Ripple’s RLUSD Poised to Lead as Tether Exits European Market

- Tether exits the EU due to MiCA, leaving a $150B stablecoin gap.

- Ripple’s RLUSD gains traction as a fully MiCA-compliant alternative.

- The shift may benefit compliant tokens and drive XRP’s market role.

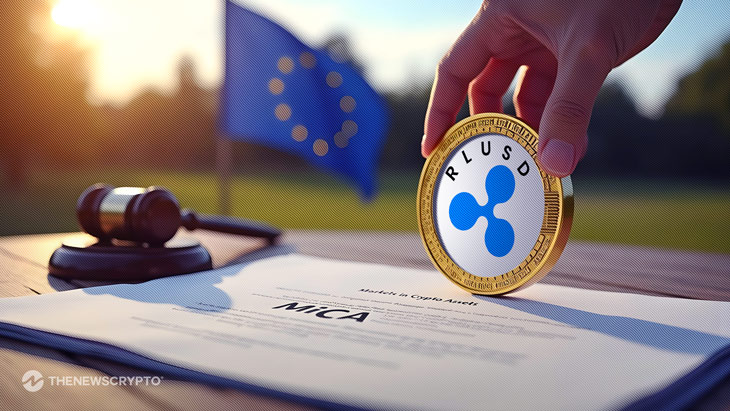

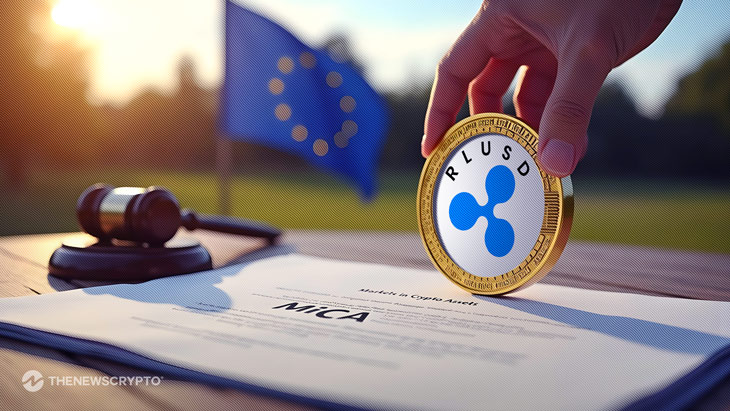

Tether’s withdrawal of USDT, the world’s most actively traded stablecoin, from the European market in response to MiCA regulations has created a humongous $150 billion liquidity gap. This sudden withdrawal has presented an opportunity for Ripple’s RLUSD to take dominance.

The EU’s MiCA regulation that came into force in December 2024 introduces comprehensive requirements for stablecoin issuers, focusing on reserve management, prohibition of interest payments, transaction caps, and mandatory partnerships with EU-approved banks. Tether’s USDT has not met these requirements, leading to its exclusion from the EU market under MiCA.

Crypto analyst Jake Claver summed up the situation bluntly: “Tether took one look and said, ‘we’re out.’” This signals the end of USDT’s reign in the European market and the beginning of a new stablecoin race.

RLUSD Moves In: A MiCA-Ready Stablecoin

Ripple’s RLUSD is emerging as the strongest MiCA-compliant stablecoin alternative. Already listed on Bitstamp, a leading European crypto exchange, RLUSD benefits from a head start in regulatory alignment. Launched in December 2024, RLUSD is fully compliant, issued across both the XRP Ledger and Ethereum, and supported by Ripple’s robust network of institutional partners.

“USDC is compliant but small. Tether is massive but non-compliant. Ripple’s RLUSD brings the best of both worlds,” says Claver. RLUSD’s scalability and compliance position it as a key player in the post-MiCA stablecoin landscape.

Circle has also responded with USDC and EURC, both MiCA-compliant. However, their smaller market size compared to Tether limits their immediate impact. While USDC has global reach and regulatory credibility, it still lacks the trading volume and liquidity that once made USDT the top choice in Europe.

USDC vs RLUSD: The Stablecoin Showdown

While USDC’s foothold is growing, Ripple’s RLUSD is gaining momentum fast. Though USDC’s position is expanding, Ripple’s RLUSD is picking up speed quickly. With MiCA supporting stablecoins with utmost transparency and rigorous regulation, RLUSD’s dual-chain operation and international strategy place it at an advantage.

Ripple’s past emphasis on markets abroad, particularly Asia, now puts it in the driver’s seat in the EU. Its aggressive approach toward regulation has been rewarded, providing crypto traders in Europe with a secure, reliable, and compliant substitute.

However, Claver believes RLUSD is not just a replacement for USDT; it could reshape how stablecoins operate in a post-MiCA world.

While the shift is being called for celebration by some, others insist on larger consequences to follow. Speaking of doubts was crypto analyst sKar PRIME, who claimed that the exit of the stablecoin Tether might widen market instability. By way of examples, he suggested that it might differ a liquidity across platforms with ramifications thereafter, thereby raising the demand for compliant alternatives like RLUSD or perhaps even Bitcoin.

The stablecoin upheaval is greater than a reordering, it’s a sign of maturing international regulations and the increasing significance of compliance in crypto’s future.

Highlighted Crypto News Today:

Ripple’s RLUSD Poised to Lead as Tether Exits European Market

- Tether exits the EU due to MiCA, leaving a $150B stablecoin gap.

- Ripple’s RLUSD gains traction as a fully MiCA-compliant alternative.

- The shift may benefit compliant tokens and drive XRP’s market role.

Tether’s withdrawal of USDT, the world’s most actively traded stablecoin, from the European market in response to MiCA regulations has created a humongous $150 billion liquidity gap. This sudden withdrawal has presented an opportunity for Ripple’s RLUSD to take dominance.

The EU’s MiCA regulation that came into force in December 2024 introduces comprehensive requirements for stablecoin issuers, focusing on reserve management, prohibition of interest payments, transaction caps, and mandatory partnerships with EU-approved banks. Tether’s USDT has not met these requirements, leading to its exclusion from the EU market under MiCA.

Crypto analyst Jake Claver summed up the situation bluntly: “Tether took one look and said, ‘we’re out.’” This signals the end of USDT’s reign in the European market and the beginning of a new stablecoin race.

RLUSD Moves In: A MiCA-Ready Stablecoin

Ripple’s RLUSD is emerging as the strongest MiCA-compliant stablecoin alternative. Already listed on Bitstamp, a leading European crypto exchange, RLUSD benefits from a head start in regulatory alignment. Launched in December 2024, RLUSD is fully compliant, issued across both the XRP Ledger and Ethereum, and supported by Ripple’s robust network of institutional partners.

“USDC is compliant but small. Tether is massive but non-compliant. Ripple’s RLUSD brings the best of both worlds,” says Claver. RLUSD’s scalability and compliance position it as a key player in the post-MiCA stablecoin landscape.

Circle has also responded with USDC and EURC, both MiCA-compliant. However, their smaller market size compared to Tether limits their immediate impact. While USDC has global reach and regulatory credibility, it still lacks the trading volume and liquidity that once made USDT the top choice in Europe.

USDC vs RLUSD: The Stablecoin Showdown

While USDC’s foothold is growing, Ripple’s RLUSD is gaining momentum fast. Though USDC’s position is expanding, Ripple’s RLUSD is picking up speed quickly. With MiCA supporting stablecoins with utmost transparency and rigorous regulation, RLUSD’s dual-chain operation and international strategy place it at an advantage.

Ripple’s past emphasis on markets abroad, particularly Asia, now puts it in the driver’s seat in the EU. Its aggressive approach toward regulation has been rewarded, providing crypto traders in Europe with a secure, reliable, and compliant substitute.

However, Claver believes RLUSD is not just a replacement for USDT; it could reshape how stablecoins operate in a post-MiCA world.

While the shift is being called for celebration by some, others insist on larger consequences to follow. Speaking of doubts was crypto analyst sKar PRIME, who claimed that the exit of the stablecoin Tether might widen market instability. By way of examples, he suggested that it might differ a liquidity across platforms with ramifications thereafter, thereby raising the demand for compliant alternatives like RLUSD or perhaps even Bitcoin.

The stablecoin upheaval is greater than a reordering, it’s a sign of maturing international regulations and the increasing significance of compliance in crypto’s future.

Highlighted Crypto News Today: