Italy’s largest bank Intesa Sanpaolo enters Bitcoin market with initial €1 million investment

Intesa Sanpaolo, Italy’s largest bank, has reportedly entered the Bitcoin market by acquiring €1 million worth of the leading digital asset.

This translates to approximately 11 BTC, according to an internal email allegedly signed by Niccolo Bardoscia, the head of the bank’s digital asset trading and investment division.

Although Intesa has yet to confirm the acquisition, several credible media outlets, including Reuters, have reported on it.

Meanwhile, Intesa’s reported Bitcoin acquisition follows a series of strategic moves in the digital asset space.

Last year, the bank’s crypto division reportedly secured approval for spot crypto trading, adding to its existing offerings of crypto options, futures, and exchange-traded funds (ETFs).

However, it is unclear if this Bitcoin purchase signals its broader expansion into the digital assets ecosystem.

Nevertheless, Pierre Rochard, Vice President of Bitcoin Miner Riot Platforms, highlighted the significance of this shift, noting that financial institutions increasingly recognize Bitcoin’s potential.

He stated:

“All of the banks need to start accumulating BTC to recapitalize their balance sheets.”

Intesa is widely recognized as a leader in digital asset adoption within Italy’s traditional finance sector. It also holds the top spot among Eurozone banks by market capitalization, valued at €69 billion—outpacing competitors like Santander (€67 billion) and BNP Paribas (€66 billion).

Institutional Bitcoin interest

Market observers noted that Intesa’s purchase reflects a broader trend of increased Bitcoin adoption among financial institutions.

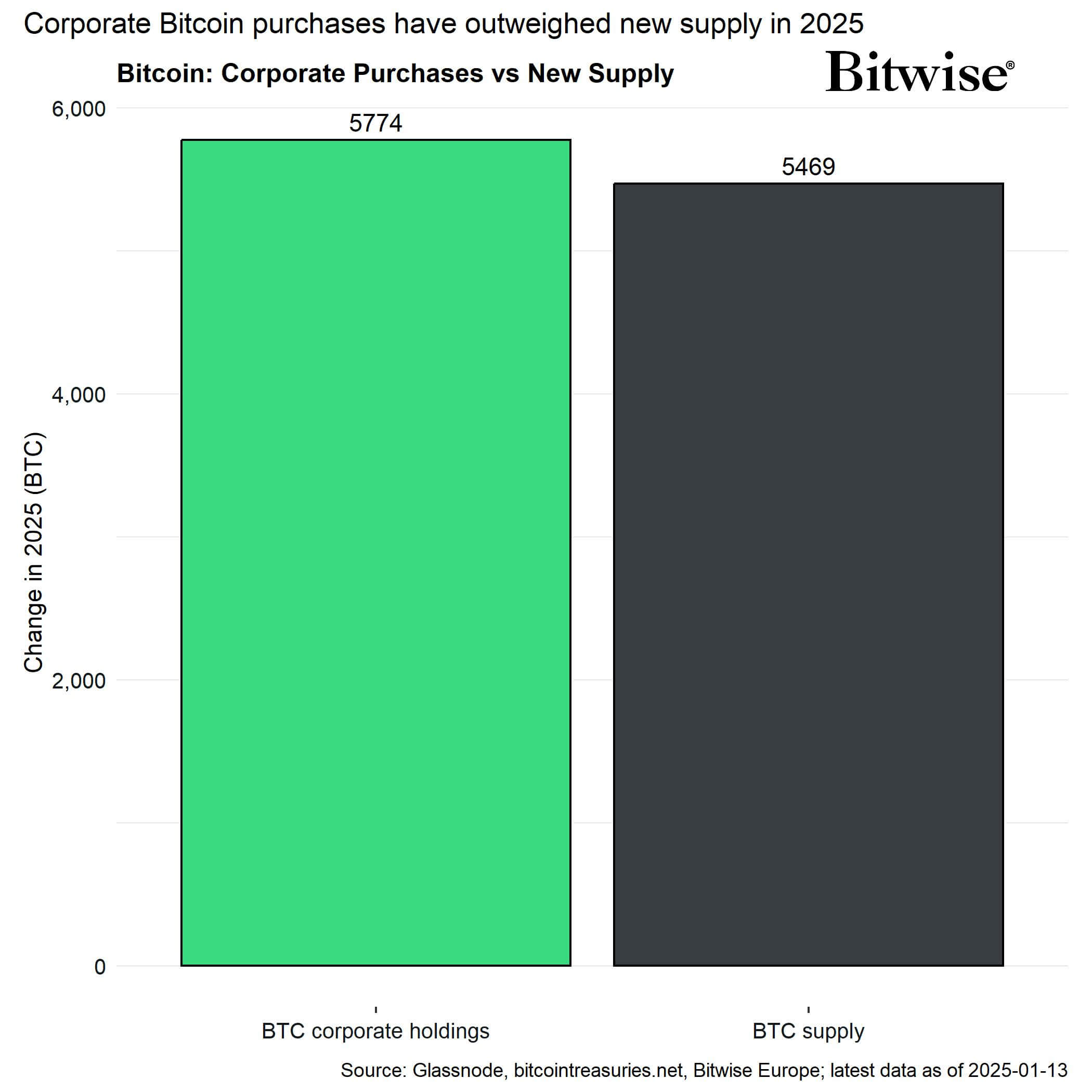

Data from Bitwise highlights that corporate demand for Bitcoin in 2025 has exceeded the supply of newly mined coins. Companies have collectively purchased 5,774 BTC since the beginning of the year, while only 5,469 BTC were mined during the same period.

Among the prominent corporate buyers is MicroStrategy, which has added approximately 3,600 BTC to its reserves this year. Other firms like Semler Scientific and Ming Shing Group have also turned to Bitcoin in their liquidity and reserve diversification strategies.

Hunter Horsley, Bitwise CEO, expects this trend to continue this year, saying:

“Corporations buying Bitcoin is going to be a major theme of 2025.”

The post Italy’s largest bank Intesa Sanpaolo enters Bitcoin market with initial €1 million investment appeared first on CryptoSlate.

Italy’s largest bank Intesa Sanpaolo enters Bitcoin market with initial €1 million investment

Intesa Sanpaolo, Italy’s largest bank, has reportedly entered the Bitcoin market by acquiring €1 million worth of the leading digital asset.

This translates to approximately 11 BTC, according to an internal email allegedly signed by Niccolo Bardoscia, the head of the bank’s digital asset trading and investment division.

Although Intesa has yet to confirm the acquisition, several credible media outlets, including Reuters, have reported on it.

Meanwhile, Intesa’s reported Bitcoin acquisition follows a series of strategic moves in the digital asset space.

Last year, the bank’s crypto division reportedly secured approval for spot crypto trading, adding to its existing offerings of crypto options, futures, and exchange-traded funds (ETFs).

However, it is unclear if this Bitcoin purchase signals its broader expansion into the digital assets ecosystem.

Nevertheless, Pierre Rochard, Vice President of Bitcoin Miner Riot Platforms, highlighted the significance of this shift, noting that financial institutions increasingly recognize Bitcoin’s potential.

He stated:

“All of the banks need to start accumulating BTC to recapitalize their balance sheets.”

Intesa is widely recognized as a leader in digital asset adoption within Italy’s traditional finance sector. It also holds the top spot among Eurozone banks by market capitalization, valued at €69 billion—outpacing competitors like Santander (€67 billion) and BNP Paribas (€66 billion).

Institutional Bitcoin interest

Market observers noted that Intesa’s purchase reflects a broader trend of increased Bitcoin adoption among financial institutions.

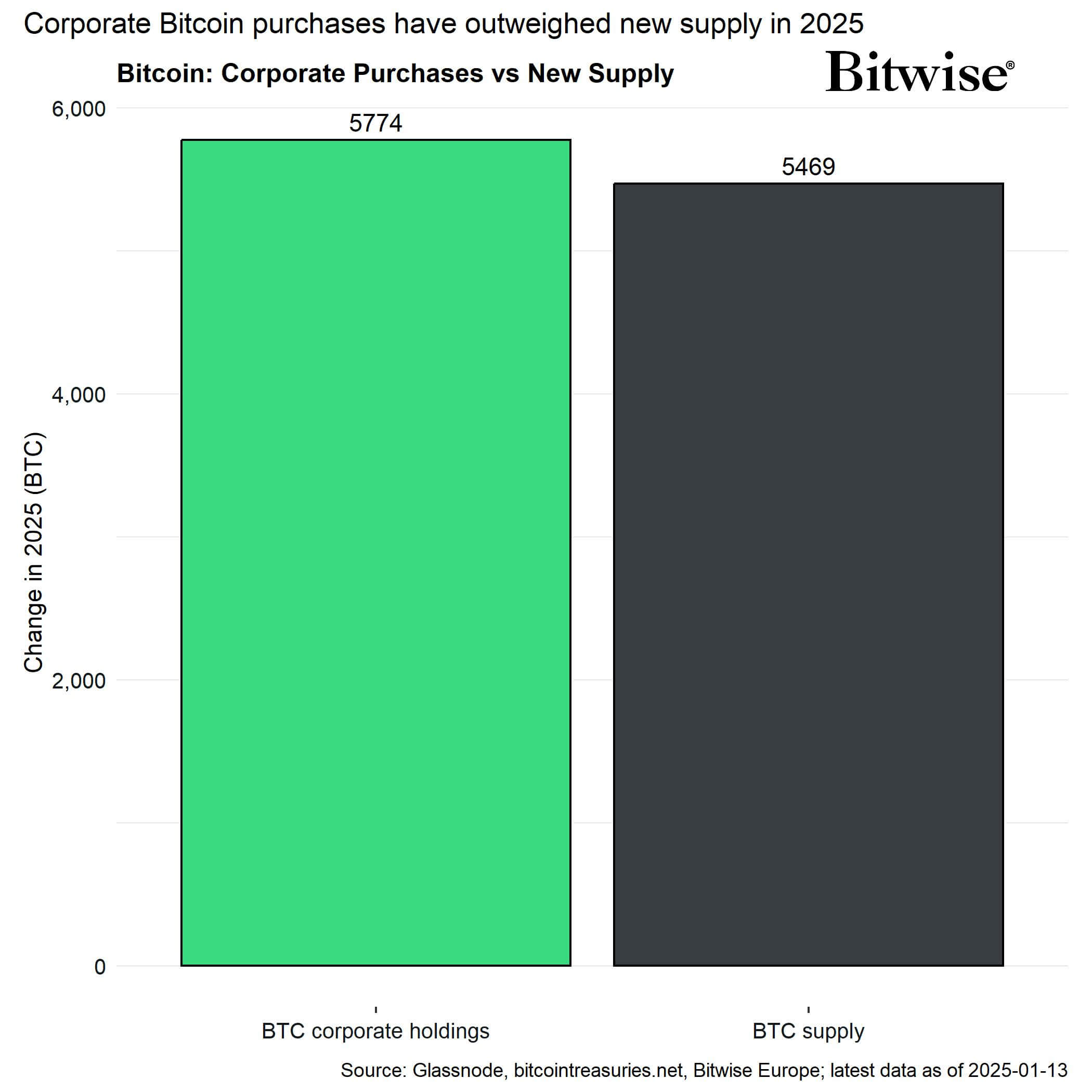

Data from Bitwise highlights that corporate demand for Bitcoin in 2025 has exceeded the supply of newly mined coins. Companies have collectively purchased 5,774 BTC since the beginning of the year, while only 5,469 BTC were mined during the same period.

Among the prominent corporate buyers is MicroStrategy, which has added approximately 3,600 BTC to its reserves this year. Other firms like Semler Scientific and Ming Shing Group have also turned to Bitcoin in their liquidity and reserve diversification strategies.

Hunter Horsley, Bitwise CEO, expects this trend to continue this year, saying:

“Corporations buying Bitcoin is going to be a major theme of 2025.”

The post Italy’s largest bank Intesa Sanpaolo enters Bitcoin market with initial €1 million investment appeared first on CryptoSlate.