Samourai Wallet Lawyers Say Prosecutors Hid Evidence

The move stems from a 2023 call in which FinCEN reportedly told prosecutors that the wallet did not qualify as a Money Services Business. This critical detail was only disclosed to the defense almost a year later, which prompted calls for case dismissal and hearings over prosecutorial conduct.

Meanwhile, OpenSea CEO Devin Finzer criticized the SEC’s past enforcement-heavy tactics under the Biden administration, and described them as stifling innovation. He praised the Trump-era regulatory shift that led to dropped cases against Coinbase, Ripple, and others. At the same time, the trial of former SafeMoon CEO Braden Karony is beginning under new DOJ leadership, adding further complexity. Overall, it seems like there is a growing clash between US federal prosecutors and the crypto industry cross multiple high-profile cases.

Samourai Wallet Fights Back

Samourai Wallet’s legal team is accusing federal prosecutors of withholding critical information that could have changed the course of the criminal case against its co-founders. In a letter that was submitted to a Manhattan federal court on May 5, attorneys for Keonne Rodriguez and William Hill revealed that prosecutors were informed by the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) in late 2023 that Samourai Wallet did not qualify as a Money Services Business (MSB) under existing guidance.

Despite this, prosecutors still moved forward six months later with criminal charges alleging that the crypto mixing service was operating as an unlicensed money transmitter. The defense claims this guidance should have been disclosed by May 8, 2024, but was only shared with them on April 1, 2025, almost a year late.

Rodriguez and Hill were charged in February of 2024 and arrested in April for allegedly facilitating over $2 billion in unlawful transactions, including $100 million linked to online black markets and scams, through Samourai’s crypto-mixing technology. Both men pleaded not guilty.

Samourai Wallet website

Their lawyers argue that FinCEN explicitly told prosecutors in a call that the Samourai app, which does not take custody of funds or hold private keys, would not be considered an MSB. According to a prosecutor's email summarizing that call, FinCEN representatives said that without custody, Samourai would likely not require a license, and that any attempt to argue otherwise would be legally difficult due to lack of precedent.

The defense is now requesting a court hearing to examine the government's delayed disclosure and explore potential remedies. They also plan to renew a motion to dismiss the case, due to the new evidence and a recent Justice Department policy shift.

In an April 7 memo, Deputy Attorney General Todd Blanche stated that prosecutors should not pursue cases against crypto mixers for accidental regulatory violations. The defense argues that if Samourai was never required to register as a money transmitter under FinCEN’s own guidance, the entire basis of the criminal charges collapses. Both sides already asked the court for more time on April 28 to consider whether to continue the case in light of the Justice Department’s changing stance on crypto enforcement.

OpenSea CEO Slams SEC

Others in the industry are also not very happy with how crypto enforcement was treated. OpenSea CEO Devin Finzer recently criticized the US Securities and Exchange Commission’s (SECs) prior approach to crypto regulation, and described it as overly broad and harmful to innovation.

In a recent interview, Finzer argued that under the Biden administration, the SEC unfairly targeted legitimate players in the digital asset space, including OpenSea, by treating all digital assets with a one-size-fits-all approach. This, he said, created a persistent regulatory overhang that stifled progress in the sector.

OpenSea CEO Devin Finzer

OpenSea received a Wells notice from the SEC in 2024, signaling a potential enforcement action over claims that it operated as an unregistered securities exchange. Finzer pushed back against the charge, and called it an example of “regulation by enforcement.”

Finzer is very optimistic that the new leadership under SEC Chair Paul Atkins will take a more nuanced and innovation-friendly stance. He firmly believes that there is a need for regulation that protects consumers while still allowing space for experimentation and growth.

Since the transition to the Trump administration, the SEC greatly reduced its legal pressure on crypto firms, including dropping cases against Coinbase, Kraken, Uniswap, Yuga Labs, and OpenSea. It even dismissed its years-long battle with Ripple. This change followed strong support from the crypto industry during the 2024 US elections, with pro-crypto candidates receiving over $119 million in donations.

While the broader crypto market suffered after the FTX collapse in 2022 , Finzer is still confident in the long-term future of NFTs. He said that despite low trading volumes, innovation in areas like gaming and digital art continues to thrive. OpenSea, meanwhile, is now working to expand beyond NFTs to support a wider range of on-chain assets.

SafeMoon Trial Opens During DOJ Shake-Up

The US Attorney’s Office for the Eastern District of New York (EDNY) underwent a leadership change just as the criminal trial of former SafeMoon CEO Braden John Karony is set to begin. On May 5, the office announced that Joseph Nocella will take over as interim US Attorney for a period of 120 days or until a Senate-confirmed nominee is appointed.

Statement from the United States Attorney’s Office

Nocella was appointed by President Donald Trump, replacing Acting US Attorney John Durham. He vowed to focus on prosecuting narcotics traffickers, gang members, terrorists, and other serious offenders.

The timing of Nocella’s appointment happened as jury selection begins in the high-profile crypto fraud case against Karony. This raised some questions about whether the leadership transition could affect the prosecution’s direction.

SafeMoon CEO Braden John Karony

Karony, along with co-defendants Kyle Nagy and Thomas Smith, was indicted in November of 2023 on charges of securities fraud conspiracy, wire fraud conspiracy, and money laundering conspiracy. Prosecutors allege the trio misappropriated millions of dollars’ worth of SafeMoon (SFM) tokens between 2021 and 2022. Karony maintained his innocence and has been out on a $3 million bond since February of 2024.

Earlier this year, Karony asked the court to consider delaying the trial due to proposed changes to US securities laws under the Trump administration, which he argued could influence the legal grounds of the case. However, jury selection is proceeding as scheduled under US Magistrate Judge James Cho, with District Judge Eric Komitee set to oversee the full trial starting May 6.

While EDNY has not traditionally been the focal point for high-profile crypto enforcement actions, it has handled several cases involving digital assets, including a SEC complaint against Hex founder Richard Heart. Its neighboring jurisdiction, the Southern District of New York, will oversee the sentencing of former Celsius CEO Alex Mashinsky on May 8.

Samourai Wallet Lawyers Say Prosecutors Hid Evidence

The move stems from a 2023 call in which FinCEN reportedly told prosecutors that the wallet did not qualify as a Money Services Business. This critical detail was only disclosed to the defense almost a year later, which prompted calls for case dismissal and hearings over prosecutorial conduct.

Meanwhile, OpenSea CEO Devin Finzer criticized the SEC’s past enforcement-heavy tactics under the Biden administration, and described them as stifling innovation. He praised the Trump-era regulatory shift that led to dropped cases against Coinbase, Ripple, and others. At the same time, the trial of former SafeMoon CEO Braden Karony is beginning under new DOJ leadership, adding further complexity. Overall, it seems like there is a growing clash between US federal prosecutors and the crypto industry cross multiple high-profile cases.

Samourai Wallet Fights Back

Samourai Wallet’s legal team is accusing federal prosecutors of withholding critical information that could have changed the course of the criminal case against its co-founders. In a letter that was submitted to a Manhattan federal court on May 5, attorneys for Keonne Rodriguez and William Hill revealed that prosecutors were informed by the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) in late 2023 that Samourai Wallet did not qualify as a Money Services Business (MSB) under existing guidance.

Despite this, prosecutors still moved forward six months later with criminal charges alleging that the crypto mixing service was operating as an unlicensed money transmitter. The defense claims this guidance should have been disclosed by May 8, 2024, but was only shared with them on April 1, 2025, almost a year late.

Rodriguez and Hill were charged in February of 2024 and arrested in April for allegedly facilitating over $2 billion in unlawful transactions, including $100 million linked to online black markets and scams, through Samourai’s crypto-mixing technology. Both men pleaded not guilty.

Samourai Wallet website

Their lawyers argue that FinCEN explicitly told prosecutors in a call that the Samourai app, which does not take custody of funds or hold private keys, would not be considered an MSB. According to a prosecutor's email summarizing that call, FinCEN representatives said that without custody, Samourai would likely not require a license, and that any attempt to argue otherwise would be legally difficult due to lack of precedent.

The defense is now requesting a court hearing to examine the government's delayed disclosure and explore potential remedies. They also plan to renew a motion to dismiss the case, due to the new evidence and a recent Justice Department policy shift.

In an April 7 memo, Deputy Attorney General Todd Blanche stated that prosecutors should not pursue cases against crypto mixers for accidental regulatory violations. The defense argues that if Samourai was never required to register as a money transmitter under FinCEN’s own guidance, the entire basis of the criminal charges collapses. Both sides already asked the court for more time on April 28 to consider whether to continue the case in light of the Justice Department’s changing stance on crypto enforcement.

OpenSea CEO Slams SEC

Others in the industry are also not very happy with how crypto enforcement was treated. OpenSea CEO Devin Finzer recently criticized the US Securities and Exchange Commission’s (SECs) prior approach to crypto regulation, and described it as overly broad and harmful to innovation.

In a recent interview, Finzer argued that under the Biden administration, the SEC unfairly targeted legitimate players in the digital asset space, including OpenSea, by treating all digital assets with a one-size-fits-all approach. This, he said, created a persistent regulatory overhang that stifled progress in the sector.

OpenSea CEO Devin Finzer

OpenSea received a Wells notice from the SEC in 2024, signaling a potential enforcement action over claims that it operated as an unregistered securities exchange. Finzer pushed back against the charge, and called it an example of “regulation by enforcement.”

Finzer is very optimistic that the new leadership under SEC Chair Paul Atkins will take a more nuanced and innovation-friendly stance. He firmly believes that there is a need for regulation that protects consumers while still allowing space for experimentation and growth.

Since the transition to the Trump administration, the SEC greatly reduced its legal pressure on crypto firms, including dropping cases against Coinbase, Kraken, Uniswap, Yuga Labs, and OpenSea. It even dismissed its years-long battle with Ripple. This change followed strong support from the crypto industry during the 2024 US elections, with pro-crypto candidates receiving over $119 million in donations.

While the broader crypto market suffered after the FTX collapse in 2022 , Finzer is still confident in the long-term future of NFTs. He said that despite low trading volumes, innovation in areas like gaming and digital art continues to thrive. OpenSea, meanwhile, is now working to expand beyond NFTs to support a wider range of on-chain assets.

SafeMoon Trial Opens During DOJ Shake-Up

The US Attorney’s Office for the Eastern District of New York (EDNY) underwent a leadership change just as the criminal trial of former SafeMoon CEO Braden John Karony is set to begin. On May 5, the office announced that Joseph Nocella will take over as interim US Attorney for a period of 120 days or until a Senate-confirmed nominee is appointed.

Statement from the United States Attorney’s Office

Nocella was appointed by President Donald Trump, replacing Acting US Attorney John Durham. He vowed to focus on prosecuting narcotics traffickers, gang members, terrorists, and other serious offenders.

The timing of Nocella’s appointment happened as jury selection begins in the high-profile crypto fraud case against Karony. This raised some questions about whether the leadership transition could affect the prosecution’s direction.

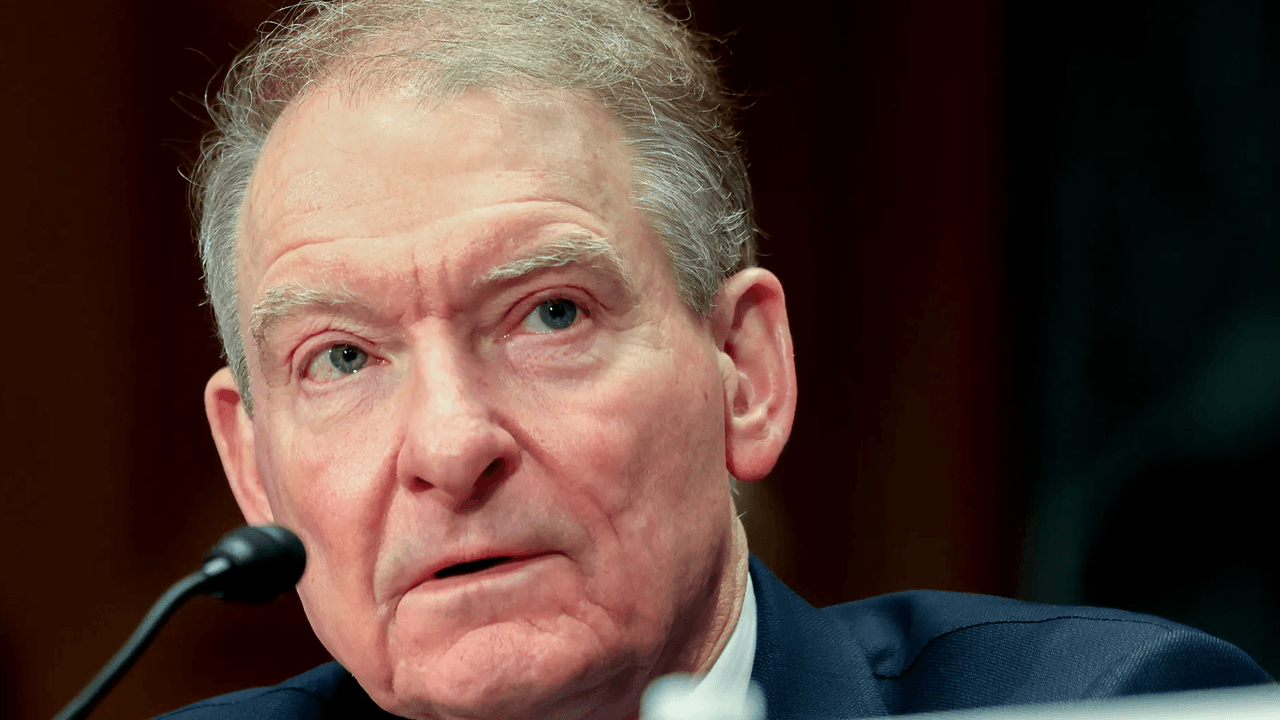

SafeMoon CEO Braden John Karony

Karony, along with co-defendants Kyle Nagy and Thomas Smith, was indicted in November of 2023 on charges of securities fraud conspiracy, wire fraud conspiracy, and money laundering conspiracy. Prosecutors allege the trio misappropriated millions of dollars’ worth of SafeMoon (SFM) tokens between 2021 and 2022. Karony maintained his innocence and has been out on a $3 million bond since February of 2024.

Earlier this year, Karony asked the court to consider delaying the trial due to proposed changes to US securities laws under the Trump administration, which he argued could influence the legal grounds of the case. However, jury selection is proceeding as scheduled under US Magistrate Judge James Cho, with District Judge Eric Komitee set to oversee the full trial starting May 6.

While EDNY has not traditionally been the focal point for high-profile crypto enforcement actions, it has handled several cases involving digital assets, including a SEC complaint against Hex founder Richard Heart. Its neighboring jurisdiction, the Southern District of New York, will oversee the sentencing of former Celsius CEO Alex Mashinsky on May 8.