Bitcoin Hits New All-Time High Above $125K Amid U.S. Shutdown Uncertainty

- Bitcoin jumped 12% last week, blasting past $125,500 for a new all-time high.

- U.S. shutdown fears, weak jobs data, and Japan’s political shift fueled the rally.

- Treasury bond auctions and Powell’s speech could test Bitcoin’s momentum this week.

Bitcoin came roaring back last week, climbing more than 12% and wiping away the sluggish losses of September. Unlike the summer months, when altcoins like Ethereum and Solana often stole the spotlight, this time it was Bitcoin driving the market higher. ETH and SOL managed modest gains of around 13%, but BTC set the pace with a sharp and decisive run that reminded traders where the real weight still lies.

U.S. Shutdown and Weak Jobs Data Fuel BTC Rally

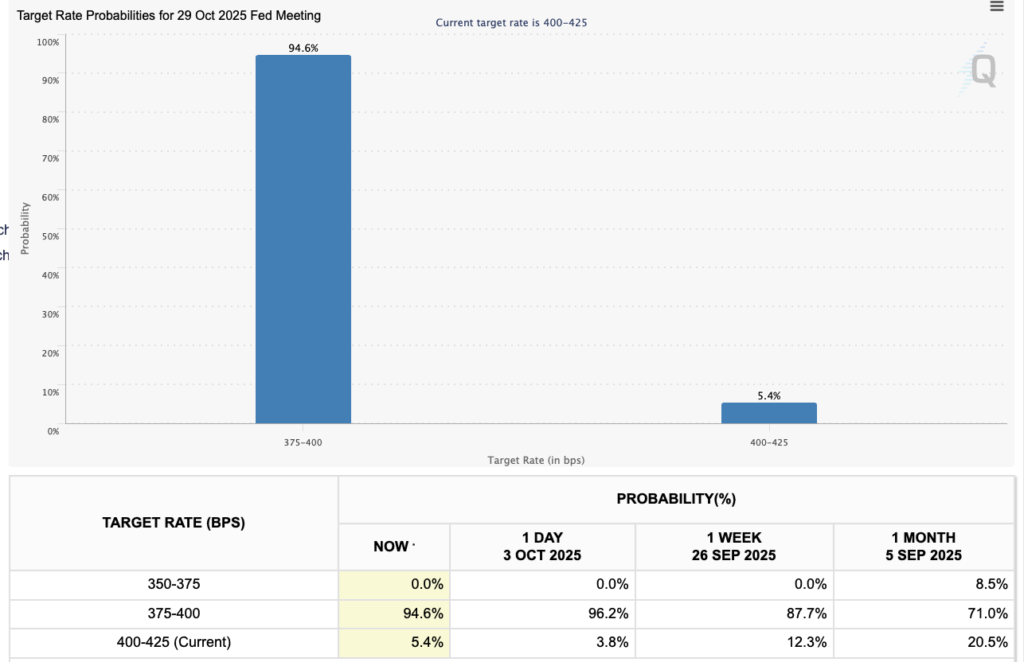

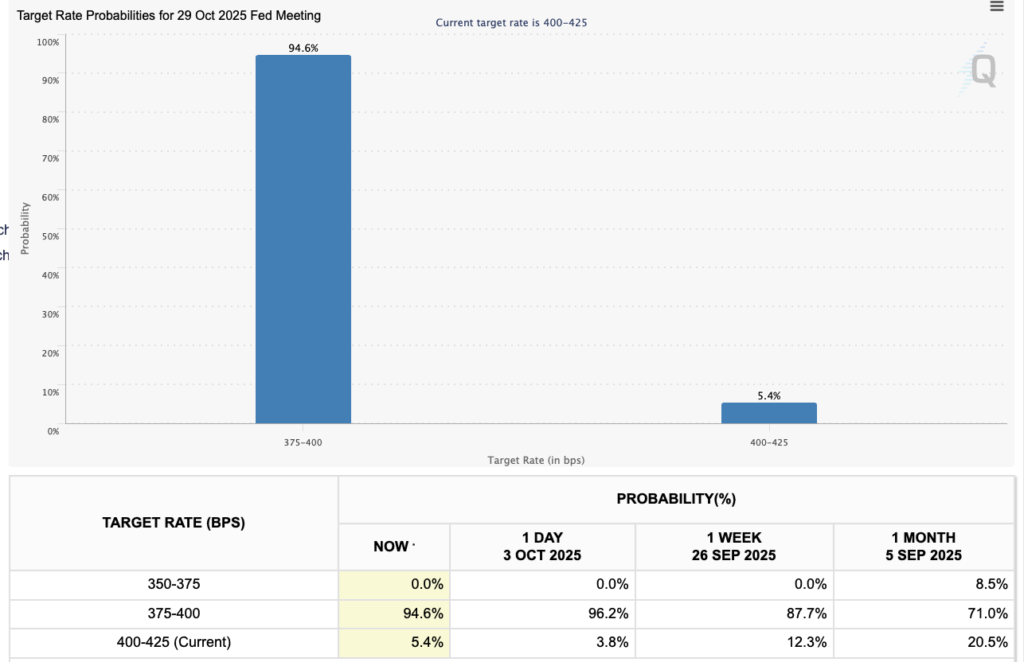

The rally really kicked off with the U.S. government shutdown midweek. When government employees are sent home and federal spending grinds to a halt, investors immediately start factoring in economic uncertainty—and that usually points to rate cuts from the Federal Reserve. The FedWatch tool showed odds of a rate cut in October shooting up to 98% after the shutdown was confirmed. At nearly the same moment, Bitcoin leapt from $112,000 and didn’t look back. Weak labor numbers added fuel to the fire. The ADP jobs report missed badly, showing a loss of 32,000 instead of the expected gain. With unemployment already climbing and non-farm payrolls weakening, markets are now betting on as many as four rate cuts before next summer.

Japan’s Political Shift Adds to Bitcoin Bullish Momentum

It wasn’t just U.S. politics shaping the move. Over in Japan, Sanae Takaichi’s election as leader of the Liberal Democratic Party set expectations for softer monetary policy and a weaker yen. That added another layer of global liquidity optimism. By Friday night into the weekend, Bitcoin briefly shot past $125,500, hitting a fresh all-time high. Traders framed the move as a direct play on easier conditions worldwide—cheap money, weaker currencies, and a central bank pivot just over the horizon. Still, the rally rests on fragile footing if the U.S. shutdown drags on and liquidity dries up too quickly.

Treasury Bond Auctions Could Test Bitcoin’s Liquidity

This week could be tricky. The U.S. Treasury plans to auction nearly $250 billion in short-term bonds, which will drain liquidity even without government spending in play. That puts Bitcoin’s quick 10% three-day jump to the test. Can bulls hold the line if surplus cash starts getting soaked up? Powell’s Thursday speech looms large, but most analysts say expectations of an October cut are already baked in. The wild card now is Congress, where shutdown-related decisions and talk of federal employee cuts could rattle markets. For now, Bitcoin looks strong, but traders know well—volatility never stays quiet for long.

The post Bitcoin Hits New All-Time High Above $125K Amid U.S. Shutdown Uncertainty first appeared on BlockNews.

Bitcoin Hits New All-Time High Above $125K Amid U.S. Shutdown Uncertainty

- Bitcoin jumped 12% last week, blasting past $125,500 for a new all-time high.

- U.S. shutdown fears, weak jobs data, and Japan’s political shift fueled the rally.

- Treasury bond auctions and Powell’s speech could test Bitcoin’s momentum this week.

Bitcoin came roaring back last week, climbing more than 12% and wiping away the sluggish losses of September. Unlike the summer months, when altcoins like Ethereum and Solana often stole the spotlight, this time it was Bitcoin driving the market higher. ETH and SOL managed modest gains of around 13%, but BTC set the pace with a sharp and decisive run that reminded traders where the real weight still lies.

U.S. Shutdown and Weak Jobs Data Fuel BTC Rally

The rally really kicked off with the U.S. government shutdown midweek. When government employees are sent home and federal spending grinds to a halt, investors immediately start factoring in economic uncertainty—and that usually points to rate cuts from the Federal Reserve. The FedWatch tool showed odds of a rate cut in October shooting up to 98% after the shutdown was confirmed. At nearly the same moment, Bitcoin leapt from $112,000 and didn’t look back. Weak labor numbers added fuel to the fire. The ADP jobs report missed badly, showing a loss of 32,000 instead of the expected gain. With unemployment already climbing and non-farm payrolls weakening, markets are now betting on as many as four rate cuts before next summer.

Japan’s Political Shift Adds to Bitcoin Bullish Momentum

It wasn’t just U.S. politics shaping the move. Over in Japan, Sanae Takaichi’s election as leader of the Liberal Democratic Party set expectations for softer monetary policy and a weaker yen. That added another layer of global liquidity optimism. By Friday night into the weekend, Bitcoin briefly shot past $125,500, hitting a fresh all-time high. Traders framed the move as a direct play on easier conditions worldwide—cheap money, weaker currencies, and a central bank pivot just over the horizon. Still, the rally rests on fragile footing if the U.S. shutdown drags on and liquidity dries up too quickly.

Treasury Bond Auctions Could Test Bitcoin’s Liquidity

This week could be tricky. The U.S. Treasury plans to auction nearly $250 billion in short-term bonds, which will drain liquidity even without government spending in play. That puts Bitcoin’s quick 10% three-day jump to the test. Can bulls hold the line if surplus cash starts getting soaked up? Powell’s Thursday speech looms large, but most analysts say expectations of an October cut are already baked in. The wild card now is Congress, where shutdown-related decisions and talk of federal employee cuts could rattle markets. For now, Bitcoin looks strong, but traders know well—volatility never stays quiet for long.

The post Bitcoin Hits New All-Time High Above $125K Amid U.S. Shutdown Uncertainty first appeared on BlockNews.