Ethereum To Explode by 50% in ‘Best-Case Scenario,’ Predicts Popular Crypto Analyst – But There’s a Catch

A widely followed crypto analyst and trader believes Ethereum (ETH) could rally to levels last witnessed about a year ago.

Pseudonymous crypto analyst Kaleo tells his 586,700 Twitter followers that Ethereum could surge to $2,400, a level last reached in May of 2022 before the Terra (LUNA) ecosystem collapsed.

However, Kaleo also says that Ethereum could first dip to $1,600 before rallying by around 50% to his target price.

“This is still my best-case scenario play for ETH.

Dip to $1,600s, then run it back up to approximately $2,400 to retest the pre-LUNA/UST liquidation breakdown level.”

Meanwhile, fellow crypto strategist Bluntz holds a similar outlook on ETH.

According to Bluntz, the second-largest crypto asset by market cap could find support at around the $1,600 area before potentially ending its current corrective move.

“ETH is getting absolutely mauled right now.

Not too sure where I would be looking for longs, probably somewhere between $1,600 – $1,700 and even then I would want to see a very significant reversal candle.”

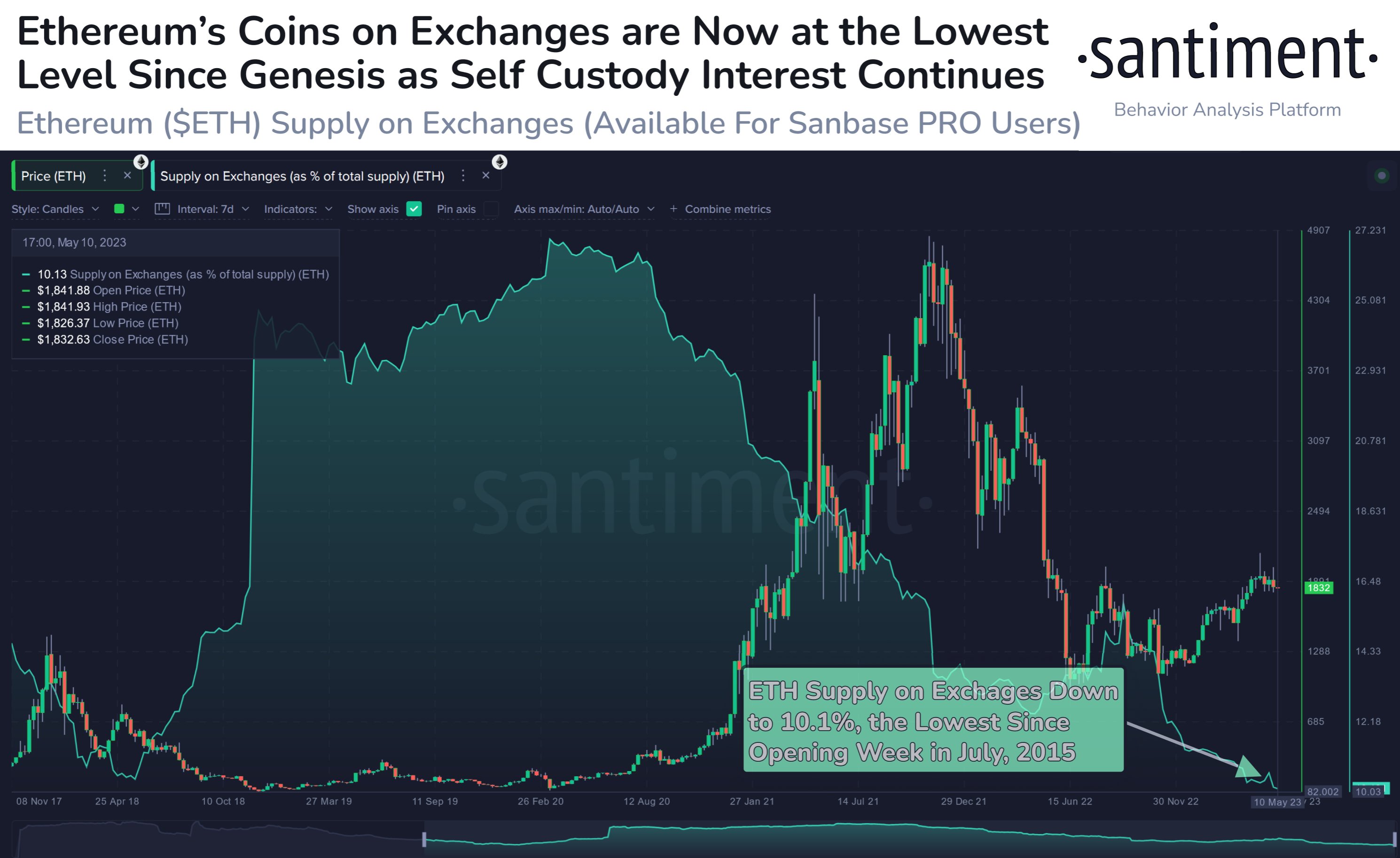

The analysts’ view on Ethereum comes as a prominent analytics firm reveals that ETH’s supply on crypto exchanges is falling.

According to Santiment, the percentage of Ethereum on crypto exchanges has plunged to an eight-year low.

“As Ethereum has dipped to $1,780 today, we’ve seen exchange supply continue to decrease. The percentage of ETH on exchanges is at its lowest (10.1%) since public trading began in 2015. This is essentially the all-time high for non-exchange holdings.”

Ethereum is trading at $1,811 at time of writing.

Don't Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Ethereum To Explode by 50% in ‘Best-Case Scenario,’ Predicts Popular Crypto Analyst – But There’s a Catch appeared first on The Daily Hodl.

Ethereum To Explode by 50% in ‘Best-Case Scenario,’ Predicts Popular Crypto Analyst – But There’s a Catch

A widely followed crypto analyst and trader believes Ethereum (ETH) could rally to levels last witnessed about a year ago.

Pseudonymous crypto analyst Kaleo tells his 586,700 Twitter followers that Ethereum could surge to $2,400, a level last reached in May of 2022 before the Terra (LUNA) ecosystem collapsed.

However, Kaleo also says that Ethereum could first dip to $1,600 before rallying by around 50% to his target price.

“This is still my best-case scenario play for ETH.

Dip to $1,600s, then run it back up to approximately $2,400 to retest the pre-LUNA/UST liquidation breakdown level.”

Meanwhile, fellow crypto strategist Bluntz holds a similar outlook on ETH.

According to Bluntz, the second-largest crypto asset by market cap could find support at around the $1,600 area before potentially ending its current corrective move.

“ETH is getting absolutely mauled right now.

Not too sure where I would be looking for longs, probably somewhere between $1,600 – $1,700 and even then I would want to see a very significant reversal candle.”

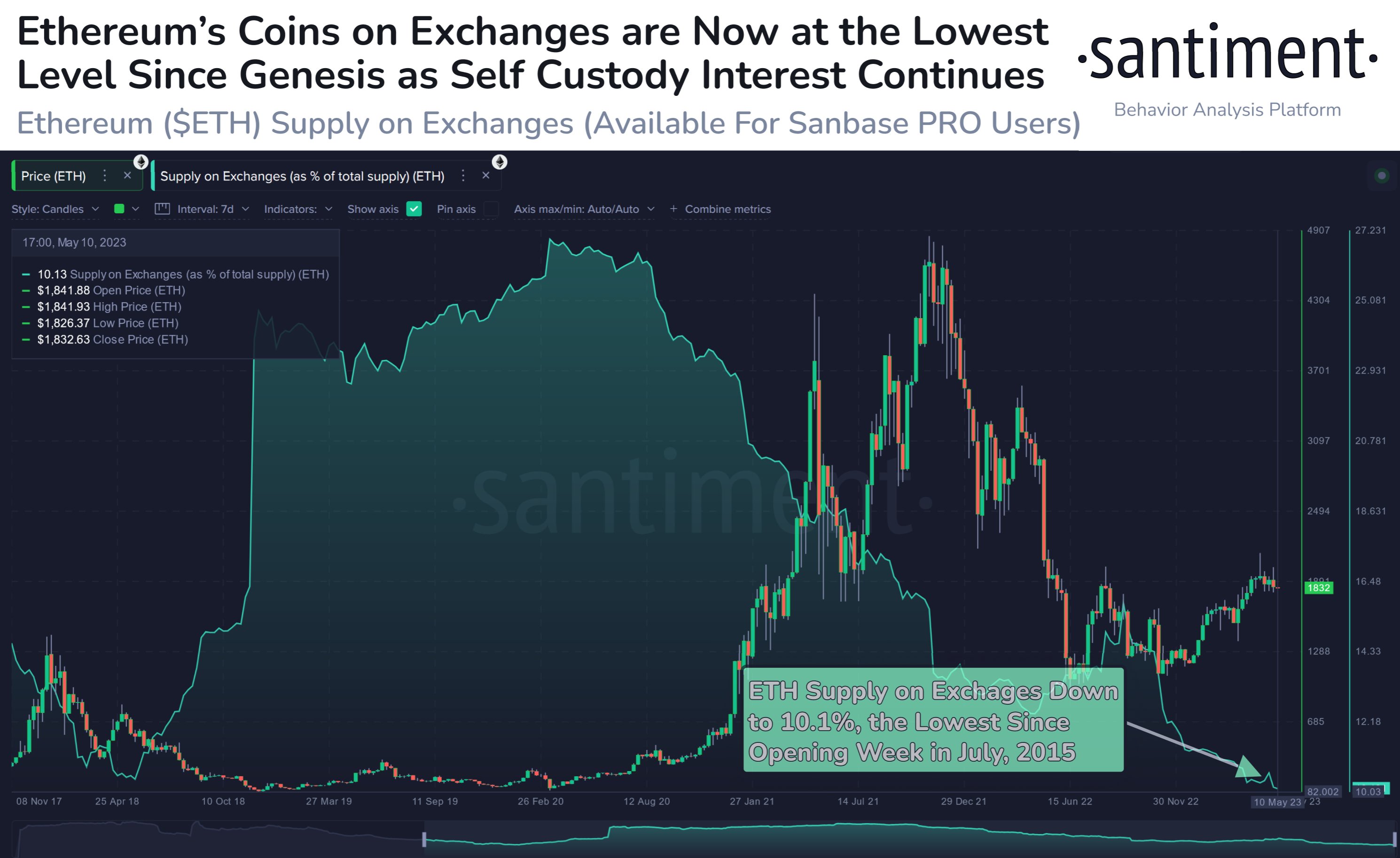

The analysts’ view on Ethereum comes as a prominent analytics firm reveals that ETH’s supply on crypto exchanges is falling.

According to Santiment, the percentage of Ethereum on crypto exchanges has plunged to an eight-year low.

“As Ethereum has dipped to $1,780 today, we’ve seen exchange supply continue to decrease. The percentage of ETH on exchanges is at its lowest (10.1%) since public trading began in 2015. This is essentially the all-time high for non-exchange holdings.”

Ethereum is trading at $1,811 at time of writing.

Don't Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Ethereum To Explode by 50% in ‘Best-Case Scenario,’ Predicts Popular Crypto Analyst – But There’s a Catch appeared first on The Daily Hodl.