Ethereum Price Analysis: ETH Needs to Hold This Key Support to Continue Its Bull Run

Ethereum is consolidating above the key $2.5K support, reflecting market indecision and low trading activity.

This sideways movement indicates an equilibrium state, with buyers and sellers awaiting a decisive breakout to determine the next trend.

Technical Analysis

By Shayan

The Daily Chart

Following a rebound above the $2.5K support region, ETH has faced low trading activity, leading to choppy price action. The asset has been experiencing a period of sideways consolidation, reflecting market indecision. Considering the significance of the $2.5K level as a psychological support and the potential demand in this range, a bullish rebound is expected, targeting the 200-day MA at $3K.

However, Ethereum remains confined within the $2.5K-$3K range, and a breakout is necessary to establish a sustained trend. If selling pressure increases, a break below this range could push the price to lower levels.

The 4-Hour Chart

On the lower timeframe, Ethereum has been consolidating with low volatility after breaking below the descending wedge’s lower boundary. This indecisive price action suggests that market participants are awaiting a decisive breakout. The asset is currently hovering below the key resistance region of the 0.5-0.618 Fibonacci range, which could lead to a rejection if sellers dominate.

However, if buyers step in, a breakout above this level could trigger a fresh rally. The short-term outlook remains uncertain, with the upcoming price action determining the next impulsive move.

Onchain Analysis

By Shayan

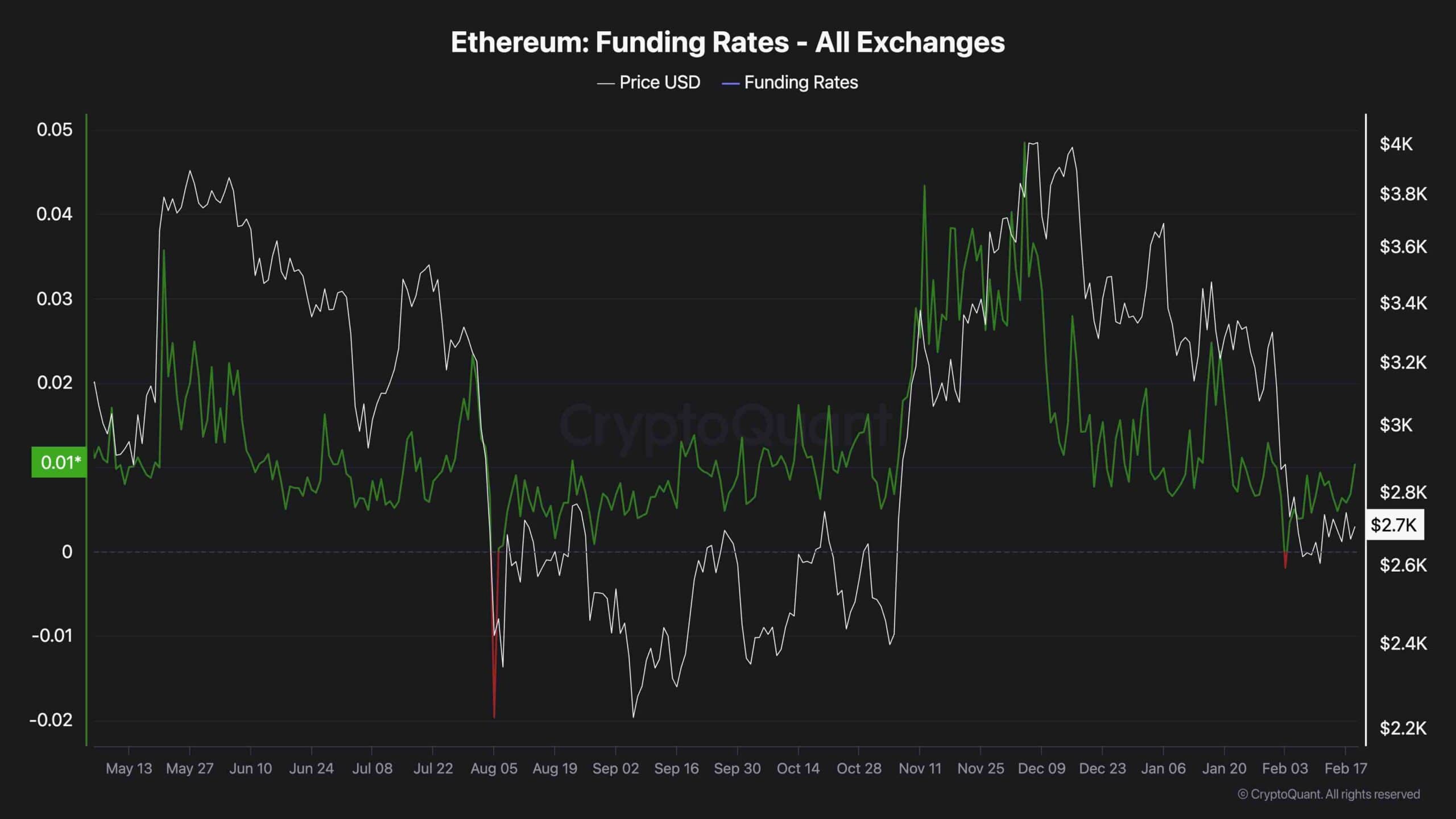

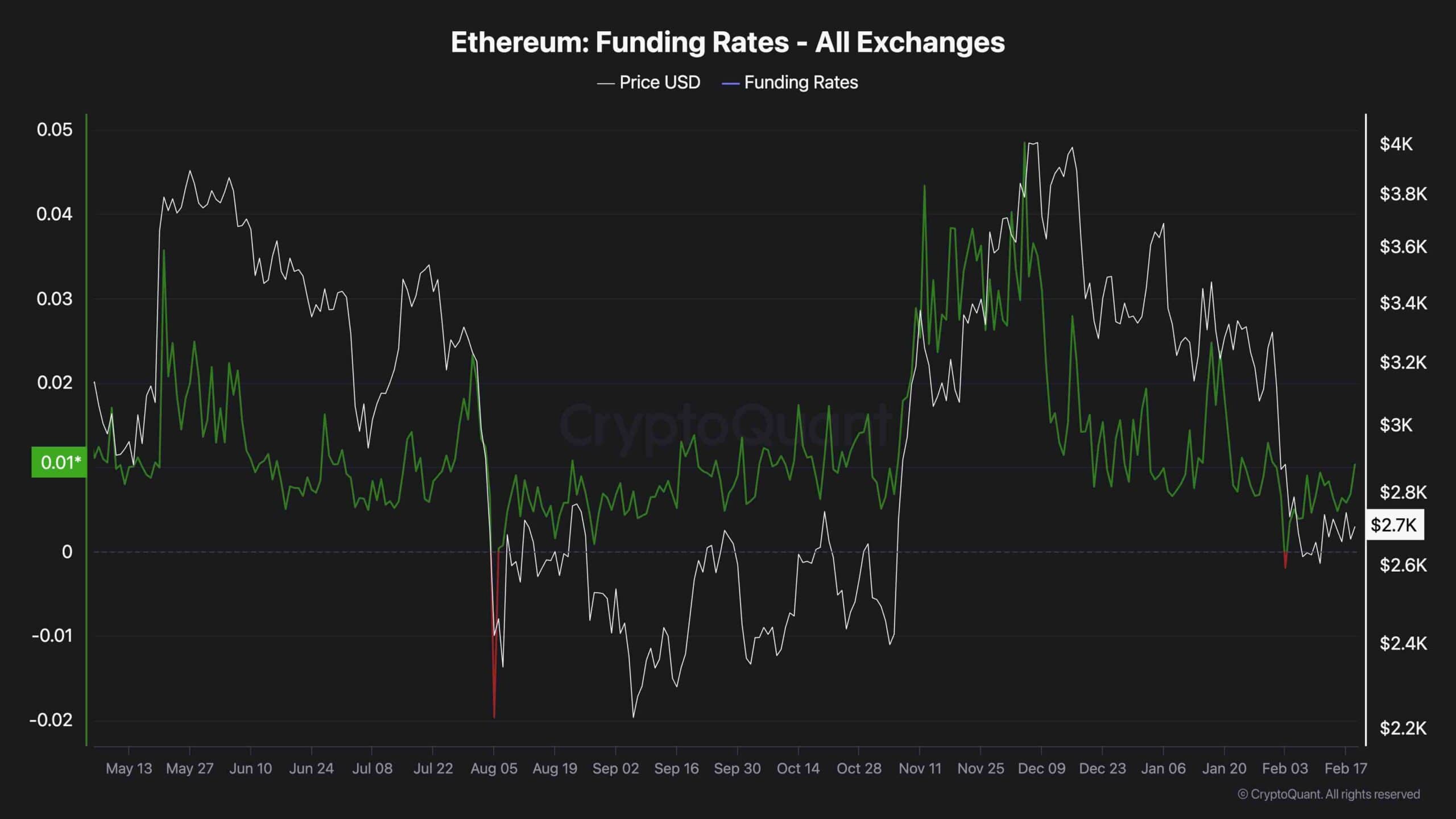

Historically speaking, the futures market has significantly influenced Ethereum’s price action. The funding rates metric serves as a pivotal indicator of sentiment in the futures market, as it quantifies the extent to which buyers or sellers are executing their orders with greater urgency.

As depicted in the chart, funding rates have experienced a slight increase during the recent market consolidation. This suggests that the futures market is anticipating a potential influx of buyers following the recent impulsive crash. If this pattern persists in conjunction with sufficient spot demand, the market is poised for a quick recovery and a renewed attempt to reclaim the pivotal $3K threshold.

The post Ethereum Price Analysis: ETH Needs to Hold This Key Support to Continue Its Bull Run appeared first on CryptoPotato.

Read More

Ethereum Sees 77K ETH Moved to Derivatives – Market Prepping for Another Drop?

Ethereum Price Analysis: ETH Needs to Hold This Key Support to Continue Its Bull Run

Ethereum is consolidating above the key $2.5K support, reflecting market indecision and low trading activity.

This sideways movement indicates an equilibrium state, with buyers and sellers awaiting a decisive breakout to determine the next trend.

Technical Analysis

By Shayan

The Daily Chart

Following a rebound above the $2.5K support region, ETH has faced low trading activity, leading to choppy price action. The asset has been experiencing a period of sideways consolidation, reflecting market indecision. Considering the significance of the $2.5K level as a psychological support and the potential demand in this range, a bullish rebound is expected, targeting the 200-day MA at $3K.

However, Ethereum remains confined within the $2.5K-$3K range, and a breakout is necessary to establish a sustained trend. If selling pressure increases, a break below this range could push the price to lower levels.

The 4-Hour Chart

On the lower timeframe, Ethereum has been consolidating with low volatility after breaking below the descending wedge’s lower boundary. This indecisive price action suggests that market participants are awaiting a decisive breakout. The asset is currently hovering below the key resistance region of the 0.5-0.618 Fibonacci range, which could lead to a rejection if sellers dominate.

However, if buyers step in, a breakout above this level could trigger a fresh rally. The short-term outlook remains uncertain, with the upcoming price action determining the next impulsive move.

Onchain Analysis

By Shayan

Historically speaking, the futures market has significantly influenced Ethereum’s price action. The funding rates metric serves as a pivotal indicator of sentiment in the futures market, as it quantifies the extent to which buyers or sellers are executing their orders with greater urgency.

As depicted in the chart, funding rates have experienced a slight increase during the recent market consolidation. This suggests that the futures market is anticipating a potential influx of buyers following the recent impulsive crash. If this pattern persists in conjunction with sufficient spot demand, the market is poised for a quick recovery and a renewed attempt to reclaim the pivotal $3K threshold.

The post Ethereum Price Analysis: ETH Needs to Hold This Key Support to Continue Its Bull Run appeared first on CryptoPotato.

Read More