UBS Revises Gold Forecast After Hitting $3,000: See the New Price Target

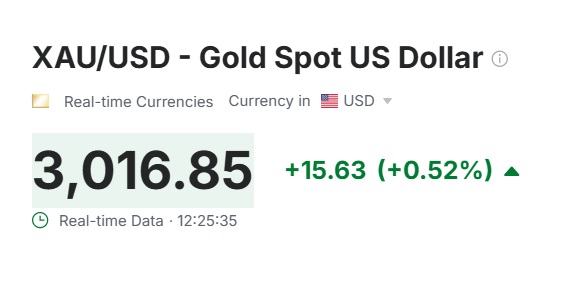

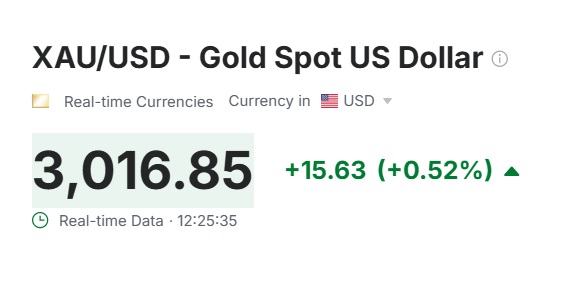

Gold prices are trading well above the $3,000 mark on Tuesday hitting the day’s high of $3,017. The XAU/USD index has surged close to 15% year-to-date and is among the top-performing assets in the commodity markets. The phenomenal rise has led to an influx of funds in the precious metal with investors riding the rally.

Also Read: Pi Network’s PI Token Plummets: Will It Fall Below $1 Soon?

Commodity strategists are bullish on gold prices indicating that $3,000 is still considered cheap. The prices could go further north as Trump’s tariffs are shaking the confidence of the stock market. Various businesses are affected due to the tariffs leading to the stock market sending mixed reactions this month.

Also Read: Official Trump (TRUMP) Predicted To Reclaim $52: Here’s When

UBS Provides New Gold Price Forecast: Here’s the Target

Leading investment bank UBS remains confident that gold prices will surge hereon. It was among the first ones to predict last year that gold could reach the $3,000 mark in the first half of 2025. Now that the forecast has turned accurate, the investment bank has gone further providing a new target for the precious metal.

Also Read: Ripple: Here’s How High XRP May Go Irrespective Of The SEC Verdict

According to the latest and revised price prediction from UBS, gold could hit the $3,300 milestone next. That’s another 10% rise from its current price and is a bold and bullish prediction. “With the price now reaching our long-held target of USD 3,000/oz, the main question is whether the rally will continue. We think so, as long as policy risks and an intensifying trade conflict continue to spur safe-haven demand,” said UBS commodity strategists led by Wayne Gordon.

He added that “the prevailing mood among investors remains one of caution for US equities and confidence in gold.” Therefore, there is a higher chance of the glittery metal rallying further and not the broader stock market index. Taking an entry position in the precious metal could still prove beneficial even though it has reached a new ATH. Read here to know a new price prediction on when it could reach the $4,000 mark.

Read More

South Korean Investors Favor Bitcoin Over Gold for Next Six Months

UBS Revises Gold Forecast After Hitting $3,000: See the New Price Target

Gold prices are trading well above the $3,000 mark on Tuesday hitting the day’s high of $3,017. The XAU/USD index has surged close to 15% year-to-date and is among the top-performing assets in the commodity markets. The phenomenal rise has led to an influx of funds in the precious metal with investors riding the rally.

Also Read: Pi Network’s PI Token Plummets: Will It Fall Below $1 Soon?

Commodity strategists are bullish on gold prices indicating that $3,000 is still considered cheap. The prices could go further north as Trump’s tariffs are shaking the confidence of the stock market. Various businesses are affected due to the tariffs leading to the stock market sending mixed reactions this month.

Also Read: Official Trump (TRUMP) Predicted To Reclaim $52: Here’s When

UBS Provides New Gold Price Forecast: Here’s the Target

Leading investment bank UBS remains confident that gold prices will surge hereon. It was among the first ones to predict last year that gold could reach the $3,000 mark in the first half of 2025. Now that the forecast has turned accurate, the investment bank has gone further providing a new target for the precious metal.

Also Read: Ripple: Here’s How High XRP May Go Irrespective Of The SEC Verdict

According to the latest and revised price prediction from UBS, gold could hit the $3,300 milestone next. That’s another 10% rise from its current price and is a bold and bullish prediction. “With the price now reaching our long-held target of USD 3,000/oz, the main question is whether the rally will continue. We think so, as long as policy risks and an intensifying trade conflict continue to spur safe-haven demand,” said UBS commodity strategists led by Wayne Gordon.

He added that “the prevailing mood among investors remains one of caution for US equities and confidence in gold.” Therefore, there is a higher chance of the glittery metal rallying further and not the broader stock market index. Taking an entry position in the precious metal could still prove beneficial even though it has reached a new ATH. Read here to know a new price prediction on when it could reach the $4,000 mark.

Read More