US Dollar Drops 4.7% in 2025: What’s Next for Your Portfolio?

The US dollar drop has surprised many investors as the greenback continues to weaken against nearly all major developed market currencies. The rather significant 4.7% decline represents a major shift in global currency trends and also raises some crucial questions about portfolio risk management strategies going forward.

Currency market volatility has increased following President Trump’s second term, though not exactly as many analysts had anticipated. While tariffs typically tend to strengthen the dollar, the current uncertainty around trade policies is seemingly undermining confidence in the US economy at the time of writing.

Also Read: 2 Reasons Why Shiba Inu (SHIB) ETFs Should Become a Reality

How US Dollar Decline in 2025 Affects Your Portfolio and the Market

The US dollar drop in 2025 continues alongside strengthening currencies across multiple regions these days. This ongoing shift in US dollar performance creates both challenges and also opportunities for investors with any kind of international exposure.

Also Read: XRP Price Prediction: Where Is It Headed By 2027?

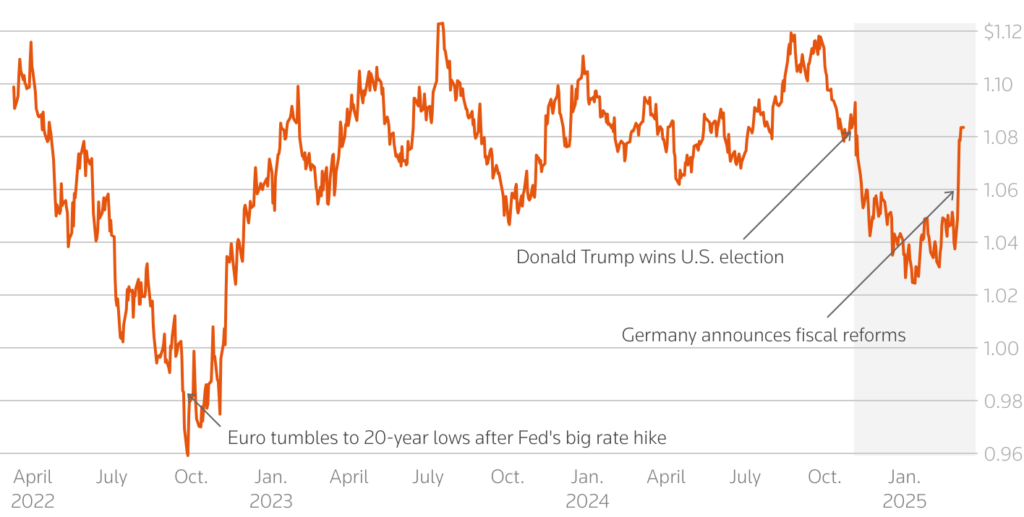

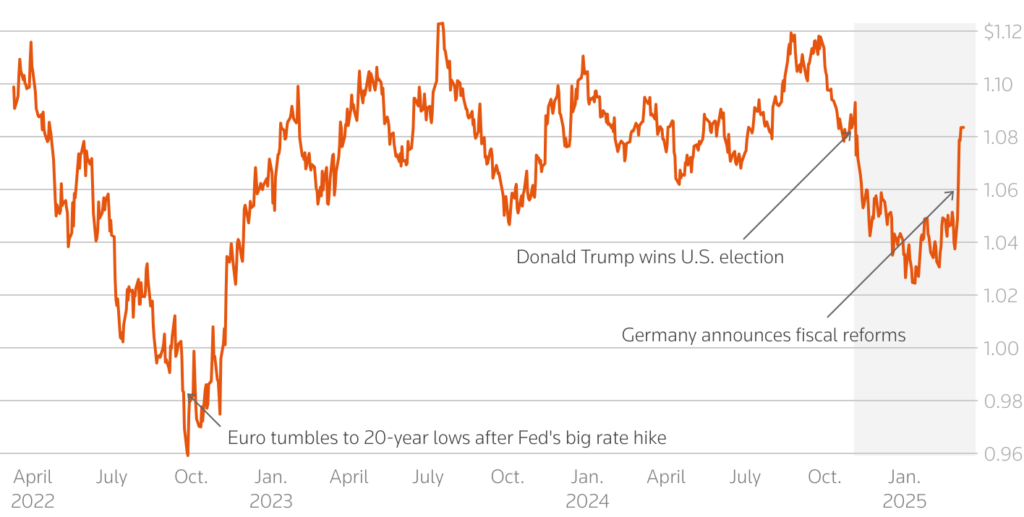

Euro Regains Strength Against the Dollar

The Euro has emerged as one of the top performers against the weakening dollar recently. The common currency posted its largest weekly gain versus the dollar since 2009 and is also heading for its best quarter since 2022, with an impressive 5% rise.

Lefteris Farmakis, FX strategist at Barclays, stated:

Tariffs, generally speaking, tend to be good for the dollar. But when they are applied against very close trading partners, they can harm confidence in the U.S.

Kenneth Broux, head of corporate research FX and rates at Societe Generale, had this to say:

The European Central Bank approaching the end of its easing cycle and Europe’s increased defence spending has changed the outlook for the euro in a fundamental way.

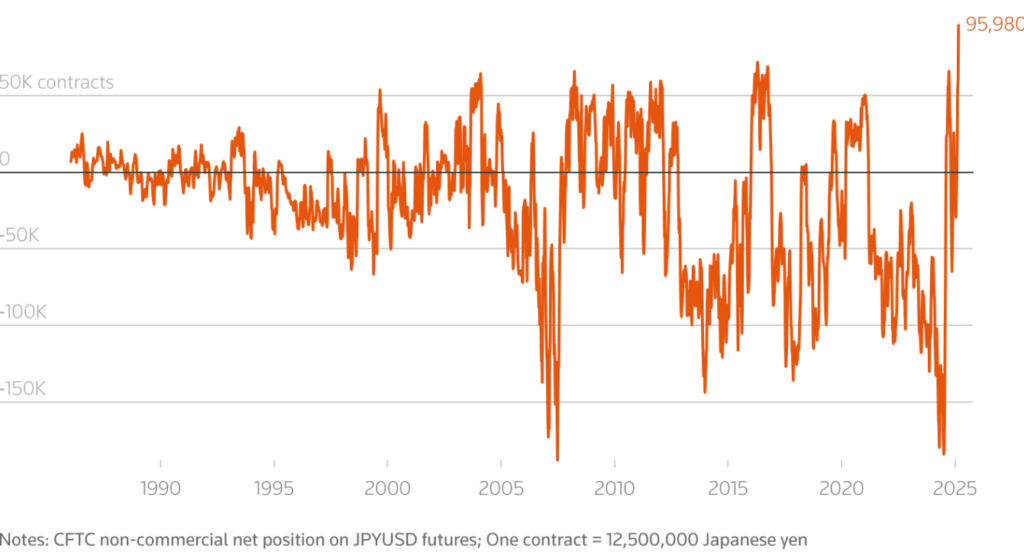

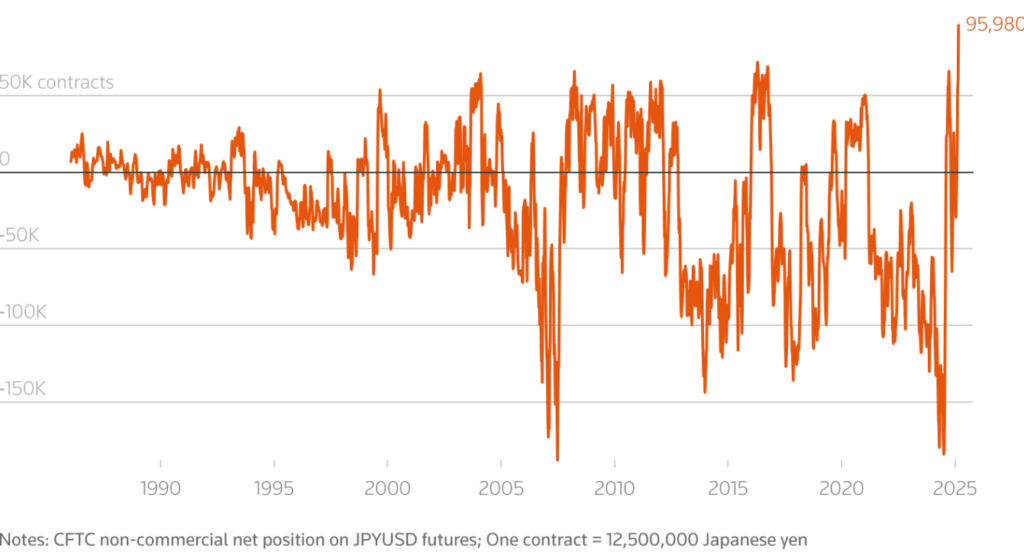

Japanese Yen and Other Currency Winners

The Japanese Yen has strengthened by about 6% against the dollar this year due to higher Japanese rates and also safe-haven flows. The currency market volatility has benefited certain currencies more than others in recent months.

Also Read: Pepe: Analyst Predicts 50% Rally To $0.0000105

Lefteris Farmakis from Barclays said:

If you want to hedge against the risk of slowdown in the U.S. you go to Japan because of the risks for lower U.S. Treasury yields.

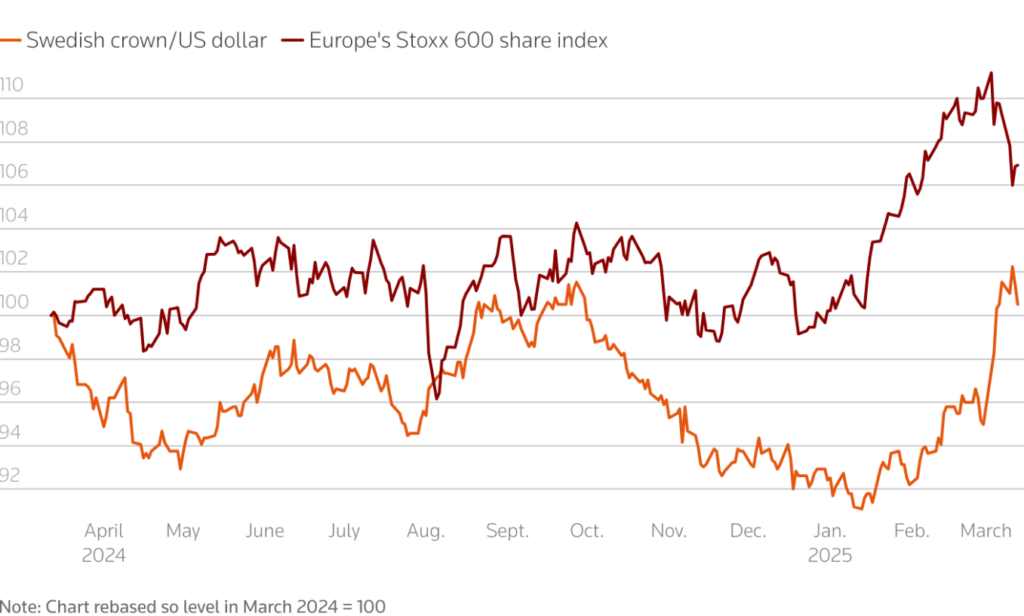

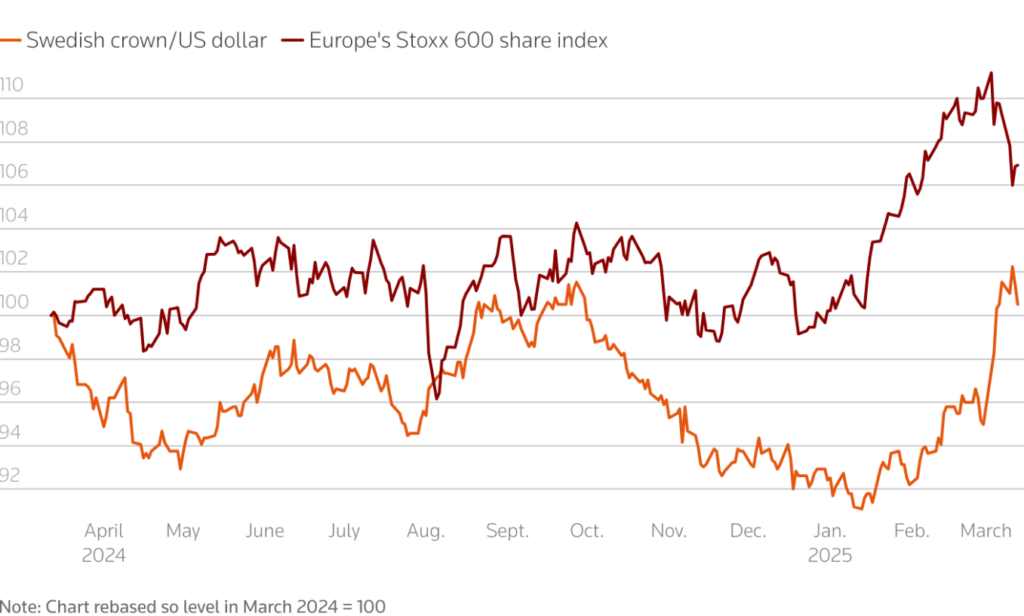

Sweden’s crown has strengthened by around 9% to near 10 crowns per dollar, reaching its firmest level since late 2023. This ongoing US dollar drop has created some unexpected winners in the global currency trends landscape for sure.

Impact on Portfolio Risk Management

For many investors, these currency movements create significant implications for portfolio risk management these days. The US dollar performance in 2025 affects different asset classes in various ways, sometimes quite dramatically.

U.S. investors with unhedged international holdings may benefit from foreign currency appreciation right now. Conversely, companies with significant overseas revenue face potential headwinds when converting earnings back to dollars.

Future Outlook

While the dollar has weakened substantially, risks remain for both further decline and also potential recovery. The impact of Trump’s trade policies continues to be closely monitored, particularly the effects of steel and aluminum tariffs that recently took effect.

Also Read: Pi Network’s PI Token Plummets: Will It Fall Below $1 Soon?

The currency market volatility will likely continue as major economies perform differently in the coming months. Economic data releases, central bank policies, as well as geopolitical developments will probably determine global currency trends for the remainder of 2025.

Read More

Bitcoin Stalls on Rate Cut as Hopes Fade—Will This Week Be Different?

US Dollar Drops 4.7% in 2025: What’s Next for Your Portfolio?

The US dollar drop has surprised many investors as the greenback continues to weaken against nearly all major developed market currencies. The rather significant 4.7% decline represents a major shift in global currency trends and also raises some crucial questions about portfolio risk management strategies going forward.

Currency market volatility has increased following President Trump’s second term, though not exactly as many analysts had anticipated. While tariffs typically tend to strengthen the dollar, the current uncertainty around trade policies is seemingly undermining confidence in the US economy at the time of writing.

Also Read: 2 Reasons Why Shiba Inu (SHIB) ETFs Should Become a Reality

How US Dollar Decline in 2025 Affects Your Portfolio and the Market

The US dollar drop in 2025 continues alongside strengthening currencies across multiple regions these days. This ongoing shift in US dollar performance creates both challenges and also opportunities for investors with any kind of international exposure.

Also Read: XRP Price Prediction: Where Is It Headed By 2027?

Euro Regains Strength Against the Dollar

The Euro has emerged as one of the top performers against the weakening dollar recently. The common currency posted its largest weekly gain versus the dollar since 2009 and is also heading for its best quarter since 2022, with an impressive 5% rise.

Lefteris Farmakis, FX strategist at Barclays, stated:

Tariffs, generally speaking, tend to be good for the dollar. But when they are applied against very close trading partners, they can harm confidence in the U.S.

Kenneth Broux, head of corporate research FX and rates at Societe Generale, had this to say:

The European Central Bank approaching the end of its easing cycle and Europe’s increased defence spending has changed the outlook for the euro in a fundamental way.

Japanese Yen and Other Currency Winners

The Japanese Yen has strengthened by about 6% against the dollar this year due to higher Japanese rates and also safe-haven flows. The currency market volatility has benefited certain currencies more than others in recent months.

Also Read: Pepe: Analyst Predicts 50% Rally To $0.0000105

Lefteris Farmakis from Barclays said:

If you want to hedge against the risk of slowdown in the U.S. you go to Japan because of the risks for lower U.S. Treasury yields.

Sweden’s crown has strengthened by around 9% to near 10 crowns per dollar, reaching its firmest level since late 2023. This ongoing US dollar drop has created some unexpected winners in the global currency trends landscape for sure.

Impact on Portfolio Risk Management

For many investors, these currency movements create significant implications for portfolio risk management these days. The US dollar performance in 2025 affects different asset classes in various ways, sometimes quite dramatically.

U.S. investors with unhedged international holdings may benefit from foreign currency appreciation right now. Conversely, companies with significant overseas revenue face potential headwinds when converting earnings back to dollars.

Future Outlook

While the dollar has weakened substantially, risks remain for both further decline and also potential recovery. The impact of Trump’s trade policies continues to be closely monitored, particularly the effects of steel and aluminum tariffs that recently took effect.

Also Read: Pi Network’s PI Token Plummets: Will It Fall Below $1 Soon?

The currency market volatility will likely continue as major economies perform differently in the coming months. Economic data releases, central bank policies, as well as geopolitical developments will probably determine global currency trends for the remainder of 2025.

Read More