Sideways SOPR: A prelude to Bitcoin’s next big move?

Bitcoin’s price has been a study in tranquility since it broke through the $30,000 level, setting a tight trading range between $30,000 and $31,000 for most of July. This period of low volatility has left many traders and analysts uncertain about future price movements. However, on-chain data, specifically the Spent Output Profit Ratio (SOPR), may provide a clearer picture of where the market might be heading.

SOPR is a crucial metric in Bitcoin analysis. It is calculated by dividing the price sold by the price paid for a Bitcoin, effectively measuring the profit or loss made by Bitcoin holders when they sell their coins. A rising SOPR indicates that holders are selling at a profit, while a declining SOPR suggests selling at a loss. The entity-adjusted SOPR, which considers only entities that have been active for at least a month, provides a more accurate gauge of the market.

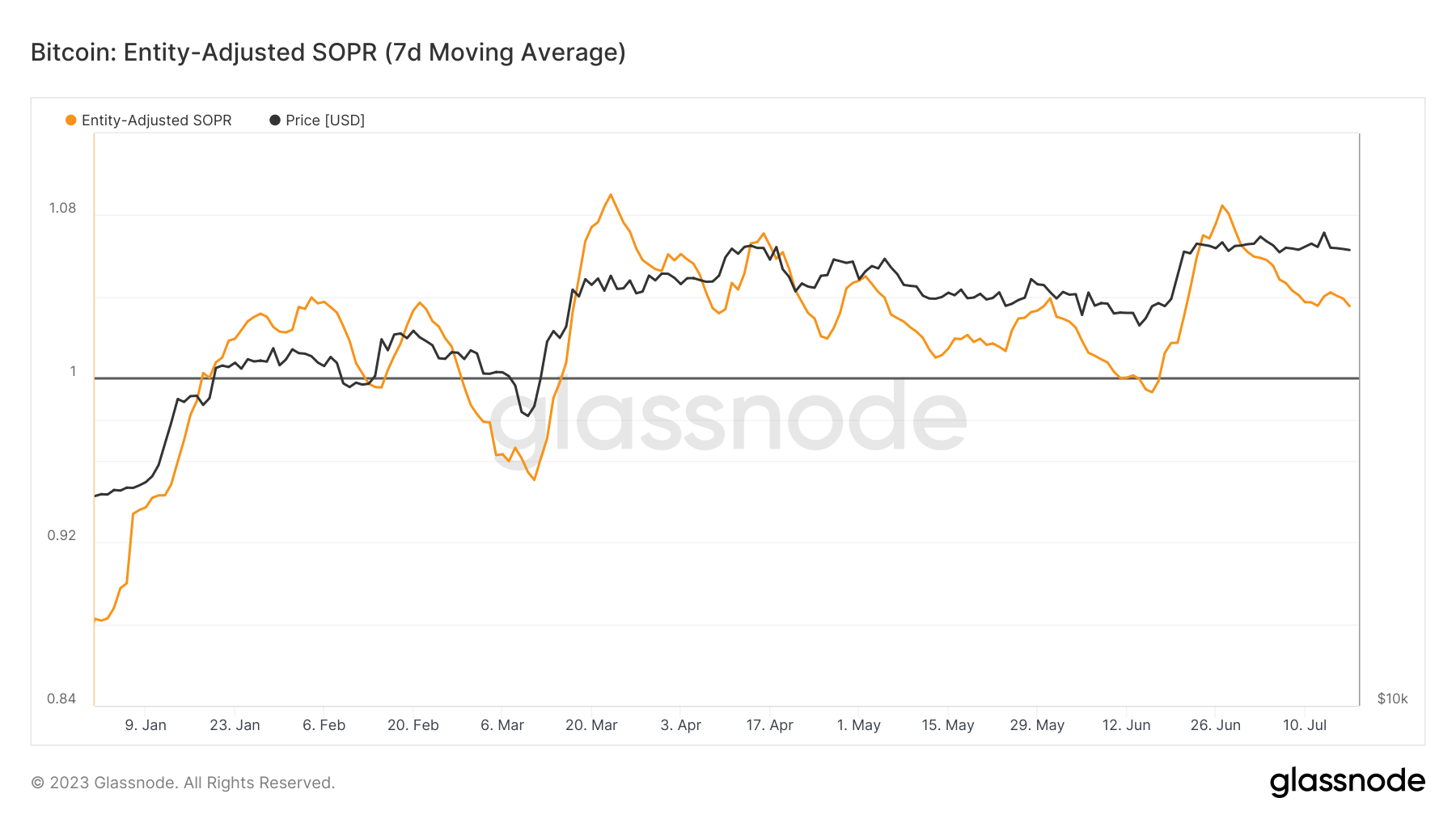

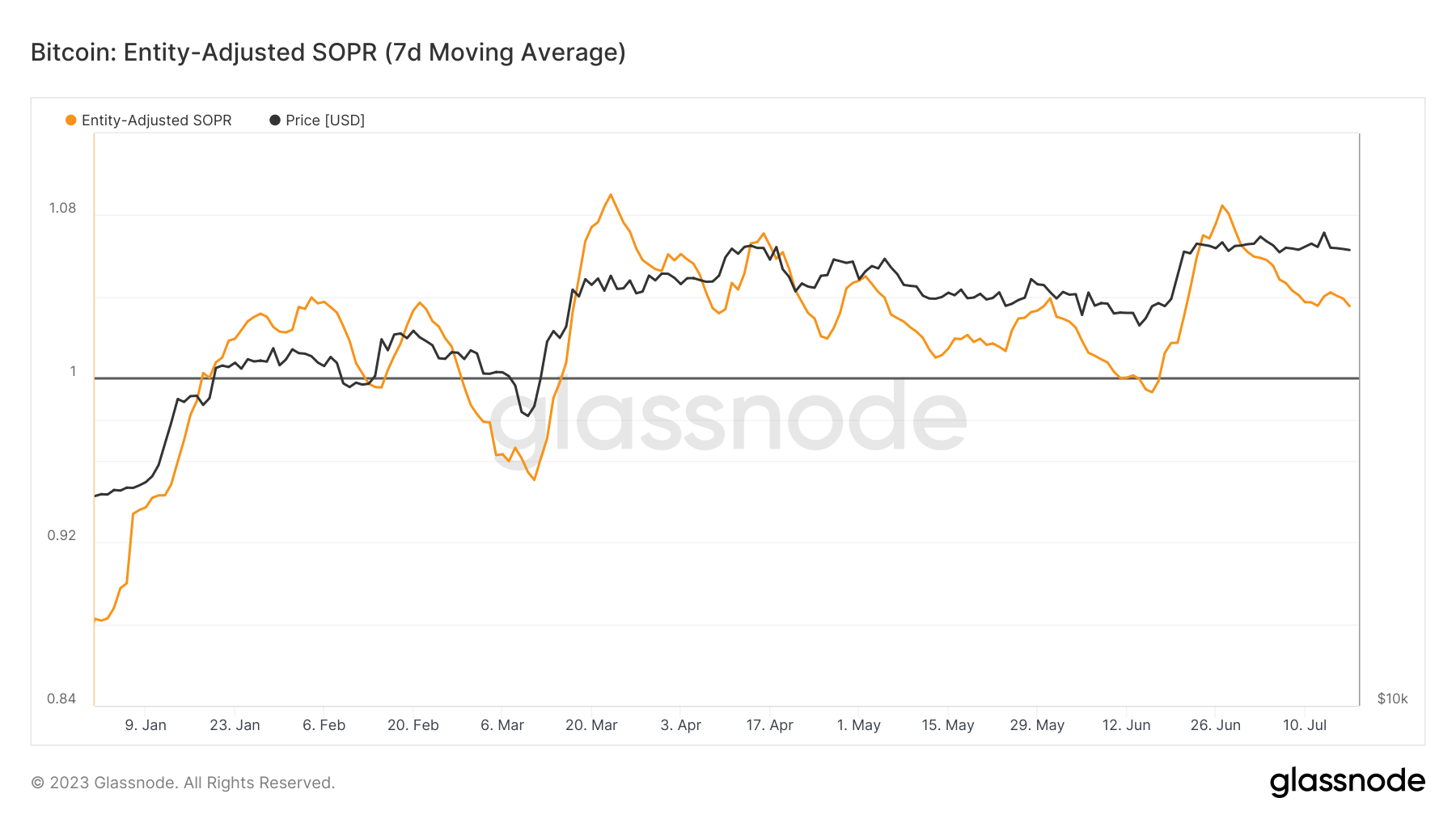

The 7-day moving average of the entity-adjusted SOPR has been on an upward trajectory since the start of the year, breaking above the value of 1. Despite experiencing several sharp uptrends in January, February, and June, it has been declining since June 27, dropping to a value of 1.03 on July 17.

However, despite the notable drop, the ratio remains in a profit-dominant regime. This means that, on average, the entities selling their Bitcoin are still doing so at a profit.

According to market analysis, the current sideways SOPR trend could indicate a market in a consolidation phase, potentially setting the stage for the next significant price movement in Bitcoin.

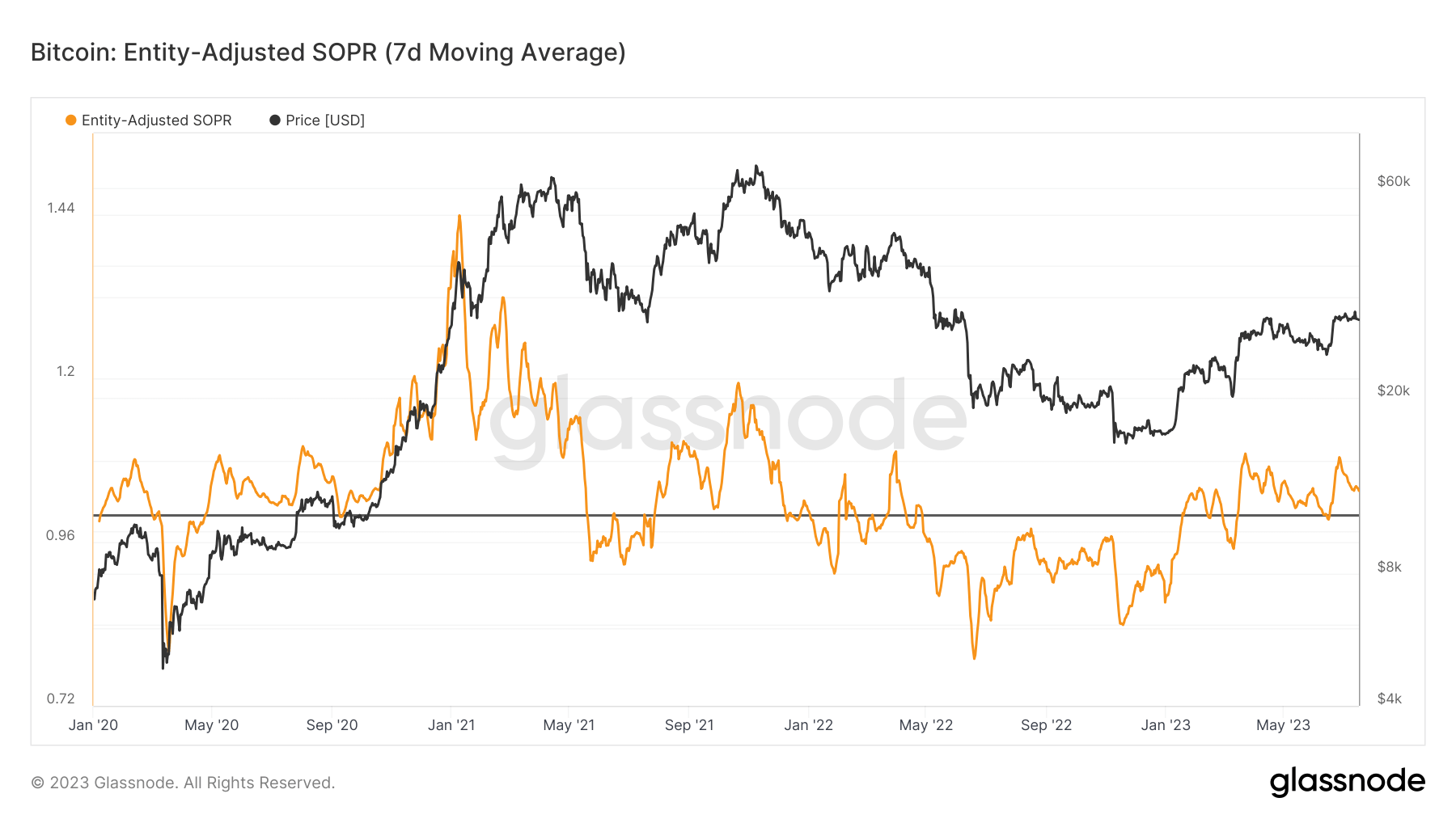

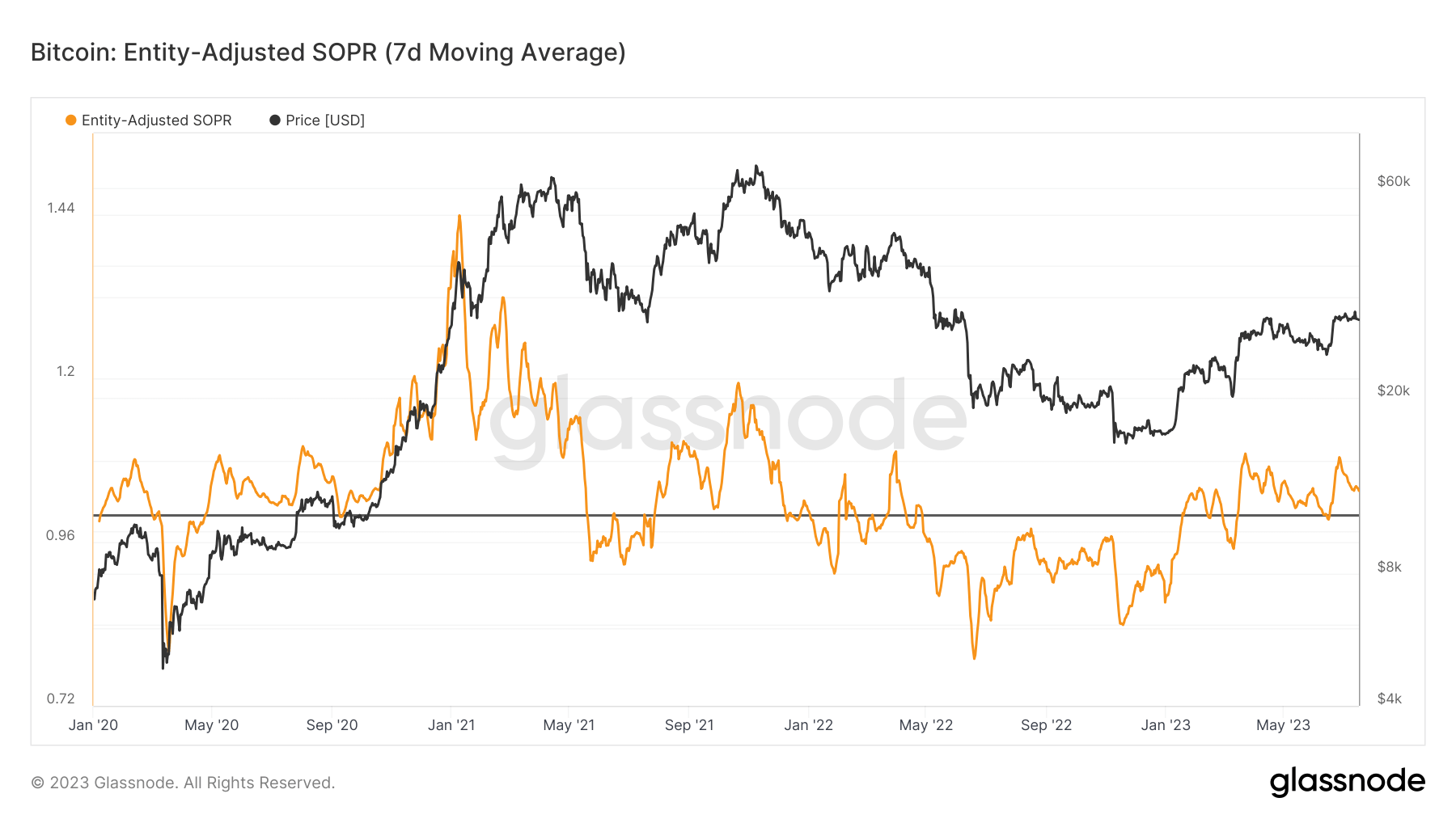

In the world of trading and investing, consolidation is a period of indecision that ends when the asset’s price breaks beyond the restrictive barriers. A substantial price rally could follow this period, as in 2016 and 2019.

Moreover, a steady SOPR could also suggest a balanced market where the number of Bitcoin sellers making profits is approximately equal to those incurring losses.. This equilibrium could potentially lead to a more stable market, reducing the likelihood of extreme price volatility in the short term.

The post Sideways SOPR: A prelude to Bitcoin’s next big move? appeared first on CryptoSlate.

Sideways SOPR: A prelude to Bitcoin’s next big move?

Bitcoin’s price has been a study in tranquility since it broke through the $30,000 level, setting a tight trading range between $30,000 and $31,000 for most of July. This period of low volatility has left many traders and analysts uncertain about future price movements. However, on-chain data, specifically the Spent Output Profit Ratio (SOPR), may provide a clearer picture of where the market might be heading.

SOPR is a crucial metric in Bitcoin analysis. It is calculated by dividing the price sold by the price paid for a Bitcoin, effectively measuring the profit or loss made by Bitcoin holders when they sell their coins. A rising SOPR indicates that holders are selling at a profit, while a declining SOPR suggests selling at a loss. The entity-adjusted SOPR, which considers only entities that have been active for at least a month, provides a more accurate gauge of the market.

The 7-day moving average of the entity-adjusted SOPR has been on an upward trajectory since the start of the year, breaking above the value of 1. Despite experiencing several sharp uptrends in January, February, and June, it has been declining since June 27, dropping to a value of 1.03 on July 17.

However, despite the notable drop, the ratio remains in a profit-dominant regime. This means that, on average, the entities selling their Bitcoin are still doing so at a profit.

According to market analysis, the current sideways SOPR trend could indicate a market in a consolidation phase, potentially setting the stage for the next significant price movement in Bitcoin.

In the world of trading and investing, consolidation is a period of indecision that ends when the asset’s price breaks beyond the restrictive barriers. A substantial price rally could follow this period, as in 2016 and 2019.

Moreover, a steady SOPR could also suggest a balanced market where the number of Bitcoin sellers making profits is approximately equal to those incurring losses.. This equilibrium could potentially lead to a more stable market, reducing the likelihood of extreme price volatility in the short term.

The post Sideways SOPR: A prelude to Bitcoin’s next big move? appeared first on CryptoSlate.