ING Experts: Yuan’s Resilience Against 145% Tariffs Accelerates 2025 De-Dollarization

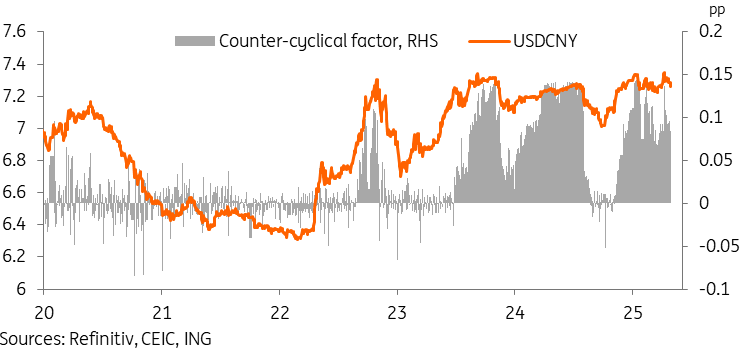

De-dollarization continues to gain momentum right now in 2025 as China’s yuan shows remarkable stability despite the rather extreme 145% tariffs imposed by Trump. According to a recent ING currency analysis, the People’s Bank of China has actually managed to maintain yuan stability even after the so-called “Liberation Day” announcement. This strategic response to what many consider the first major economic shock of 2025 might actually be signaling an important shift in global currency dynamics, potentially accelerating de-dollarization trends across various markets and regions.

Also Read: De-Dollarization: 5 Oil Giants Now Settling in Yuan, Not USD

How China’s PBoC Strategy Against Trump’s Tariffs Strengthens Global De-Dollarization Momentum

Yuan Stability Maintained Despite Tariff Pressure

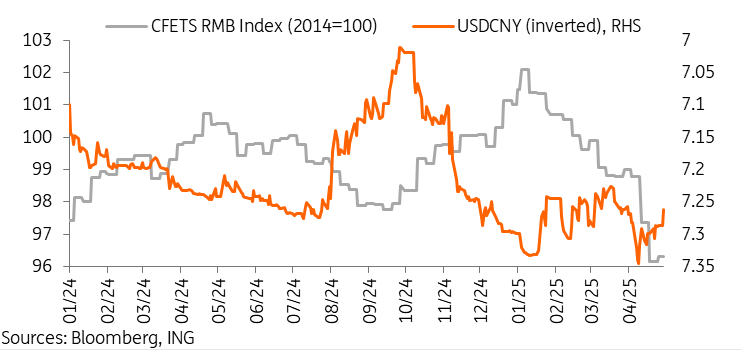

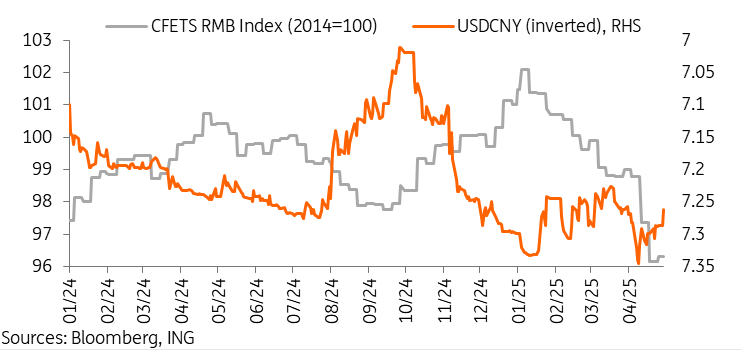

The Chinese yuan faced some pretty intense pressure after Trump’s unexpected tariff announcement. Despite briefly reaching around 7.35 against the dollar, the currency has basically returned to pre-tariff levels of about 7.26, which demonstrates China’s ongoing commitment to currency stability even during these rather tense trade disputes. This stability is also considered by many analysts to be a key factor in current de-dollarization efforts.

Also Read: China CBDC Deal With 10 ASEAN & 6 Middle Eastern Nations – Real or Fake

Lynn Song, Chief Economist for Greater China at ING, stated:

“The abrupt escalation of tariffs sent yuan depreciation pressure to a new peak, with the USD/CNY eclipsing 7.35 and the USD/CNH nearing 7.43 at their respective summits.”

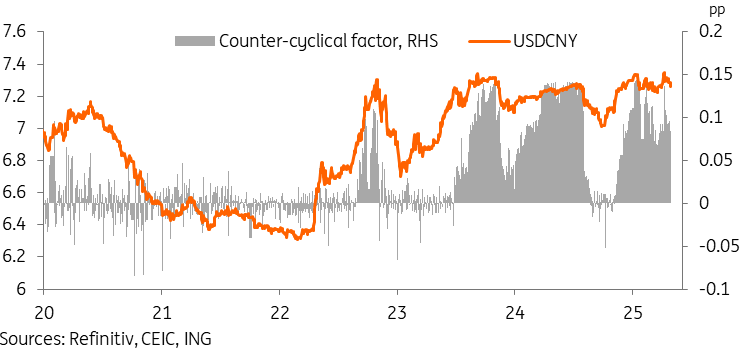

PBoC Defies Market Expectations

Many analysts and market watchers kind of expected China to perhaps devalue its currency to help offset these tariffs, but the PBoC has instead prioritized stability above all else. This approach to de-dollarization seems to focus on maintaining domestic purchasing power while also supporting the broader RMB internationalization goals that China has been pursuing for some time now.

Different From Previous Currency Tensions

Also Read: Goldman Sachs: Hedge Funds Make Shocking Bank Stock Move

The ING currency analysis also points out several key differences that basically explain why the current de-dollarization situation is actually quite different from previous trade wars:

- The Federal Reserve is currently in a rate cut cycle, creating a somewhat weaker dollar environment

- These 145% tariffs are obviously threatening economic outlooks for both nations in various ways

- The patterns of capital flows have shifted quite dramatically since 2018

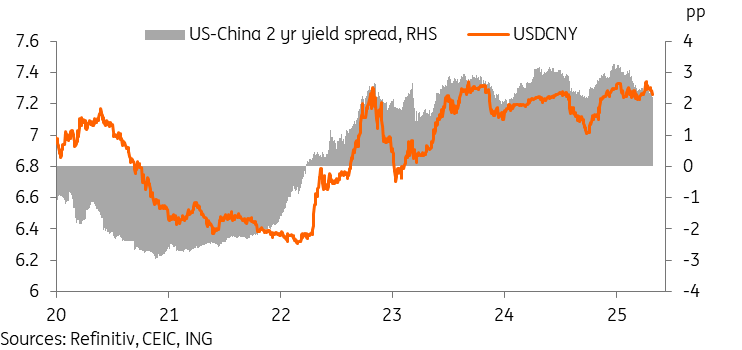

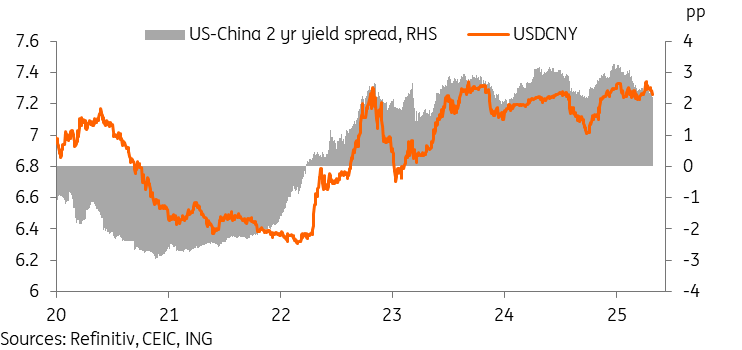

Yuan Strength Supported By Yield Trends

At the moment, the PBoC monetary strategy appears to benefit from the narrowing US-China yield spreads, which helps support yuan stability and seems to reinforce ongoing de-dollarization efforts. The experts at ING are actually forecasting further spread narrowing as the monetary policies continue to diverge.

ING analysts reported:

“James Knightley forecasts 100bp of Fed cuts before year-end, while we are looking for just 30bp of cuts in China, which should result in a further narrowing of the US-China yield spread, and sets a foundation for CNY strengthening in the medium term.”

For now, ING maintains its USD/CNY forecast band of around 7.00-7.40, with some potential for a stronger yuan if tensions happen to ease somewhat. China’s successful defense against these extreme tariff pressures is essentially marking an important milestone in the global de-dollarization process, and in many ways strengthening the yuan’s position as an alternative to traditional dollar dominance in international markets.

Read More

Bitcoin Price Watch: BTC Holds $106K Amid Mixed Technical Signals

ING Experts: Yuan’s Resilience Against 145% Tariffs Accelerates 2025 De-Dollarization

De-dollarization continues to gain momentum right now in 2025 as China’s yuan shows remarkable stability despite the rather extreme 145% tariffs imposed by Trump. According to a recent ING currency analysis, the People’s Bank of China has actually managed to maintain yuan stability even after the so-called “Liberation Day” announcement. This strategic response to what many consider the first major economic shock of 2025 might actually be signaling an important shift in global currency dynamics, potentially accelerating de-dollarization trends across various markets and regions.

Also Read: De-Dollarization: 5 Oil Giants Now Settling in Yuan, Not USD

How China’s PBoC Strategy Against Trump’s Tariffs Strengthens Global De-Dollarization Momentum

Yuan Stability Maintained Despite Tariff Pressure

The Chinese yuan faced some pretty intense pressure after Trump’s unexpected tariff announcement. Despite briefly reaching around 7.35 against the dollar, the currency has basically returned to pre-tariff levels of about 7.26, which demonstrates China’s ongoing commitment to currency stability even during these rather tense trade disputes. This stability is also considered by many analysts to be a key factor in current de-dollarization efforts.

Also Read: China CBDC Deal With 10 ASEAN & 6 Middle Eastern Nations – Real or Fake

Lynn Song, Chief Economist for Greater China at ING, stated:

“The abrupt escalation of tariffs sent yuan depreciation pressure to a new peak, with the USD/CNY eclipsing 7.35 and the USD/CNH nearing 7.43 at their respective summits.”

PBoC Defies Market Expectations

Many analysts and market watchers kind of expected China to perhaps devalue its currency to help offset these tariffs, but the PBoC has instead prioritized stability above all else. This approach to de-dollarization seems to focus on maintaining domestic purchasing power while also supporting the broader RMB internationalization goals that China has been pursuing for some time now.

Different From Previous Currency Tensions

Also Read: Goldman Sachs: Hedge Funds Make Shocking Bank Stock Move

The ING currency analysis also points out several key differences that basically explain why the current de-dollarization situation is actually quite different from previous trade wars:

- The Federal Reserve is currently in a rate cut cycle, creating a somewhat weaker dollar environment

- These 145% tariffs are obviously threatening economic outlooks for both nations in various ways

- The patterns of capital flows have shifted quite dramatically since 2018

Yuan Strength Supported By Yield Trends

At the moment, the PBoC monetary strategy appears to benefit from the narrowing US-China yield spreads, which helps support yuan stability and seems to reinforce ongoing de-dollarization efforts. The experts at ING are actually forecasting further spread narrowing as the monetary policies continue to diverge.

ING analysts reported:

“James Knightley forecasts 100bp of Fed cuts before year-end, while we are looking for just 30bp of cuts in China, which should result in a further narrowing of the US-China yield spread, and sets a foundation for CNY strengthening in the medium term.”

For now, ING maintains its USD/CNY forecast band of around 7.00-7.40, with some potential for a stronger yuan if tensions happen to ease somewhat. China’s successful defense against these extreme tariff pressures is essentially marking an important milestone in the global de-dollarization process, and in many ways strengthening the yuan’s position as an alternative to traditional dollar dominance in international markets.

Read More