BitMine Scoops Up 200K ETH in the Dip — Here’s How Tom Lee’s Firm Just Doubled Down on Ethereum

- BitMine added 202K ETH during last week’s crash, lifting its holdings past 3 million tokens.

- The firm now controls 2.5% of Ethereum’s supply, halfway to its goal of 5%.

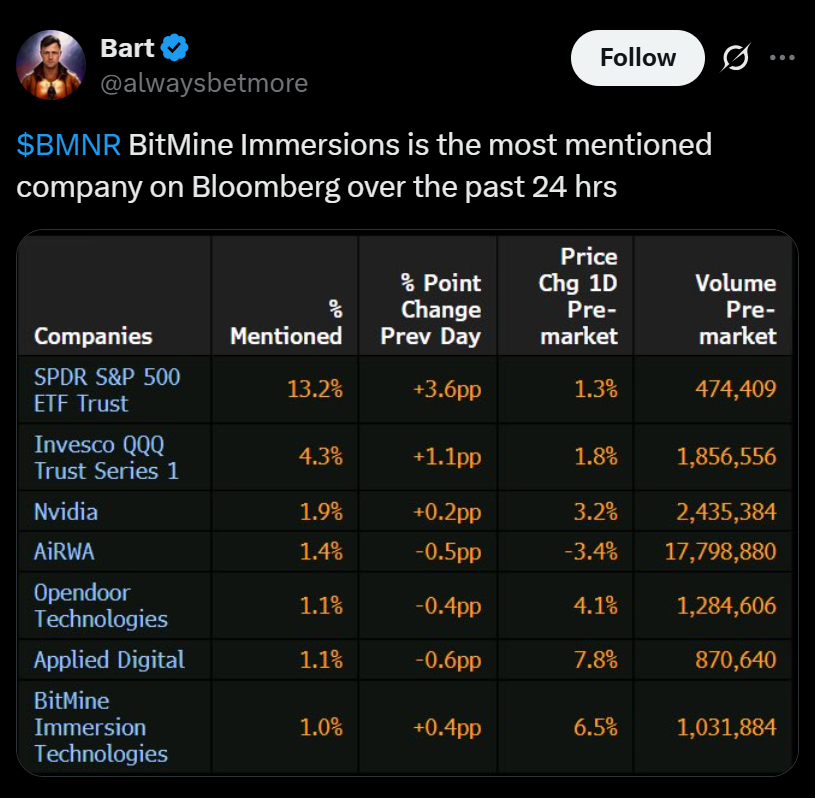

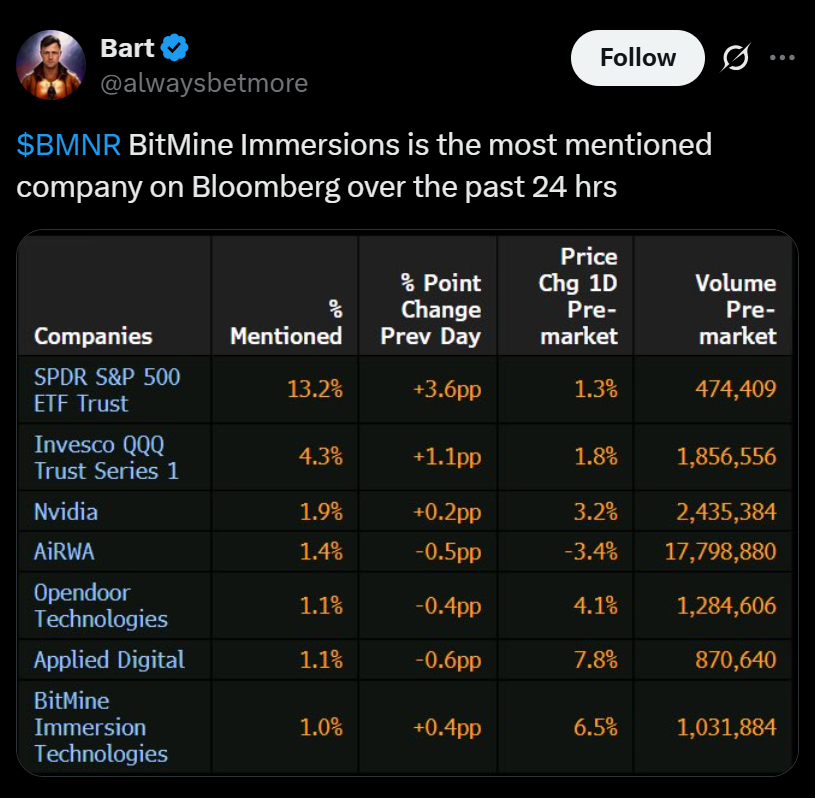

- ETH rebounded above $4,100, while BitMine shares rose 4.3% after the announcement.

The company’s massive buy puts its ETH stash over 3 million, closing in on its goal to own 5% of all circulating Ether.

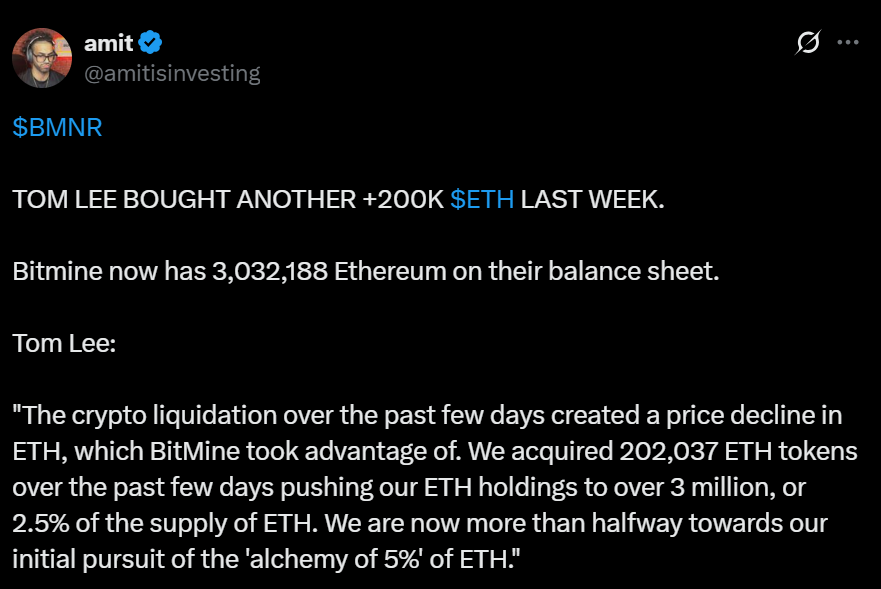

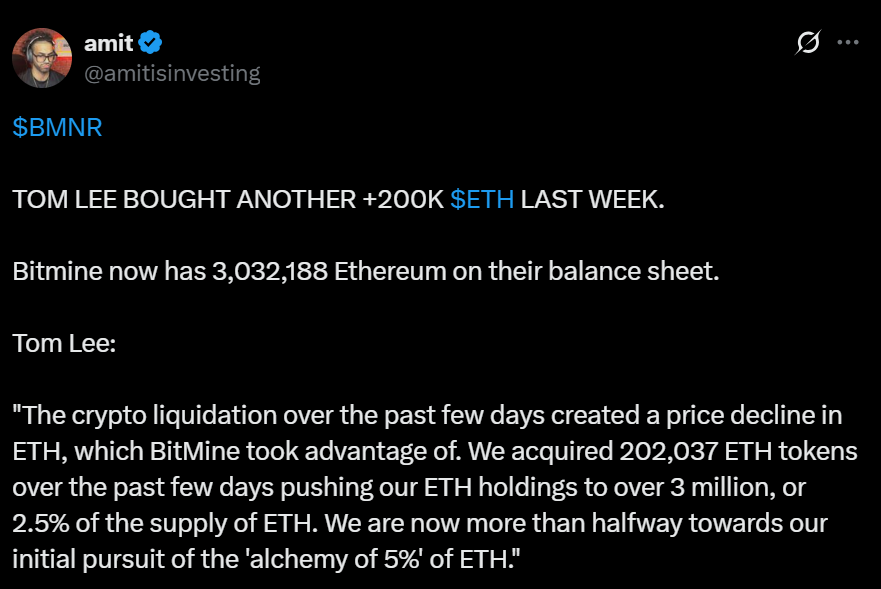

When markets dipped last week, Tom Lee’s BitMine Technologies didn’t flinch—it loaded up. The company quietly grabbed 202,037 ETH, worth about $828 million, seizing on the sudden price crash that wiped billions across the crypto space. Chairman Thomas Lee said the move was part of a long-term play, not a reaction to fear.

“The crypto liquidation over the past few days created a window we couldn’t ignore,” Lee said, noting how volatility tends to “shake out traders” and hand opportunities to patient holders. BitMine now holds more than 3 million ETH, roughly 2.5% of the total supply, marking the halfway point toward its ambitious goal of cornering 5% of Ethereum’s circulation.

A Quiet Whale Move During the Flash Crash

Blockchain watchers first spotted unusual withdrawals late Friday, just as crypto markets melted down. Data from Lookonchain pointed to BitMine-linked addresses pulling 128,718 ETH (around $480 million at the time) off Kraken and FalconX. Another batch—roughly 43,800 ETH—was withdrawn earlier that week, likely part of the same accumulation effort.

Although those wallets aren’t officially labeled as BitMine’s, the math fits the company’s reported totals almost perfectly. The timing, too, was suspiciously precise—right after ETH dropped from $4,500 to $3,500 in a single day when U.S.-China trade tensions reignited and President Trump slapped 100% tariffs on Chinese goods.

Buying Fear, Selling Doubt

Lee’s philosophy hasn’t changed much since the early Bitcoin days. He calls this kind of chaos “a discount to the future.” In his view, deleveraging events don’t destroy value—they just move it around. “Volatility creates opportunity,” he said, adding that sharp selloffs often separate investors from traders.

And for BitMine, it’s clearly working. The company has been quietly building one of the largest ETH treasuries in the world, betting big on Ethereum’s role in the next stage of finance—from AI infrastructure to on-chain settlement. With over $13 billion in total holdings, BitMine is now positioned as a kind of Ethereum-native microstrategy, but with a longer leash.

Market Reaction and What’s Next

ETH prices have since recovered to around $4,100, clawing back some of the damage from Friday’s flash crash. BitMine’s own shares (BMNR) bounced 4.3% in pre-market trading Monday, after a brutal 11% drop at the end of last week.

If the firm keeps buying at this pace, it could hit its 5% supply target before mid-2026—assuming the market doesn’t run away first. And if that happens, BitMine won’t just be another corporate whale—it’ll be one of Ethereum’s biggest power players.

The post BitMine Scoops Up 200K ETH in the Dip — Here’s How Tom Lee’s Firm Just Doubled Down on Ethereum first appeared on BlockNews.

BitMine Scoops Up 200K ETH in the Dip — Here’s How Tom Lee’s Firm Just Doubled Down on Ethereum

- BitMine added 202K ETH during last week’s crash, lifting its holdings past 3 million tokens.

- The firm now controls 2.5% of Ethereum’s supply, halfway to its goal of 5%.

- ETH rebounded above $4,100, while BitMine shares rose 4.3% after the announcement.

The company’s massive buy puts its ETH stash over 3 million, closing in on its goal to own 5% of all circulating Ether.

When markets dipped last week, Tom Lee’s BitMine Technologies didn’t flinch—it loaded up. The company quietly grabbed 202,037 ETH, worth about $828 million, seizing on the sudden price crash that wiped billions across the crypto space. Chairman Thomas Lee said the move was part of a long-term play, not a reaction to fear.

“The crypto liquidation over the past few days created a window we couldn’t ignore,” Lee said, noting how volatility tends to “shake out traders” and hand opportunities to patient holders. BitMine now holds more than 3 million ETH, roughly 2.5% of the total supply, marking the halfway point toward its ambitious goal of cornering 5% of Ethereum’s circulation.

A Quiet Whale Move During the Flash Crash

Blockchain watchers first spotted unusual withdrawals late Friday, just as crypto markets melted down. Data from Lookonchain pointed to BitMine-linked addresses pulling 128,718 ETH (around $480 million at the time) off Kraken and FalconX. Another batch—roughly 43,800 ETH—was withdrawn earlier that week, likely part of the same accumulation effort.

Although those wallets aren’t officially labeled as BitMine’s, the math fits the company’s reported totals almost perfectly. The timing, too, was suspiciously precise—right after ETH dropped from $4,500 to $3,500 in a single day when U.S.-China trade tensions reignited and President Trump slapped 100% tariffs on Chinese goods.

Buying Fear, Selling Doubt

Lee’s philosophy hasn’t changed much since the early Bitcoin days. He calls this kind of chaos “a discount to the future.” In his view, deleveraging events don’t destroy value—they just move it around. “Volatility creates opportunity,” he said, adding that sharp selloffs often separate investors from traders.

And for BitMine, it’s clearly working. The company has been quietly building one of the largest ETH treasuries in the world, betting big on Ethereum’s role in the next stage of finance—from AI infrastructure to on-chain settlement. With over $13 billion in total holdings, BitMine is now positioned as a kind of Ethereum-native microstrategy, but with a longer leash.

Market Reaction and What’s Next

ETH prices have since recovered to around $4,100, clawing back some of the damage from Friday’s flash crash. BitMine’s own shares (BMNR) bounced 4.3% in pre-market trading Monday, after a brutal 11% drop at the end of last week.

If the firm keeps buying at this pace, it could hit its 5% supply target before mid-2026—assuming the market doesn’t run away first. And if that happens, BitMine won’t just be another corporate whale—it’ll be one of Ethereum’s biggest power players.

The post BitMine Scoops Up 200K ETH in the Dip — Here’s How Tom Lee’s Firm Just Doubled Down on Ethereum first appeared on BlockNews.