlock new possibilities for decentralized finance (DeFi) applications and non-fungible tokens (NFTs), making TRX an even more attractive prospect for developers and users.

In time, this could translate to increased liquidity and broader adoption of the TRX token. Mert, the CEO of Helius Labs and Solana defender, definitely sees the potential in the integration, even offering to help in the comment section.

Justin Sun’s teaser triggered excitement among investors and the larger community, causing TRX to surge by about 10% while its trading volume jumped 54% to over $991 million in the 24-hour period.

The surge saw TRX outperform other large-cap cryptocurrencies, including Bitcoin and Dogecoin, which declined 0.58% and 0.26%, respectively.

This was a direct response to Sun teasing the TRX-SOL integration. After all, the wider adoption of the Tron on Solana means more interoperability, faster transactions, and attracting interest from investors and traders.

Tron price had retested and found support around the 200-day Exponential Moving Average (EMA) at $0.21 on Monday. However, following Sun’s announcement on Tuesday, it rallied about 7.43%. By Wednesday, it was facing a rejection from its weekly resistance level at $0.24 and was trading around $0.23, while its trading volume jumped 54% to over $991 million in the 24-hour period.

It has maintained that momentum and continues to hover around that price. If TRX breaks and closes above its weekly resistance at $0.24, the rally can extend to retest its next daily resistance at $0.27.

The Moving Average Convergence Divergence (MACD) indicator also flipped to a bullish crossover on Wednesday, giving buy signals and suggesting a bullish trend ahead. If the TRX token fails to find support around the 200-day EMA at $0.21 and closes below it, Tron could extend the decline to retest its December 2 low of $0.20.

Why Tron on Solana is a big deal

Wrapped tokens are tokenized versions of cryptocurrencies operating on blockchains they were not originally created on. When TRX first launched, it was an Ethereum-based token. However, in 2018, it transitioned to its own blockchain.

The move was driven by a strategic and operational need as relying on Ethereum, a chain known for its scalability issues and high gas fees, was limiting Sun’s vision to provide high-throughput, low-cost transactions for digital content creators and dApps.

TRON also wanted to compete with other blockchains like Ethereum, EOS, and Solana which was not possible while it was affiliated with the ETH blockchain.

Transitioning to its own blockchain meant TRON could implement its own consensus mechanism which is the delegated proof-of-stake, and optimize its network for higher transactions per second.

The integration of TRX on Solana might also open up new avenues for decentralized finance and increase the coin’s liquidity. The integration of TRX on SOL brings another major cryptocurrency to Solana, which enriches its token offerings and gives TRON users a reason to gravitate toward Solana’s many platforms.

Increased transactions and trading pairs involving TRX can also boost Solana’s network activity, fees for validators, and overall adoption, further strengthening its position as a leading blockchain.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

Tron’s Justin Sun announces TRX CA on Solana blockchain

Tron has been having a great day. Its founder Justin Sun took to X, formerly Twitter, with an update to a tweet he shared days before; “TRX on SOL is now live!” He wrote before adding that “All liquidity is ready!” and sharing the Contract Address (CA) which is GbbesPbaYh5uiAZSYNXTc7w9jty1rpg3P9L4JeN4LkKc.

In subsequent tweets, Sun was quick to clarify that his account was not hacked and that he had in fact shared the contact address of TRX on SOL. “TRX can now be purchased on the SOL chain,” he concluded.

The next tweet he shared contained what Sun called a 1:1 back address, presumably for holders of TRX who wish to convert to the SOL version.

The news follows Sun’s announcement on March 18

Sun initially announced plans for Tron’s token to become available on the Solana blockchain on Tuesday, March 18. “TRX will be soon on Solana. Ready to buy and collaborate,” Sun wrote.

While some community members can’t see the importance of integrating TRX into SOL, the move has the potential to unlock new possibilities for decentralized finance (DeFi) applications and non-fungible tokens (NFTs), making TRX an even more attractive prospect for developers and users.

In time, this could translate to increased liquidity and broader adoption of the TRX token. Mert, the CEO of Helius Labs and Solana defender, definitely sees the potential in the integration, even offering to help in the comment section.

Justin Sun’s teaser triggered excitement among investors and the larger community, causing TRX to surge by about 10% while its trading volume jumped 54% to over $991 million in the 24-hour period.

The surge saw TRX outperform other large-cap cryptocurrencies, including Bitcoin and Dogecoin, which declined 0.58% and 0.26%, respectively.

This was a direct response to Sun teasing the TRX-SOL integration. After all, the wider adoption of the Tron on Solana means more interoperability, faster transactions, and attracting interest from investors and traders.

Tron price had retested and found support around the 200-day Exponential Moving Average (EMA) at $0.21 on Monday. However, following Sun’s announcement on Tuesday, it rallied about 7.43%. By Wednesday, it was facing a rejection from its weekly resistance level at $0.24 and was trading around $0.23, while its trading volume jumped 54% to over $991 million in the 24-hour period.

It has maintained that momentum and continues to hover around that price. If TRX breaks and closes above its weekly resistance at $0.24, the rally can extend to retest its next daily resistance at $0.27.

The Moving Average Convergence Divergence (MACD) indicator also flipped to a bullish crossover on Wednesday, giving buy signals and suggesting a bullish trend ahead. If the TRX token fails to find support around the 200-day EMA at $0.21 and closes below it, Tron could extend the decline to retest its December 2 low of $0.20.

Why Tron on Solana is a big deal

Wrapped tokens are tokenized versions of cryptocurrencies operating on blockchains they were not originally created on. When TRX first launched, it was an Ethereum-based token. However, in 2018, it transitioned to its own blockchain.

The move was driven by a strategic and operational need as relying on Ethereum, a chain known for its scalability issues and high gas fees, was limiting Sun’s vision to provide high-throughput, low-cost transactions for digital content creators and dApps.

TRON also wanted to compete with other blockchains like Ethereum, EOS, and Solana which was not possible while it was affiliated with the ETH blockchain.

Transitioning to its own blockchain meant TRON could implement its own consensus mechanism which is the delegated proof-of-stake, and optimize its network for higher transactions per second.

The integration of TRX on Solana might also open up new avenues for decentralized finance and increase the coin’s liquidity. The integration of TRX on SOL brings another major cryptocurrency to Solana, which enriches its token offerings and gives TRON users a reason to gravitate toward Solana’s many platforms.

Increased transactions and trading pairs involving TRX can also boost Solana’s network activity, fees for validators, and overall adoption, further strengthening its position as a leading blockchain.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More