UK Tests Offline CBDC Payments—What This Means for Bitcoin and Privacy Coins

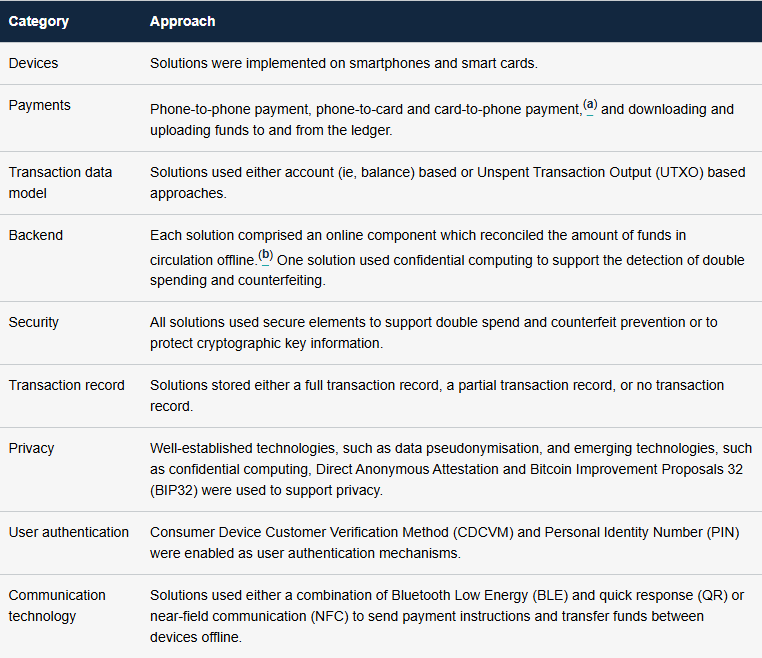

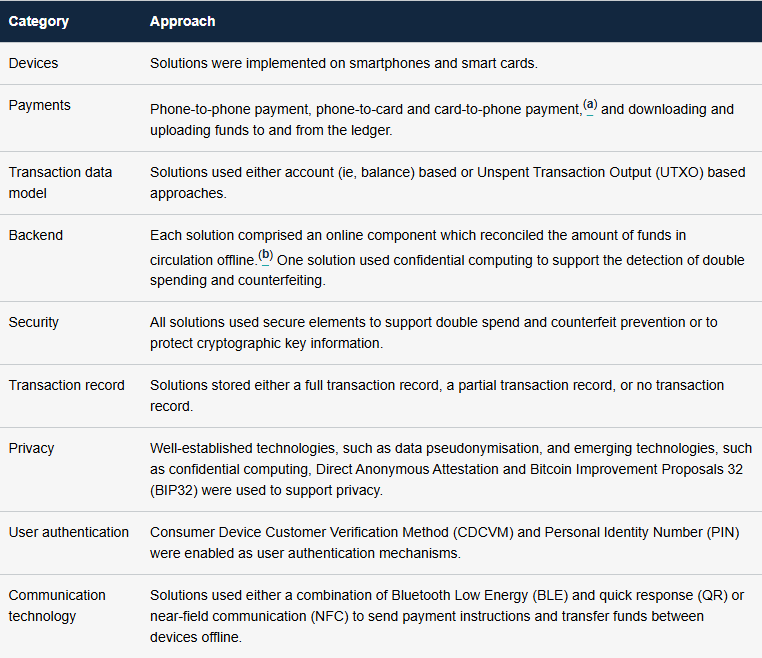

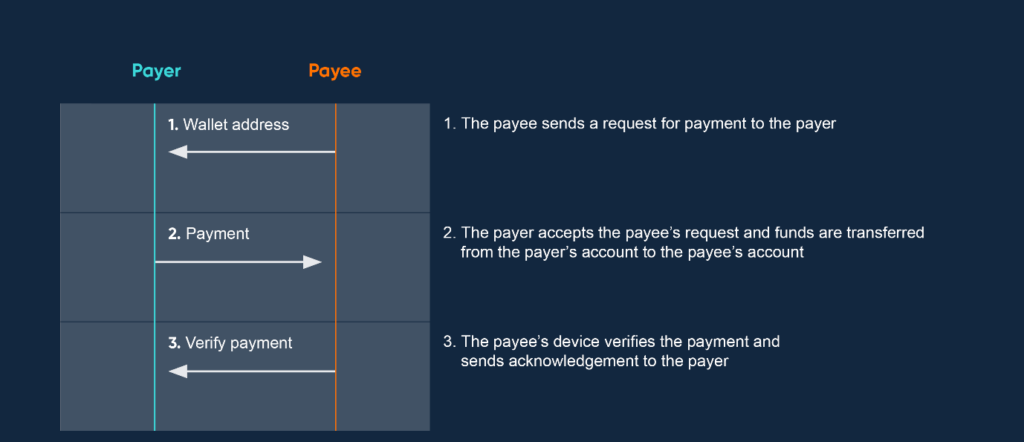

Offline CBDC payments are being tested right now by the Bank of England as part of their ongoing digital pound experiment. The recently released April 2025 report, which came out just a few days ago, shows that such payments are technically feasible in some ways, but also highlights several security challenges that could potentially impact Bitcoin and privacy coins as various governments around the world continue to advance their own CBDC plans.

Also Read: Gold Hits $3,245—Echoes of 1980s Rally, But Built to Last

How Offline CBDCs Impact Bitcoin, Privacy, and Crypto Adoption Risks

The Bank of England stated in their comprehensive report:

“This project demonstrated that while it might be technically feasible to implement an offline payment functionality for a digital pound, there are trade-offs, particularly around user experience and preventing double spending and counterfeiting, that make implementing it challenging.”

Security Challenges

Offline CBDC payments currently rely on secure elements embedded in various devices like smartphones and smart cards. The report noted a rather critical vulnerability where if these secure elements were somehow breached, double spending becomes possible. The Bank specifically acknowledged this risk:

“Since the security of the solutions relied on secure elements, if the secure elements were breached, double spending and counterfeiting would be possible.”

Also Read: G7 Central Banks Confront US Chaos: ECB to Cut Rates, Canada Watches Inflation

Privacy Implications

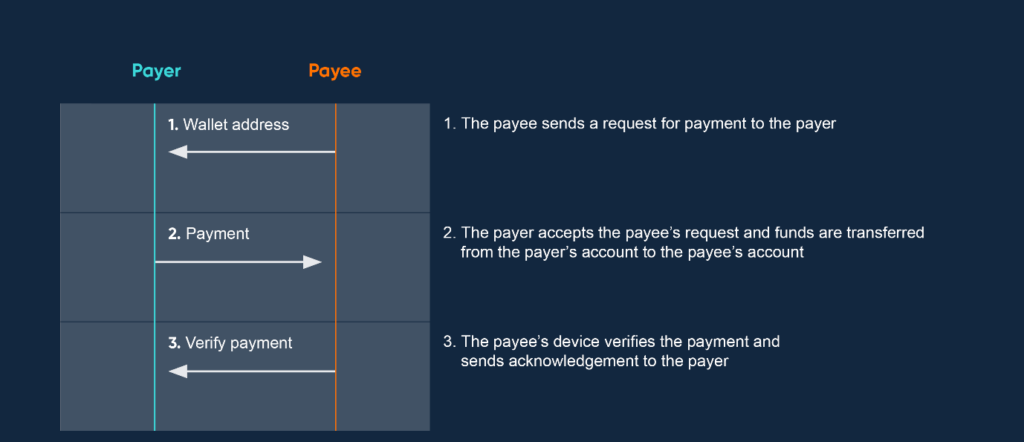

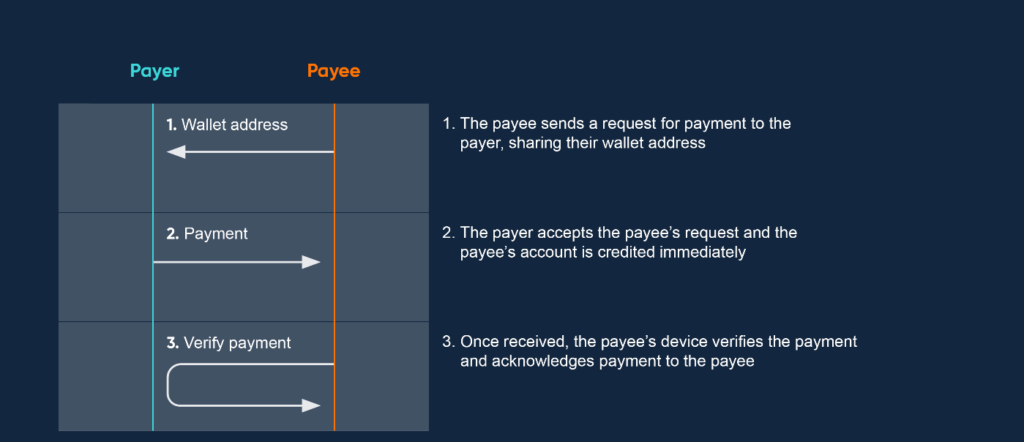

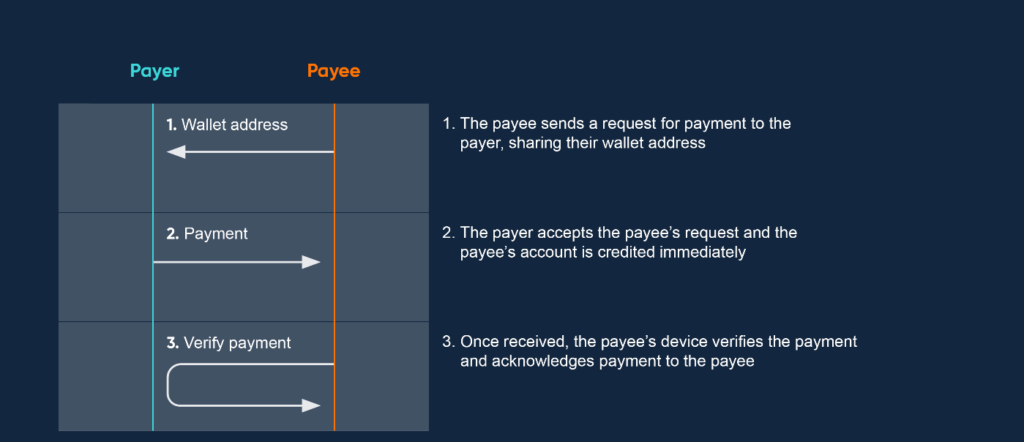

Privacy coins and Bitcoin face new and potentially significant challenges as offline CBDC payments begin to incorporate several privacy technologies. The Bank explained in their findings:

[Image 2: Diagram showing the synchronous payment flow for offline CBDC transactions]“Well-established technologies, such as data pseudonymisation, and emerging technologies, such as confidential computing, Direct Anonymous Attestation and Bitcoin Improvement Proposals 32 (BIP32) were used to support privacy.”

Impact on Crypto Adoption

Offline CBDC payments could possibly reduce Bitcoin’s appeal in certain markets while threatening privacy coins even more in the long run. If central banks manage to offer transaction privacy along with regulatory compliance, privacy coins may actually lose their unique advantage with some users.

At the end of the day, the Bank of England’s report concludes with an important note about the future of offline CBDC payments:

“No final decision has been made on whether an offline payment functionality would be implemented if a digital pound were launched.”

Also Read: Currency Surprise: These 9 Currencies Are Outperforming The US Dollar

Read More

Dormant XRP Coins Flood the Market — Here’s What It Means for Price

UK Tests Offline CBDC Payments—What This Means for Bitcoin and Privacy Coins

Offline CBDC payments are being tested right now by the Bank of England as part of their ongoing digital pound experiment. The recently released April 2025 report, which came out just a few days ago, shows that such payments are technically feasible in some ways, but also highlights several security challenges that could potentially impact Bitcoin and privacy coins as various governments around the world continue to advance their own CBDC plans.

Also Read: Gold Hits $3,245—Echoes of 1980s Rally, But Built to Last

How Offline CBDCs Impact Bitcoin, Privacy, and Crypto Adoption Risks

The Bank of England stated in their comprehensive report:

“This project demonstrated that while it might be technically feasible to implement an offline payment functionality for a digital pound, there are trade-offs, particularly around user experience and preventing double spending and counterfeiting, that make implementing it challenging.”

Security Challenges

Offline CBDC payments currently rely on secure elements embedded in various devices like smartphones and smart cards. The report noted a rather critical vulnerability where if these secure elements were somehow breached, double spending becomes possible. The Bank specifically acknowledged this risk:

“Since the security of the solutions relied on secure elements, if the secure elements were breached, double spending and counterfeiting would be possible.”

Also Read: G7 Central Banks Confront US Chaos: ECB to Cut Rates, Canada Watches Inflation

Privacy Implications

Privacy coins and Bitcoin face new and potentially significant challenges as offline CBDC payments begin to incorporate several privacy technologies. The Bank explained in their findings:

[Image 2: Diagram showing the synchronous payment flow for offline CBDC transactions]“Well-established technologies, such as data pseudonymisation, and emerging technologies, such as confidential computing, Direct Anonymous Attestation and Bitcoin Improvement Proposals 32 (BIP32) were used to support privacy.”

Impact on Crypto Adoption

Offline CBDC payments could possibly reduce Bitcoin’s appeal in certain markets while threatening privacy coins even more in the long run. If central banks manage to offer transaction privacy along with regulatory compliance, privacy coins may actually lose their unique advantage with some users.

At the end of the day, the Bank of England’s report concludes with an important note about the future of offline CBDC payments:

“No final decision has been made on whether an offline payment functionality would be implemented if a digital pound were launched.”

Also Read: Currency Surprise: These 9 Currencies Are Outperforming The US Dollar

Read More