Solana Price Analysis: $12B Trading Volume Signals Big Move Ahead

- Solana faces critical support at $200 amid market-wide selling.

- Institutional holdings and staking activity show long-term confidence.

- Technicals suggest $190–$200 downside risk, but $250 remains the main target.

The new trading week didn’t start on the brightest note for crypto. Bitcoin dipped under $112K, snapping its key $112.5K support. Naturally, that ripple dragged Solana too. After showing strong energy earlier in the month, SOL is now stuck in a consolidation phase. Buyers are trying to defend important levels, but sellers are pressing just as hard, keeping the token pinned in a critical zone. What was thought to be just a quick pullback is now looking more like a serious continuation of bearish pressure.

Is Solana’s $200 Support in Trouble?

Volatility has been shrinking in recent sessions, which usually means a big move is coming. The $200 support level suddenly feels fragile. Interestingly, trading activity has spiked — over $12B worth of SOL changed hands in just 24 hours. That kind of liquidity can cut both ways, driving sharp swings up or down. Still, fundamentals show confidence isn’t gone. Around 590,000 SOL (about $123M) have been added to institutional holdings over the past month, while corporate staking commitments are now above 8.27M SOL (~$1.72B). That’s a strong base, even if short-term volatility rattles nerves.

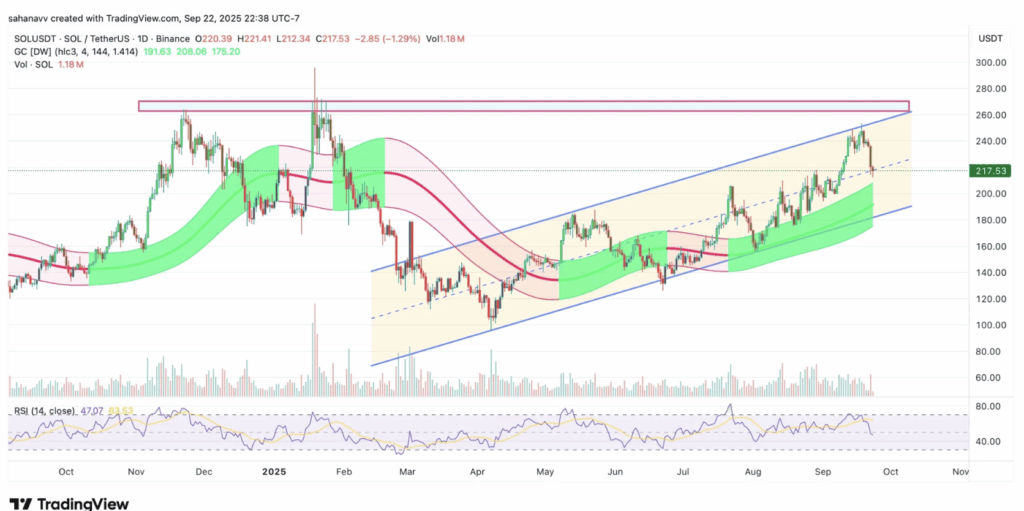

Solana’s Technical Picture

Looking at the daily chart, SOL trades inside an ascending channel, retreating from the upper boundary near $260. Current support is at the midline around $210–$215, which also lines up with the 50-day EMA. RSI cooled to roughly 47, so the heat has come off the overbought conditions. Volume isn’t screaming capitulation either, more like calm consolidation. If buyers defend this midline, SOL could make another push above $250. But if it breaks down, $190–$200 is the likely landing zone.

Short-Term Pressure vs Long-Term Target

Traders are also watching the Gaussian channel closely. If SOL taps it, history suggests it could test the lower bands again, reinforcing bearish pressure for a while. Even so, the broader setup still points toward $250 as the “magnet” level where price wants to drift back. Bears may drag it below $200 temporarily, but unless fundamentals collapse, the token looks ready to recover from those dips.

The post Solana Price Analysis: $12B Trading Volume Signals Big Move Ahead first appeared on BlockNews.

Solana Price Analysis: $12B Trading Volume Signals Big Move Ahead

- Solana faces critical support at $200 amid market-wide selling.

- Institutional holdings and staking activity show long-term confidence.

- Technicals suggest $190–$200 downside risk, but $250 remains the main target.

The new trading week didn’t start on the brightest note for crypto. Bitcoin dipped under $112K, snapping its key $112.5K support. Naturally, that ripple dragged Solana too. After showing strong energy earlier in the month, SOL is now stuck in a consolidation phase. Buyers are trying to defend important levels, but sellers are pressing just as hard, keeping the token pinned in a critical zone. What was thought to be just a quick pullback is now looking more like a serious continuation of bearish pressure.

Is Solana’s $200 Support in Trouble?

Volatility has been shrinking in recent sessions, which usually means a big move is coming. The $200 support level suddenly feels fragile. Interestingly, trading activity has spiked — over $12B worth of SOL changed hands in just 24 hours. That kind of liquidity can cut both ways, driving sharp swings up or down. Still, fundamentals show confidence isn’t gone. Around 590,000 SOL (about $123M) have been added to institutional holdings over the past month, while corporate staking commitments are now above 8.27M SOL (~$1.72B). That’s a strong base, even if short-term volatility rattles nerves.

Solana’s Technical Picture

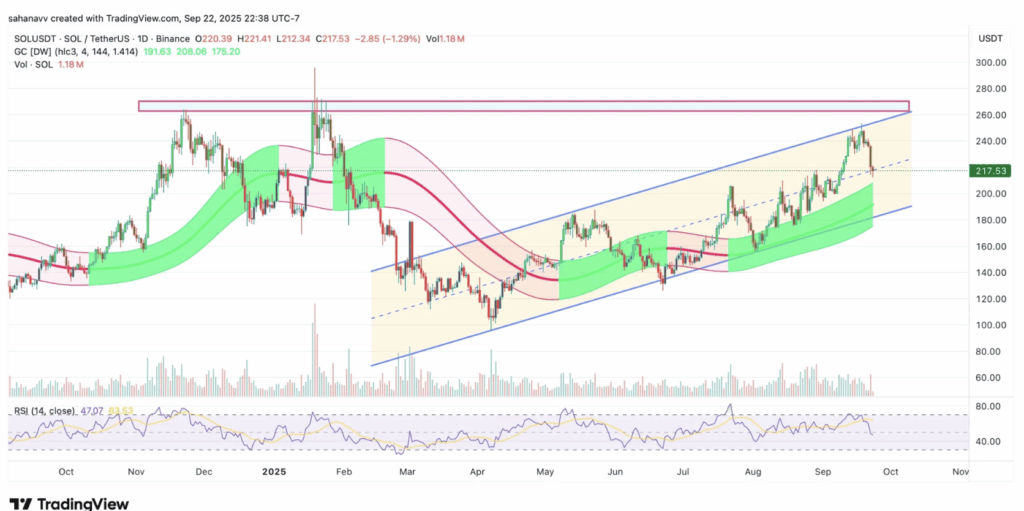

Looking at the daily chart, SOL trades inside an ascending channel, retreating from the upper boundary near $260. Current support is at the midline around $210–$215, which also lines up with the 50-day EMA. RSI cooled to roughly 47, so the heat has come off the overbought conditions. Volume isn’t screaming capitulation either, more like calm consolidation. If buyers defend this midline, SOL could make another push above $250. But if it breaks down, $190–$200 is the likely landing zone.

Short-Term Pressure vs Long-Term Target

Traders are also watching the Gaussian channel closely. If SOL taps it, history suggests it could test the lower bands again, reinforcing bearish pressure for a while. Even so, the broader setup still points toward $250 as the “magnet” level where price wants to drift back. Bears may drag it below $200 temporarily, but unless fundamentals collapse, the token looks ready to recover from those dips.

The post Solana Price Analysis: $12B Trading Volume Signals Big Move Ahead first appeared on BlockNews.