China Escalates Trade War: US Goods Face 125% Tariff Starting April 12

China tariff increase to 125% on US imports marks a dramatic escalation in the US-China trade war. The Chinese Finance Ministry announced Friday that tariffs on US goods will jump from 84% to 125% beginning April 12, intensifying economic tensions between the world’s largest economies.

Also Read: 3 Infrastructure Tokens Under $2 With 10x Potential in 2025

Understanding The Us-china Trade War Impact And Economic Fallout Of Retaliatory Tariffs

China’s Finance Ministry said:

“If the US continues to impose additional tariffs on Chinese goods exported to the US, China will ignore it. If the US insists on continuing to infringe upon China’s interests in a substantive way, China will resolutely take countermeasures and fight to the end.”

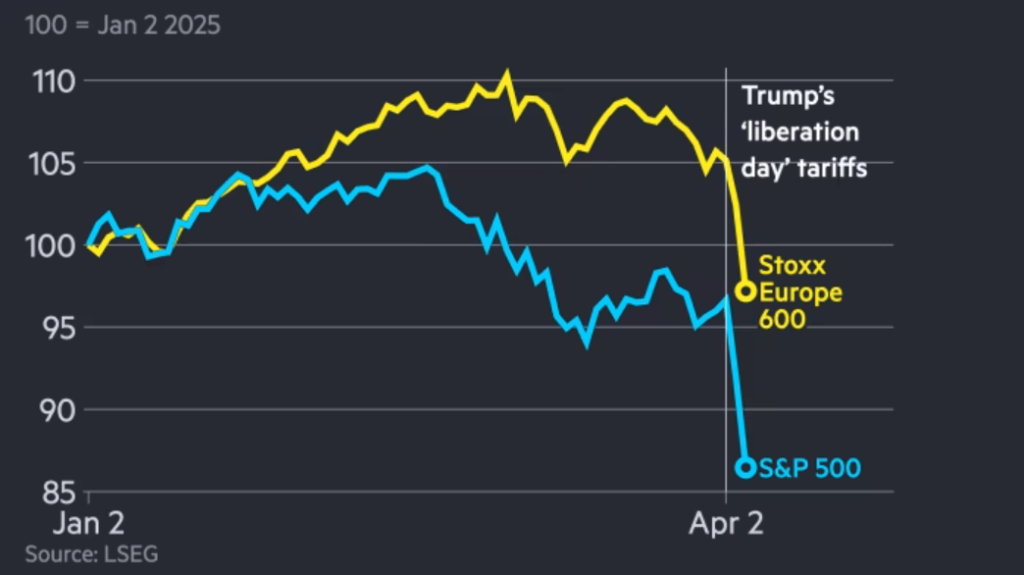

This china tariff increase comes in direct response to recent US actions. Markets reacted swiftly, with US stock futures falling and the Dollar Index losing 1.1%. Gold prices surged above $3,210 as trade tensions intensified.

Diplomatic Responses

China’s Commerce Ministry urged the US to take action, saying:

“China firmly opposes, condemns the US’ wanton unilateral tariff measures, has taken resolute countermeasures to safeguard own rights and interests.”

The ministry also called on the US to “take a big step forward in eliminating the so-called ‘reciprocal tariffs’ and completely correct its wrong practices.”

Also Read: Ripple and SEC Reach Agreement — April 16 Filing Canceled

Economic Impact

The china tariff increase will significantly affect US exporters relying on the Chinese market. American products will face substantially higher costs, with agricultural goods, manufactured items, and technology exports particularly vulnerable to these retaliatory tariffs.

The us-china trade war continues to disrupt global trade patterns. Companies with supply chains spanning both countries are scrambling to adjust their strategies amid escalating trade tensions.

Also Read: Pepe Coin: AI Predicts PEPE For Mid April 2025

Future Outlook

With China explicitly stating its willingness to “fight to the end,” resolution appears unlikely in the near term. The timing of this china tariff increase announcement, just before a weekend, gives markets limited time to process the news, potentially leading to increased volatility in coming days.

As both nations strengthen their positions, the us-china trade war and resulting economic fallout will continue to impact global markets, with the prospect of further retaliatory tariffs remaining a significant concern for international trade.

China Escalates Trade War: US Goods Face 125% Tariff Starting April 12

China tariff increase to 125% on US imports marks a dramatic escalation in the US-China trade war. The Chinese Finance Ministry announced Friday that tariffs on US goods will jump from 84% to 125% beginning April 12, intensifying economic tensions between the world’s largest economies.

Also Read: 3 Infrastructure Tokens Under $2 With 10x Potential in 2025

Understanding The Us-china Trade War Impact And Economic Fallout Of Retaliatory Tariffs

China’s Finance Ministry said:

“If the US continues to impose additional tariffs on Chinese goods exported to the US, China will ignore it. If the US insists on continuing to infringe upon China’s interests in a substantive way, China will resolutely take countermeasures and fight to the end.”

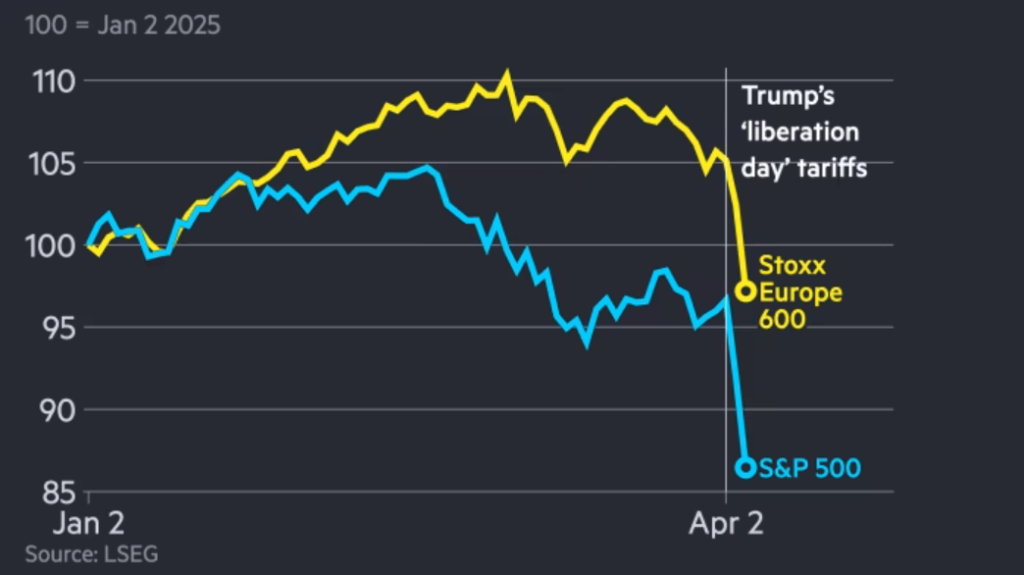

This china tariff increase comes in direct response to recent US actions. Markets reacted swiftly, with US stock futures falling and the Dollar Index losing 1.1%. Gold prices surged above $3,210 as trade tensions intensified.

Diplomatic Responses

China’s Commerce Ministry urged the US to take action, saying:

“China firmly opposes, condemns the US’ wanton unilateral tariff measures, has taken resolute countermeasures to safeguard own rights and interests.”

The ministry also called on the US to “take a big step forward in eliminating the so-called ‘reciprocal tariffs’ and completely correct its wrong practices.”

Also Read: Ripple and SEC Reach Agreement — April 16 Filing Canceled

Economic Impact

The china tariff increase will significantly affect US exporters relying on the Chinese market. American products will face substantially higher costs, with agricultural goods, manufactured items, and technology exports particularly vulnerable to these retaliatory tariffs.

The us-china trade war continues to disrupt global trade patterns. Companies with supply chains spanning both countries are scrambling to adjust their strategies amid escalating trade tensions.

Also Read: Pepe Coin: AI Predicts PEPE For Mid April 2025

Future Outlook

With China explicitly stating its willingness to “fight to the end,” resolution appears unlikely in the near term. The timing of this china tariff increase announcement, just before a weekend, gives markets limited time to process the news, potentially leading to increased volatility in coming days.

As both nations strengthen their positions, the us-china trade war and resulting economic fallout will continue to impact global markets, with the prospect of further retaliatory tariffs remaining a significant concern for international trade.