Bitcoin’s Plunge Below $100K Wipes Out a Single Whale for $100M

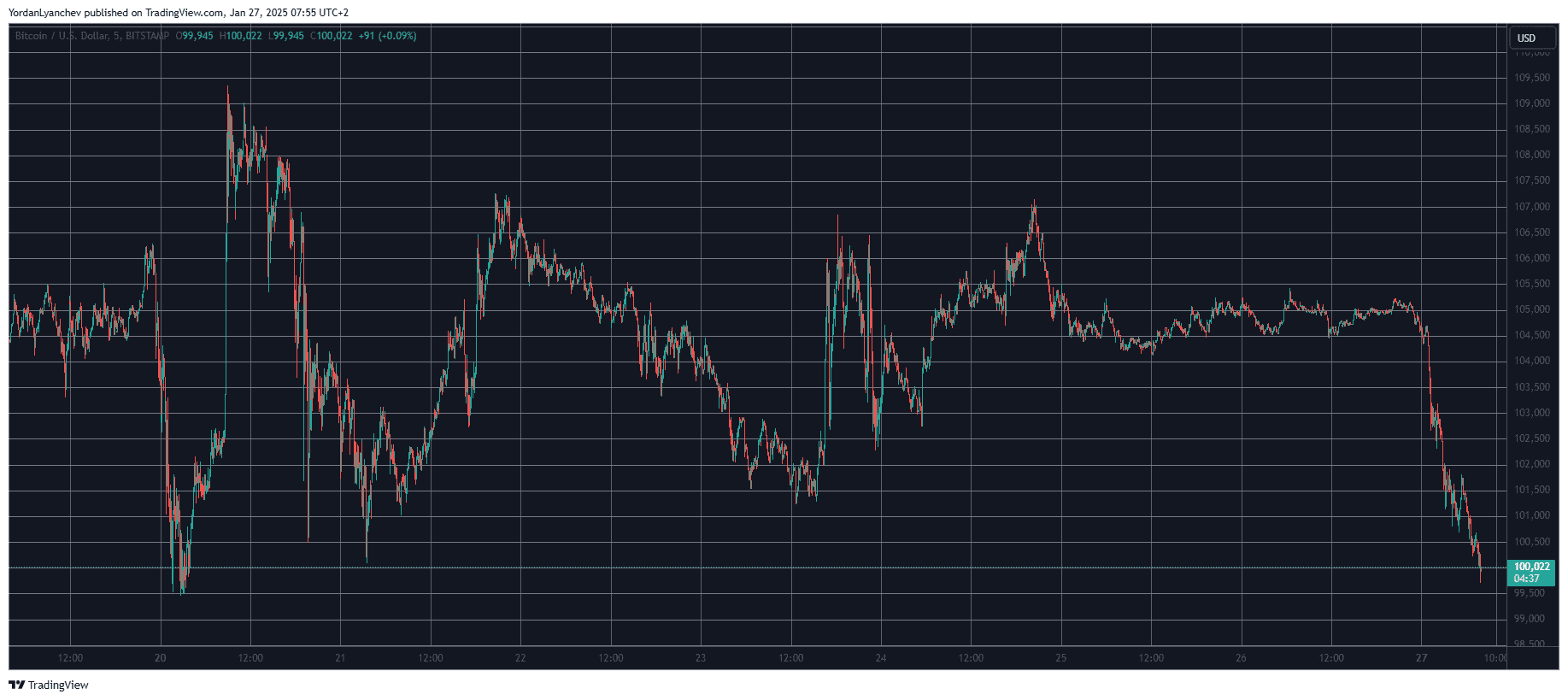

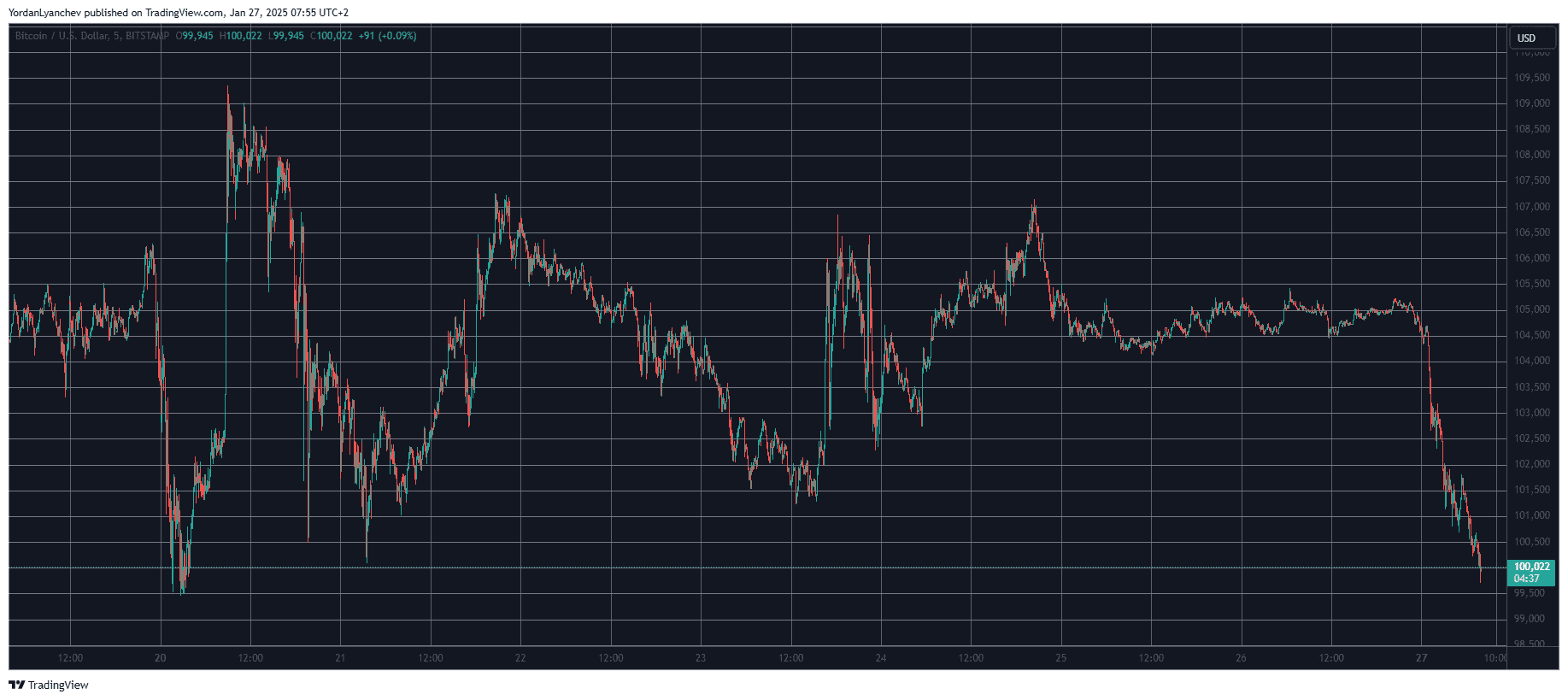

After the quiet weekend, in which BTC stood primarily around $105,000, the asset’s price movements have turned sour, and it slumped to a weekly low of under $100,000.

The altcoins have bled out even more heavily, with massive price declines from the likes of DOGE, XRP, ADA, SOL, and many others.

Similar to the previous Monday, this one has started quite painfully for the crypto market. As reported over the weekend, bitcoin had calmed at around $105,000 with little to no movements over a 36-hour period.

However, the Monday morning Asian trading session began with a nosedive that pushed the largest digital asset from its aforementioned level to a weekly low (for now) of $99,700.

This 5% daily drop has harmed the cryptocurrency’s market cap, which has plunged below the coveted $2 trillion mark.

The altcoins have felt even more substantial pain within the same period. ETH, which challenged $3,400 a few days ago, has dropped by 7% in a day to $3,100.

XRP has slumped below $3 for the first time in a few weeks, BNB is down to $650, ADA has plunged to $0.9, and LINK is at $23. More substantial declines come from the likes of SOL, DOGE, SUI, PEPE, HBAR, SHIB, LTC, APT, AAVE, and others, as all of them are with double-digit losses.

CoinGlass’ data paints a violent picture of the aforementioned volatility. The total value of wrecked positions has shot up to well above $600 million on a daily scale and $560 million within the past 12 hours alone.

Nearly 230,000 traders have been liquidated, while the largest single wrecked position is a whopping one of $98.46 million. It took place on HTX and involved the BTC/USDT pair.

The post Bitcoin’s Plunge Below $100K Wipes Out a Single Whale for $100M appeared first on CryptoPotato.

Bitcoin’s Plunge Below $100K Wipes Out a Single Whale for $100M

After the quiet weekend, in which BTC stood primarily around $105,000, the asset’s price movements have turned sour, and it slumped to a weekly low of under $100,000.

The altcoins have bled out even more heavily, with massive price declines from the likes of DOGE, XRP, ADA, SOL, and many others.

Similar to the previous Monday, this one has started quite painfully for the crypto market. As reported over the weekend, bitcoin had calmed at around $105,000 with little to no movements over a 36-hour period.

However, the Monday morning Asian trading session began with a nosedive that pushed the largest digital asset from its aforementioned level to a weekly low (for now) of $99,700.

This 5% daily drop has harmed the cryptocurrency’s market cap, which has plunged below the coveted $2 trillion mark.

The altcoins have felt even more substantial pain within the same period. ETH, which challenged $3,400 a few days ago, has dropped by 7% in a day to $3,100.

XRP has slumped below $3 for the first time in a few weeks, BNB is down to $650, ADA has plunged to $0.9, and LINK is at $23. More substantial declines come from the likes of SOL, DOGE, SUI, PEPE, HBAR, SHIB, LTC, APT, AAVE, and others, as all of them are with double-digit losses.

CoinGlass’ data paints a violent picture of the aforementioned volatility. The total value of wrecked positions has shot up to well above $600 million on a daily scale and $560 million within the past 12 hours alone.

Nearly 230,000 traders have been liquidated, while the largest single wrecked position is a whopping one of $98.46 million. It took place on HTX and involved the BTC/USDT pair.

The post Bitcoin’s Plunge Below $100K Wipes Out a Single Whale for $100M appeared first on CryptoPotato.